A slight increase in hay acreage and yield-boosting moisture conditions in some regions provide hope for increased forage production in 2023. However, the stubborn exit of winter suggests a slow start to the growing season. Here’s Progressive Forage’s monthly look at hay markets and conditions in early April.

Early acreage estimates

The USDA’s 2023 Prospective Plantings report was released March 31. Based primarily on surveys conducted during the first two weeks of March, U.S. producers intend to harvest 50.6 million acres of all dry hay in 2023, up 2% from 2022’s 115-year low. Compared to a year ago, largest increases in 2023 hay acreage are forecast in Texas, South Dakota and Colorado, offsetting declines in Kansas, Iowa and Illinois.

Record-low all hay harvested area in 2023 is expected in California, Illinois, North Dakota, Ohio and Wisconsin.

The pre-season estimate doesn’t differentiate between alfalfa and other hay. In 2022, about 30% of all dry hay acreage was devoted to alfalfa and alfalfa mixtures.

Moisture conditions better

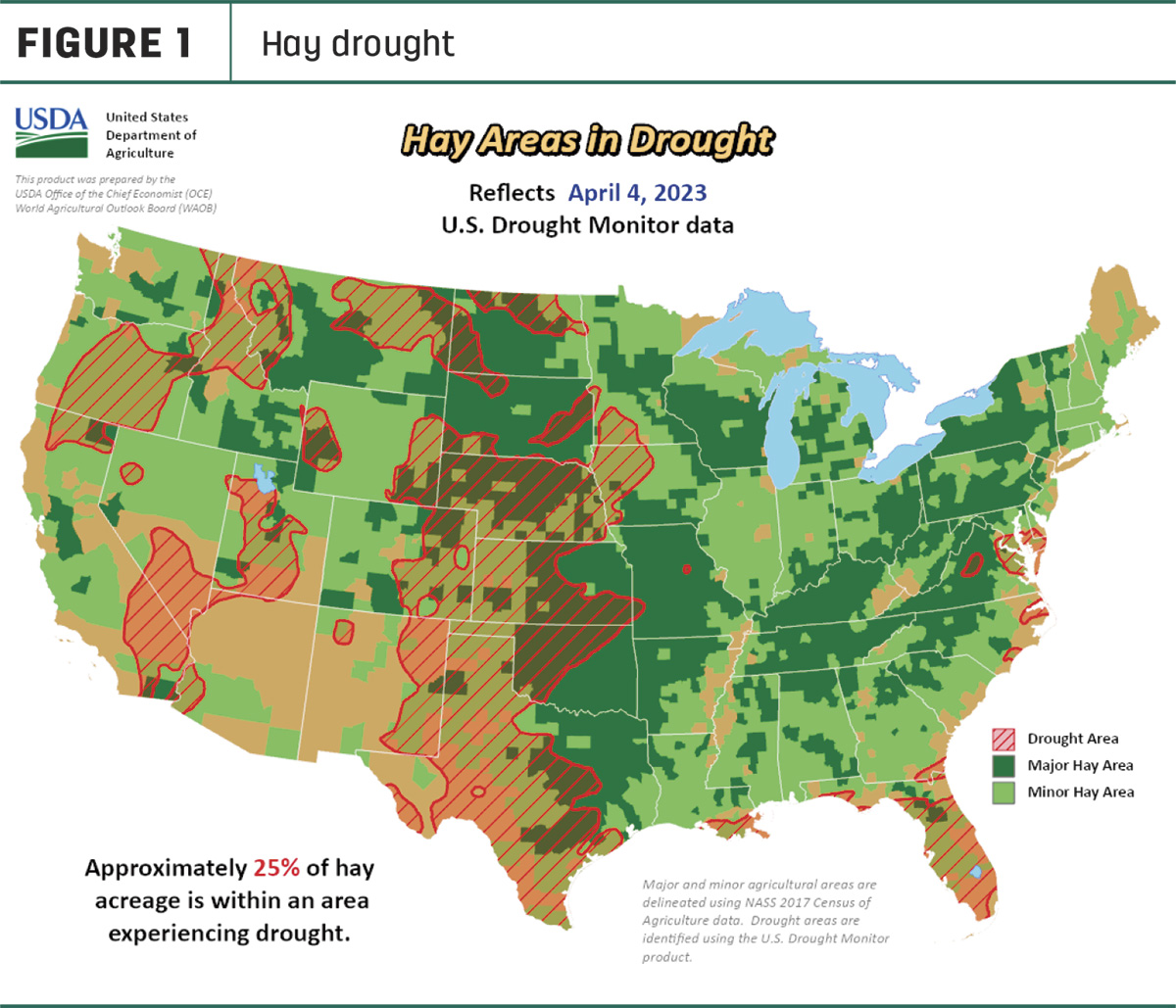

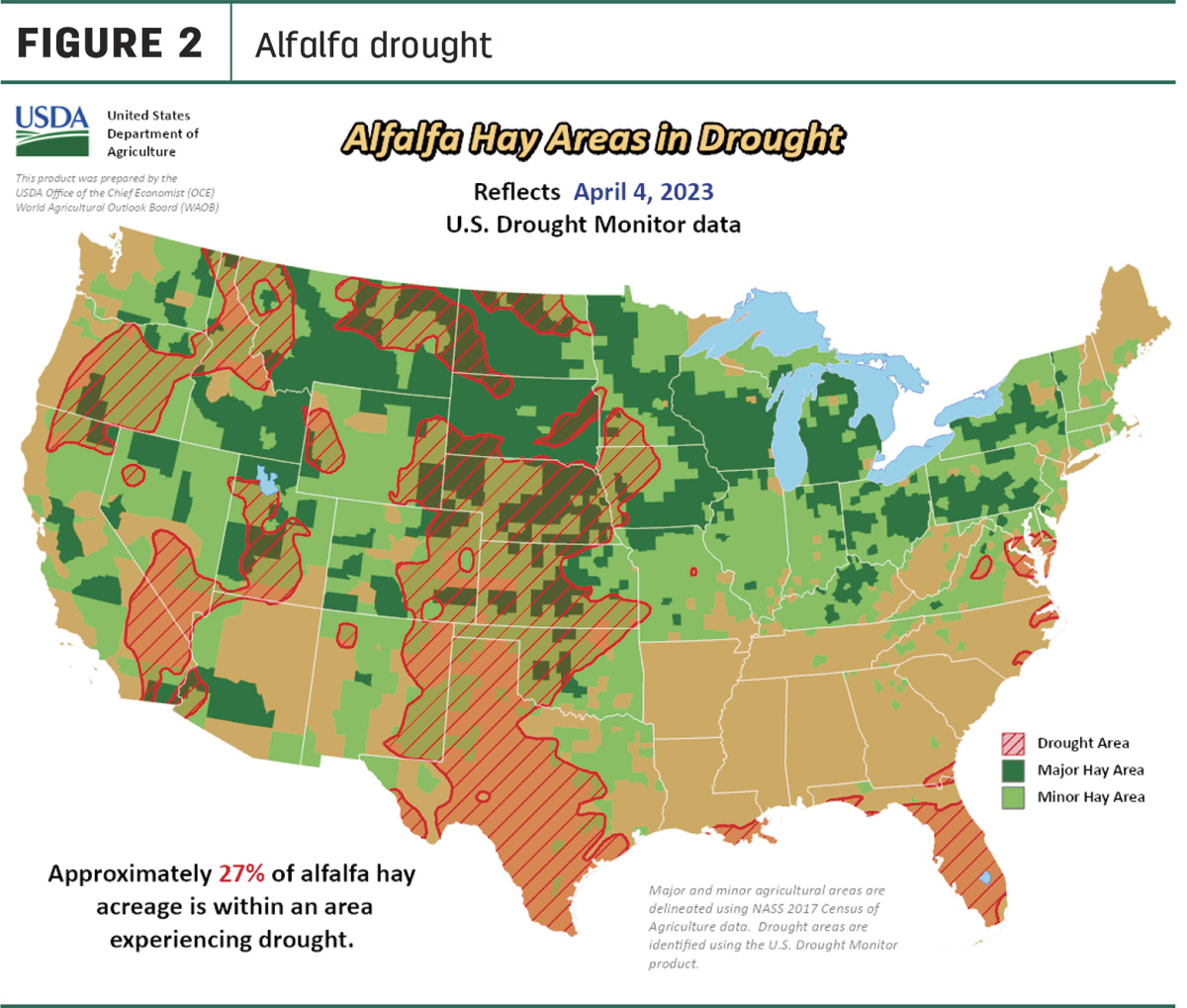

U.S. Drought Monitor maps indicate drought areas continue to shrink. As of April 4, about 25% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 8% less than a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was down 16% from early March to 27%.

Read: 2023 dry hay acreage may rebound slightly

The lower percentages of acreage considered under drought are now at multiyear lows.

Much of the improvement can be attributed to California and west of the Rocky Mountains, as well as South Dakota and Michigan. The Central Plains, from Texas north to areas adjoining Nebraska, remain dry.

Hay prices tracked

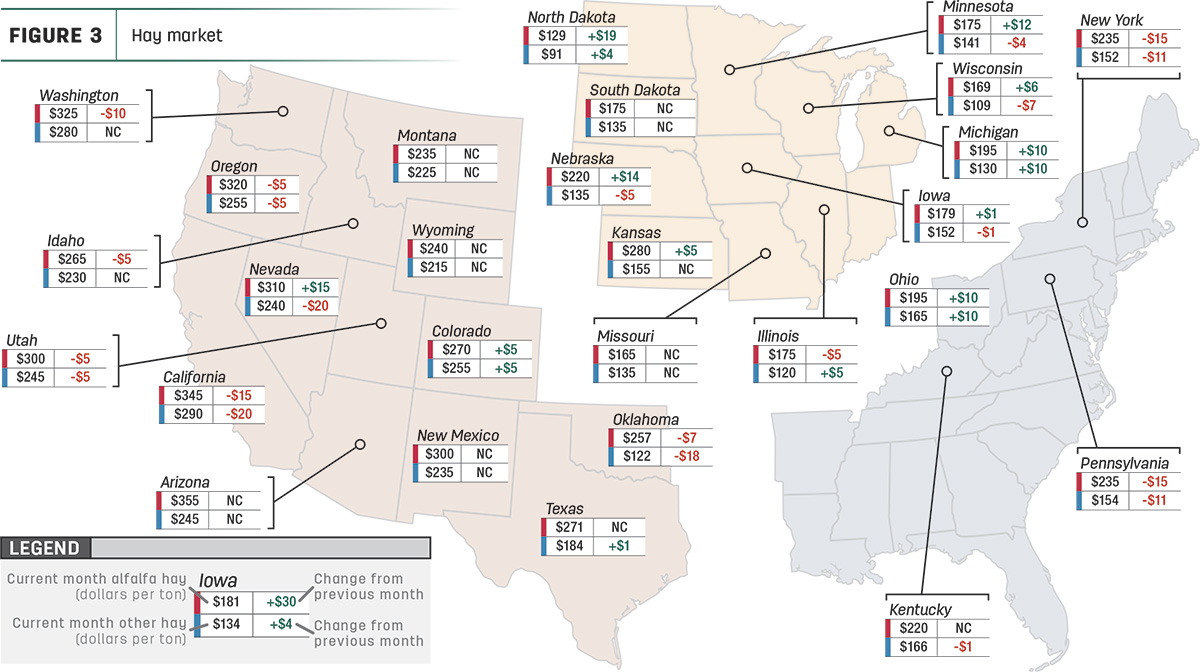

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change.

The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

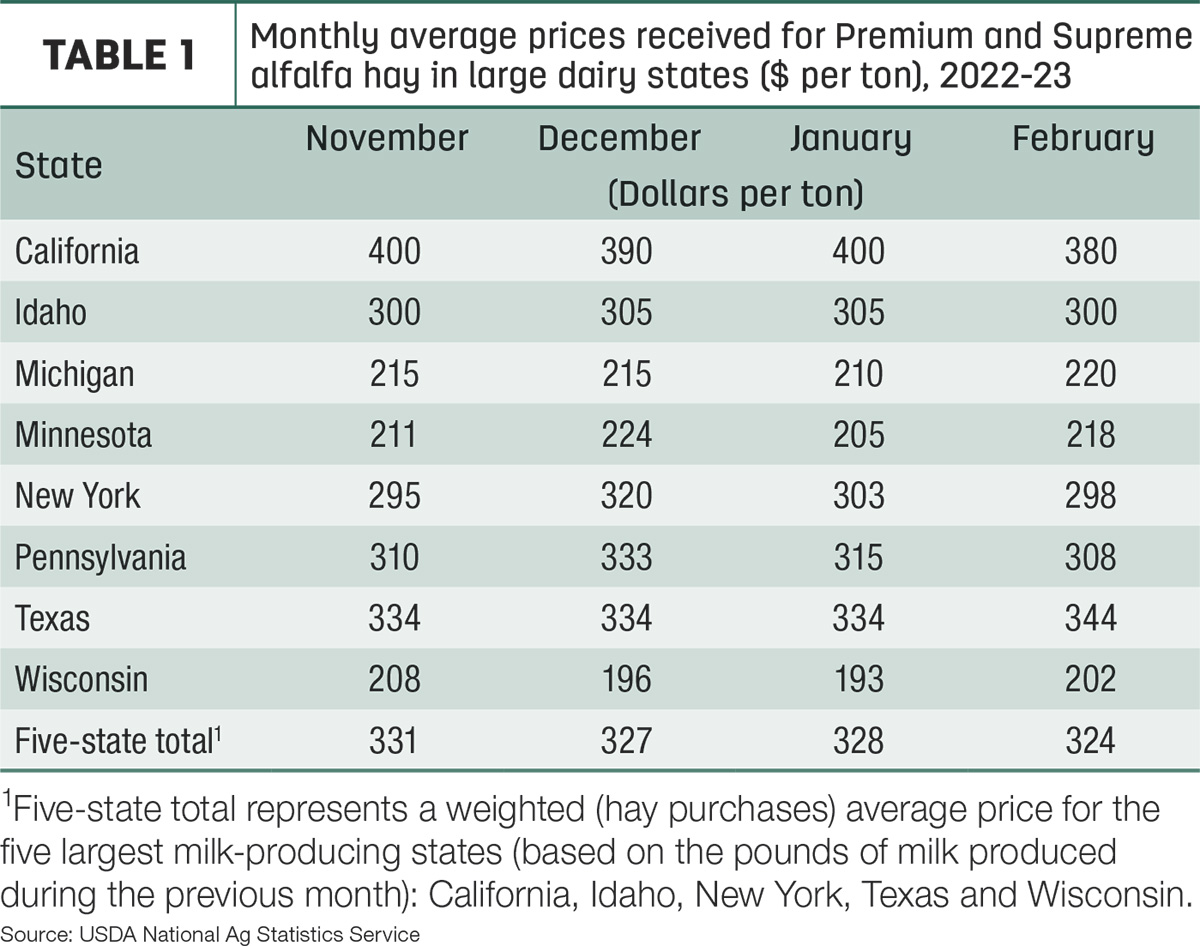

At $324 per ton, February’s average price for Premium and Supreme alfalfa hay in the top milk-producing states declined $4 from January but was $58 higher than a year ago (Table 1). Prices were mixed among major states: down in the West and Northeast but up in the Midwest and Texas.

Alfalfa

The U.S. average price for all alfalfa hay rose $3 in February to $266 per ton. Prices increased in 10 of 27 major forage states, led by increases in North Dakota, Nevada and Nebraska. Prices were lower in nine states, with California, New York and Pennsylvania all down $15.

Year-over-year prices were up $90 and $95 per ton in Arizona and Kansas, respectively.

The spread between U.S. average alfalfa and other hay prices widened to about $94 per ton in February.

Other hay

At $172 per ton, the February 2023 U.S. average price for other hay was down $3 per ton from January. Prices increased in just six of 27 major hay-producing states, with largest month-to-month increases ($10) in Michigan and Ohio. Largest declines were in California and Nevada (-$20).

February average prices for other hay were $45-$55 more than a year ago in Idaho, Kansas and Utah, and up $17 nationally. Compared to a year ago, average prices slipped $20 per ton in Illinois and Wisconsin.

Hay exports rebound somewhat

While still historically low, February 2023 exports of most U.S. hay products rebounded slightly from January.

Exports of alfalfa hay were estimated at 162,968 metric tons (MT), up about 20,000 MT from January’s eight-year low. At 85,072 MT, February sales to China rose about 7,500 MT from January’s two-year low. China was the destination for about 52% of all U.S. alfalfa hay exports during the month. Sales to Japan totaled 27,700 MT, 17% of the month’s total and a three-month high.

February exports of alfalfa cubes (8,711 MT) and alfalfa meal (2,385 MT) were up from January.

Exports of other hay increased about 9,530 MT from January to 76,363 MT. The total is still well below monthly averages extending back two decades. Japan maintained its spot as the top market, taking about 64% of other hay shipments (49,017 MT) during the month, up more than 10,000 MT from January and a three-month high. Sales to South Korea were steady at 12,461 MT, 16% of the total.

Regional markets

- Southwest: Many states in the western U.S. measured new record-high mountain snowpacks as well as new record amounts of snow accumulation in March.

In California, trade and activity were moderate to good; demand for retail hay was good with steady prices. Dairy and export hay demand were light to moderate, with prices slightly higher. Fields of alfalfa were coming out of dormancy and were being sprayed for weeds and weevils. In Tulare County, numerous fields were damaged due to excess rain.

In Oklahoma, hay trade was slow but still in good demand in western Oklahoma where conditions are drier. Hay producers were trying to find the best starting point for customers as the new season began.

In Texas, hay prices remained steady to firm on very good demand. Hay movement was steady as supplemental livestock feeding continued throughout the early spring months. Strong winds and short topsoil and subsoil moisture levels increased drought conditions in most all regions. Producers continue to cull livestock due to the lack of hay with little relief in sight.

- Northwest: Rain and snow in northern Washington, northern Idaho and northwestern Montana were far below normal in March, and snow drought concerns remain in these areas.

In the Columbia Basin, few hay sales were reported to start the month. Trade remained slow with light to moderate demand.

In Montana, hay sold generally steady on good demand. Ranchers continued to search for hay, and producers holding hay were starting to move excess loads, fearing new-crop hay will be more plentiful following this year’s abundant snowfall. Demand for straw bedding was very good as many ranchers were in the middle of calving.

In Idaho, very few sales were reported, and trade remains near standstill.

In Colorado, trade activity was light on good demand; there were few trades on horse hay. Growers were feeling out the new-crop market with offers, but no contracts have been finalized.

In Wyoming, large squares of dairy-quality hay sold $20 higher; other hay categories sold steady. Demand remained very good as most of the state continued to get snow, with reports that farming is roughly a month behind.

- Midwest: In Nebraska, all reported hay sales sold steady. Demand was moderate to good. Some farmers are out baling cornstalks. Late-baled stalks are trading in the $80-$85-per-ton range, ground into a feedlot ration. Most of the state remained in a severe drought.

In Kansas, first-stage alfalfa weevil feeding was evident during the first week of April, and exceptional drought existed, especially in the southern and western parts of the state. Hay demand remained good, prices were steady, but trade activity remained slow.

In South Dakota, all types and classes of hay sold steady to firm as winter lingered and demand was very good. Blizzard conditions resulted in closed interstate highways. Country gravel roads remained very soft, with some impassable for trucks. Demand for bedding was very good as livestock producers attempted to keep livestock comfortable. Much warmer weather was forecast for mid-April.

In Missouri, improved weather conditions helped kick-start tillage and fertilizer applications and even some corn planting. The supply of hay was light, demand was moderate, and prices were steady.

- East: In Pennsylvania, alfalfa and alfalfa-grass mix hay sold weaker; orchardgrass, orchard-timothy and prairie-meadow grass sold with stronger undertones. Buyer demand was moderate on a moderate supply.

In Alabama, trade was moderate on light supply and moderate demand.

Other things we’re seeing

-

Dairy: A declining U.S. average milk price and higher average costs for corn and soybean meal drove the February U.S. average milk income margin down to $6.19 per hundredweight (cwt), the lowest since August 2021. Based on Dairy Margin Coverage (DMC) program projections at the end of March, the monthly margin is forecast to be below $7 per cwt in March, May and June, and below $9 for all months until October, averaging $7.91 per cwt for the year.

-

Cattle: Fed cattle prices jumped to end March, hitting $170 per cwt in some markets. Tighter supplies of fed cattle and the decline in beef cows going to slaughter have contributed to escalating prices.

-

Fuel: Fuel prices were mixed to start April but remain well below a year ago, according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.50 per gallon on April 3, up almost 8 cents from the previous week but down 67 cents from a year earlier. The average U.S. on-highway price of diesel was $4.11 per gallon, about 2 cents per gallon below the prior week and $1.04 less than early April 2022.

-

Trucking: Spot flatbed prices trended higher to start April, up a dime from March and averaging $2.82 per mile nationally, according to DAT Trendlines. Regionally, average spot prices per mile were: Southeast – $2.83, Midwest – $2.98, South – $2.69, Northeast – $2.71 and West – $2.30.

-

Other costs: The USDA’s February index of prices paid for commodities and services, interest, taxes and farm wages was unchanged from January but up 5.2% from February 2022. Machinery costs dipped 1% from January but were up 6.6% from February a year ago. The February fuel cost index was down 2.3% from the previous month and year, with lower diesel prices offsetting higher gasoline prices. Fertilizer prices dipped 4.7% from January and 6.4% from February 2022.