- Dairy product exports on 7-month run

- Dairy heifer exports weaken

- China buying hay but shipping a concern

- Monthly ag trade balance turns deficit

- USMCA implementation date disputed

- USTR rebukes EU over dairy trade policies

- U.S. export impact: Japan adds to COVID-19 support

Dairy products on seven-month run

U.S. dairy exporters topped year-earlier levels for the seventh straight month in March despite disruptions resulting from the coronavirus outbreak, according to the U.S. Dairy Export Council (USDEC).

- Volume basis: U.S. suppliers shipped 190,456 tons of milk powders, cheese, whey products, lactose and butterfat, 2% more than the same month a year before. This is the highest figure since May 2018.

Southeast Asia continues to be the main source of growth for U.S. suppliers. Shipments of milk powders, whey, lactose and cheese were a record-high 49,729 tons in March, up 10% from a year earlier.

Whey volumes continued to improve, posting a 7% gain and the highest volume in 19 months. The recovery in sales to China was noteworthy, with first-quarter 2020 shipments up 21% from the same period a year earier.

Meanwhile, total cheese exports were 33,356 tons in March, the most in 10 months, but down 10% from last March’s record volume.

-

Value basis: The value of all exports was $592 million, up 10% from March 2019. Exports to Southeast Asia were valued at just shy of $120 million, up 33% from a year earlier and the best month in more than five years. First-quarter 2020 exports (adjusted for leap day) to the region were up 54% from a year ago.

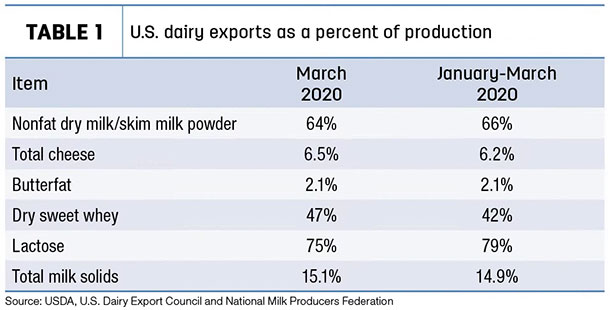

- Total milk solids basis: U.S. exports were equivalent to 15.1% of U.S. milk solids production in March 2020 (Table 1).

Dairy heifer exports weaken

After a strong start to the year, the USDA estimates indicate just 558 U.S. dairy replacement heifers were exported in March, a 22-month low. All of the March shipments stayed close to home: 338 moved to Mexico and 220 headed to Canada. March exports were valued at $849,000, the lowest since April 2016.

With the fast start to the year, first-quarter 2020 dairy heifer exports are still the highest since 2017 and the second-highest since 2014. However, Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said the dairy heifer export market will essentially be shut down while the world deals with the COVID-19 crisis. Longer term, he’s worried what impact a widespread economic downturn will have on foreign customers’ abilities to purchase U.S. dairy heifers.

Gerardo Quaassdorff, T.K. Exports Inc., Boston, Virginia, said the U.S. business of exporting cattle is still open, but potential buying countries are implementing restrictive lockdown rules on transportation and banking. Exporters hope the world will be open for business later this summer. The question, however, will be what economic shape those buyers are in after the lockdown. Several countries have implemented economic measures to provide access to credit for importing livestock genetics, but in general, budgets are depleted, especially where oil is an important part of the economy.

China buying hay but shipping a concern

The hay export picture has both good news and bad. The latest USDA trade report showed March alfalfa hay exports totaled 257,363 metric tons (MT), the highest monthly total since last October 2019. Sales to China were again robust, topping 100,900 MT, the second-highest monthly total in 33 months. Sales to Japan topped 60,000 MT for the first time since May 2019.

After sitting near two-year lows, March exports of other hay totaled 131,224 MT, the second-highest volume in the past 16 months. Japan was the leading buyer at 82,966 MT, a five-year high.

Going forward, shipping line schedules and reduced cargo capacity are among the biggest issues facing U.S. hay exporters trying to make sales for June and July, said Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington. West Coast vessel space is limited and is being booked five to six weeks out, with canceled services and unknown arrival and delivery times.

