Erin Borrer, an analyst for the U.S. Meat Export Federation, gave insight on the export trade during a webinar hosted by Accelerated Beef Producers on Jan. 29.

Borrer pointed to several trends among the Asian trade partners, rising U.S. currency and dropping beef production across the globe as contributing elements to the beef trade – including the cut seen in oil prices.

“In most of our Asian markets – Japan, Hong Kong, China, Korea, Taiwan – although a lot of these consumers don’t drive as much as Americans, their manufacturing sectors can benefit from cheaper oil as can consumers,” said Borrer.

“I don’t see a lot of downside for risk for us as far as cheaper oil, and possibly some potential upside benefit as far as economic growth again in a lot of those Asian markets.”

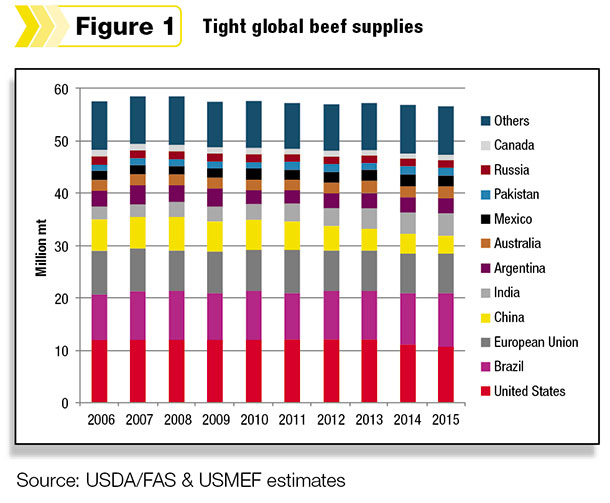

Overall, the export market for U.S. beef continues to thrive as global beef production continues to shrink. Forecasted change in production between 2014-15 shows the world at 114 million metric tons less than the year previous. The U.S., China, Australia and Canada will be on the downslope, while Brazil, the European Union, India and Mexico show increases.

Some key takeaways from each corner of the globe and how their production relates to U.S. exports:

Exports will grow for the U.S.

U.S. beef remains a hot product overseas, Borrer said, because “we have a unique product in the availability of cuts like no one else.”

Because other countries’ production is low, their own beef carcass prices are too high. “Our prices don’t look quite as much out of this world. U.S. beef is a little bit pricing elastic because of our own unique nature and the fact we’re not a staple.”

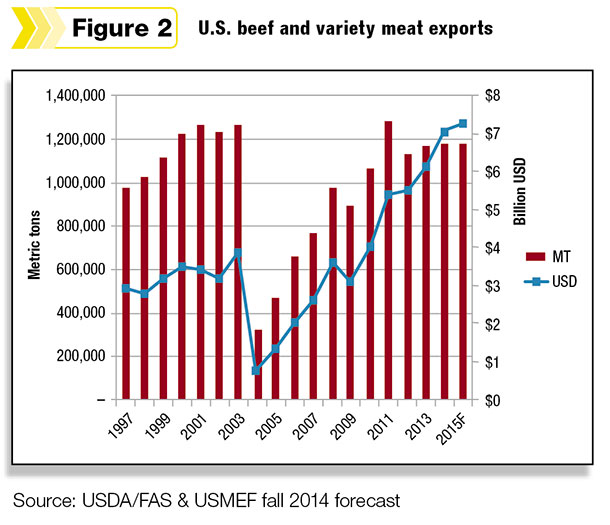

Borrer estimates that export volume will stay right around 1.2 million metric tons as it was in 2014, but the values will jump higher to the $7 billion range.

China remains a mystery

The U.S. cannot ship to greater China, due to trade restrictions going back to BSE in 2003. But that country is facing significant shortages.

“The fact is that China does not have beef,” Borrer said. “They don’t have beef or mutton. Their industry has been shrinking.” Major meat manufacturers are importing meat just to keep factories running, and to keep up with consumers’ demand.

“Although they don’t like to admit they’re a major importer, they realize they have muscles to flex,” Borrer added. “It’s become more and more clear each time I’m there that they’re a rule setter not a rule follower.”

That includes stiffer enforcement of hormone bans, beta agonist concerns and tighter probations on its transit nations (Vietnam and Taiwan) that do bring in U.S. beef.

Asia is the bell cow for U.S. beef

It has been a “long slog back” since the 2003 BSE crisis, and U.S. beef is as popular as ever in Japan and Korea. “We continue to claw back,” Borrer said. “In Taiwan and Korea, we’ve set volume records as well as higher market share than we’ve seen in the past.”

Japan is now the largest market for U.S. beef, even though the yen has weakened against the U.S. dollar. “Yet they keep buying U.S. products,” she said.

A popular chain of beef-bowl restaurants in Japan recently raised prices 27 percent on beef – serving short plate on rice. Yet the product continues to sell in both those fast-food levels and pricier levels focused on high-end product.

“U.S. beef has a place in both of those markets,” she said. “It’s been a resilient market.”

Future tests lie ahead, as Japan will see some tariff advantages, and a weaker Australian dollar may make their product more suitable for Japan.

The two sides to Australia

Having experienced two years of aggressive drought, the Australian beef market has been forced to sell off a sizable portion of its herd. Borrer estimated the count to be around 26.8 million head Down Under, a two-decade low even though they were at record highs before the drought.

Beef production will be down 14 percent, but because the Aussie dollar is also low, they have an ongoing price advantage. Exports from that nation jumped nearly 200,000 metric tons in 2014, up 17 percent.

That was a big boon to the U.S. market. We bought nearly 400,000 metric tons as our need for leaner beef fed the hamburger industry in the U.S.

But Australia is also facing the same foreign barriers the U.S. faces in China, Russia and the EU – as those nations tightened shipments.

Brazil is pushing upward … slowly

The South American giant is making a big comeback in its beef production. The Real currency is staging a good comeback, and cattle numbers are high.

But Borrer said the expansion is only one-sided. Investments in feedlots and extensive feeding have created gains in heavier carcasses and higher finishing weights. “But that investment hasn’t really happened at the cow-calf sector.”

Low repro rates make it so calf crops are inefficiently low.

“My impression is they might increase production by 2 percent at the most.”

Negotiations, ports and currency

An ongoing labor dispute between dockworkers and employers associated with the U.S. West Coast ports is posing a threat to the Pacific trade. Borrer said that the labor standoff needs resolution or the shipments to key Asian markets will be at risk.

Last November, the Obama administration made a “full court press” to get some trade agreements crafted with China. “They had incredible pressure to get a deal at that point. It was a huge effort, and they did reach out to industry.”

But it was in vain as the Chinese made some heavy demands of their own, including access for Chinese poultry, “which is a huge issue for us,” Borrer said.

Finally, the U.S. dollar’s rise since the fall has continued into 2015. This makes the U.S. less competitive as foreign currencies fall in buying power. Compared to a year ago the U.S. outpaces the Canadian dollar by 11 percent, Australia and New Zealand currencies by 10 percent, and Brazil by 6 percent.

Japan’s yen struggled the most at 14 percent below U.S. rates, with Mexico’s peso being at 10 percent less. “That means those prices in those countries, just based on currency, go up by 14 and 10 percent.” ![]()