“Leave me alone and let me farm!”

I’ve heard this from many a client over the years, sometimes in response to my request for timely financial reporting. But it is the wrong response.

I get it – you didn’t get into farming to deal with financial reporting. You got into it because you love the life; you love the job of doing. That feeling of seeing the results of your own hard work is rewarding. The reality, though, is that is no longer enough. Good production management skills and farm work are table stakes. Unfortunately, that alone no longer guarantees success for your farm.

Time spent understanding and managing your financials is time well spent. Understanding how any decision made impacts both your cost of production and your balance sheet is critical to an operation’s success. So, what does that mean? It means you better have a system in your operation to track and manage both of those things.

Where do you start?

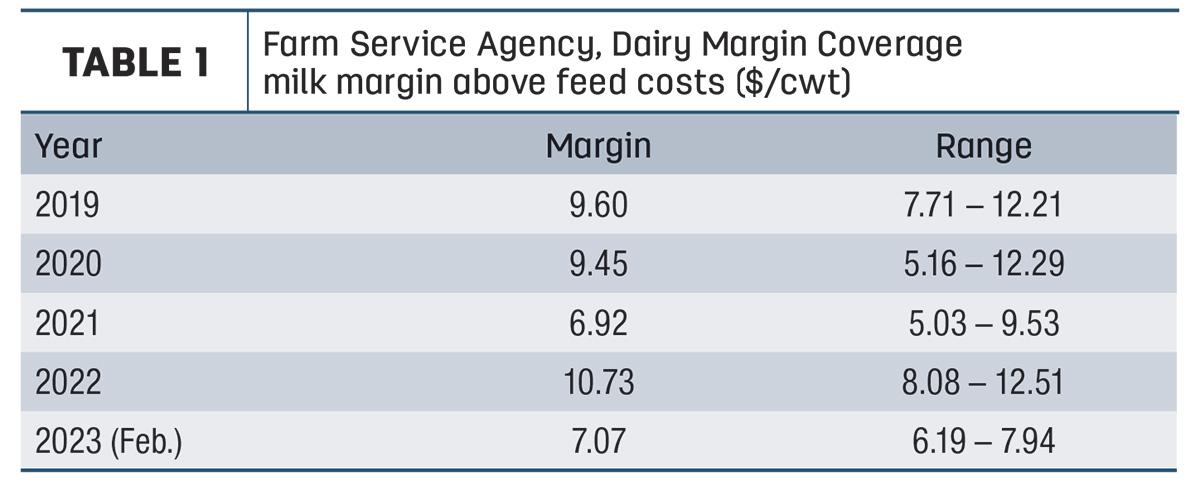

First, you need to maintain a timely and accurate balance sheet that uses consistent processes to categorize and value assets and liabilities. That is, what you own and what you owe. Timely information is key because with prices so volatile, your operating expense ratio can change overnight. Take the Dairy Margin Coverage program, for instance. Table 1 illustrates just how volatile prices and margins have been over the past several years.

You can see why it is important to stay on top of these numbers and how they impact your operation. If you are not on top of what these numbers mean from a liquidity and cost of production standpoint, you could be in for a rude awakening. If you need help getting started, I’d suggest you review the Farm Financial Standards Council’s guidelines for some great information on how to complete a balance sheet. They point out the two primary ways to complete a balance sheet: cost basis or market basis. I prefer to see both, as each has a value when it comes to analyzing an operation’s performance over time.

When evaluating a decision, the key ratios to look at on the balance sheet are the current ratio and net worth percentage. The erosion of either of these takes away from your operation’s ability to weather the next storm, so be careful in using either of them up. That is, make sure you have enough cushion in your plan to cover against execution risk, market volatility and other risks. The best will ensure the low point in their current ratio is 1.25 or better and a net worth in excess of 40% on a market-based balance sheet.

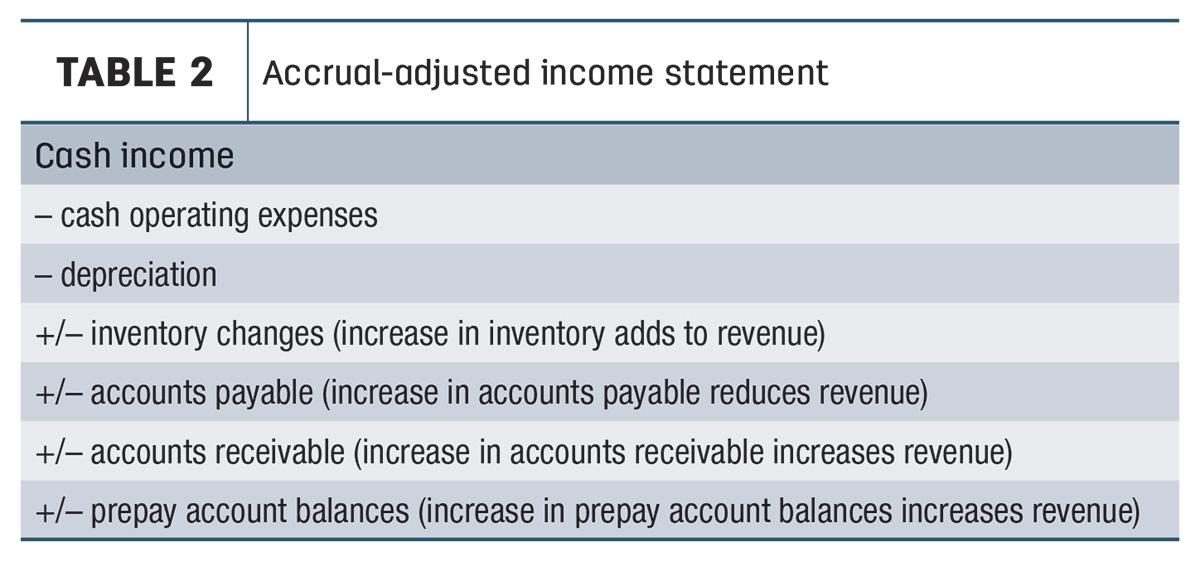

The second item you need is an accrual-adjusted income statement as a starting point to complete a projected impact of a decision. While using a cash flow statement can help with planning to the point of making sure adequate cash is available to meet all needs, the long-term profitability is critical. That means an accrual-adjusted projection that takes into account both the cash and the non-cash impacts to earnings. Remember, the whole goal of making the accrual adjustments is to associate all the costs and incomes of a specific cycle to be accounted for in that cycle. The simple math for an accrual-adjusted income statement is illustrated in Table 2.

Apply the impact of the decision to the income statement to ensure it generates a net profit per unit. The whole idea here is to understand what it does to your cost of production over time, while understanding that not all investments result in a profit immediately.

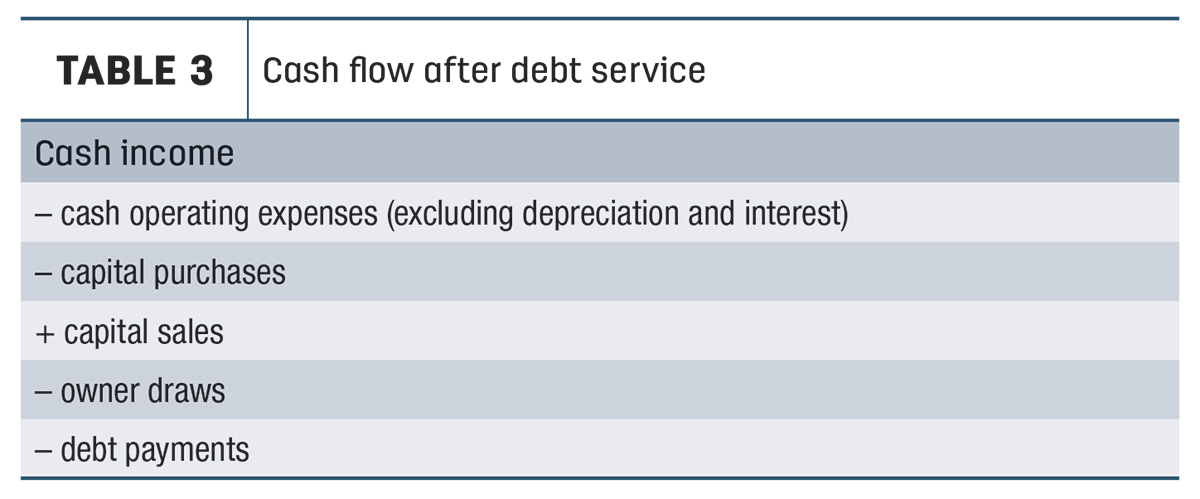

Finally, maintain a cash flow statement, which will provide a detailed view of your receipts and payments in a given period. If your cash flow is short, you’ll have to tap into your sources of liquidity – that is, cash reserves or a line of credit. A simple formula for an updated statement of your cash flow after debt service, which can help you pinpoint your borrowing needs, is shown in Table 3.

A daily project

The takeaway of this article isn’t that all leverage is bad. In fact, the best operators make smart use of leverage. That means they invest in technology and other resources that result in a stronger balance sheet over time as a result of earnings. That, in the end, is the true goal: earned net worth growth. And that is something far too important to be left to a once-in-a-while exercise.

It is about having systems in place so that you have actionable information available to you whenever you need it. To do that, maintaining timely and accurate financial information is something you need to be actively engaged in on a daily basis.

This article is provided for information purposes only. Readers should consult their own professional advisers for specific advice tailored to their needs. Information contained in this article may be subject to change without notice.