Marketing new-crop hay always brings unknown challenges, but with travel restrictions related to COVID-19, it will take even more creativity, and the marketing season is likely to get off to a slow start, Mastin said.

“With worldwide travel restrictions, customers will not be able to visit new-crop stacks and personally view and analyze the quality,” she explained. “We will have to rely on photos and samples, which can be expensive and takes time. We are all looking for the best way to evaluate hay in the stack without a physical inspection.”

For more on hay exports and market conditions, check out Progressive Forage’s Forage Market Insights update.

Monthly ag trade balance turns deficit

Overall, March 2020 U.S. ag exports were valued at $11.9 billion, while ag imports were estimated at $12.4 billion, resulting in a $502 million ag trade deficit. In year-to-date fiscal year 2020 (October 2019-March 2020), the ag trade surplus stands at about $4.6 billion, similar to the trade balance over the same period a year earlier.

Other dairy trade news

USMCA implementation date disputed

U.S. Trade Representative Robert Lighthizer notified Congress that Canada and Mexico have taken measures necessary to comply with their commitments under the U.S.-Mexico-Canada Agreement (USMCA), and that the agreement will enter into force on July 1, 2020.

However, the Dairy Farmers of Canada and the Dairy Processors Association of Canada charged parliamentarians were misled by the Trudeau government regarding the date of implementation and are seeking the implementation of the agreement to start on Aug. 1.

Canada’s “dairy year” begins annually on Aug. 1. With a July 1 start date, there are concerns export concessions negotiated for “year one” of USMCA would be in place for just one month before steeper second-year concessions begin.

Canada will phase in new tariff rate quotas – over a period of up to 20 years – exclusively for U.S. milk and U.S. dairy products, which should provide market access gains. Those tariff rate quotes will affect fluid milk, cheese, cream, skim milk powder, butter and cream powder, concentrated and condensed milk, yogurt, whey and other products. Preliminary calculations estimated the U.S. will have access to about 3.6% of Canada's dairy market, up from the current 1% and above the 3.25% market access Canada would have given the U.S. as part of the Trans-Pacific Partnership. The U.S. will provide reciprocal access on a ton-for-ton basis for imports of Canada dairy products through first-come, first-served tariff rate quotas.

Among other top priorities for the U.S. industry is the elimination of Canada’s Classes 6 and 7 milk pricing programs within six months after the agreement is implemented.

USTR rebukes EU over dairy trade policies

An annual U.S. Trade Representative (USTR) office report rebuked European Union (EU) dairy trade policies related to geographical indications (GIs). The U.S. Special 301 Report, released in late April, found that “… the EU pressures trading partners to prevent all producers, other than in certain EU regions, from using certain product names, such as fontina, gorgonzola, parmesan, asiago or feta. This is despite the fact that these terms are the common names for products produced in countries around the world.”

The USDEC and National Milk Producers Federation (NMPF) had filed comments with USTR, urging the U.S. government to confront the EU’s trade agenda against U.S. dairy.

“Rather than trying to compete on a level playing field, Europe has tried to effectively institute a blockade of U.S. dairy,” said Jim Mulhern, president and CEO of NMPF. “This is unacceptable and harms America’s dairy industry and the rural communities our farmers and processors support."

The USTR statement also drew the praise of the Consortium for Common Food Names (CCFN), of which NMPF staff member Jaime Castaneda is executive director.

U.S. export impact: Japan adds to COVID-19 support

In late April, Japan’s Agriculture and Livestock Industries Corporation (ALIC) announced additional support for beef and dairy companies as part of a $875 million COVID-19 supplementary budget.

The dairy supports include incentive payments for dairy manufacturers to replace imported ingredients with domestic milk powder. In addition to the ALIC funding, the Japanese government is considering an additional $17.5 million to redirect excess milk to further processing.

As noted by Progressive Dairy previously, the impact on the U.S. dairy industry will likely be in the form of reduced nonfat dry milk (NFDM) exports. Japan’s stocks of NFDM are already near historical highs. In 2019, Japan imported 5,804 MT of NFDM from the U.S., valued at $13 million (U.S.). ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke