Many banking institutions that support the dairy industry require reviewed financial statements to be completed at least semiannually. As outlined below, reviewed financial statements provide an extra layer of reliability for the information included therein. It is important that the financial statements provided to the lender represent an accurate story of what has transpired during the period.

A reviewed financial statement is required to be reported on the accrual basis of accounting, whereas many dairy farmers maintain their internal books on the cash basis. Although the cash basis of accounting is the reporting standard for income tax purposes, it does not tell the story of the dairy operation. The accrual basis allows for the reporting of income and expenses as they are incurred, rather than paid.

Maybe you’ve heard of audited financial statements, but are not familiar with a reviewed statement? Financial statements prepared in the U.S. are required to be reported using Generally Accepted Accounting Principles (GAAP) as defined by the American Institute of Certified Public Accountants (AICPA) and the Financial Accounting Standards Board (FASB). There are four performance standards of which CPAs in public accounting are required to report:

- Audit – To express an opinion on the financial statements based on the audit, in accordance with auditing standards generally accepted in the U.S.

- Review – Obtain limited assurance as a basis for reporting whether the accountant is aware of any material modifications that should be made to the financial statements for them to be in accordance with the applicable financial reporting framework, primarily through the performance of inquiry and analytical procedures.

- Compilation – To apply accounting and financial reporting expertise to assist management in the presentation of financial statements and report in accordance with this section without undertaking to obtain or provide any assurance that there are no material modifications that should be made to the financial statements in order for them to be in accordance with the applicable financial reporting framework.

- Preparation – To prepare financial statements pursuant to a specified financial reporting framework.

In summary, an audit gives the highest level of assurance that the financial statements are free from material misstatement. A review provides limited assurance, and a compilation provides no assurance. The majority of financial statements prepared for dairy farmers are reviews. These give the reader assurance that the statement was prepared in accordance with accounting standards, but does not include an in-depth review of the internal control procedures.

As mentioned above, financial statements prepared under GAAP are generally completed on the accrual basis. The main distinction between an accrual and cash basis financial statement is when income and expenses are reported.

One example of a cash versus accrual difference is accounting for crops in the ground. On a cash basis, expenses paid toward the crop is expensed as paid. The crops in the ground are not assigned a value using cash basis of accounting. However, when valuing assets on an accrual basis, there would be a value to those crops.

One of the fundamental accounting principles included in GAAP is the matching principle. This principle states that expenses should show up on the income statement at the same time as the income. Because it takes many months for a row crop to grow, it is likely that a financial statement will be prepared while that crop is still in the ground. Under the matching principle, the income and expense are realized in the same period.

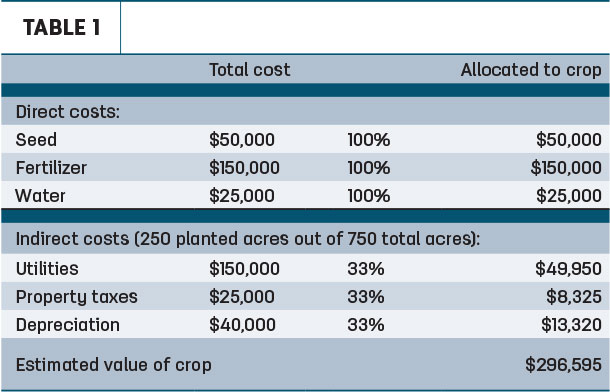

To do this on an interim financial statement, one needs to calculate the expense into the crop as of the period end. In addition to the direct costs (seed, fertilizer, labor, water), a farm manager should also evaluate the indirect expenses. Some indirect expenses would include utilities, property taxes, depreciation and general repairs, just to name a few. Although there may be multiple methods of allocating indirect costs, the easiest would be to allocate these over the number of acres planted.

For example, a farm may be split into two crops: 500 acres of alfalfa and 250 acres of corn/wheat. One-third of the indirect costs would be allocated the corn/wheat. Since these crops are generally planted on the same field, the timing of the expense would also need to be taken into consideration.

Table 1 is an example of how to calculate a crop in the ground, including direct and indirect costs.

If the farm operation is coincidental to a dairy operation, a farm manager would need to allocate the expense to the farm prior to this calculation.

Once the estimated value of the crop is calculated, the related expenses are moved to the balance sheet as a current asset. When the crop is harvested, the expenses will be moved back to the income statement and expensed against the income.

The result of this is an income statement that includes the income and expenses for the same crop, included in the same time period. This can be useful with assessing whether or not to continue growing the crop or to assist in identifying what can be done differently to derive a different result.

This same method can be used to calculate cows and other crops. However, the rules for trees are different for tax purposes. Tax regulations require that pre-productive tree costs be capitalized and then depreciated over the trees’ productive life. For more information on tree capitalization, consult your accountant.

A financial statement is expected to tell the financial story of the operation. All business owners are encouraged to review these on a continual basis, and any questions should be asked of your accountant prior to release. ![]()

-

Brandie O’Dell

- CPA

- Frazer LLP

- Email Brandie O’Dell