It feels like these days we are inundated with information about automated milking systems. We have learned how these innovative systems can increase productivity and improve efficiencies. The next question is: “How might robots fit into my operation?” As you continue to explore this idea, you will have a lot to consider, especially in terms of finances.

With any significant investment, it is important to understand how the full scope of the project impacts your financial situation. Your balance sheet, equity and liquidity, cash flow and cost of production (COP) can be affected, and this takes time to analyze. Consider these five areas to determine if robots are the right fit for you.

Consideration No. 1: Capital cost

If you are comparing milking systems, robots tend to pencil out as a higher investment, as you are likely looking at $3,200 per cow. We are more limited on the number of cows we can milk through the robot, as time becomes our most limiting factor. For a comparison, a rotary system will cost about $1,100 per cow. You can stretch the equipment investment over more cows because you have more flexibility in pushing cow throughput. No matter the system, you will have to determine capital needs for structures to house the milking equipment and storage rooms. Also think about the cost of adding more stalls, improving and adding manure systems and storage or building new facilities.

Keep in mind that only comparing the cost of equipment may lead to an incomplete decision. Considering how the scope of the project impacts cash flow is an important consideration. It will help you evaluate your return on investment (ROI).

Consideration No. 2: Projection and budget

Understand how expenses and revenue may be affected, and what you can realistically expect.

Expenses:

-

Labor: Be realistic. How will a transition to robotics change the way you manage your labor? Over time, a good target to shoot for is $1.50 per hundredweight (cwt) reduction of labor costs. But keep in mind that it is possible the savings recognized in labor may be reallocated to other expense line items. We tend to see those utilizing eight or more robots gaining the most reduction in labor expense and overall COP.

-

Feed: Estimate half a penny or 1 cent per pound more of dry matter compared to conventional diets. This can vary depending on the type of flow system you have in your barn, as well as the type of feed fed at the robot. Be sure you are visiting with your nutritionist to best understand how this area may change.

-

Repairs, maintenance and supplies: This is an area that can vary across units. Is your parlor still operational? How are you allocating these repairs, maintenance and supplies on your dairy from an accounting perspective? Considering several variables, combined services on your dairy can range from $16,000 to $24,000 per robot box per year. Using an average of 63 cows per robot, the cost is $253 to $380 per cow annually. Compared to conventional systems, repair costs range from $45 to $55 per cow annually and supplies of $75 to $100 per cow annually for a total combined cost of $120 to $155 per cow annually. Keep in mind total cow throughput attributing to these costs (i.e., parlor cows) to best determine true expense per cow.

-

Utilities: Estimate 25% to 50% increase depending on if you are transitioning from tiestall or parlor to robotics. Consider the energy needed for the robots, as well as any improvements to ventilation in existing facilities.

- Bedding, breeding and animal health: Will you be making a change to your bedding type? What is the cost associated with your bull selection? Consider changes to your breeding program, as it is important to manage reproduction tightly. Animal health should always be a priority, and robots will give you access to more data to earlier detect and better monitor your cows. However, understand how this will change the way you will manage your cows when considering the type of flow system.

Revenue:

- Milk production:

- Consider retrofit or new construction. Ask yourself how your current facilities impact animal health and cow comfort. How does this compare to post-implementation?

- Acknowledge how many milkings per day on your current system, and what type of production you are achieving. How will moving to an average of 2.7 to 2.9 milkings a day impact production post-implementation?

- Time constraints: There are limiting factors of the robots, so what is your goal for number of cows per robot? Obtaining peak production requires time fetching and adapting new cows. Do not limit yourself on labor. You may need to account for the time managing unproductive gaps in your cows’ new routine. Be sure this aligns with what you have budgeted for labor.

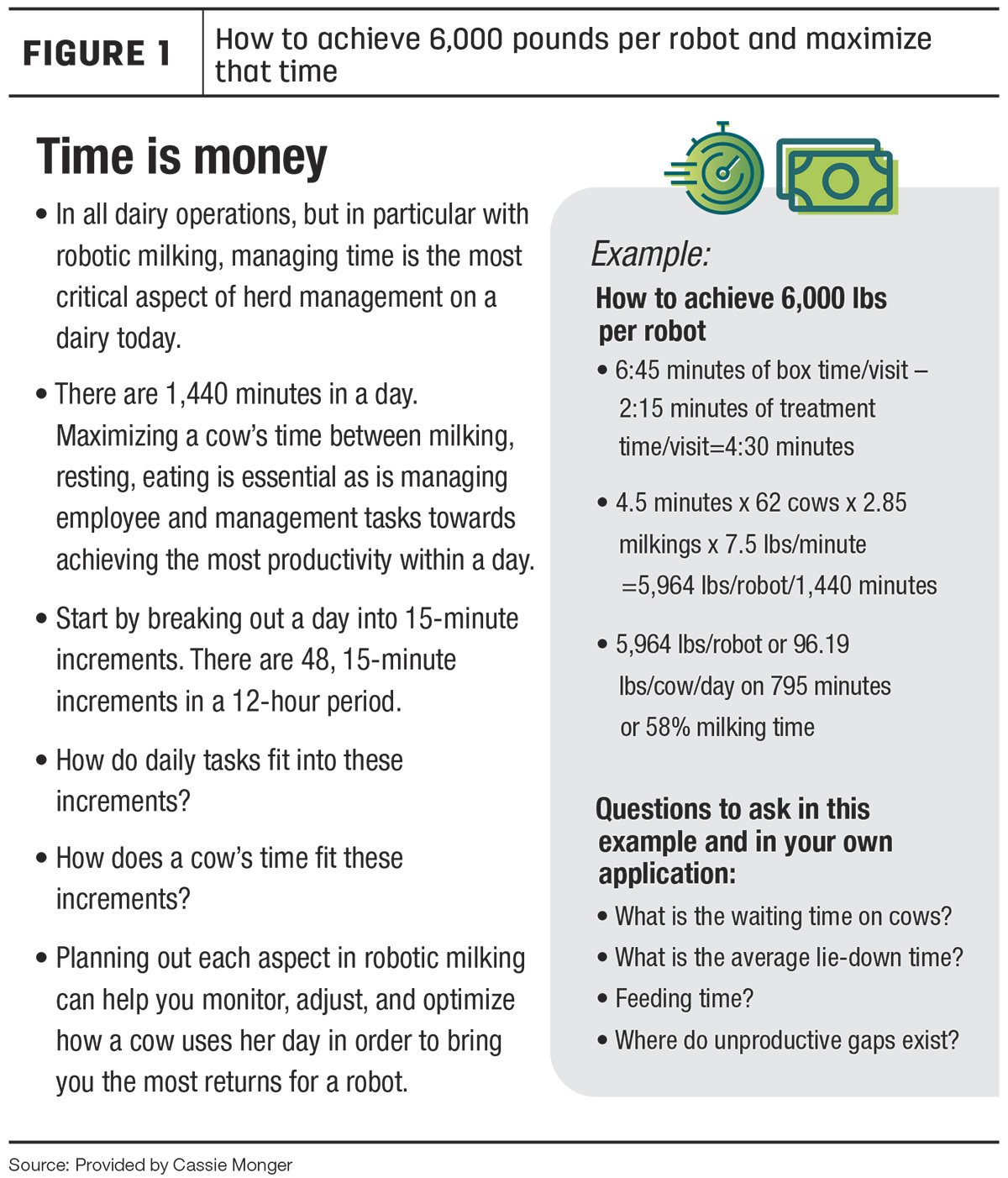

- What does 6,000 pounds per robot per day really mean from a management perspective? Time is money. How do you maximize that time in the robots? (Figure 1)

- Culling and replacements: This can go both ways.

- We know not all cows will adapt to robots. Will you need to buy replacements to keep the barn full?

- We also have seen do-not-breeds (DNBs) milk longer in robot herds, and we know cow longevity should be top-of-mind.

- Consider right-sizing your heifer inventory to avoid involuntarily culling to make room for excess heifers.

- Milk price: Look at long-range averages, considering highs and lows. Do you protect any of your milk today? Consider how this investment may change the way you are looking at risk management. Do you need to make a change from what you are doing today?

Consideration No. 3: Balance sheet and equity position

As you understand what your current equity position is, and how it impacts your balance sheet post-close, consider that appraised values on new constructions tend to come in less than cost.

If working with your accountant, you may also consider leasing the robots, as there may be some tax advantages in doing so. Most importantly, determine how much leverage you feel comfortable with so it does not hinder future projects or investments. Allow yourself to be ready to invest again, and keep in mind how much capital you want to tie up and for how long.

Consideration No. 4: Debt repayment and structure

Considering what your balance sheet is able to support, structure the debt appropriately and determine what is best for your operation. As a guideline, target your debt repayment per cwt to be at or below $2.50 per cwt (total annual principal and interest per total amount cwt produced).

Be sure you have a strong working capital position post-close. Ideally, target 30% of adjusted gross income, or $450 per cow. We cannot always anticipate potential hiccups during transition, nor do we have a lot of control over changes in the market. Working capital provides you with more liquidity to get through those downturns. Working capital per cow is total assets minus total liabilities divided by total cows.

Consideration No. 5: Feasibility

Determine if your plan aligns with your business, personal and financial goals. If you need revisions to make it more financially viable, consider alternative options that change the impact. For example, evaluate if keeping your parlor operational for a period of time makes sense. Or perhaps you are not ready to expand the number of cows you are milking along with implementing robotics and instead consider that a phase two plan down the road. These could be good alternatives when considering ROI.

We know our industry has evolved quickly. Remaining competitive and maximizing potential opportunities for growth is imperative, as long as it comes with improving efficiencies and increased profitability. Consider these five areas when working through the decisioning process to position yourself for success.

— Article submitted by Compeer Financial.