Since January, slaughter data has indicated a 12% decline in beef cow slaughter. This is likely a combination of improving pasture conditions, sufficient reductions in animal units per acre on poorer pastures and the prospect of improved profitability from selling calves. At the same time, dairy cow slaughter is up almost 6% year over year, but not by enough to offset the effect of declining beef cow slaughter on total cow slaughter. However, beef cow retention will likely cap cow slaughter for the foreseeable future.

Summarizing heifer calf prices to steer calf prices in the first six months of 2023, prices for lightweight heifer calves have increased at a faster pace than prices for lightweight steer calves. Concurrently, the six-month cumulative number of heifers sold is up 4% from the same period last year, while total sales are up 6% based on sales receipts reported in the USDA Agricultural Marketing Service National Feeder and Stocker Cattle Summary. Heifer slaughter as a percent of total steer and heifer slaughter remains above a year ago, as well as above the six-year period of the last herd contractionary period, 2009-14. This seems to be supported by the percent of heifers on feed to the total number of steers and heifers on feed which, as of April 1, 2023, is 1 percentage point higher than in April 2022 and over 2 percentage points lower than the 2009-14 period.

Second-half 2023 production higher on feedlot placements

The outlook for 2023 beef production is raised marginally from last month by 70 million pounds to 27.2 billion pounds. The forecast is only 4% below the record volume set last year and the fourth-largest overall. This reflects adjustments to the second-quarter forecast based on estimated and actual slaughter data reported for June showing a slower pace of fed cattle slaughter, which offsets higher-than-expected cow slaughter and lower aggregate carcass weights than expected last month. Despite a faster expected pace of cow slaughter in the third quarter, production is lowered on lighter expected average carcass weights and lower steer and heifer slaughter.

For fourth-quarter 2023, the production outlook is raised from last month as more fed cattle are expected to be marketed based on higher expected year-over-year second-quarter placements. Based on the latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), feedlot net placements in May were 5% higher year over year at 1.881 million head. The increase was more than expected, which supported an increase in the forecast for second-quarter 2023 placements, reflecting both an expectation of a greater proportion of the feeder cattle outside feedlots to be placed and the earlier placement of some calves.

Beef production for 2024 is projected lower than last month by 95 million pounds to 24.7 billion pounds. This is based on a slower expected pace of marketing in the first quarter that is reflected in lower expected steer and heifer slaughter.

Cattle prices projected higher from last month

In the first half of 2023, feedlot placements, as well as feeder and stocker sales receipt data, point to a faster pace than what was expected at the beginning of this year. Further, improving pasture conditions, relatively cheaper corn prices and the prospect for higher fed cattle prices have fueled feeder cattle sales. In turn, this likely lowers the expected supply for feeder cattle available in the second half of 2023, which will likely further elevate feeder cattle prices.

In June, the weighted-average price for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards was $230.87 per hundredweight (cwt). This was a $25 increase from May and nearly $68 higher than June 2022. In the second week of July, and first sale of the month, prices were nearly steady from the two weeks prior at $236.94 per cwt. Accounting for recent price strength and tight cattle supplies next year, the third-quarter price forecast for feeder steers is raised $17 to $241 per cwt, and fourth quarter is raised $20 to $246 per cwt. Further, the 2024 forecast is raised $23 to $250 per cwt.

Fed steer prices in the 5-area marketing region established a new record for the week ending June 11 of $188.75 per cwt. This was likely buoyed by a boost in packer margins supported by weekly comprehensive wholesale boxed beef values in June that climbed as high as 24% above year-ago levels at $325.29 per cwt for the week of June 23. From their respective June highs to the first week of July, comprehensive prices have since declined almost 3% to $316.60 per cwt and fed steer prices have declined by more than 3% to $182.06 per cwt. The June average price for fed steers in the 5-area marketing region was $184.51 per cwt, more than $7 above the prior-record monthly price in April 2023 and $42 higher year over year. Based on recent data and expectations of continued firm packer demand, the third-quarter 2023 fed steer price forecast is raised $5 to $178 per cwt, and the fourth quarter is raised $9 to $183 per cwt. The forecast for 2024 is raised $4 to $184 per cwt.

