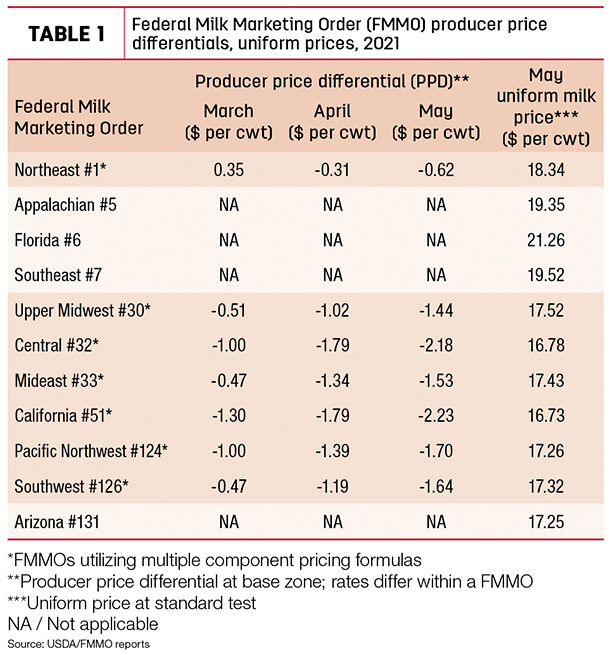

Uniform milk prices, producer price differentials (PPDs) and milk pooling behavior stayed on trend in May across most Federal Milk Marketing Orders (FMMOs). Monthly price announcements, released by FMMO administrators during the week ending June 11, showed uniform or “blend” prices posted small increases from the month before, while PPDs headed deeper into negative territory and were the lowest since December 2020.

Uniform prices and PPDs

May uniform prices at standardized test hit five-month highs in all 11 FMMOs, with a high of $21.26 per hundredweight (cwt) in Florida FMMO #6 and lows of $16.78 per cwt in Central FMMO #32 and $16.73 per cwt in California FMMO #51 (Table 1). The April-May price increases ranged from a low of 82 cents per cwt in the California FMMO #51 and Arizona FMMO #131 to a high of $1.10 per cwt in the Mideast FMMO #33.

Like April, May PPDs were again negative and slightly deeper than a month earlier in the seven FMMOs utilizing multiple component pricing, dipping 19-45 cents from April. PPDs have zone differentials, so they’ll vary slightly within each FMMO. In addition, PPDs’ impacts on individual milk checks are based on individual milk handlers.

Six FMMOs have now seen negative PPDs every month since June 2020, and the PPD in the California FMMO has been negative for 16 consecutive months, since February 2020.

As outlined in a paper by Marin Bozic, assistant professor and dairy economist with the University of Minnesota, and Christopher Wolf, Cornell University dairy economist, multiple factors affect FMMO marketing and PPDs. Several of those factors were evident in May.

The values of milk protein and butterfat both rose in May, but not at the same rate. At about $3.13 per pound, the value of milk protein in May FMMO milk price calculations rose nearly 32 cents from April and is the highest since November 2020. The value of butterfat posted a more modest 3.5-cent gain to about $1.99 per pound, the highest since January-February 2020.

Used in milk class price formulas, the FMMO May 2021 Class III and Class IV milk prices were $18.96 per cwt and $16.16 per cwt, respectively, a spread of $2.80 per cwt and the widest gap since November 2020.

The May Class III price was also higher than the advance Class I base price for the month at $17.10 per cwt.

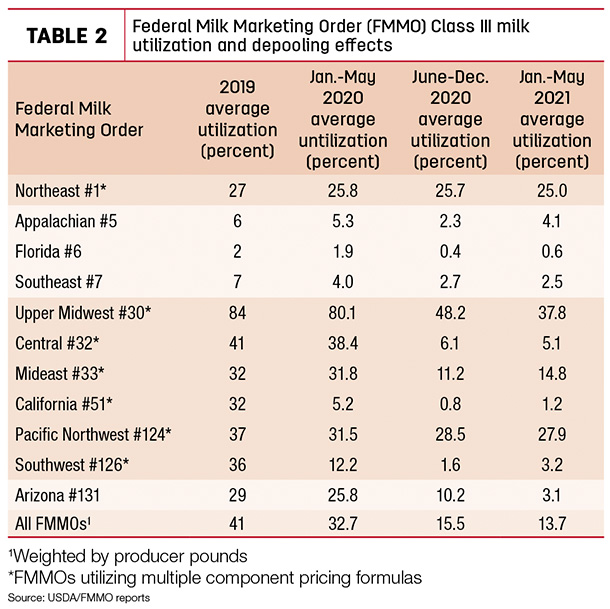

Those class price relationships provided incentives for depooling the higher-valued Class III milk. On both a volume and percentage basis, May levels of Class III milk utilization and pooling were similar with April levels in almost all FMMOs.

On a volume basis, total Class III milk pooled across all FMMOs in May 2021 was about 1.48 billion pounds, up slightly from April but down from 4.56 billion pounds a year earlier, just prior to major milk marketing disruptions caused by COVID-19.

On a percentage basis, Class III utilization was about 13.9% of all FMMO milk marketings in May 2021, well below the 34.5% pre-pandemic utilization rate in May 2020 and far below the average of 41% for all of 2019.

Through the first five months of 2021 (Table 2), average Class III utilization rate was below the second half of 2020 and substantially less than the first half of 2020 and all of 2019.

Looking ahead

The spread between monthly Class III-Class IV milk futures prices looks to be shrinking dramatically in June.

Based on the close of trading on June 11, the June Class III futures price settled at $17.25 per cwt, while the Class IV futures price settled at $16.56 per cwt, a spread of just 69 cents. That would be the slimmest Class III-Class IV price gap since pre-pandemic January 2020. In addition, the advance June Class I base price has already been announced at $18.29 per cwt, up $1.19 from May.

Both those factors will reduce FMMO depooling incentives in June, although each FMMO has its own rules for “repooling” as Class III milk handlers jump back in the pool.

Farther out (based on futures prices as of June 11), the Class III-Class IV price spread widens to a range of $1.16-$1.40 per cwt in August through November, but then shrinks to 26 cents in the first quarter of 2022. Class III-Class IV prices are essentially even in the second quarter of 2022 and less than 33 cents in the second half of next year. Markets are subject to change, of course.