Since last month’s Livestock, Dairy and Poultry report, estimated steer and heifer slaughter was slower than expected in November and early December, suggesting a slower pace of marketings for the month and lowering expectations for the quarter.

On the other hand, the placements of cattle were above a year ago for the month of October and November weekly sales data from the National Feeder and Stocker Cattle Summary, as well as weekly import data for feeder cattle, suggest that November placements could also be relatively strong.

Anticipated fourth-quarter 2023 placements are generally higher than might otherwise be expected given the historically low number of feeder cattle supplies that were available for placement on Oct. 1. This is likely supported by an increase in heifers not being kept for replacements and demand for feeder cattle, with optimism for generally higher fed cattle prices in 2024.

The proportion of heifers reported in weekly federally inspected slaughter data and in weekly sales data for feeder and stocker cattle remain quite strong, particularly given historically high nominal price levels recorded this year. Possible impediments to cow-calf producers retaining heifers in their herds may be a lack of forage and continued relatively high operating expenses.

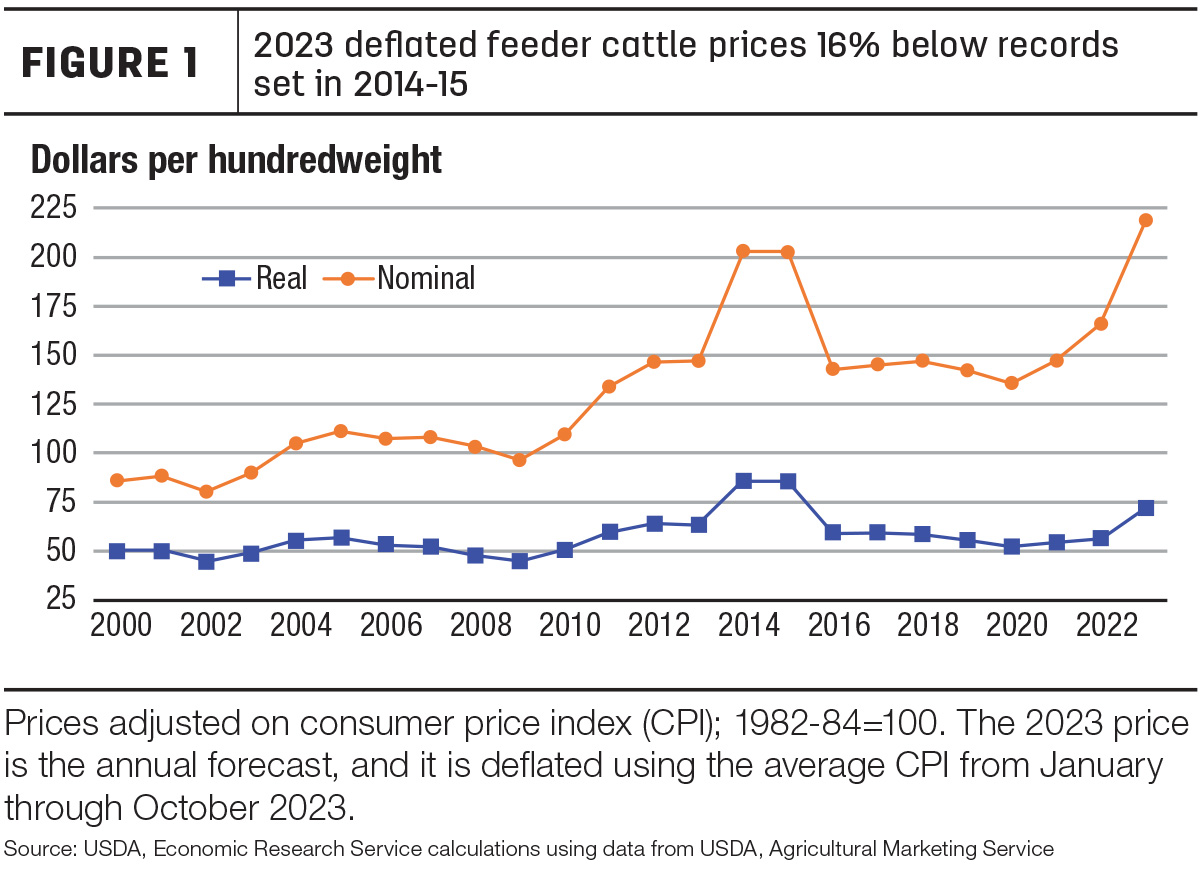

Although feeder prices have breached previous records this year, when prices are deflated to real levels, 2023 prices for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards have not matched levels in 2014 and 2015 (Figure 1).

2024 production higher on both weights and cattle slaughter

According to the latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), Nov. 1 feedlot inventory is estimated at 11.931 million head, almost 2% above 11.736 million head in the same month last year. Feedlot net placements in October were nearly 4% higher year over year at 2.109 million head. However, marketings in October tallied 1.758 million head, which were down over 3% from a year ago. The year-over-year decline in marketings, despite one more weekday of slaughter available compared to last year, reflects poor packer margins in October that resulted in a slower pace of slaughter. Consequently, the slower pace of marketings is reflected in two of the three largest cattle-feeding states, Texas and Kansas, holding 4% and 56%, respectively, more cattle on feed over 150 days on Nov. 1 than a year ago, which has likely helped boost steer and heifer carcass weights to above year-ago levels for the week ending Nov. 25.

Despite the slower pace of cattle slaughter through most of the fourth quarter, the beef production outlook for 2023 is unchanged from last month at 26.932 billion pounds. The unchanged forecast for fourth-quarter production reflects the slower-than-expected pace of fed cattle slaughter that is offset by a higher pace of cow slaughter than previously anticipated and heavier average cattle carcass weights.

