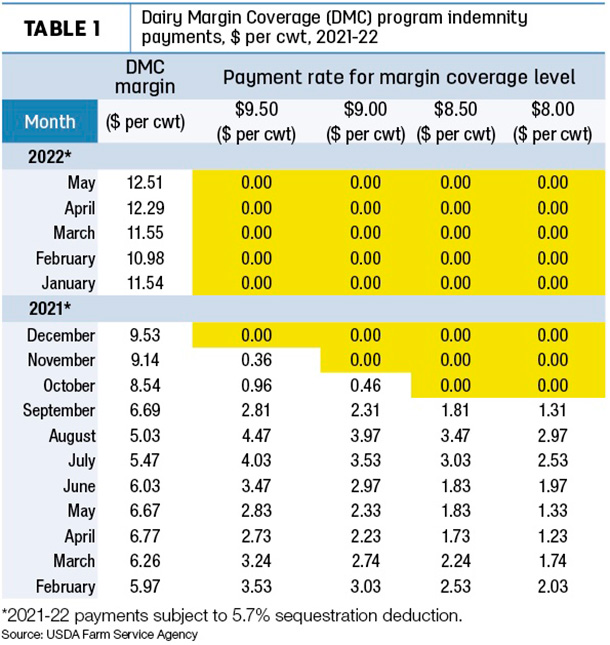

The USDA released its latest Ag Prices report on June 30, including factors used to calculate the May DMC margin and potential indemnity payments. The May DMC margin is $12.51 per hundredweight (cwt), above the top Tier I insurable level of $9.50 per cwt (Table 1). It’s up 21 cents from the April margin and the highest since November 2014.

Milk price sets another new high

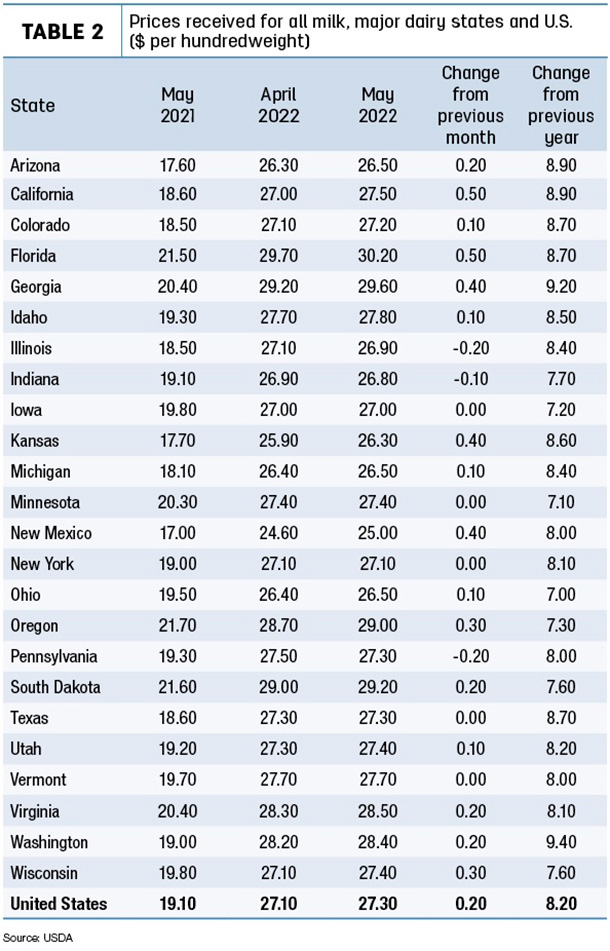

The May 2022 announced U.S. average milk price rose 20 cents from April to $27.30 per cwt, another new record high. Through the first five months of 2022, the U.S. all-milk price has averaged $25.84 per cwt, surpassing the $24.60 per cwt average for January-May 2014.

May milk prices were higher than the month before in 16 of 24 major dairy states, down in three (Illinois, Indiana and Pennsylvania) and unchanged in five (Table 2). Monthly average milk prices topped $29 per cwt in four states: Florida, Georgia, Oregon and South Dakota. Largest month-to-month increases were in California and Florida, each up 50 cents per cwt.

The highest prices were in Florida and Georgia, at $30.20 and $29.60 per cwt, respectively. New Mexico was the only state where the April average price was less than $26 per cwt.

Compared to a year earlier, May 2022’s U.S. average milk price was up $8.20 per cwt. Year-over-year prices were up $8 per cwt or more in 17 states, led by a $9.40 increase in Washington.

