Digest highlights

- NMPF lays out FMMO modernization timeline

- Rodenbaugh takes over as head of DFA

- GDT price index drops

- Dairy margins ended June stronger

- AgChoice, MidAtlantic Farm Credit merge

- Ag producer sentiment dragged lower

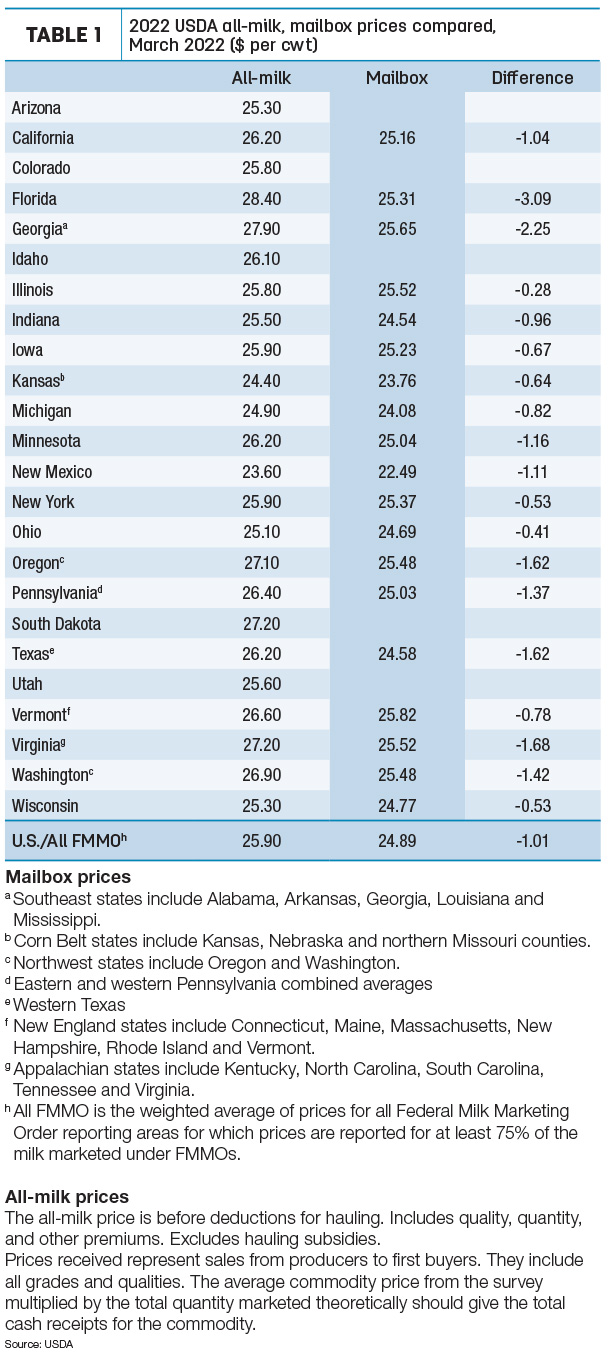

- March all-milk, mailbox price spread averaged $1.01

NMPF lays out FMMO modernization timeline

The National Milk Producers Federation (NMPF) held a webinar, July 6, to update members on the organization’s activities regarding potential Federal Milk Marketing Order (FMMO) reforms. Primary presenters during the webinar were Jim Sleper, former CEO of Southeast Milk Inc., who currently oversees NMPF’s FMMO modernization process, and Peter Vitaliano, NMPF vice president of economic policy and market research. Sleper said the process began last November with a member survey by NMPF’s Economic Policy Committee, seeking to evaluate interest in pursuing reforms through a FMMO hearing. After receiving overwhelming response, a task force was established in December 2021. NMPF then created working groups within the task force to examine four primary issues: Class I pricing (Class I mover and location differentials), dairy products and product specifications used to establish class prices, milk component composition used in current pricing formulas and make allowances. The task force unanimously recommended 10 proposals to the Economic Policy Committee in those four areas, which are now being shared more broadly with NMPF members and other stakeholders for further discussion and refinement. The NMPF task force panels will continue to refine recommendations this summer, with a plan to forward a final package of recommendations to the Economic Policy Committee and NMPF board of directors this fall. If adopted by the board, NMPF would petition the USDA for a national FMMO hearing on the package in late 2022 or early 2023. Sleper said any recommendations will be national in nature, leaving pooling-depooling issues, diversion limits and negative producer price differentials (PPDs) to address on an order-order basis. He said NMPF would work with the American Farm Bureau Federation, International Dairy Foods Association (IDFA) and other stakeholders in moving the process forward. NMPF has tentatively scheduled two other webinars, July 21 and July 26, to provide further updates to help members understand the issues under consideration as part of the FMMO’s modernization effort. Separate from an FMMO hearing, House and Senate agricultural committees have also starting hearings and listening sessions regarding dairy provisions of the 2023 Farm Bill.

Rodenbaugh takes over as head of DFA

Dairy Farmers of America (DFA) board members completed the transition to new leadership, elevating Dennis Rodenbaugh as president and CEO, effective July 1. He succeeded Rik Smith, who officially stepped down on June 30 after 16 years at the helm. Rodenbaugh joined DFA in 2007 and has held several leadership roles throughout the organization, including vice president and chief operating officer of the Mideast, Mountain and Western areas. In recent years, he was named executive vice president of DFA and president of council operations and ingredient solutions, with responsibility for overseeing U.S. milk marketing and farm services, along with the 23 commercial manufacturing plants and marketing operations of DFA’s global ingredient solutions division. Rodenbaugh also serves as chair of Newtrient, and he is on the executive board of directors for NMPF, on the executive committee and as a board member for IDFA, and on the boards for a number of other DFA fluid milk affiliates. Prior to joining DFA, Rodenbaugh had extensive background in banking and finance, as well as ownership and management of dairy farms and other agri-businesses.

GDT price index drops

The latest Global Dairy Trade (GDT) auction saw the overall price index decline 4.1%, with most individual product categories lower:

- Skim milk powder was down 5.2% to $4,063 per metric ton (MT, or about 2,205 pounds).

- Whole milk powder was down 3.3% to $3,961 per MT.

- Butter was down 9.1% to $5,648 per MT.

- Cheddar cheese was up 1.4% to $4,908 per MT.

- Anhydrous milkfat was down 3.1% to $5,706 per MT.

The GDT platform offers dairy products from six global companies: Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Arla (Denmark), Arla Foods Ingredients (Denmark) and Polish Dairy (Poland). The next GDT auction is July 19. On June 30, Fonterra announced that the New Zealand Exchange (NZX) and the European Energy Exchange (EEX) took ownership stakes in GDT, creating the potential for increasing international dairy market presence and leading to more frequent GDT auction events.

Dairy margins ended June stronger

The outlook for dairy margins improved over the second half of June, with projected feed costs decreasing more than milk prices during the period, according to Commodity & Ingredient Hedging LLC. The USDA updated Acreage and Grain Stocks reports, both of which were neutral to market expectations. The corn market was pressured lower due to improved weather forecasts. Estimated May 2022 U.S. milk production was 19.7 billion pounds, down 0.7% from the previous May. Strong cheese production has kept pressure on the market recently. The USDA reported total cheese stocks in cold storage at the end of May at 1.512 billion pounds, up 2.1% from April and 3.7% higher than last year. Total butter inventories of 321.58 million pounds were up 7.8% from April but down 22.3% from last year. Upcoming reports impacting milk checks include: FMMO uniform prices and producer price differentials for June milk marketings, released by July 14; USDA’s latest Milk Production (July 21) and Cold Storage (July 22) reports; and the June Dairy Margin Coverage (DMC) program margin and indemnity payments, July 29.

AgChoice, MidAtlantic Farm Credit merge

AgChoice Farm Credit and MidAtlantic Farm Credit merged effective July 1, forming Horizon Farm Credit. The new ag lender serves 100 counties in Delaware, Maryland, Pennsylvania, Virginia and West Virginia and is made up of more than 20,000 member-borrowers. The merged entity has 25 offices across its five-state footprint and is headquartered in Mechanicsburg, Pennsylvania. No office closures or staffing changes will occur as a result of the merger. Former MidAtlantic Farm Credit chief executive officer, Tom Truitt, serves as CEO of Horizon Farm Credit.

Ag producer sentiment dragged lower

Rising costs and uncertainty about the future continue to be a drag on farmer sentiment, according to results of the monthly Purdue University/CME Group Ag Economy Barometer survey. About 51% of survey respondents said they expect their farms to be worse off financially a year from now, the most negative response received to this question since data collection began in 2015. The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released July 5, reflect ag producer outlooks as of June 13-17. Farmers responding to the June survey were a bit more optimistic about current conditions, but that was more than offset by weaker expectations for the future, said James Mintert, the barometer's principal investigator and director of Purdue University's Center for Commercial Agriculture. The Farm Capital Investment Index remained at a record low for the second month in a row. Producers continue to view this as not being a good time to make large investments in their farm operation. One reason producers say it’s not a good time to make large investments is the problems they’ve experienced in the supply chain. For the second month in a row, 50% of producers in this month’s survey said that tight machinery inventories impacted their farm machinery purchase plans. A breakdown on the Purdue/CME Group Ag Economy Barometer June results can be viewed here. Find the audio podcast discussion for insight on this month’s sentiment here.

March all-milk, mailbox price spread averaged $1.01

March 2022 “mailbox” prices averaged about $1.01 per hundredweight (cwt) less than announced average “all-milk” prices for the same month, based on a preliminary look at two USDA milk price announcements.

- During March, U.S. all-milk prices averaged $25.90 per cwt, up $1.20 from February 2022 and $8.50 more than March 2021.

- The March 2022 mailbox prices for selected FMMOs averaged $24.89 per cwt, up $1.01 per cwt from February 2022 and $8.48 more than March 2021, but $1.01 less than the announced all-milk price.

In Table 1, Progressive Dairy attempts to align the state-level all-milk prices and the FMMO marketing area prices as closely as possible. The March spread between individual states or regions varied widely, with a difference of -$3.09 per cwt in Florida and -28 cents per cwt in Illinois.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the DMC, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price.

As Progressive Dairy notes each month, there’s a disclaimer of sorts. Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the DMC, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price.

As Progressive Dairy notes each month, there’s a disclaimer of sorts. Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

-

All-milk prices. The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded. Prices are reported monthly by the USDA National Ag Statistics Service (NASS).

- Mailbox prices. The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Based on latest annual data, about 61% of U.S. milk production was marketed through FMMOs in 2021. Data included in all payments for milk sold are over-order premiums; quality, component, breed and volume premiums; payouts from state-run over-order pricing pools; payments from superpool organizations or marketing agencies in common; payouts from programs offering seasonal production bonuses; and monthly distributions of cooperative earnings. Annual distributions of cooperative profits/earnings or equity repayments are not included. Included in mailbox price costs associated with marketing milk are hauling charges; cooperative dues, assessments, equity deductions/capital retains and reblends; the FMMO deduction for marketing services; and federally mandated assessments such as the dairy checkoff and budget sequestration deductions. Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) but generally lag all-milk price announcements by a month or more.

The price announcements also reflect similar – but not exactly the same – geographic areas. The NASS reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices reported by the USDA’s AMS cover selected FMMO marketing areas. For example, while NASS reports an all-milk price for Georgia, the mailbox price lumps Georgia with other Southeast states: Alabama, Arkansas, Louisiana and Mississippi. Similarly, Kansas is part of the Corn Belt states, Oregon and Washington are combined in the Northwest states, Vermont is among six New England states, and Virginia is clustered with Kentucky, North Carolina, South Carolina and Tennessee among Appalachian states.