Month after month this year, feedlots have maintained large numbers of cattle on feed relative to history as more calves are being pushed into feedlots at a quicker-than-normal pace due to the drought impact on forage availability. However, packers have demonstrated an ability to process cattle that is above the pace of the past two years. These timely marketings have kept fed cattle supplies relatively current, evidenced by packers’ weekday slaughter volumes.

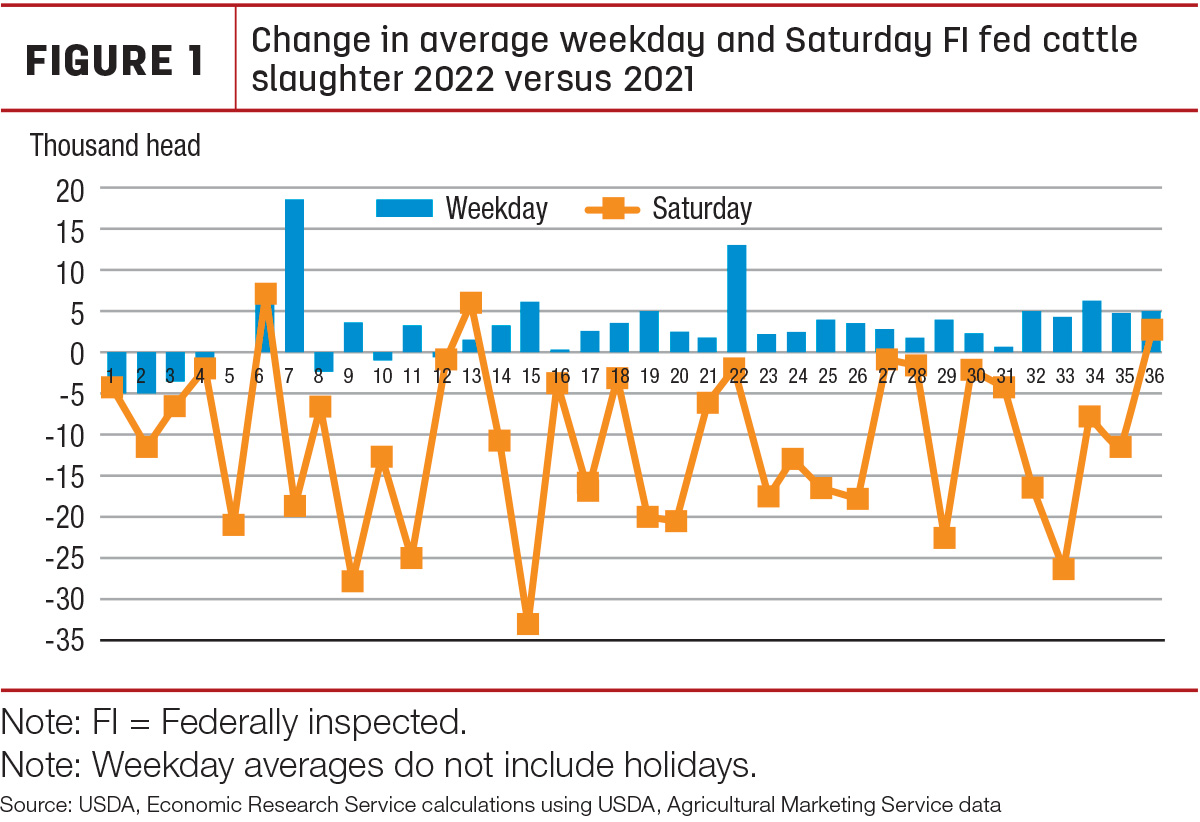

For the week ending Aug. 27, packers delivered the largest fed (steer and heifer) cattle slaughter volume this year and the largest since June 2021. Figure 1 is highlighting year-over-year change in the average weekday and Saturday slaughter volumes of federally inspected fed cattle.

During the first 10 weeks of the third quarter, fed cattle slaughter averaged about 4,000 head per weekday more than last year. This improvement in weekday slaughter is more than offsetting the underutilization of Saturday slaughter capacity, which averaged 9,000 head less than a year ago for the same period.

Based on the expected pace of cattle slaughter and carcass weight data reported in the first 10 weeks of the third quarter, beef production is adjusted slightly lower by 25 million pounds. In fourth-quarter 2022, beef production is raised 40 million pounds on higher expected fed cattle and cow slaughter. As a result, the outlook for 2022 beef production is only marginally higher by 16 million pounds from the previous month to nearly 28 billion pounds.

The latest NASS Cattle on Feed report showed an Aug. 1 feedlot inventory of 11.224 million head, the second largest for the month since the series began in 1996 and 1.4% higher than 11.074 million head in 2021. Despite another month of near-record feedlot inventories, the volume is declining seasonally month-over-month since the high set on Feb. 1, 2022. Feedlot net placements in July were up almost 2% year-over-year at 1.709 million head and well above industry analyst expectations. Marketings in July were 1.825 million head, down almost 4% year-over-year with one less weekday in the month. On a weekday basis, the pace of marketings in July was up almost 1% from last year’s pace and the highest since 2011 for the month.

The large placement of cattle in July and weekly reported sales of stocker and feeder cattle in August supports raising anticipated placements in third-quarter 2022. This has further resulted in raising expected fed cattle marketings in early 2023 and subsequently raising projected first-quarter 2023 beef production. As the drought pushes more calves into feedlots at a faster pace than normal, this will likely pull feeder cattle forward next year, decreasing expected marketings in late 2023. Consequently, 2023 beef production forecast is slightly raised by 70 million pounds to 26.3 billion pounds as higher marketings in early 2023 more than offset fewer fed cattle expected for marketing later in the year.

Calf prices advance on tightening supplies

Based on recent NASS Cattle on Feed reports, average placement weights are declining, suggesting fewer yearlings are available for placement. This has likely improved demand for calves weighing more than 700 pounds. The price for feeder steers 750 to 800 pounds at the Oklahoma City National Stockyards averaged $174.18 per hundredweight (cwt) in August, up nearly $5 from the previous month and $18 from last year. The most recent available price from Sept. 12 reports sales of yearling feeder steers at $180.35 per cwt, a jump of more than $6 from the previously reported week.

Based on continued firm feedlot demand in second-half 2022 and current price data, the third- and fourth-quarter 2022 price forecasts are raised $2 to $173 per cwt and $4 to $177 per cwt, respectively. As cattle are expected to be pulled forward from early 2023, the current price strength was carried forward into the outlook for feeder steer prices the first half of next year. First- and second-quarter 2023 prices are raised to $172 and $190 per cwt, respectively, from the previous month.

Wholesale beef prices may look strikingly cheap when compared to year-ago price levels, but beef remains historically expensive. For the week ending Sept. 2, the comprehensive beef cutout value was $259.97 per cwt, about $21 below value reported the week ending Sept. 3, 2021. Ignoring the relatively brief spike in May 2020, beef prices remain above the previous record of $259.01 set in 2014.

Relatively strong boxed beef prices and a generally faster pace of slaughter than a year ago have supported fed cattle prices. Weekly fed steer prices set a new high for the year during the week ending Aug. 21 of $146.88 per cwt, eclipsing the previous high set the week ending July 3 of $146.16 per cwt. Although prices have declined more than $4 from this peak through the beginning of September, fed steer prices will likely average seasonally higher in the fourth quarter. Based on current price data, the third-quarter 2022 fed steer price is projected $3 higher than the previous month at $143 per cwt, and the fourth quarter is unchanged from the previous month at $147 per cwt. The 2023 fed steer price forecast is unchanged from the previous month at $154 per cwt.

Strong exports maintain pace for another record quarter

Beef exports in July were 307 million pounds, 3% above last year and 14% above the five-year average. Monthly exports to China and Japan showed strong year-over-year increases at 17% and 10%, respectively. There were also large year-over-year increases in July exports to smaller markets, led by the Philippines, Vietnam and the Netherlands.