Corn, hay costs increase

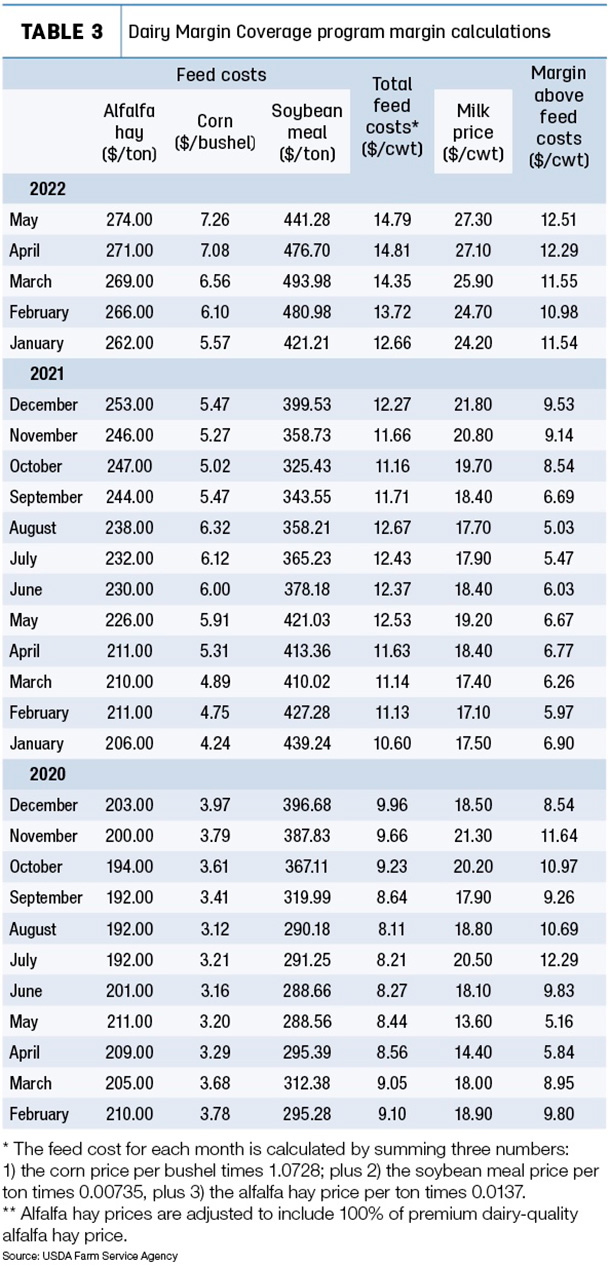

While the news was again good on the milk income side of the ledger, total feed costs remained near last month’s record, supported by prices for corn and alfalfa hay (Table 3).

- The average price for corn rose another 18 cents from April to $7.26 per bushel, the highest price on record since the inception of the DMC program or its predecessor, the Margin Protection Program for Dairy (MPP-Dairy).

- With the DMC change to include the price of dairy-quality alfalfa hay in feed cost calculations, the May average price for hay was $274 per ton, up $3 from April and also the highest on record.

- The average cost of soybean meal declined to $441.28 per ton, down about $35.40 from April and the lowest since January.

May feedstuff prices yielded an average DMC total feed cost of $14.79 per cwt of milk sold, down 2 cents from April but still the second-highest total during the DMC or MPP-Dairy era dating back to March 2014.

Other costs escalate

Outside of feed, other costs continued to rise. The May index of prices paid for commodities and services, interest, taxes and farm wages was up 0.6% from April 2022 and up 15% from May 2021. The May fuel cost index was up 6% from April and 67% from May 2021.

Those higher prices for fuel and other inputs weigh heavily on farmers, notes Shelby Myers, economist with the American Farm Bureau Federation.

U.S. average retail gasoline prices hit a new high, rising above $5.006 per gallon in June, according to the U.S. Energy Information Administration. This was up 63% compared to the same week in June 2021 and was nearly two times higher than the five-year average price of gasoline before 2020 when COVID lockdowns pushed gasoline demand way down.

Diesel prices rose to $5.718 per gallon in June, up 74% compared to June 2021. The current high price of diesel is more than two times the five-year average price paid before 2020.

Based on USDA estimates, fuel represented about 3% of total on-farm expenditures in 2020. Latest USDA cost of production data estimates that the cost of fuel, lube and electricity combined is projected to increase 34% in 2022 compared to 2021, after just a slight cost reduction, decreasing 1% from 2020 to 2021.

A glimmer of hope for farmers is the USDA’s estimate that the price of fuel may decrease about 18% in 2023 compared to 2022, but these projections are very early and there is significant uncertainty.

For analysis on what’s driving higher fuel prices, read: Rising fuel costs continue to impact farmers.

Cull cow prices dip

May prices paid for cull cows dipped slightly. U.S. prices received for cull cows (beef and dairy combined) averaged $86.70 per cwt, down $1.40 from April 2022 but still about $15.90 more than May 2021.

Through the first five months of 2022, cull cow prices have averaged $81.80 per cwt, about $15 more than January-May 2021.