Michigan State University land value and rental rate surveys show that average farm land rental rates continue to increase. Some of the rent increases are a function of competition: As farms are getting larger, some are willing to work on smaller margins spread over more acres.

Other farms are willing to pay greater and greater land rents as crop sale prices increase.

Chances are that some landlords will be pushing for higher land rents, which makes it more important for farmers to consider the use of safety valve rental agreements to counter the higher risk levels in farming since the spike in crop prices of 2008.

With current crop sales prices reaching higher levels, it is expected that input and overhead costs also will increase, using up some of the wider profit margins. Livestock producers need to secure the land base that is vital for the production of feed and forages along with the opportunity for the spreading of manure, a valued resource of livestock operations.

Understanding the value of an acre of forages like alfalfa, on a real basis to the farm, can help some dairy farmers better compete with cash crop farmers eager to take over their rented land. Dairy farmers must look beyond what they have been able to rent land for in the past and consider what a crop’s value is to the dairy when setting rents.

We are seeing that very good lands continue to command higher rents, while the poor, low productivity lands stay the same. Renters are looking for land that has the potential to take advantage of new technologies in seed selection and vigor, tillage, fertilization and weed or pest control.

The best land has corn yields well above 150 bushels per acre, has good soil structure, is well drained with a newer tile drainage system and has well-balanced soil fertility already established. Good crop rotation practices help to maintain the soil’s health and productivity for future crops.

Rents generally are increasing, with some of the move being supported by higher grain prices. Because of the continued volatility in the grain markets, farmers can and should consider alternative types of rental agreements, such as variable rate, flexible rent, or shares to reduce some of the risks.

Cash rental price hikes

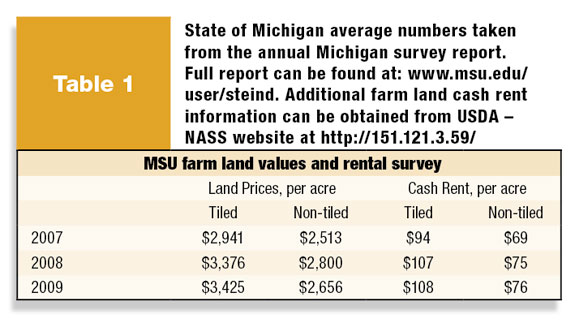

Cash rents have trended upward in the last couple of years ( Table 1** ). Michigan State University Extension (MSUE) and USDA National Agricultural Statistics Service (NASS) surveys show that the base rental rates range from $50 to $160 per acre.

This suggests that in some locations the rental rate is still in the $30-per-acre range, while in other parts of the state, it is not uncommon to see rents in the +$200-per-acre range.

Flex rent

Converting to a flex rent is a way to share the risks and rewards. Your formula can promise the base cash rent price, which is often paid in advance, with a possible bonus at harvest, based on the gross value (yield times price) of the crop.

Flex rent landlords may receive much higher rents, possibly better than some of the highest cash rents in the area. In the case of a revenue disaster, the renter is obligated to pay only the base cash rate.

The comfort level of accepting risk tends to exert impact on the flex rent decision, as some landlords prefer guaranteed, set cash rent. The preference for cash rent is not uncommon, as landowners look to eliminate uncertainty and risk.

Fixed bushel rent

A fixed bushel agreement with landlords is an alternative to the share crop arrangement. The rent payment is a set number of bushels of grain per acre to the landlord (for example, a corn rent might be 40 bushels of corn per acre).

The bushel rent is delivered to the local elevator in the landlord’s name, which means the landowner has the opportunity and responsibility to market the grain.

When the corn sale price is high, rental income to the landowner increases; in lower price years, rental income goes down. The marketing ability of the landowner could significantly affect eventual income.

Multiple choice flex leases

Some flex agreements offer a fixed price per bushel multiplied by the average corn yield for that field (for example, $1 times the average yield – 150 bushels per acre, let’s say – produces a cash rent of $150 per acre).

Flex leases also can be based on crop prices only. For example, the lease payment could be based on the price of corn in the Chicago futures market measured on the same day every month for a set number of months.

If the average corn price is $3 per bushel, the farmer pays $100 per acre in cash rent; $4 per bushel, the cash rent is $150 per acre; $5 per bushel produces a cash rent of $200 per acre. Be clear on when the crop price is set, so there is no confusion. In this formula, a yield factor may need to apply to cover a disaster crop yield.

Another common type of variable cash rent sets a minimum rent with a bonus payment at certain production or price benchmarks. Those arrangements have a good chance to pay out this year, because production appears to set record highs in many parts of the state and crop prices have increased significantly since July.

If trends continue, the price index that sets the rent for 2011 will likely be higher than the prices that would have set the rent for 2010. A year ago, crop prices were not as high as they are now, which may have resulted in slightly conservative rents.

To understand and calculate the variables in a flex lease or see sample flex rent leases, go to the website: http://www.msu.edu/user/steind ; click on “Land Rent and Purchase Information.”

You also can find simple crop budget templates to help in calculating and estimating a reasonable land rental value and keep your crop farming operations profitable. In addition, you can find a simple landlord checklist and worksheet to cover some of the bases before going out to meet with your landlord. PD

—Excerpts from Michigan Dairy Review, Vol. 16, No. 1, pages 11-12.

PHOTOIf trends continue, the price index that sets the rent for 2011 will likely be higher than the prices that would have set the rent for 2010. A year ago, crop prices were not as high as they are now, which may have resulted in slightly conservative rents.Photo by PD staff.

**TABLE State of Michigan average numbers taken from the annual Michigan survey report. Full report can be found at: www.msu.edu/user/steind . Additional farm land cash rent information can be obtained from USDA – NASS website at http://151.121.3.59/

Dennis Stein

Extension Farm Management Educator

Michigan State University

steind@anr.msu.edu