Beef exports still strong despite lower year-over-year levels

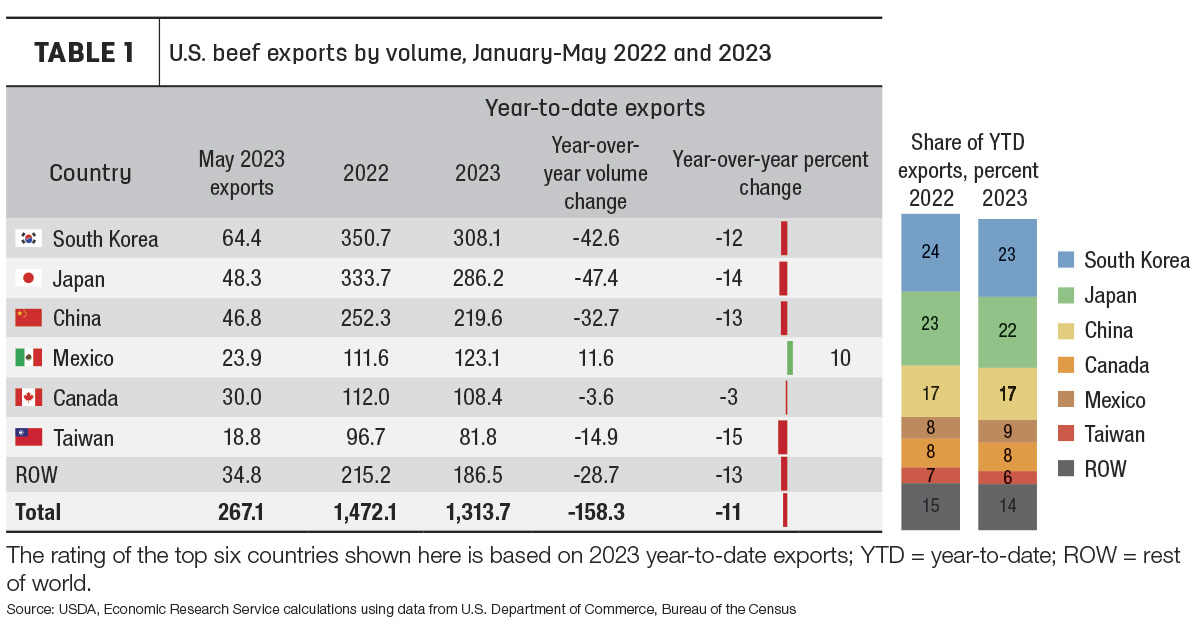

U.S. beef exports in May totaled 267 million pounds, 17% below a year ago and 2% below the five-year average. Exports to Japan fell 37% year over year, while exports to South Korea and China were down 14% and 13%, respectively. These decreases more than offset year-over-year increases in exports to Canada, Taiwan and Hong Kong. Exports to Taiwan, at nearly 19 million pounds, were the highest for the month of May. Exports to Canada spiked to 30 million pounds, nearly 23% higher year over year. However, year-to-date exports to nearly all major markets are lower year over year, as Table 1 shows.

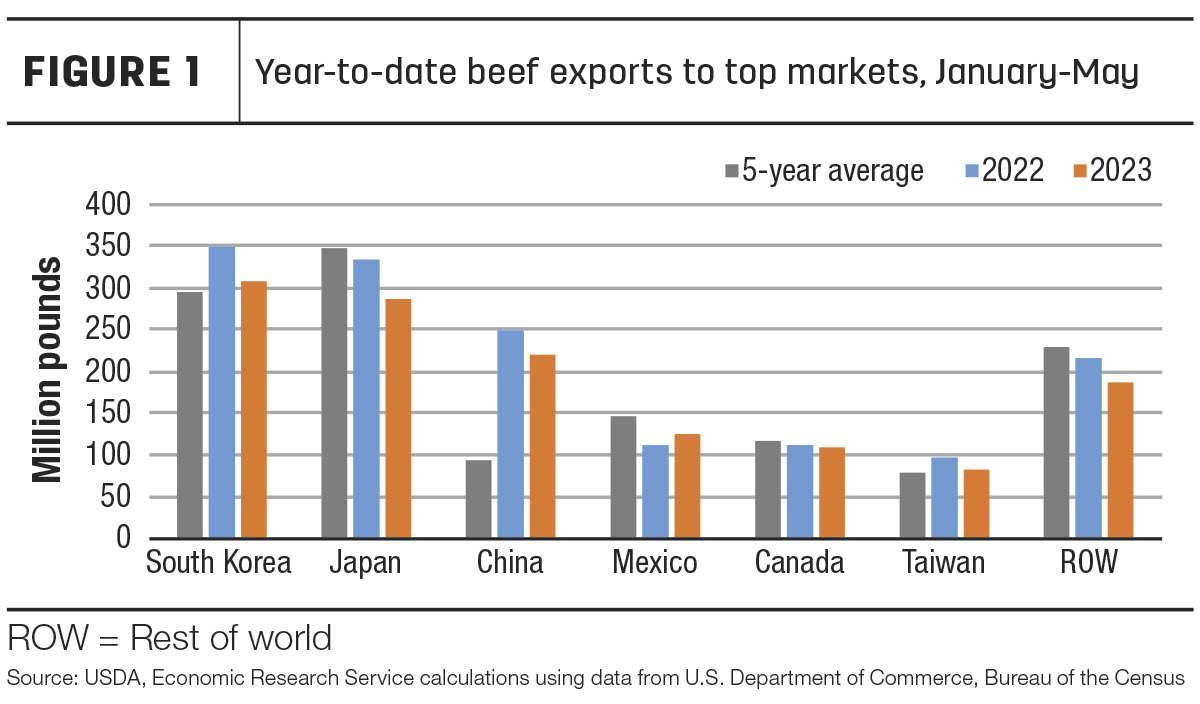

Year-over-year comparisons with last year’s record trade volumes make this year’s cumulative exports seem low, but year-to-date exports are still above the five-year average. U.S. beef exports through May this year are just over 1.3 billion pounds, 11% lower year over year but still the third-highest on record, behind 2022 and 2021. Exports to several of the larger Asian markets are lower than last year but higher than the five-year average; this is shown for South Korea, China and Taiwan in Figure 1. Exports to Mexico are above last year, while exports to Canada are slightly below last year and the five-year average.

