- USDA 2021 milk production forecast jumps, pressuring price expectations lower

- FMMO class prices, PPDs and uniform prices

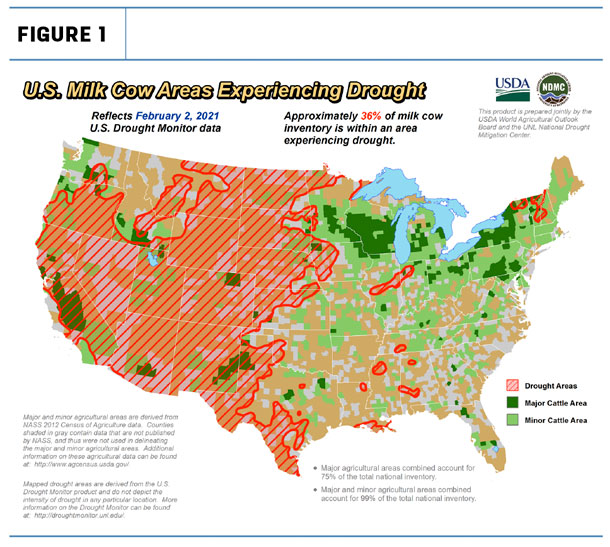

- 36% of dairy cows in ‘drought areas’

- Land O’Lakes subsidiary launching carbon credit program

- Things you might have missed

USDA 2021 milk production forecast jumps, pressuring price expectations lower

With U.S. dairy cow numbers at a 25-year high, the USDA raised the 2021 milk production forecast and added some more milk onto the 2020 total in its February World Ag Supply and Demand Estimates (WASDE) report.

The report, released Feb. 9, forecasts the 2021 all-milk price to average about $1.15 per hundredweight (cwt) less than 2020, with much of the decline coming from Class III milk. Feed costs are also expected to be higher.

Final milk production for 2020 was estimated at 223.1 billion pounds, up another 200 million pounds from last month’s estimate. At that total, 2020 milk production was up almost 2.2% from 2019’s total of 218.4 billion pounds.

For 2021, the USDA raised the overall production forecast to 227.4 billion pounds, up another 700 million pounds from last month’s estimate. If realized, it would be up about 1.9% from 2020.

Compared to a month ago, projected 2021 cheese, butter and whey prices were all reduced, with only the price for nonfat dry milk expected to increase. As a result, the outlook for 2021 milk prices was also lowered. The projected average all-milk price was cut 50 cents to $17.15 per cwt, the average Class III price was reduced 30 cents to $16.60 per cwt, and the Class IV price was cut 40 cents to $13.70 per cwt.

The 2020 average all-milk price was $18.32 per cwt, and the 2020 Class III price averaged $18.16 per cwt, while the average Class IV price was $13.49 per cwt.

Beef outlook – The 2021 beef production forecast was raised from the previous month primarily on higher cattle slaughter and heavier-than-expected early year cattle weights. Projected fed-cattle prices were lowered for the second half of the year on increased production. The 2021 annual average price was forecast at $115 per cwt, up about $7 from the 2020 average.

Feed costs to rise – Based on WASDE supply and demand estimates, feed supply and cost projections included:

-

Corn: This month’s 2020-21 U.S. corn outlook is for higher exports and lower ending stocks. At $4.30 per bushel, the projected 2020-21 season-average corn price received by producers was raised 10 cents from last month’s forecast and would be about 74 cents (21%) more than 2019-20.

- Soybeans: This month’s 2020-21 U.S. soybean outlook is for increased exports and lower ending stocks. The U.S. season-average soybean price received by producers for 2020-21 was estimated at $11.15 per bushel, unchanged from last month’s forecast and about $2.58 (30%) more than the 2019-20 average. The projected soybean meal price was raised $10 from last month’s forecast to $400 per ton, which would be about $100 (34%) more than the 2019-20 average.

FMMO class prices, PPDs and uniform prices

Most Federal Milk Marketing Order (FMMO) administrators will announce uniform milk prices and producer prices differentials (PPDs) for January milk marketings late in the week of Feb. 8-12. (Check the Progressive Dairy website for updates.) With weaker milk prices, negative PPDs are less likely due to diminished incentives for depooling.

FMMO Class III and Class IV milk prices started the new year only slightly better than they ended the past one. The January 2021 Class III milk price is $16.04 per cwt, up 32 cents from December 2020 but $1.01 less than January 2020. The 2020 Class III milk price averaged $18.16 per cwt.

The value of milk protein in January was less than a penny higher than December at about $3.04 per pound. Protein averaged $3.76 per pound in 2020, up about $1.38 from 2019.

Meanwhile, the January 2021 Class IV milk price is $13.75 per cwt, up 39 cents from December but $2.90 less than January 2020. The 2020 Class IV price averaged $13.49 per cwt.

The January Class III-Class IV price gap ($2.29 per cwt) is the smallest since May 2020.

With the January 2021 FMMO Class I base price at $15.14 per cwt, additional zone differentials will push FMMO Class I prices to a high of about $20.50 per cwt in the Florida FMMO and a low of $16.94 per cwt in the Upper Midwest. With those Class I prices above the Class III price, FMMO depooling should be reduced.

36% of dairy cows in ‘drought areas’

More than one-third of U.S. dairy cows were located in “drought areas” at the start of February, according to the USDA’s World Agricultural Outlook Board (see Figure 1). The percentage is down slightly from last October but still near the highest level since the first half of 2015.

The weekly U.S. Drought Monitor overlays areas experiencing drought with maps of major production areas for hay, alfalfa hay, corn, soybeans and other crops, as well as primary dairy and beef cattle areas. A concern for dairy farmers, 55% of major alfalfa hay production areas were under drought conditions in early February, the highest percentage dating back to 2013.

Land O’Lakes subsidiary launching carbon credit program

Truterra LLC, the sustainability business and subsidiary of Land O’Lakes Inc., announced the launch of TruCarbon, a program designed to help farmers generate and sell carbon credits to private sector buyers.

TruCarbon offers buyers carbon credits that are created using soil and conservation science and precision data and verification methods. Microsoft is the program’s first secured buyer. For the initial launch, participating farmers may receive $20 per ton of carbon, with the first tranche of payments starting this summer.

Participating farmers and their ag retailers will use the Truterra Insights Engine to measure and track on-farm practices and model new practice changes, such as cover crops and no-till, based on environmental impact and profitability. Truterra will handle soil testing and other activities designed to ensure maximum credit quality and value.

Qualifying farmers may be compensated for carbon sequestration retroactively up to five years based on the soil health practices they adopted in prior growing seasons.

Click here for program and enrollment information.

Things you might have missed

-

U.S. milk production is increasing faster than demand is recovering, making 2021 a challenging year for dairy farmers, warns Peter Vitaliano, National Milk Producers Federation (NMPF) chief economist, in a recent podcast. Bright spots do remain for the medium- and longer-term dairy outlook. Demand for U.S. dairy exports is at record levels, and demand for dairy away from home should increase as the COVID-19 pandemic fades.

-

The USDA released the final rule for its Agricultural Conservation Easement Program, which enables agricultural producers and private landowners to protect farmlands, grasslands and wetlands with conservation easements.

- The USDA also extended the Conservation Reserve Program (CRP) general sign-up period beyond its scheduled closing date of Feb. 12. Incoming USDA staff are evaluating ways to increase enrollment in the program that provides annual rental payments for 10 to 15 years for land devoted to conservation purposes. No new sign-up period closing date has been announced.

- Compared with 2020, much lower government payments and higher expenses are expected to drive U.S. net farm income down 8%-10% in 2021. Direct government farm payments are forecast at $25.3 billion in 2021, a decrease of $21 billion (45%) in nominal terms. Higher feed, fertilizer and labor costs are expected to push production expenses up 2.5%, according to the USDA’s February 2020 farm income forecast.

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke