Milk price is dependent on several factors – supply and demand, quality, and federal and state policies. In the U.S., most milk is priced according to its end use product and grouped into four classes.

Class I corresponds to milk used to produce fluid or beverage-related items. Class II includes milk destined for the creation of "soft" processed goods like yogurt, ice cream and sour cream. Class III includes milk used in hard cheese production, while Class IV milk is used to make butter and dry goods such as nonfat dry milk.

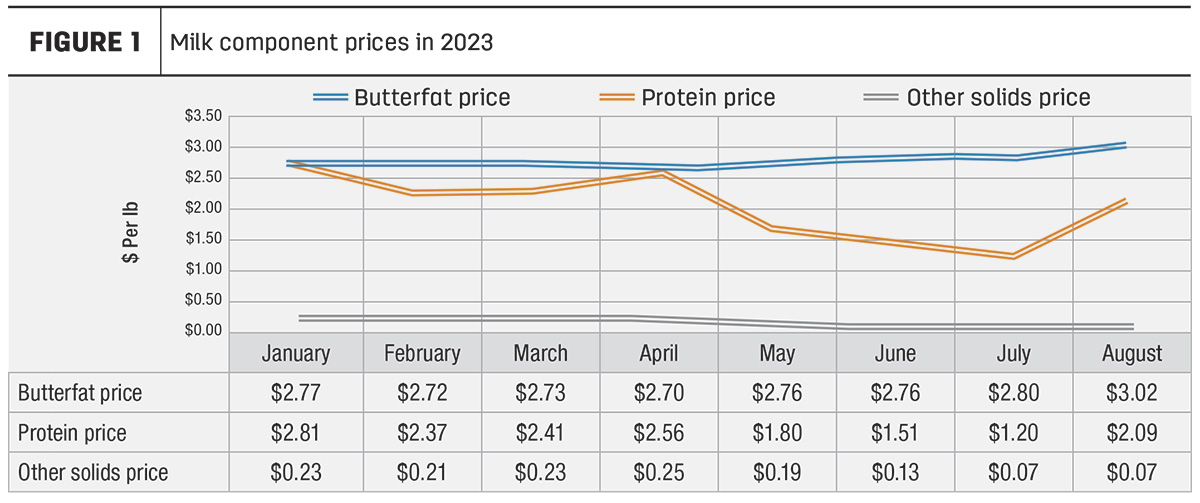

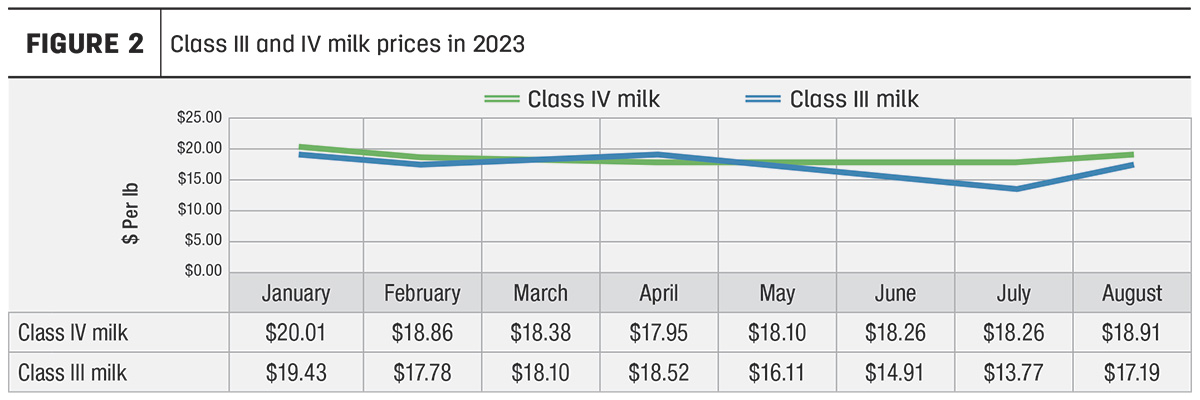

This summer, there has been a notable discrepancy in milk pricing between Class III and IV. The Class III milk price significantly dropped, presenting a sharp contrast to the year record-breaking price seen within Class IV. Through the beginning of the fall, we continue to see this variation between milk protein and butterfat prices (Figure 1).

- Milk protein prices hit a low point of $1.20 per pound in July, after consistently declining since April's high of $2.56 per pound. In August, we saw some recovery, where milk protein jumped to $2.09 per pound, a relief welcomed by producers. Unfortunately, it seems to have dropped again, to $1.94 per pound in the last weeks of September.

- Butterfat prices held steady in May and June, at $2.76 per pound. Since then, they continued the rise to $2.80 per pound in July, $3.02 per pound in August, reaching $3.23 per pound in the last week of September. That’s a 53-cent increase since the beginning of the summer.

While the recent increase in Class III and IV prices is certainly good news, it’s not going to affect the bottom line for producers as much (Figure 2). Margins are still tight and, if you haven’t already, now is a good time to re-evaluate your diets. Consider these strategies to maximize butterfat and increase efficiency, while avoiding extra feed costs.

When margins are tight and milk protein price is low

Consider more moderate starch – When a diet contains enough fiber to ensure a healthy rumen, the practice of increasing starch while decreasing neutral detergent fiber (NDF) becomes quite popular among farmers and nutritionists. This is because it usually boosts the daily milk production and protein yield. However, high-starch diets can also lead to a slight decrease in butterfat.

- Pushing starch and decreasing NDF in today’s milk component market gets us a gain of 0.075 pound of protein (+14 cents) and a potential drop of 0.06 pound in milkfat (-19 cents). At present, keeping more moderate levels of starch while ensuring sufficient protein and fiber in the rumen may be the more profitable approach.

Maximize use of quality home-grown forages – Home-grown forages and feeds have no markups from purchasing, hauling and so forth, making them a practical way to reduce your feed bill. However, we need to make sure we are putting up high-quality feeds to maximize their use. As for silages, growing specific hybrids that have good yield and digestibility are key strategies to be considered.

Producers and their nutritionists should also adjust the economic value of forages to account for NDF digestibility. Research has already shown that a one-unit increase in in-vitro or in-situ digestibility of NDF was associated with a 0.5-pound increase in milk production. Therefore, properly adjusting the forage ingredients to reflect that while optimizing your diets will help you maximize your on-farm resources and savings.

- Michigan State University has developed a tool to give forages different marginal values based on their NDF digestibility.

Reconsider expensive protein sources – Maintaining an amino acid balance in the diet is still important, but which high-cost protein sources are used could be adjusted based on the current economic situation.

With low protein milk prices, feeding feeds rich in rumen-undegradable protein (RUP) or using rumen-protected amino acids may not pencil out. Response varies depending on diet, stage of lactation and the amino acids supplied, but as an example:

- Feeding 15 to 20 grams per day of methionine from a rumen-protected methionine source is expected to increase milk protein yield by about 0.06 pound per day – worth about 11 cents per cow. However, after deducting the product cost, unfortunately most bypass amino acid products available will surpass the 11-cent investment.

Given animal protein ingredient costs as well as protected amino acid costs, income over feed cost will not benefit from an aggressive feed formulation and cost approach to push milk protein these days.

One alternative to consider is adding a rumen modifier to your ration – Certain rumen modifiers can reduce the protein breakdown in the rumen, making a fraction of rumen-degradable protein (RDP) bypass to the cow’s intestines. Such products can improve the metabolizable protein supply to the cow and increase energy-corrected milk. One strategy we can apply when formulating a rumen modifier into the diet is to maximize the use of an economical RDP commodity source – soybean meal – and reduce the need for more expensive bypass sources – blood meal.

- For reference, soymeal prices have remained relatively stable, and year-to-date prices appear to be gradually decreasing from February peaks, hovering around $450 as of September. Conversely, blood meal prices have trended upward since March and are currently ranging from $1,100 to $1,200.

- Lowering the inclusion of blood meal by a half-pound will reduce ration cost by approximately 30 cents – the ration must be adjusted to maintain production. After accounting for the rumen modifier cost, and extra soy meal, and other adjustments needed to support the peptide and protein balance, there is still an opportunity to save 10 cents to 19 cents in a ration.

Consider what research tells us about feeding certain groups of cows more and less protein – A 2022 study from the University of Wisconsin found that diets with crude protein (CP) ranging from 16.3% to 17.4% maintained intake and milk output in early and mid-early lactation. Once cows progressed to late lactation, CP was reduced to between 15.7% and 17.1%. If a dairy can group, feeding different diets for the various stages of lactation could optimize cows’ performance and save on feed costs.

Market outlook

Despite all the uncertainties, next year is offering a bit more positivity. Forecasts show an uptick in the all-milk price and for inflated animal protein costs to stabilize.

Milk – The all-milk price forecast for 2023 is up by another 45 cents to a total of $20.40 per hundredweight (cwt).

- All-milk price for 2024 is forecast to $20.30 per cwt, 95 cents higher than last month's prediction – due mostly to the reduction of farm milk production forecasts, decrease in cow numbers and recent strength in some dairy product wholesale prices.

- Currently, specialists say that Class III milk should recover soon. In the Northeast, milk production is down in some states due to the hot weather, and in the Midwest, cheesemakers say tight milk volumes are causing them to run reduced production schedules. With higher demand compared to the offer, Class III should be up in the next reports.

Blood meal – Availability is limited and most domestic facilities have adopted a constrained operating schedule of five days per week. Nevertheless, the recent USDA report indicates an increase of 465 million pounds in the projected beef/cattle production for 2024. Experts suggest that with the prospective rise in culling and reduced usage of blood in dairy rations, price will likely decline another $100 per ton.

Soybean meal – Prices are forecast at $365 per ton for 2023-24, down $90 from 2022-23. However, the USDA's inaugural survey-based projection for the 2023-24 U.S. soybean yield, released in August, stirred the market a bit, and we saw a quick increase in spot prices mid-September. It did not last, and the month closed with lower prices again. As of Sept. 16, the USDA National Agricultural Statistics Service (NASS) lowered the 2023-24 national average soybean yield from the previous forecast of 50.9 bushels per acre to 50.1 bushels per acre. Consequently, the soybean production forecast for marketing year 2023-24 is now reduced 4.15 billion bushels. Exports are down, and with higher crushing and ending stocks, we may still see price stability in the coming period.

My advice

Make a plan with your nutritionist and consultants. As we discussed, there are strategies that can and should be put in place to increase profits. Remember that fixating solely on immediate cost cutting might sow the seeds for prolonged and costly repercussions by compromising the long-term health and performance of our animals. Additionally, it’s never a bad idea to consider risk management programs, such as the Dairy Margin Coverage.

References omitted but are available upon request by sending an email to the editor.