Year-to-date exports to Japan are significantly lower than last year and the five-year average. Monthly exports to Japan have declined since February, falling to 48 million pounds in May, the lowest since 2016. The exchange rate between the U.S. and Japan has risen more than 8% since January, making U.S. beef exports more expensive in Japan.

Based on recent data, the second-quarter export estimate is decreased 20 million pounds to 805 million. Expected strength in demand from certain parts of Asia and North America support a 10-million-pound increase in third-quarter exports, raising the forecast to 840 million. The fourth-quarter forecast remains unchanged at 790 million pounds for an annual 2023 forecast of 3.214 billion pounds. The 2024 forecast remains unchanged from last month at 2.95 billion pounds.

Beef import forecast raised slightly

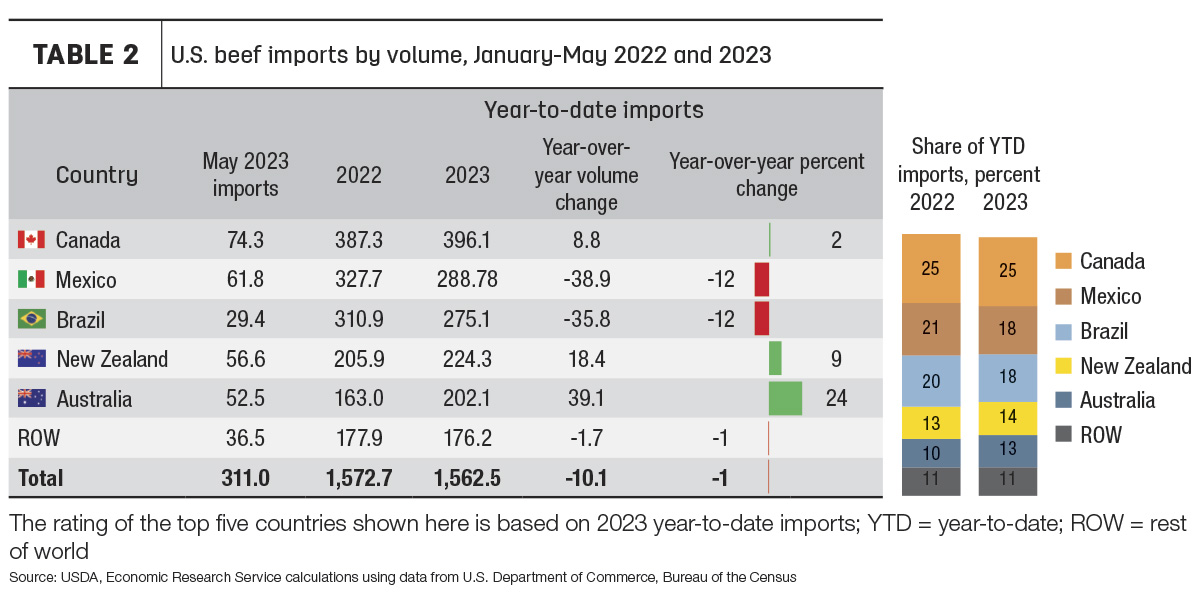

U.S. beef imports in May totaled 311 million pounds, 6% above a year ago and nearly 11% above the five-year average (Table 2). There were significant year-over-year increases in monthly imports from Australia (+39%) and New Zealand (+23%). Imports were down year over year from Brazil (-10%), Canada (-7%), and Mexico (-4%).

Cumulative imports through May are running about 1% lower than last year, with the partial recovery due in large part to significantly higher imports from Oceania. Year-to-date imports from Australia are up nearly 40 million pounds, a year-over-year increase of about 24%. Imports from New Zealand are up over 18 million pounds (9%) from the same period last year. Imports from Canada are also up slightly over last year. These increases are offset by decreased imports from Mexico and Brazil, both down 12% from last year, resulting in less than a 1% decrease in total year-to-date imports from the same time last year.

The second-quarter estimate for beef imports is raised 20 million pounds to 910 million based on recent data. The third- and fourth-quarter forecasts are unchanged from last month at 890 million and 765 million pounds. The annual forecast for 2023 is 3.521 billion pounds. The annual forecast for 2024 is unchanged from last month at 3.56 billion pounds.