If you still view your beef-on-dairy crossbred calves as a byproduct, you are probably still getting paid byproduct prices. Embrace your beef crossbreeding program as a revenue stream and look for strategies to capture the most value per head.

In economics, disintermediation means removing intermediaries from a supply chain. When it comes to beef-on-dairy crossbred calves, there are a lot of middlemen to be cut out. There is a lot of profit potential in retaining cattle ownership all the way to harvest.

Most fed cattle are sold on a grid, or formula, value-based pricing system. Grid price calculations are based on USDA-inspected carcass performance for yield, quality and dressed (carcass) weight.

Grid pricing is value-based marketing

Grids reflect consumer supply and demand. Packers design various grid structures to incentivize the most valuable carcass to fit their end-buyer preferences. Therefore, grid formulas will vary between packers. And prices can change often.

Each grid will have an average price or base price. The final price is determined at harvest based on carcass performance. This is on an individual basis, not a pen-level average.

Research how price is computed beyond your target grid’s base with quality credits and, especially, discounts.

“It is a discount-hungry industry,” says Tim Timmons, business development specialist for ABS Global.

Similarly to how your dairy sire selection choices are influenced by the most valuable milk composition for your market, beef-on-dairy genetics should also reflect the end-buyer goal. Genetic decisions for creating crossbred calves should align with your target grid carcass premiums.

Premiums and discounts

Genetics and environment, from birth to harvest, introduce carcass variations. The more consistency in your cattle, the more predictability you can have in beef revenue when marketing on a grid.

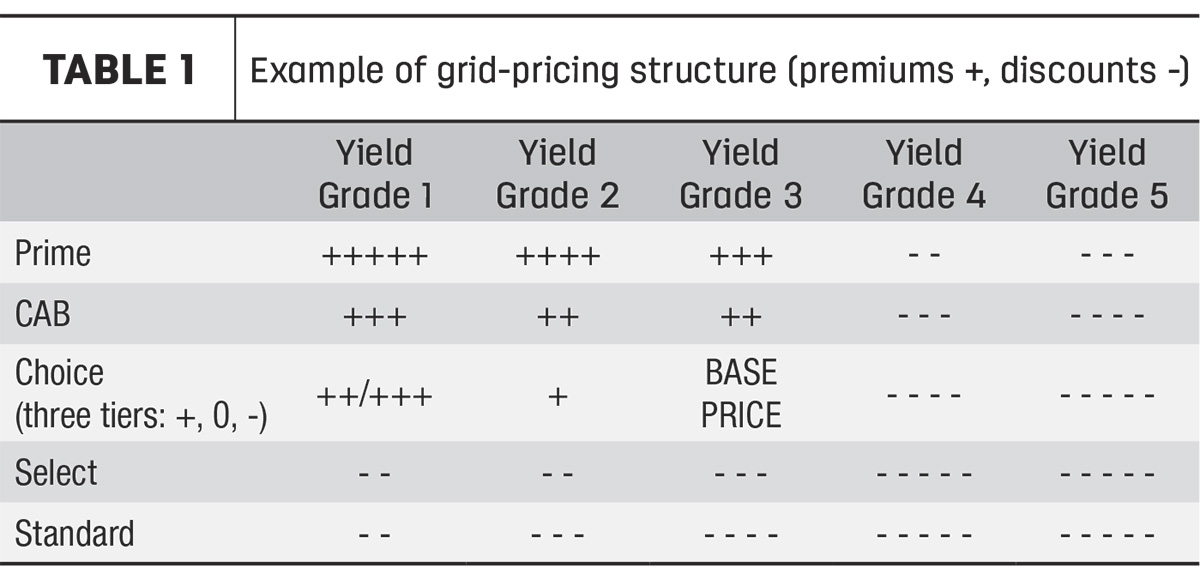

Yield and quality drive price. Typically, grids will have yield grades on the horizontal axis and quality grades on the vertical axis (Table 1).

Yield grades, or dressing percent, measure carcass harvest efficiency or cutability. This is the percentage of trimmed red meat yield from the carcass. Typically, this is measured on a scale of one to five, with Yield Grade 1 as the most desirable.

Quality grades are indicators of consumer palatability (tenderness, juiciness and flavor). Carcasses are evaluated for maturity, color and texture of ribeye, and marbling amount and distribution. Prime is the highest quality grade, followed by three tiers of Choice, Select and Standard.

Every grid will have an optimum combination of quality versus yield. However, quality tends to be more valued in grids than yield. A large price step-up is usually expected when moving from Select to Choice quality. However, the price increase from Choice to Prime is not generally as drastic.

The final price is hot carcass weight (HCW) multiplied by the grid-determined price per pound. The HCW acceptable range is usually 600-1,000 pounds. If carcasses are out of the normal spectrum for weight, either higher or lower, there are sliding discounts.

If your cattle have reliable performance, excellent management for cattle health, nutrition designed specifically for beef-crossbreeds and profitable genetics, selling on a grid can be a valuable marketing tool. Remember to request carcass reports on previously sold cattle to evaluate future marketing decisions.

Who wants the risk?

Selling on the grid assigns risk and reward to the seller for HCW, quality and yield grade. Versus when pricing live-fed cattle, the packer takes the risk for characteristics that can’t be evaluated on the hoof. As a result, buyers’ prices factor in discount assumptions based on quality expected at processing. This is why buyers value knowledge about cattle background, such as genetics or enrollment in third-party verification programs.

However, if you have invested in quality genetics and know your cattle will perform above average, you won’t capture full-price potential selling loads of live cattle. Even if you are raising superior cattle, the cash market will often only earn you average prices. The best thing you can do to widen margins is own cattle until harvest. Take the risk of death loss and how they grade at harvest but get rewarded for your investment in quality control from birth to finish.

From byproduct to revenue stream

Dan Dorn, business development specialist for ABS Global, encourages retained ownership to get the most value when marketing cattle, whether beef or beef-on-dairy crossbred.

“Every piece of the supply chain will take a piece of the pie. Producers will capture the ultimate value of good genetics by retaining ownership,” Dorn says.

There are a number of options to retain cattle ownership. Find the one that is most economically comfortable for you. For some dairy operations with extra feed and space due to more efficient replacement heifer numbers, this could be raising calves on-site until 400 or 600 pounds.

If shipping cattle to a calf ranch and then a feedlot makes the most sense, there are financing and partnership opportunities available through feedlots to retain shares in cattle. Interest rates at feedlots are often more competitive than banks.

Interview feedlots to understand their level of marketing support. Progressive feedlots will assist in marketing cattle on a grid. Nutritionists at the feedlot should also have experience feeding beef-on-dairy crossbreeds.

If you retain ownership, it is critical to have a balanced genetic plan. Do not just focus on carcass traits; include feed efficiency traits. There are genetic lines that grade well but are not feed-efficient. Fewer days on feed to finish is a profit driver.

Another consideration, whether owning cattle to 400 pounds or all the way to fed cattle, is volume. The ability to fill a truck, ideally gender separated, is important. Optimize the number of beef pregnancies you can afford per month without creating a dairy herd deficit. Work with a reproduction and genetic adviser to carefully calculate dairy replacement-heifer numbers needed for your operation.

Opportunity cost

Retaining ownership might not be for everyone or in every market condition.

“In a market where everything has an inflated value, it might not make sense to keep ownership right now,” Timmons says. “However, it will adjust at some point.”

In times when cattle will never be worth more than they are right now, it might be most lucrative to cash out, regardless of age sold. This relieves you of the death-loss risk and market crash potential. However, in normal markets, most value is typically captured by retaining until the end.

The most valuable asset to your business is knowledge. Understand the impact your beef sire selection choices today will have on future beef-crossbred marketing options. Build a network of advisers who can help you create uniform loads of cattle that are most desirable to the buyers you are targeting.