The first step would be to identify today’s objectives for FMMOs. In the past, that meant an adequate supply of milk for the fluid market and “orderly marketing conditions.” However, all of that is academic today. Fluid milk consumption in the U.S. continues to decline, and domestic cheese and export markets account for much more milk solids. So should FMMOs continue to focus on this declining fluid market or on the entire U.S. market for milk and dairy products?

If we go with the broad approach, let’s consider four objectives. First, reform pricing to allow the market to grow. Second, continue to price Class I milk above manufacturing values and “share” the proceeds with farmers who supply that market. Third, continue to require the USDA to share market information. And fourth, make changes everybody can benefit from.

There are a few objectives I did not mention. One is “preserving orderly market conditions.” Federal order regulations do not preserve orderly marketing conditions; market participants do that. Also, I did not mention raising farmgate milk prices. That’s because federal orders should focus on “price discovery” rather than enhancing milk prices. The 2023 Farm Bill would be a much better vehicle for providing farm benefits for size, green projects and sustainability, etc. That is the pathway the European Union has chosen. They support their farmers, are World Trade Organization (WTO) compliant and are fierce export competitors.

Let’s examine a few changes that will likely be debated.

Fluid milk pricing

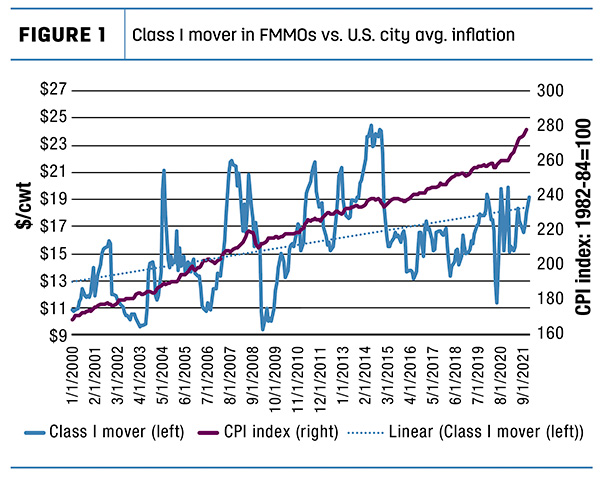

Some may partially blame the decline in fluid milk consumption on the high cost of Class I milk. But since the FMMO Class I price (called the mover) is based on commodity prices and fixed Class I differentials, it has fallen behind inflation in terms of year-to-year price trends since 2000 (Figure 1).

The Class I mover (measured on the left axis) has been volatile and has basically not increased since 2007. Inflation (measured on the right axis) has gone up every year, accelerating in 2021.

Also, when compared to plant-based beverages, bovine milk is a bargain, especially when considering the superior nutrition in real milk. So in terms of improvements in Class I pricing, there is some room in federal orders for raising Class I differentials. At the same time, reducing the volatility of the Class I mover may also be a good idea that may encourage more fluid milk sales.

End-product pricing for components

The monthly component values for fat, true protein and other solids are set by formula and largely move with basic dairy commodity prices. The component values are derived from a very limited USDA survey of cheddar cheese, butter, nonfat dry milk and dry whey sales. The so-called “make allowances” used in that formula (the cost to convert components to finished dairy products) have not been updated since October 2008.

There are other factors that need to be updated as well, but some of these changes could lead to lower component prices. In a non-regulated market, these changes are made on a daily basis, so farmers would not even notice them. But within FMMOs, the change is abrupt and farmers would have to vote in an order that could end up lowering their own milk check. If these end-product prices are to be kept, a more practical approach would be to conduct annual surveys of plant efficiencies and costs, and adjust these parameters automatically.

Pooling rules

Pooling is the method the USDA uses to share the higher-value Class I sales with participating farmers in a given market. Manufacturers of Class III and IV products must share some of their milk with Class I processors in order to pool their revenues and potentially pull dollars out of the pool. However, this is getting more difficult to do. First, there are fewer Class I sales to pool. Second, in some months, Class III prices are higher than the pool average, resulting in cheese processors opting to pull out of the pool in specific months (depool). Third, there are increasingly more Class III and IV sales that could be pooled. These rules for opting “in” or “out” of the pool vary by each federal order. A more consistent approach across orders, and one that makes it more difficult to depool, should be used in all orders.

Basis

One big fault with FMMOs is: There is no consideration for “basis.” The monthly farm price of protein in the Central Valley of California is exactly the same as it is in the Midwest and Northeast. That doesn’t make commercial sense. Also, exports are largely left out of the weekly USDA survey of commodity prices used to set these component prices. So the FMMO farm value of components used to make export products is often out-of-sync with the global market. Our competitors, namely Europe and New Zealand, don’t have this problem. One approach for reform would be to ditch the federal commodity surveys and allow each order to report their actual sales, and then use regional formulas to derive regional component prices. That would make better commercial sense.

Conclusions

So, will federal order reform address all of these issues? In a recent blog post, I listed seven changes that would need to take place under federal order reform just for protein pricing. And that did not even include an update for make allowances. It will not be easy to “reform” federal orders if the goal is to focus on making everybody happy. It would be far easier to scale down expectations and focus on what FMMOs do best: price and pool Class I milk, test milk and components, and report prices. Leave the rest to the commercial market to figure out how to best price fat and protein. ![]()

PHOTO: Getty images.

Ken Bailey is a consultant and author of the textbook Dairy Economics: Pricing, Policy, and Risk Management. He addresses U.S. and global dairy, trade, risk management and other issues in his blog.

-

Ken Bailey

- Ken Bailey Dairy Consulting LLC

- Email Ken Bailey