Dairy farmers have to navigate several risks – environmental, regulatory, animal care and management succession are just a few. But of all the risks dairy producers must manage, price volatility – which has grown more intense over the last decade – should be a top priority.

Price risk management is always an important tool for dairy producers. But contrary to popular belief, it’s not just for large farms. Even if your operation has fewer than 50 cows, it’s wise to put some basic risk management strategies to work.

Having the right price risk management tools in place enables producers of all sizes to think about margins, not just milk prices. That starts by knowing your costs, examining the pricing opportunities available to you and having the right instruments in place to act on those opportunities.

More than milk prices

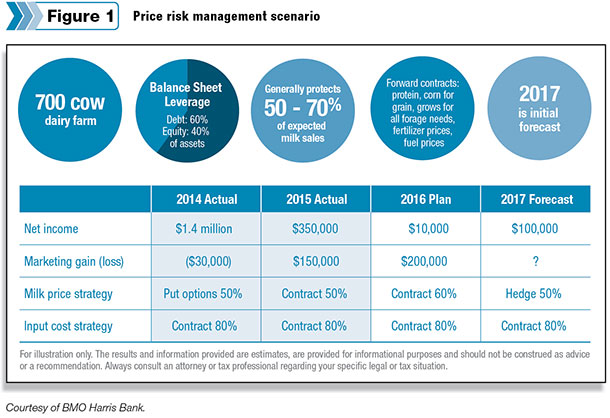

A current challenge that many farmers face is lack of liquidity. During periods of tight margins, liquidity is of utmost importance because it allows you to meet cash flow requirements as your income drops below the cost of production. Additionally, the higher your balance sheet leverage (that is, a high debt per cow), the more vulnerable you are to price volatility.

With the federal Margin Protection Program (MPP), dairy producers have a safety net to protect them against severely compressed margins. The program offers those who choose to participate several levels of coverage, including catastrophic protection, which provides payments when the national dairy production margin falls below $4 per hundredweight.

There are limitations. Because it’s a national program, milk prices and feed costs will vary for producers in any given region, reducing the program’s effectiveness.

But many dairy farmers make the mistake of focusing solely on milk price risk while ignoring costs, which is also a significant factor in your profitability. It’s always a good idea to ask yourself what variable expenses you can apply price risk management to, such as feed, fuel and fertilizer, to minimize or define your costs.

It’s natural that producers don’t want to miss out on milk price upsides. But if you don’t manage costs effectively during a strong price environment, your operation may not be as profitable as it could be when prices turn less favorable. Keep in mind, it’s not the price you receive for your milk, but the amount you keep after paying expenses. Managing the margin is the key, not the price.

Get started

To take advantage of whatever pricing opportunities are available, producers need to understand the various market tools for price risk management, including:

- Forward contracts

- Hedge positions

- LGM Insurance for Dairy

- Margin Protection Program

- Options, including multiple options strategies using puts and calls

- Combinations of these tools

Employing these strategies will help get your operation through periods of compressed margins. If you’re not doing anything about price risk management, you need to start somewhere. And if you are doing something, it’s a good time to look at additional opportunities. Seek a qualified agricultural commodities broker to provide education and advice regarding these tools and to assist in developing your price risk management program.

Once you have a risk management strategy in place, it’s wise to follow a few ground rules, including:

- Start with a simple plan

- Meet margin call timetables

- Only trade in commodities you use

Also note that as you employ more advanced strategies, you’ll need access to certain financial support.

Even if you’re a small farm with limited resources, risk management is an effective use of your time. By having the appropriate price risk management strategies in place, you’ll know your margins and be in a position to sell against your financial objectives. PD

For more agriculture industry insights, visit the BMO Harris Bank website.

-

Sam Miller

- Managing Director, Head of Agriculture Banking

- BMO Harris Bank

- Email Sam Miller