At this time of the year, I wish I could bring you some good news. I am afraid, however, that what has been a modest recovery for our dairy farms starting in late spring is about to end. Most dairy farms, still under the shock of the 2009 financial disaster, now barely hold their heads above water. What’s next? Feed prices have gone through the roof, and the November decline in milk prices can be the initial signal for further price declines despite the recent surge of dairy product prices on the cash and futures markets. Tight financial management will be the norm for the first half of 2011. First, let us look at feed prices. I used the software SESAME™ that we developed at Ohio State to price the important nutrients in dairy rations to estimate breakeven prices of major commodities and to identify feedstuffs that currently are significantly underpriced.

I looked at price estimates of net energy lactation (NEl, $ per Mcal), metabolizable protein (MP, $ per lb – MP is the sum of the digestible microbial protein and digestible rumen-undegradable protein of a feed), non-effective NDF (ne-NDF, $ per lb), and effective NDF (e-NDF, $ per lb).

Compared to historical averages (i.e., since January 2005), NEL is now priced at about average (10¢ per lb). For MP, these figures stand at a premium of about 20¢ per lb, or a 195 percent premium over the six-year average. Thus, although we have seen a substantial increase in the price of corn and other energy commodities this fall, the rise in the protein complex has been more substantial.

One must keep in mind that over the last 20 years, dietary energy (NEL) has been priced at about 5¢ per Mcal. Thus, the current dietary energy cost is still well above the long-run average. The cost of ne-NDF is currently discounted by the markets (i.e., feeds with a significant content of non-effective NDF are price discounted), but the discount is at about the six-year average.

Meanwhile, unit costs of e-NDF are historically low, with a discount of about 2¢ per lb over the six-year average. Home-grown forages can be inexpensive sources of this important nutrient.

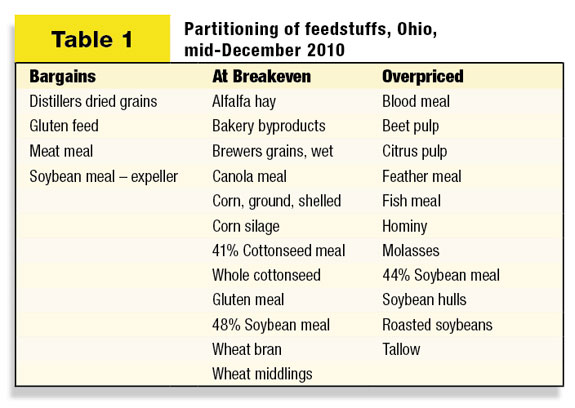

Based on mid-December wholesale prices in some areas, feed commodities can be partitioned into the three following groups ( Table 1 ).

The disconcerting thing from this table is that only four feeds are currently in the bargain column, and nearly half of all feeds are in the overpriced column. This limits potential feed cost savings from feed ingredient substitution.

I must remind readers that these results do not mean that you can formulate a balanced diet using only feeds in the bargain column.

Feeds in the “bargains” column offer savings opportunity, and their usage should be maximized within the limits of a properly balanced diet.

In addition, prices within a commodity type can vary considerably because of quality differences as well as non-nutritional value added by some suppliers in the form of nutritional services, blending, terms of credit, etc. In addition, there are reasons a feed might be a very good fit in your feeding program while not appearing in the “bargains” column.

For example, molasses is often used to reduce ingredient separation in TMR. Molasses is also an excellent source of sugars. Some nutritionists balance rations for sugars. In those situations, molasses might not be at all overpriced.

Thus right now, many dairy producers are operating at about breakeven levels. But the radar map for milk prices is very uncertain and the financial situation could be deteriorating quickly. PD

—Excerpts from December 2010 Buckeye Dairy News

-

Normand St-Pierre

- Dairy Extension Specialist

- Ohio State University

- Email Normand St-Pierre