Prior expectations for the number of cattle on feed in the second half of 2023 were that generally tighter cattle supplies and potentially growing retention of heifers for breeding would lead to smaller levels than a year ago. However, the Cattle on Feed report, published on Oct. 20 by the USDA National Agricultural Statistics Service (NASS) estimated the Oct. 1 feedlot inventory at 11.58 million head, 0.6% above 11.509 million head in the same month last year. Feedlot net placements in September were 6% higher year over year at 2.149 million head, which was above industry analyst expectations. Marketings in September registered 1.663 million head, down more than 10% year over year.

Regarding September placements, U.S. imports of feeder cattle from Mexico in September were up 136% from last year, likely contributing to the increase in placements. From January to September, U.S. imports of feeder cattle from Mexico were up 45% from the same period last year but slightly above the five-year average. Drought conditions in Mexico and strong U.S. calf prices likely supported Mexican producers exporting their calves to the U.S.

The October Cattle on Feed report also breaks down the number of steers and heifers on feed. There were just slightly more steers on feed than last year, but heifers increased more than 1% year over year. This is largely consistent with the number of heifers reported in weekly sales receipts based on the USDA Agricultural Marketing Service report National Feeder and Stocker Cattle Summary. Compared to January-October 2022, there were 3% more heifers being sold in the same period this year.

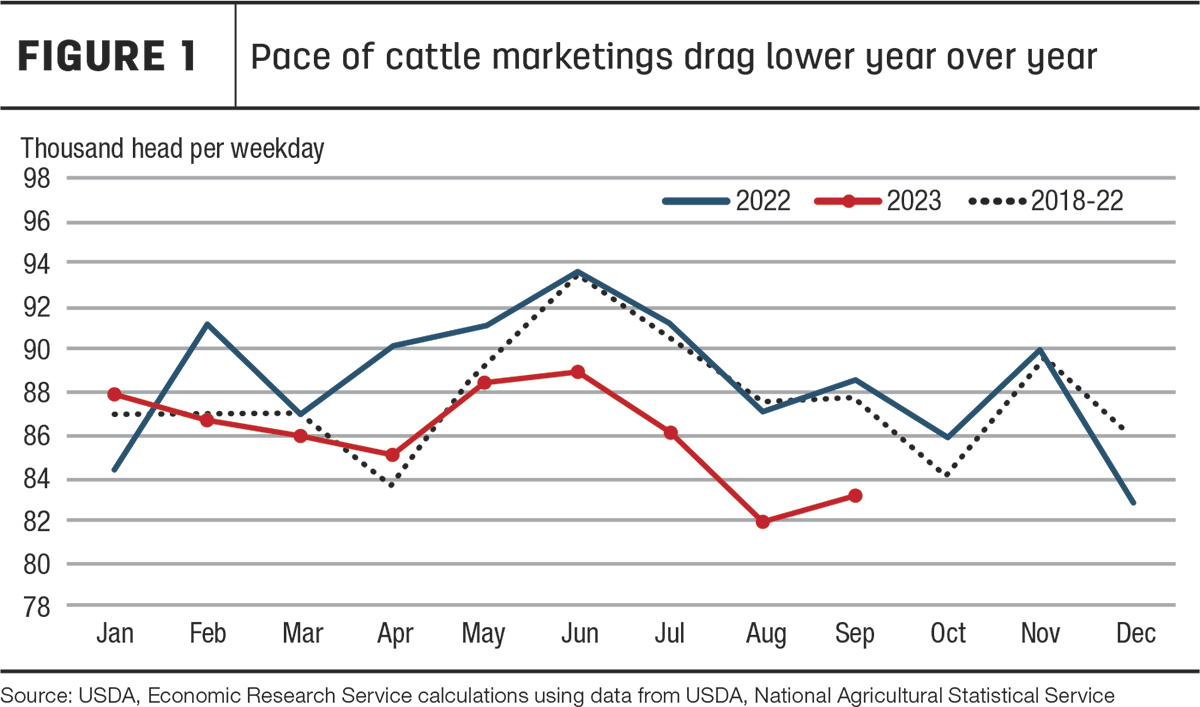

With respect to the marketing of fed cattle for slaughter, packers continue to restrain the pace of fed cattle slaughter through November and at a lower volume than previously considered last month (Figure 1).

Higher year-over-year placements have been reported in three of the last five months (May, June and September). When combined with a slower year-over-year pace of marketings, this has pushed the percent of cattle on feed over 150 days back to above year-ago levels. It also suggests a larger supply of cattle that will be marketed in the coming quarters.

The larger-than-expected level of placements during September has led to about 4%, or 1.1 million head, fewer cattle outside feedlots on Oct. 1 that are available for placements in the coming months. Since the Cattle on Feed series began in 1996, this is a record low for supplies outside feedlots estimated on Oct. 1.

Higher expected placements raise 2024 production forecast

Reflecting actual and estimated slaughter data through early November, production in the fourth quarter of 2023 is adjusted 45 million pounds lower. Fourth-quarter 2023 is lowered as less fed cattle slaughter more than offsets higher expected cow slaughter and slightly higher expected average carcass weights. Including adjustments for actual September production, the total 2023 beef production forecast is adjusted slightly downward by 44 million from last month at 26.932 billion pounds.

The 2024 beef production forecast is raised 535 million pounds from last month to 25.81 billion pounds. With the addition of more heifers on feed than a year ago and higher forecast cattle imports from last month, expectations for fourth-quarter 2023 placements are raised from last month, and anticipated placements in first-half 2024 are also raised. This reflects an increase in expected fed cattle marketings next year, in addition to greater cow and bull slaughter.

Cattle prices, off from expectations, remain historically high

Recently, cattle prices have not advanced from September lows. However, they remain at record highs and are forecast to continue elevated through 2024, with mostly offsetting changes in the quarterly forecasts reflecting recent price data and changes to cattle placements and marketings.

In October, the weighted-average price for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards was $243.50 per hundredweight (cwt). This was a decrease of nearly $12 from September but more than $69 above October 2022. In the first week of November, feeder steers were recorded at $234.90 per cwt, an increase from the lightly tested week of Oct. 30 but an overall decline from the market top of $259.33 on Sept. 18. The pullback in prices is reflected in a lower expected fourth-quarter price forecast of $240 per cwt. The annual projection for 2024 feeder steer prices is down from last month at $252 per cwt. However, the first half of the year was lowered and was partially offset by an increase in the second half of next year.

Boxed beef values have increased a few dollars from their recent low in early October. However, that support seems to have waned. Nonetheless, wholesale beef prices remain at record levels for this time of year, so the typical holiday boost may be relatively muted.

It appears that sales for delivery during the holidays is below the standard deviation for this time of year. Note that beef production is less than a year ago, so it makes sense that sales volumes would generally also be less. However, it is important to follow the seasonal patterns, as most medium-sized and large supermarket chains book beef four to eight weeks ahead of the delivery date for regular weekly deliveries. Although not shown below, spot sales for deliveries zero to 21 days out are above a year ago and greater than a standard deviation from the average, which suggests greater just-in-time purchasing decisions for this time of year.

The October average price for fed steers in the 5-area marketing region was $184.35 per cwt, continuing a steady course since mid-year but more than $35 higher year over year and a record for the month. Packers’ margins have declined since peaking in June as the boxed beef prices fell and fed cattle prices remain flat. Expectations for cattle prices in 2023 are unchanged from last month as weak packer margins will likely limit much upside to cattle prices in late 2023. As a result, the fed steer price forecast for fourth-quarter 2023 is unchanged from last month at $185 per cwt. However, in early 2024, higher than previously forecast volumes of cattle marketed for slaughter are expected to moderate prices in the first half of 2024. However, the third-quarter price is raised, offsetting the decline in the first half for an annual average of $185 per cwt, which is unchanged for the month.

Beef export forecast unchanged from last month

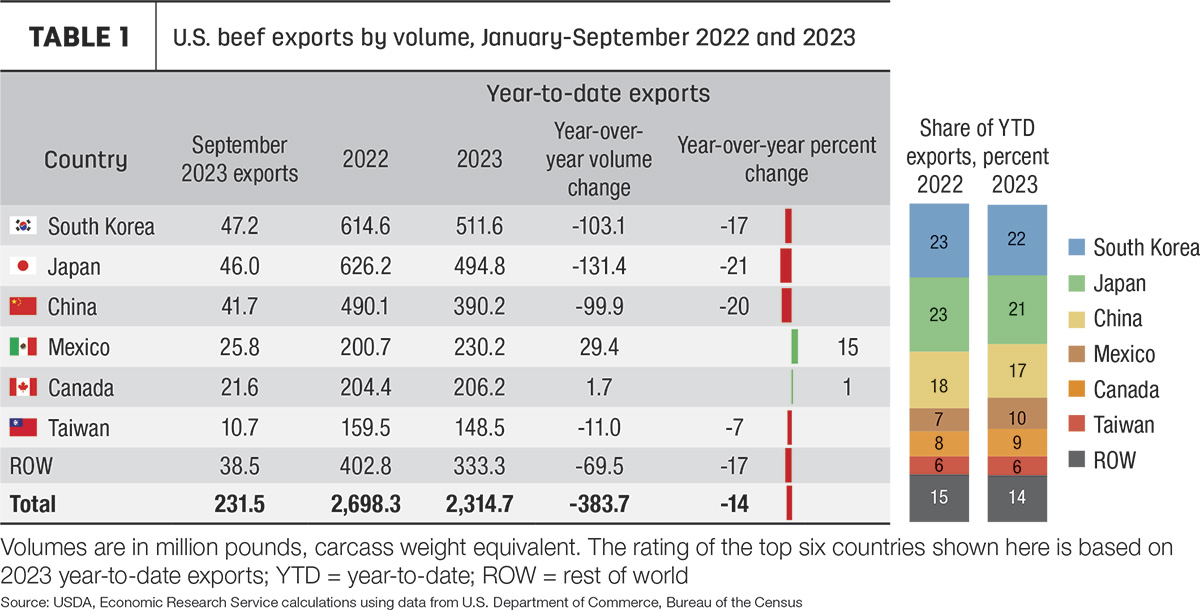

September beef exports were 232 million pounds, 17% lower year over year and 13% lower than the 2018-22 average (Table 1).

Exports to the top four major Asian markets were lower year over year in September, accounting for a combined decrease of more than 46 million pounds compared to last year. Total exports for the third quarter were 731 million pounds. This was nearly 20% lower year over year and 13% lower than the five-year average. Exports to countries in North America were 12% higher year over year for the quarter. However, quarterly exports were lower year over year to China (-32%), Japan (-30%) and South Korea (-24%). After a slightly stronger second quarter, exports to Taiwan in the third quarter were less than 2% lower year over year. Of the major Asian markets, year-to-date exports to Taiwan have shown the smallest year-over-year decrease.

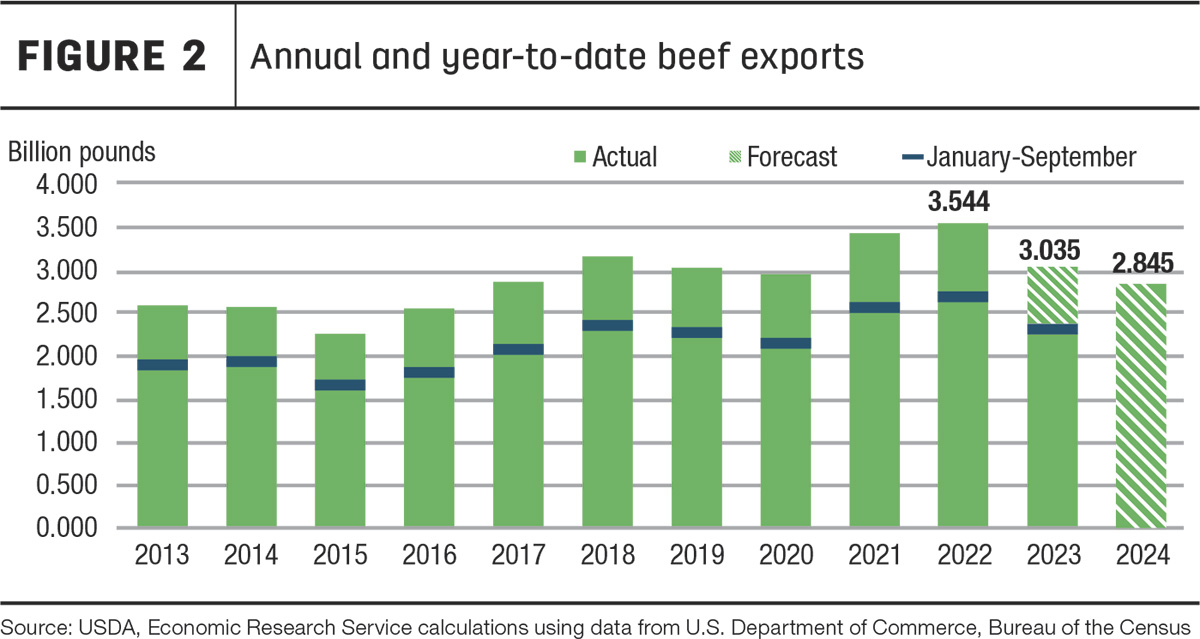

Figure 2 shows the export pace through September compared with previous years. Year-to-date exports are the fourth-highest for the time period and are relatively strong compared with previous years.

Continued strong beef imports from Oceania

Beef imports in September were a record for the month at 313 million pounds, a year-over-year increase of 21%. Monthly imports from New Zealand, Brazil and Canada were also the second-highest on record for the month of September. As in previous months this year, the year-over-year increase was driven by increased imports from Australia and New Zealand. Total imports for the third quarter were 966 million pounds, which was the fifth-highest quarter overall and the second-highest total for the third quarter behind 2020. Third-quarter imports from Australia and New Zealand were nearly double the same period last year, both around 92% higher. These increases in quarterly imports were only partly offset by year-over-year decreases in imports from Mexico (-11%) and Brazil (-6%).

According to data from the USDA Food Safety and Inspection Service, imports of boneless manufacturing trimmings were up more than 20% through September compared to the same time last year. A majority of that year-over-year increase was driven by imports from New Zealand and Australia, which were up 39% and 77%, respectively. Imports of boneless manufacturing trimmings from New Zealand and Australia were also above the average from 2018-22; however, stronger imports from Brazil also drove the increase above the average this year. While imports from Brazil are slightly lower year over year, they are well above the five-year average, as the ban on fresh (not heat-treated) beef from Brazil was lifted in 2020.

Total year-to-date imports through September were 2.824 billion pounds, a record for the time period. Year-to-date import volumes from the top five countries are shown in Table 2.

Canada is still the main supplier of beef to the U.S., with Mexico the second-largest, despite an 11% decrease year over year. Imports from Australia and New Zealand have significantly increased year over year, and the share of U.S. imports from Oceania has grown to nearly 32%. Based on stronger expected imports from Oceania, the forecast for fourth-quarter imports is raised 30 million pounds to 830 million. This would make an annual total of 3.653 billion pounds, which would be the highest annual imports since 2004. The annual forecast for 2024 is raised 40 million pounds to 3.690 billion, which if realized would be the highest annual imports on record.

Live cattle import forecast raised

Live cattle imports were very strong in September, partially underpinning the high placements on feedlots. Imports of cattle and calves for feeding were more than 65,000 head higher than a year ago; imports from Mexico were up 136% and imports from Canada were up 108% over last year. Imports of cattle for immediate slaughter from Canada were also up 22% year over year. Total year-to-date imports of cattle were up nearly 19% year over year through September. As a result of the strong pace of cattle imports, the annual forecast is raised 55,000 head to 1.975 million head. The annual forecast for 2024 is raised to 2 million head.