The March 20, 2020 Dairy Market News wrote the following in regards to the coronavirus and its impact on dairy demand, “Retail orders have climbed. For the same reason for the retail push, food service orders nearly dissolved.” Panic buying resulted in many staple products, including dairy products, clearing the grocery store shelves. Retail grocers were challenged to keep grocery store shelves stocked with the staples. The U.S. Census Bureau report, Estimated Monthly Retail and Food Services Sales, showed March and April 2020 grocery sales were 28.5% and 14.3% higher, respectively, compared to the same months a year earlier.

On the other hand, dairy sales to the food service industry dropped like a lead balloon. It is estimated dairy sales are a mixture of about 50% retail and 50% food service. Schools, restaurants, the travel industry and other institutions were shut down. Some cheese plants with most of their sales dependent upon food service had reduced or no markets for their products, thus temporarily closing or reducing production. The monthly Census Bureau report reported food services and drinking places, month-over-month sales, declined 28.5% in March and 52.5% in April.

In May, some food service segments started reopening. Consumers grew tired of preparing meals at home and ordered more take-out or deliveries. Food services started restocking their inventories and dairy sales began increasing. The federal coronavirus aid package provided funds to purchase millions of dollars of dairy products for donation programs. All of this sparked demand and moved the block cheese price to a record high.

With all of the above occurring in a relatively short period of time, what was the impact on dairy demand during the first six months of 2020? Did higher retail sales offset some of the loss in food service sales? How did exports perform during this period? As this article is being written in the middle of August, we now have the appropriate USDA data to answer these questions.

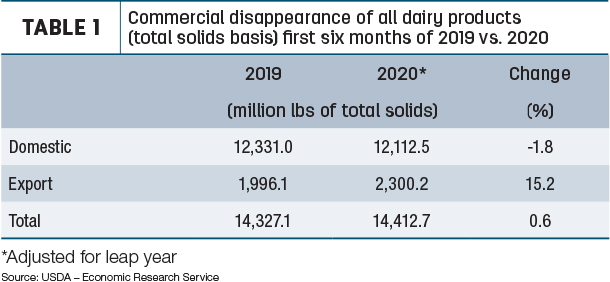

Even with all of the disruption caused by the coronavirus, there is good news to report (see Table 1).

Commercial disappearance of all dairy products (domestic + export) was 0.6% higher during the first six months of 2020 compared to the same period in 2019. Just looking at domestic disappearance, it was down 1.8%. Granted, this is a negative number, but in light of the pandemic and dairy industry’s reliance on food service, it was not a bad six months for dairy demand on the domestic front.

Shifting to exports, they were 15.2% higher for the first half of 2020 compared to last year. Strong exports provided a needed boost to total demand. Nonfat/skim milk powder led the increased exports and were almost 42% higher than a year ago. In fact, May and June were record months for exports. Through the first six months of 2020, exports are 15.96% of total solids disappearance.

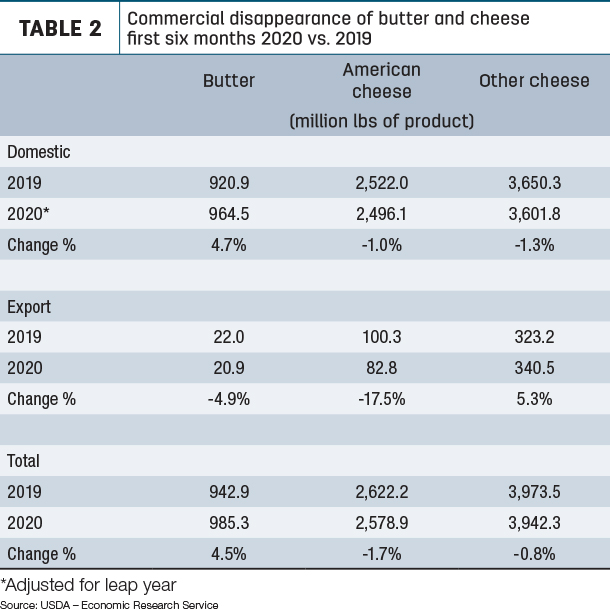

Now let’s look specifically at butter and cheese demand (see Table 2).

