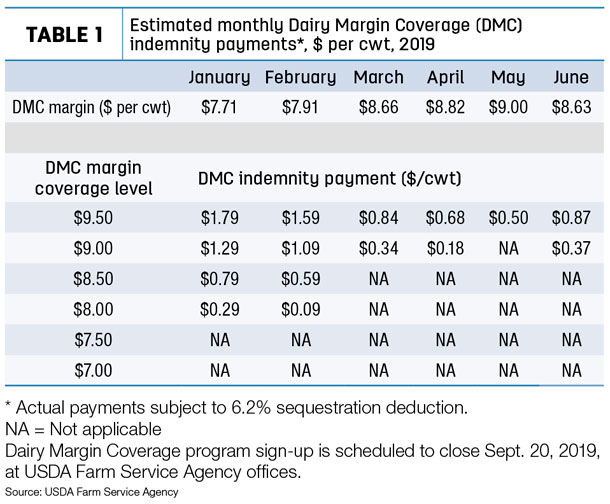

The USDA released its latest Ag Prices report on July 31, including factors used to calculate June DMC payments. The June DMC margin was estimated at $8.63 per hundredweight (cwt), resulting in a gross indemnity payment of 87 cents per cwt on milk covered at the $9.50 per cwt level (Table 1). Producers insured at the $9.50 per cwt margin level have now earned indemnity payments averaging $1.05 per cwt on milk sold between January and June.

June milk prices slightly higher

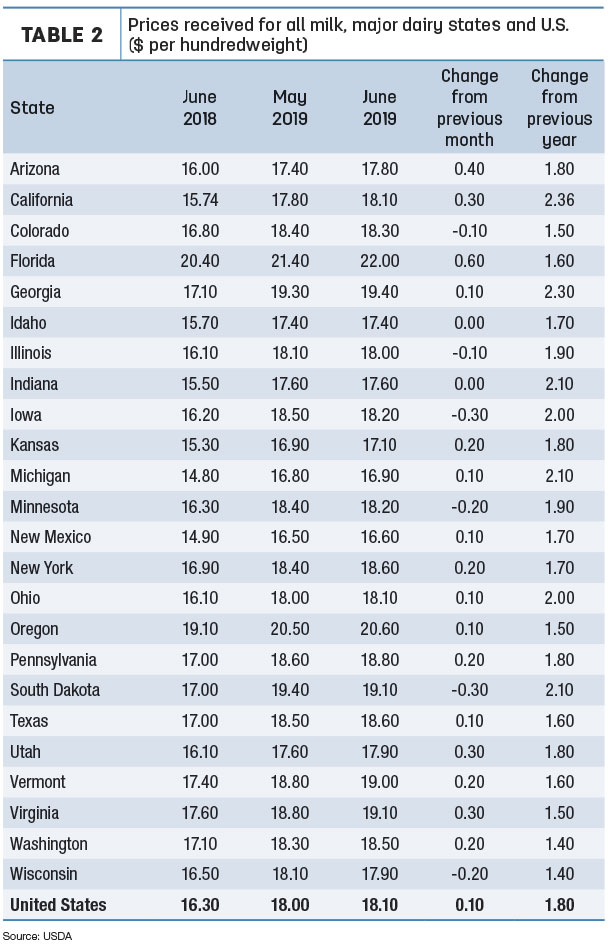

The June 2019 U.S. average milk price rose 10 cents per cwt from May to $18.10 per cwt. The average was $1.80 higher than June 2018 (Table 2) and the highest average since November 2017.

Through June, the average 2019 U.S. all-milk price stands at $17.45 per cwt, $1.55 more than the same period a year ago and the second-highest average for that six-month period since 2014.

Florida’s average of $22 per cwt remained the nation’s high, followed by Oregon at $20.60 per cwt; only Michigan and New Mexico averaged under $17 per cwt at $16.90 and $16.80 per cwt, respectively.

Compared to a year earlier, June 2019 milk prices were up at least $2 per cwt or more in seven states, with California up $2.36 per cwt to $18.10 per cwt.

Alfalfa hay cheaper, but corn and soybean meal more expensive

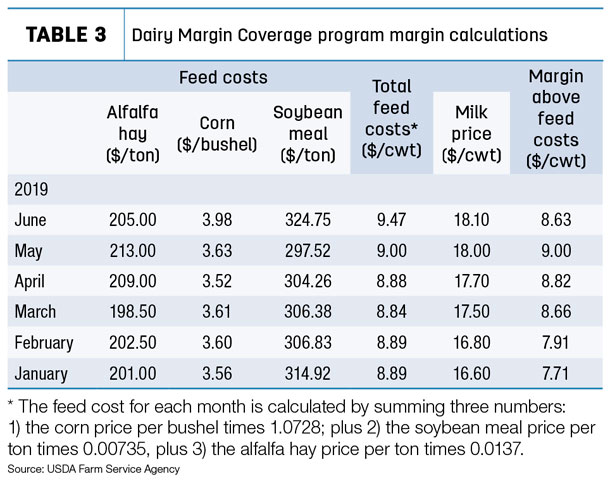

U.S. average feed costs also moved higher in June, with lower alfalfa hay only partially offsetting higher average prices for corn and soybean meal.

Under the revised DMC program formula, the USDA calculates a 50-50 blend price for alfalfa hay, averaging all alfalfa hay prices in 27 states and prices for Premium and Supreme dairy-quality alfalfa hay prices in the five largest milk-producing states each month – California, Idaho, New York, Texas and Wisconsin.

With new-crop hay now available, the June alfalfa hay average price was $205 per ton in June, down $8 from May.

However, June corn prices averaged $3.98 per bushel, up 35 cents from May, and soybean meal averaged $324.75 per ton, up $27.23 per ton.

That yielded an average DMC total feed cost of $9.47 per cwt of milk sold, up 47 cents from May (Table 3).

Based on milk and feed futures prices as of June 29, the July DMC margin is expected to push higher, near $9.45 per cwt. After a small decline in August, margins are forecast to move to about $10 per cwt through the end of the year.

Higher milk prices will contribute to the improving margin next month. We already know the July 2019 Federal Milk Marketing Order (FMMO) Class I base price is $17.18 per cwt, the highest level since January 2017.

July Class III, IV milk prices highest since 2014

And, announced on July 31, July FMMO Class III and Class IV milk prices moved to five-year highs.

The July 2019 Class III price was $17.55 per cwt, up $1.28 from June 2019 and $3.45 more than July 2018. It’s the highest Class III price since December 2014. The year-to-date average of $15.58 per cwt is up $1.21 from a year ago.

The July Class IV price was $16.90 per cwt, up 7 cents from June and $2.76 more than July 2018. It’s the highest Class IV price since November 2014. The year-to-date average of $16.11 per cwt is up $2.38 from a year ago.

Both Class III and Class IV milk prices have a long way to go to equal the record highs of 2014. That year, the Class III price averaged $22.34 per cwt, while the Class IV price averaged $22.09 per cwt.

DMC sign-up period open until Sept. 20

As of July 29, 14,353 dairy operations had signed up for the DMC program, about 53% of 26,832 dairy operations with established milk production history and about 42% of all dairy operations commercially licensed to sell milk. The USDA’s Farm Service Agency (FSA) had begun paying approximately $158.2 million to producers for milk production insured from January through May 2019. (Read: Dairy Margin Coverage payments reach $158 million.)

A reminder as you head to your FSA office to sign up for DMC before the Sept. 20 deadline: The USDA has made a web-based tool to help dairy producers evaluate coverage levels through DMC program by combining operation data and other key variables to calculate coverage needs based on price projections.

The decision tool assists producers with calculating total premiums costs and administrative fees associated with participation in DMC. It also forecasts payments that will be made during the coverage year. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke