Editor's note: An update to this article has been added to the end, incorporating an Internal Revenue Service ruling after the original article appeared. This year is shaping up to be one of the most interesting tax years in a long time.

Between USDA assistance such as the Commodity Food Assistance Program (CFAP) payments, Paycheck Protection Program (PPP) loans and everything in between, it will be critical for dairy farmers to stay up to date on projected year-end numbers to avoid unpleasant tax surprises. The first place to start is with accurate records.

PPP: Timing is critical

The biggest possible error in 2020 with dairy records is likely how the PPP is handled. Depending on when loan forgiveness takes place, there may be fewer expenses than originally thought.

Since the inception of the program, one of the major questions has been whether or not expenses paid with a PPP loan that is forgiven would be deductible. The IRS addressed the issue in Notice 2020-32 and indicated that to the extent the loan forgiveness under the PPP is excluded from income, it is considered a “class of exempt income” under the tax code. As a result, the expenses paid with the forgiven loan are not permitted to be deducted. According to the IRS, this treatment prevents the taxpayer from receiving a double tax benefit.

The major uncertainty that exists, barring further guidance, is in the case of a taxpayer who has their tax year close prior to the PPP loan being forgiven. As most taxpayers will not receive loan forgiveness until 2021, clarity is needed regarding the expenses incurred in 2020. It appears that if the loan is not forgiven until 2021, then the expenses incurred in 2020 will be deductible and the PPP funds will be recorded as a loan on the balance sheet at year-end.

Let’s take a look at two examples illustrating the timing difference of PPP forgiveness. Both are cash-basis dairy farmers who received PPP loans of $50,000 on April 1, 2020. The loans were spent entirely on farm payrolls, an eligible expense that will ultimately lead to full forgiveness.

-

Example 1: 2020 PPP forgiveness. Taxpayer A applied for and received confirmation of the $50,000 loan forgiveness in 2020. Under that scenario, she will not be able to deduct the $50,000 in payroll expenses, as the $50,000 loan forgiveness was not included in taxable income. In other words, the taxpayer’s overall taxable income is still $50,000 higher due to the disallowance of the expense. There is a proposal circulating in Congress to make these expenses deductible, but it is currently stalled.

- Example 2: 2021 PPP forgiveness. Taxpayer B had not applied for PPP forgiveness as of Dec. 31, 2020. He books a $50,000 loan on the balance sheet and deducts the $50,000 of payroll expenses.

In 2021, Taxpayer A will likely have to increase her taxable income by $50,000, as a result of the PPP loan being forgiven due to the tax benefit rule.

With the added taxable income due to CFAP in 2020, all things being equal, it likely makes sense to try to utilize the expenses paid with PPP in 2020.

Prepayment of inputs: Feed

Most cash-basis dairy farmers are aware of the ability to prepay inputs for the year in order to reduce taxable income. With regard to prepaid livestock feed, the IRS requirements are as follows:

1. The payment is for the purchase of feed and not a deposit. The purchase agreement must show that a binding commitment exists to accept delivery of a specific quantity of feed at a fixed price, with no entitlement for a refund. While the right to substitute other goods or products other than those mentioned in the contract could show proof of a deposit, the substitution of ingredients to vary a particular feed mix to meet livestock diet requirements are permitted.

2. The prepayment has a business purpose, such as fixing a maximum price, and isn’t merely tax avoidance.

3. Deducting the prepayment doesn’t result in a material distortion of income.

There may be certain instances where the deductibility of prepaid inputs is limited to 50% of the other overall farm deductible expenses for the year. More importantly, some dairy farmers may have concerns about the viability of vendors in certain cases, which brings up the option of deferred milk payment contracts.

Deferred milk payment contracts

Deferred payment contracts should be distinguished from what is known as constructive receipt of income in the tax world. Constructive receipt would be where a cash-basis dairy farm has access to a payment before year-end but tries to push the payment into the following year. In such a case, that is income to the dairy farmer in the year he or she has access to those funds.

On the other hand, a deferred milk contract is where the milk is sold under circumstances in which payment occurs in a future year. Most cooperatives are well versed in setting up these programs to mitigate IRS challenges.

The particularly nice part about this tool is: The payment from the cooperative is generally received in January, making it a quick turnaround on receiving the revenue. Since these programs often require notice from the dairy farmer to participate the month before in which the deferral will take place, farmers need to act early to employ this strategy on December’s milk check.

Overshooting tax planning

Often, many dairy farm accountants approach tax planning with a buckshot approach instead of laser precision. Dairy farmers are well aware that raised cows receive capital gains treatment (i.e., they are taxed at lower rates than ordinary income.) However, tax planning in many cases tends to be overly aggressive due to not taking advantage of this fact.

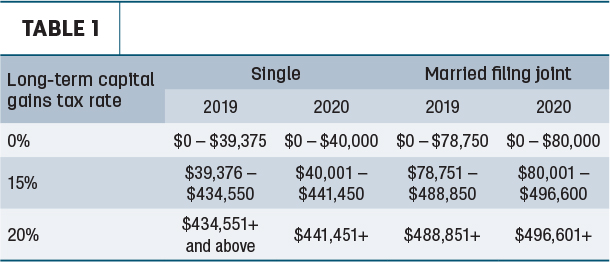

For instance, in 2020 the standard deduction for married filers filing jointly is $24,800. In addition to that, the zero percent federal capital gains bracket goes all the way up to $80,000.

Adding this all together, it means if the married dairy farming couple has no other income on their tax return, except for $104,800 of raised cows, they will incur zero federal income tax.

Now this isn’t saying farmers should tax plan down to not pay any self-employment tax, as that can be an important factor in retirement as they are building up Social Security benefits. Rather, the point is to think in terms of marginal dollars spent. It likely isn’t worth spending an extra dollar in the case where all a dairy farmer has is $40,000 of raised cow income since they are saving zero federal income tax.

There may be some state tax involved, but often that is minimal and not worth the wasted expenditures. Furthermore, some states provide farmers with tax credits that help mitigate any state taxes that would be owed.

Even for dairy farmers with significant raised cow sales, a married couple with income under $496,600 is only paying 15% federal capital gains tax (Table 1).

Another way dairy farmers may overshoot tax planning is by not factoring in their Internal Revenue Code (IRC) 199A(g) flow-through deduction from their cooperative. Cooperatives often pass through to their patrons on the 1099-PATR, a deduction permitted to offset federal income tax (but not self-employment tax).

Importantly here, C-Corporation dairy farmers are not permitted to take advantage of this cooperative flow-through and should discuss with their tax advisers whether or not conversion to an S-Corporation makes sense. Tax planning below the 199A flow-through deduction from the cooperative is not prudent because the deduction is a “use it or lose it” amount. It cannot be carried to another tax year.

Other issues: Milk base

One of the unique issues that can arise as farms consolidate is the purchase of another dairy’s milk base. This has become more prevalent in the Northeast as a result of some cooperative base excess programs.

In cases where there is a purchase of a milk base, that is not an immediate tax expense. Rather, it is considered a 15-year amortizable asset. If this is improperly coded in the records as a fully deductible expense, it will underestimate taxable income.

Putting it all together

2020 has been a very unique year in terms of many things in our lives, and tax planning has been no different. PPP and CFAP have made this year one of the most challenging in a long time from a tax planning standpoint.

Meeting with your tax adviser should not be put off until December this year. There is no one-size-fits-all to tax planning since every individual taxpayer has different tax circumstances at play. More importantly, tax planning should never be a one-year proposition. It should take a multiyear laser-focused approach to achieve the best result.

IRS Publication 225 (Farmer's Tax Guide) provides additional information for use in preparing 2020 tax returns.

Update: IRS guidance impacts PPP loan recipients

The Internal Revenue Service (IRS) has issued a ruling potentially impacting dairy farmers whose Paycheck Protection Program (PPP) loans had not been forgiven by Dec. 31, 2020, according to Dario Arezzo, senior tax consultant with Farm Credit East.

In the original article (above), Arezzo noted there was tax uncertainty for PPP loan recipients who had their tax years close prior to the PPP loan being forgiven. As most taxpayers will not receive loan forgiveness until 2021, clarity was needed regarding the expenses incurred in 2020.

At the time the article was written, it appeared that if the loan was not forgiven until 2021, then the expenses incurred in 2020 would be deductible and the PPP funds will be recorded as a loan on the balance sheet at year end.

Under guidance released in mid-November (Revenue Ruling 2020-27), the IRS ruled that a taxpayer receiving a PPP loan and who paid or incurred certain otherwise deductible expenses listed in section 1106(b) of the Coronavirus Aid, Relief and Economic Security (CARES) Act, may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the PPP loan.

In other words, even if PPP forgiveness occurs in 2021, those eligible expenses paid in 2020 with the PPP funds will not be deductible so long as the taxpayer reasonably expects to receive forgiveness. Farmers who were planning on applying for PPP forgiveness in 2021 in order to utilize those expenses should revisit their year-end tax planning projections with their advisers.