The first half of 2020 saw domestic butter disappearance increase 4.7% over the previous year. The strong increase in butter demand partially helped offset the 6.4% increase in butter production during the same time period. On the cheese side, domestic American cheese disappearance declined 1% while domestic disappearance of other cheese, which includes mozzarella, dropped 1.3%. However, exports of other cheese increased 5.3% for the first six months of the year compared to a year earlier.

Dairy product production data provides further insight into monthly demand changes. Total cheese production in April of this year was 2% lower than the previous April. Lower demand, less cheese produced. Then in June, month-over-month total cheese production was up 3.5%. For mozzarella, the primary pizza cheese, April production was down 5.6% compared to last April. Then as consumers started ordering more pizza, June mozzarella production jumped 3.9%. More demand, more cheese produced.

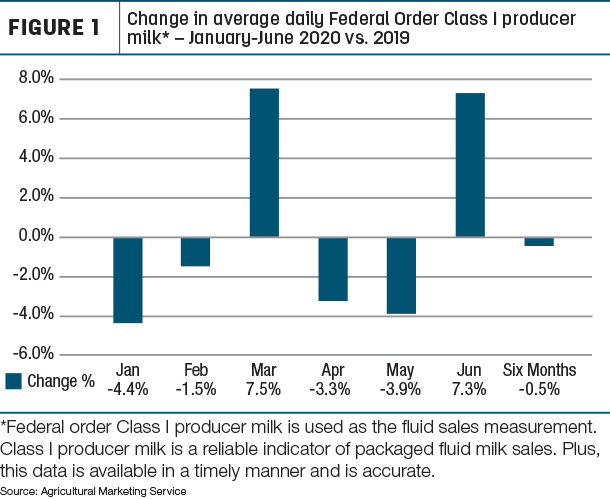

During the early stages of the coronavirus pandemic, fluid milk left the grocery store shelves almost as quickly as toilet paper. Some grocers capped milk sales at two 1-gallon containers per customer. March fluid sales were 7.5% higher than the previous March (see Figure 1).

Average daily fluid sales in March were about 10.2 million pounds more per day than the month before, February. This equates to an additional 200-plus tankers of raw milk per day to meet the increased fluid demand. Most of the higher fluid sales in March occurred during the last half of March, after the March 13 national emergency announcement. It is no wonder fluid plants and their suppliers scrambled to have enough milk to keep the grocery shelves stocked.

Then as panic buying slowed and consumers’ refrigerators were stocked, fluid sales dropped 3.3% in April and 3.9% in May, compared to year-ago levels. For the first half of the year, fluid milk sales are down 0.5%. To put this in perspective, over the past 10 years, fluid milk sales have declined at an average annual rate of about 1.6%. In other words, compared to previous years, fluid sales performed better during the first half of 2020.

The June sales increase of 7.3% stands out. There was little or no panic buying in June. So what sparked the June sales jump? The Class I mover increased $5.14 per hundredweight (cwt) or 44 cents per gallon from June to July. Historically, fluid processors, wholesalers and retailers stock up with relatively lower-priced fluid milk at the end of a month preceding a large price increase. Likewise, when the Class I mover makes a large decline, month-end inventories are minimized.

In summary, total dairy demand for the first six months of 2020 was up 0.6%. Yes, all in the dairy industry would like to see a stronger demand. However, considering all of the disruptions “from normal” caused by the coronavirus, dairy demand was better than many expected back in March. ![]()

Calvin Covington does some farming, consulting, writing and public speaking.

-

Calvin Covington

- Retired Dairy Co-op Executive

- Email Calvin Covington