Extraordinary times call for extraordinary measures. What a fitting way to describe our current scenario. Corn prices have achieved fall price levels never before witnessed. Milk prices are pushing a price spread of nearly two dollars. And our economy is still up for grabs as to whether we are heading into a double-dip recession or building a base for the next growth spurt. In our last article, we talked about seasonality and how the market normally makes its peak prices for the year in the September/October period. This year looks to be no different. What is concerning is how the market is digesting this climb higher and what is happening to the overall market structure.

As butter and cheese prices have escalated to higher levels, nearby futures prices have risen correspondingly to honor the Federal Order price formulation for Class III milk. During that same time, cow numbers have scaled higher at each monthly checkpoint, milk production from the rebounding herd keeps gaining, and cheese production continues to move forward well ahead of normal. These features seem to fly in the face of current price activity…or do they?

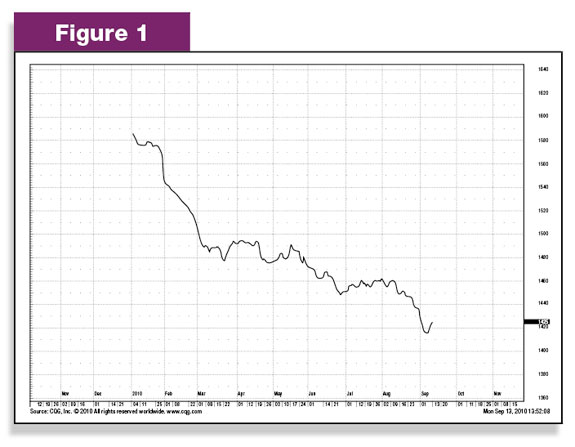

Normally a rising market tends to take with it the entire futures market offering and provide market opportunity for producers today and for an extended period into the future. That is not the case with this rally. As the nearby prices have moved higher, 2011 prices have slowly began to erode lower ( see Figure 1 ).

While September Class III milk moved over $16.00 per hundredweight, January Class III milk futures have struggled to stay over $14.00 per hundredweight. What is happening? Quite simply, the market is adjusting for product inventory, milk production and the growing herd. The profitability of the moment has jeopardized the profitability of the future…the profitability of 2011.

Many producers are caught in a real catch-22 right now. As prices have crept higher, profitability has worked its way back into the industry. As profitability has been realized, more cows have either been added or not culled. We have realized an increase of 63,000 cows as of this writing since the beginning of the year.

Many are trying to make up in 2010 for the equity that was lost in 2009, only to potentially limit the profitability of 2011. Of course, no one knows what prices will ultimately be next year. However, the market has already begun to factor in smaller opportunities based on the stage that is being set now.

How will you handle this? Are you prepared for a potentially shrinking milk check?

The market is mapping a two- dollar slide from now into the first part of 2011. Compound this with rising corn costs and the profitability scenario becomes more and more questionable. As I mentioned in the last writing, seasonality often offers extended opportunities during its seasonal peak. This is not one of those years.

As nearby prices have risen more than two dollars, next year’s average has slipped 25 cents, with the first half of next year dropping 40 cents. Could expanded production lead us back to the first quarter prices that were experienced in 2009 and 2010? If it does, prices have another dollar or more to give away.

There are really two ways to handle this. A producer can either lock in prices with their milk buyer/co-op/cheese plant/etc. or with futures contracts and buy a call option strategy to complement that sale OR the producer can buy put options to both cover the downside of the market while allowing for upside opportunity should something change. In either scenario, dairymen will be protected from shrinking markets and given opportunity to participate in expanding ones.

At present, the market is building a bias for weaker prices, hence put option values may be more than you are accustomed to paying if you have used the same strategy in the past. This is not to say that call options are being given away. However, in this environment producers may find a greater benefit in using calls in tandem with a sale to provide greater coverage in the coming calendar year.

The sale, whether made with the actual milk buyer or futures contracts, establishes a firm price for the milk throughout the contract period. The call options should be purchased together with this sale to provide for upside opportunity that could come in the event of a change to our current marketplace. Please work through these scenarios with your market adviser in order to decide what is best for you.

Of course this discussion would not be complete without diving into the feed component of your business. As investment dollars have flowed into the marketplace, the futures market has been puffed up relative to the local cash markets around the country. At a time of the year when most producers are quick to set the price of their feed, many are reluctant…and rightfully so. Prices have moved to fall levels never before witnessed in history. With corn futures prices testing $5.00 per bushel, it becomes very difficult for end users to become aggressive in buying future production.

In this kind of environment, two strategies unveil themselves for dairymen and other end users alike. You can purchase the physical commodity to capture wide basis opportunities (available at the time of this writing) and then purchase put options OR you can purchase a call option strategy that allows protection against further rising prices.

Since this discussion becomes incredibly personalized, I will leave the discussion to you and your vendors as to identify the best opportunity based on your ration, local marketplace, etc. Of course you are always welcome to ask questions of me should any of this discussion leave you torn or confused.

The bottom line is that the current market has become extremely explosive. Big movements have become normal. Uncertainty and a general lack of predictability have become the primary characteristic of the market. In the face of uncertainty, producers must take action to create certainty. Either we will act or we will be acted upon. Take the time to work through these scenarios and develop a plan that allows you to maximize your margins with today’s opportunities, while leaving the door open for better opportunities tomorrow. PD

UPDATE: Since the publication of this article, Mike North has left First Capitol Ag and is now the president of Commodity Risk Management Group. Contact him by email .

-

Mike North

- Milk Marketing Specialist

- First Capitol Ag