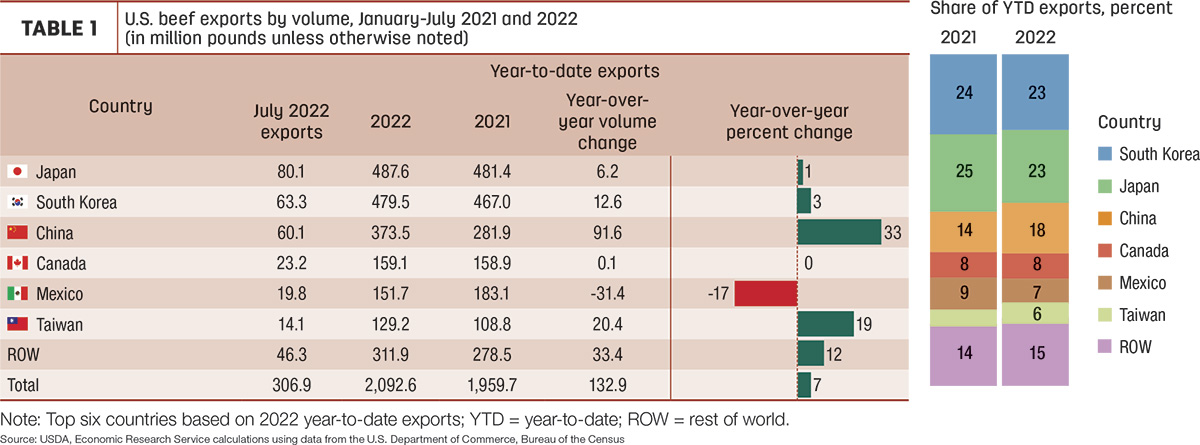

Year-to-date exports for most major markets are higher year-over-year, as Table 1 shows. Of the top six markets, only exports to Mexico are below the previous year. Exports to Taiwan dropped off slightly in July, falling below the five-year average for the first time this year.

However, year-to-date exports to Taiwan are still 19% ahead of last year. Exports to smaller countries not among the top six markets continue strong this year, with combined year-to-date exports to these countries 12% above last year.

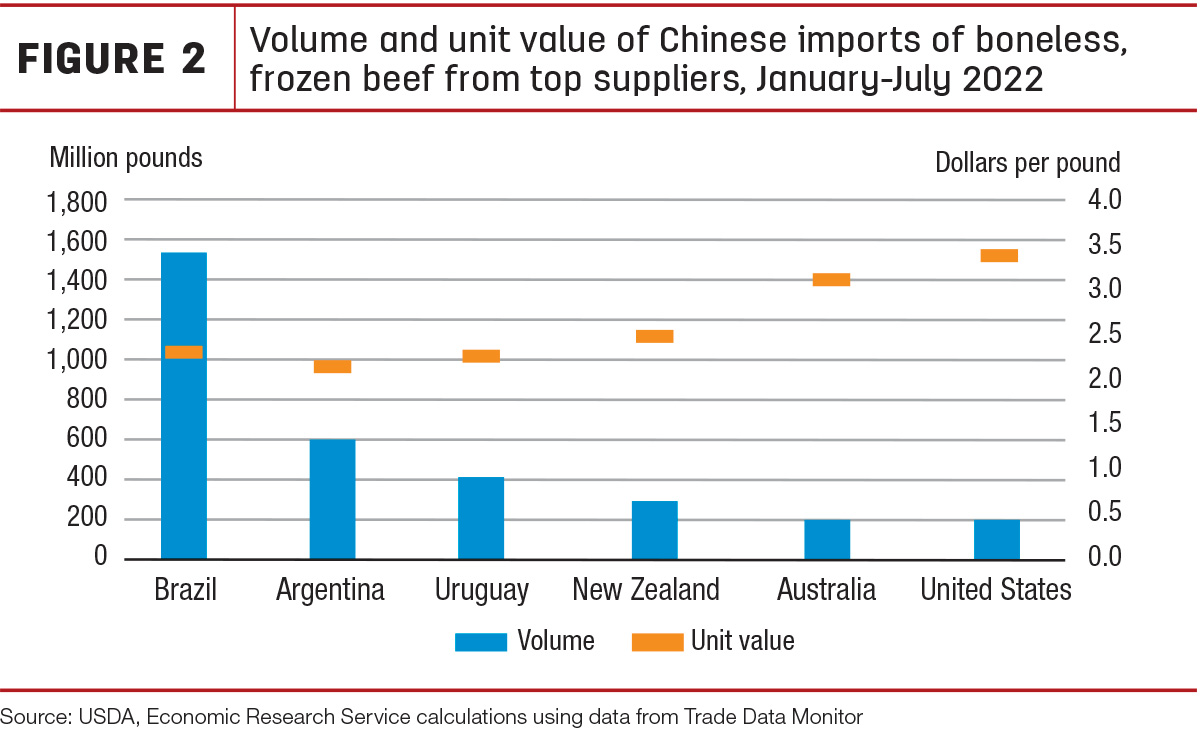

Exports to China through July this year are 33% above the same period last year. China’s total beef imports have increased rapidly over the past decade. U.S. beef exports to China have risen significantly over the past two years, aided by the U.S.-China Trade Agreement, which contained multiple provisions to allow for more Chinese imports of U.S. beef. Frozen boneless beef products have accounted for 77% of U.S. beef exports to China so far this year, compared to 82% in the same period in 2021. Comparing just the quantity and unit value of frozen boneless product, Figure 2 shows that the U.S. has been the sixth-largest supplier to China so far this year. The per-unit value of U.S. beef has been highest among the top suppliers.

The U.S. beef export forecasts for 2022 and 2023 remain unchanged from the previous month. The forecast for third-quarter 2022 is 915 million pounds, and the forecast for the fourth quarter is 860 million pounds; both would be records for their respective quarters. The annual forecast for 2022 is 3.561 billion pounds. The annual forecast for 2023 is 3.02 billion pounds, a year-over-year decrease of 15% due to a combination of a forecast decline in U.S. production and increased competition with beef exporters.

Beef import forecast lowered on supply outlook from Oceania

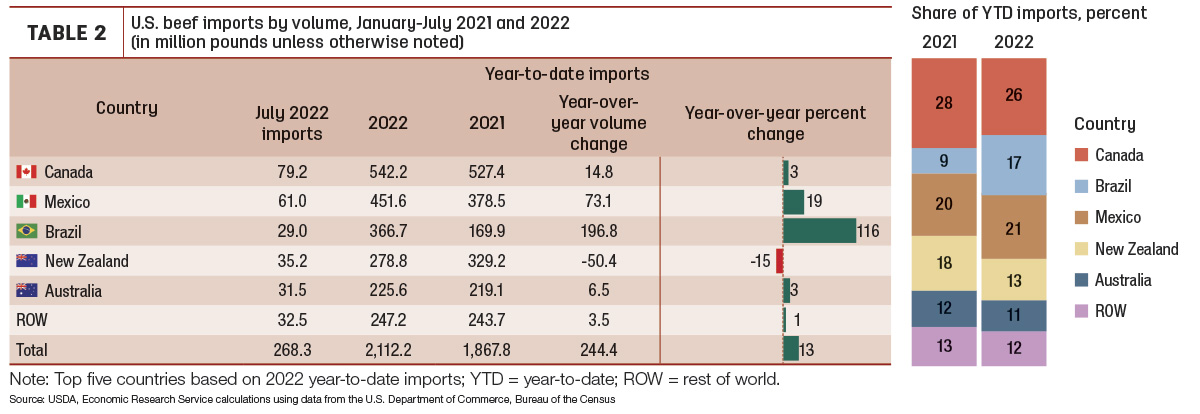

U.S. beef imports have continued to slow after the record first quarter this year. July imports were 268 million pounds, more than 12% below 2021. Of the top five suppliers, only imports from Mexico increased year-over-year in July, albeit less than 1%. The largest year-over-year decrease was in imports from New Zealand, down 33%. The largest decrease in year-to-date imports was also from New Zealand, as shown in Table 2.

Imports from Australia remain low compared to historic levels. Year-to-date imports from Australia are up 3% from last year, but 47% below the 2016-20 average. After two years of constricted supplies due to herd rebuilding following drought conditions, labor issues have kept beef production from rebounding as quickly as anticipated. Based on data from the Australian Bureau of Statistics, Australian beef production in the second quarter of 2022 increased 3% over the previous quarter; however, total production for the first half of the year was still 2% behind the same period last year and nearly 18% below the average for 2016-20.

Based

on lower expected supplies from Oceania and South America for the

remainder of 2022, the third-quarter 2022 forecast is decreased 25

million pounds to 825 million, and the fourth quarter is lowered 20

million pounds to 745 million. The 2022 annual forecast is 3.414 billion

pounds. The annual forecast for 2023 remains unchanged from the month at 3.2 billion pounds.