It will definitely be a minority of farms where people wake up in the morning and get excited about the prospects of discussing farm finances within the family – and almost certainly when the discussions involve the next generation.

The hesitation occurs for many reasons, one of which is: The topic area is quite broad. It can include financial record-keeping practices, purchase and sale decisions, capital investment, borrowing money and relationships with lenders, filing taxes and relationships with accountants, analyzing financial performance and others. It is not as difficult when, financially, times are good. It can be much worse when financial challenges exist – usually manifested as cash-flow deficiencies.

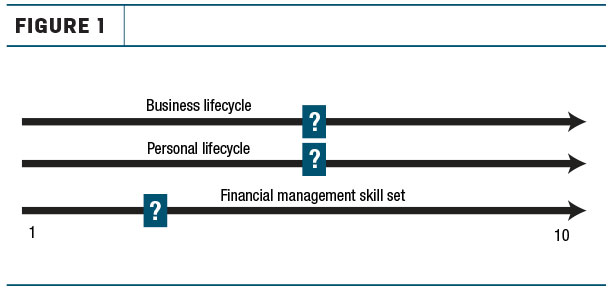

Financial management fluency is becoming more important all the time, as farms generally are becoming more complex businesses where capital investment is high and profit margins narrow. Figure 1 is a reality for many farm families and one that should be addressed, especially where intergenerational transition is in the works.

As shown in the figure, the business and personal life cycles of farms will have moved in unison, starting when the senior generation began farming. The senior generation will, in a way, have “grown up” with the business. Enjoying successes and dealing with challenges along the way that resulted sometimes from mistakes or poor decisions.

Concerning is that, generally, farm family financial management skills haven’t kept pace with the business life cycle. The adage that businesses typically outgrow management applies.

Even more concerning is when the transition of ownership and management to the next generation begins. Past generational transfers typically involved the next generation buying the “farm” from parents, effectively re-capitalizing the business and resulting in situations where the business and personal life cycles started over again. This is happening less frequently.

More common today is the next generation taking over farm businesses from where they currently sit on the life cycle continuum as the senior generation exits. The incoming generation – with their personal life cycles reverting to a “beginning” orientation – set out to advance the farm along its business life cycle, ultimately leaving it in a better place for the next transition, perhaps in 20 years or so.

The incoming generation is taking over farms much more complex and managerially demanding than where their parents started. They don’t have the same opportunity to “grow up” with their businesses. And, typically, their financial management skill sets are no more developed than their parents’.

What this all means is: Heightening the awareness and importance of financial management is very important – and certainly when intergenerational transition is factored into the discussion.

A small, informal survey of farm families was conducted to see what could be learned from examining farm families with the next generation already actively involved in the business.

The following factors were considered: age of the incoming generation, parents’ financial management skills, how the next generation had started farming, types and levels of post-secondary education, other education, work experience off the farm, current farming structure and arrangement with parents, and interest in further education and approach to this learning.

The farms included in the survey were organized into two groups. The first had common attributes of successors with financial management skills, and the second had common attributes of successors lacking financial management skills.

Successors deemed to have financial management skills started farming by owning their own operation, had an ag diploma, worked elsewhere before farming full time, were now farming full-time in their own operation and were committed to continuing education.

Note: There were not enough common attributes in age or parents’ financial management to make a conclusion.

Of interest is the observation that parents who were considered to have financial management skills did not necessarily have successors with the same financial management skills. This is of particular concern given the discussion about business and personal life cycles and financial management acumen.

The following factors can make farm finances discussions difficult:

Wealth

Farmers are millionaires. But what does that mean? Assets and equity don’t pay bills. A suggestion is to simply ask where money comes from. The only sustainable source is profit. So while the balance sheet may indicate millions of dollars in assets and equity, a key focus in discussing farm finances should be on profit.

Financial management on the farm feels like it is a mess

Understandably, why would parents be eager to discuss farm finances with the incoming generation if they think their finances are in bad shape? Further, many will not feel they can properly explain why things are the way they are. On one hand, situations like this can be very difficult. At the same time, there are things that can – and should be – done.

A first step is to engage somebody who will be able to help bring things into order. Often, situations aren’t nearly as bad as what the parents fear.

Successor disinterest in farm finances

This is a common issue. Children who express a desire to farm envision many things. One of which is not to sit behind a desk and deal with farm finances.

One way to combat this is to create the awareness that farm financial management is very important. Begin educating children about finances very early on and way before there is any specific discussion about the farm’s finances. Then, when it’s appropriate, extend the discussion to include the farm business.

Treat financial management as being an important and valuable management function

This is about walking the talk. If parents don’t place a high importance on farm finances, it’s unlikely their children will.

The family discussions

Unless the parents’ intentions are to never share financial information with their children, the issue becomes a function of timing (when) and method (how). The 11-step approach below could be used to help with the discussions.

Talking about farm finances within the family often isn’t the easiest thing to do. But it’s very important and worth the effort.

I met with a farm family for a fourth time last week to talk specifically about financial management. They had decided to improve their financial management skill sets and committed to an investment of time and money to do so.

At the meeting, one of the people commented, “It was making more sense all the time.” … “It” being financial management. ![]()

Terry Betker is a farm management consultant with Backswath Management Inc. Email Terry Betker.