For 2024, the beef production forecast is raised 180 million pounds from last month to 25.99 billion pounds. In the first quarter, the production forecast is raised on higher anticipated cow slaughter and heavier expected average carcass weights that are carried over from fourth-quarter 2023. In addition, higher production is also expected in the second and third quarters that reflect higher expected placements in late 2023 coupled with a strong pace of marketings during 2024.

Softer demand weighs on cattle prices

In November, the weighted-average price for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards was $226.83 per hundredweight (cwt), a $16.67 decline from October. In the Dec. 4 sale, feeder steers topped $219.30 per cwt, a decline of $3.71 from the prior week but more than $42 above the same week last year.

Several factors are likely contributing to lower reported feeder calf prices. Wholesale beef prices have been trending lower since the shorter-than-expected seasonal uptick in late October. This has encouraged packers to try to minimize the prices paid for fed cattle by managing throughput. This is likely putting a squeeze on feedlot returns for calves purchased at higher levels in the summer and coupled with declining futures prices for fed cattle may be affecting feedlots’ willingness to pay higher prices for feeders. Further, less heifer retention is probably helping support supplies available for placement. Accounting for recent price weakness, the fourth-quarter price forecast for feeder steers is reduced $10 from last month to $230 per cwt. That price weakness was carried into 2024, and the forecast of annual prices is lowered $10 to $242 per cwt, 11% higher than 2023.

As noted, wholesale boxed beef values have declined steadily through early December, and fed cattle prices have also declined. The November average price for fed steers in the 5-area marketing region was $178.72 per cwt, $5.59 lower than October. As a result of current fed cattle price weakness, the fed steer price forecast for fourth-quarter 2023 is lowered $7 from last month to $178 per cwt (Figure 2).

That price weakness was carried over to next year with expectations that more cattle will be available for marketing than previously expected, as well as for concerns over future demand strength. Consequently, 2024 prices are lowered $7 to $178 per cwt, still above 2023 levels and remaining historically high.

Beef export forecast lowered slightly

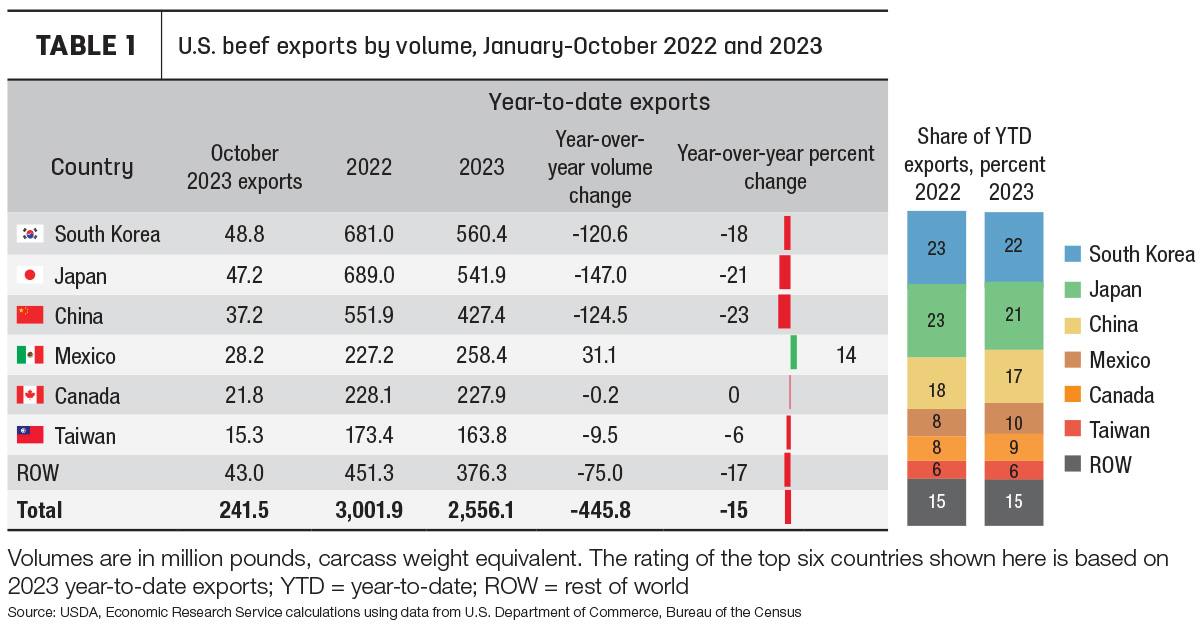

October beef exports totaled nearly 242 million pounds, almost 21% lower year over year and 11% below the five-year average (Table 1).

Monthly exports to nearly every major market were lower year over year with the exception of Taiwan and Mexico. October exports to Taiwan were nearly 11% higher year over year, and exports to Mexico were about 6% higher. The value of total U.S. beef exports through October is just over $7.8 billion, which is 17% lower than last year.

Australia’s exports through September this year were about 22% higher than a year ago. Most Asian markets have imported less total beef from the world through September this year, but in some markets Australia’s share of those imports has grown as its production has increased and it has stepped up to fill the gap left by lower U.S. exportable supplies. This is the case especially in both South Korea and Taiwan. Japan has imported nearly 9% less beef year over year, but despite a decrease in shipments the U.S. still remains the largest supplier of beef imports to Japan. The main supplier of beef to China and Hong Kong is Brazil; Hong Kong has imported significantly less beef from Brazil compared to a year ago, while China’s imports of beef from Brazil are up slightly.

The export forecast for fourth-quarter 2023 is lowered slightly by 5 million pounds to 715 million. The annual forecast is 3.03 billion, a year-over-year decrease of almost 15%. The export forecast for 2024 is unchanged from last month at 2.845 billion pounds.

Beef import forecast raised slightly

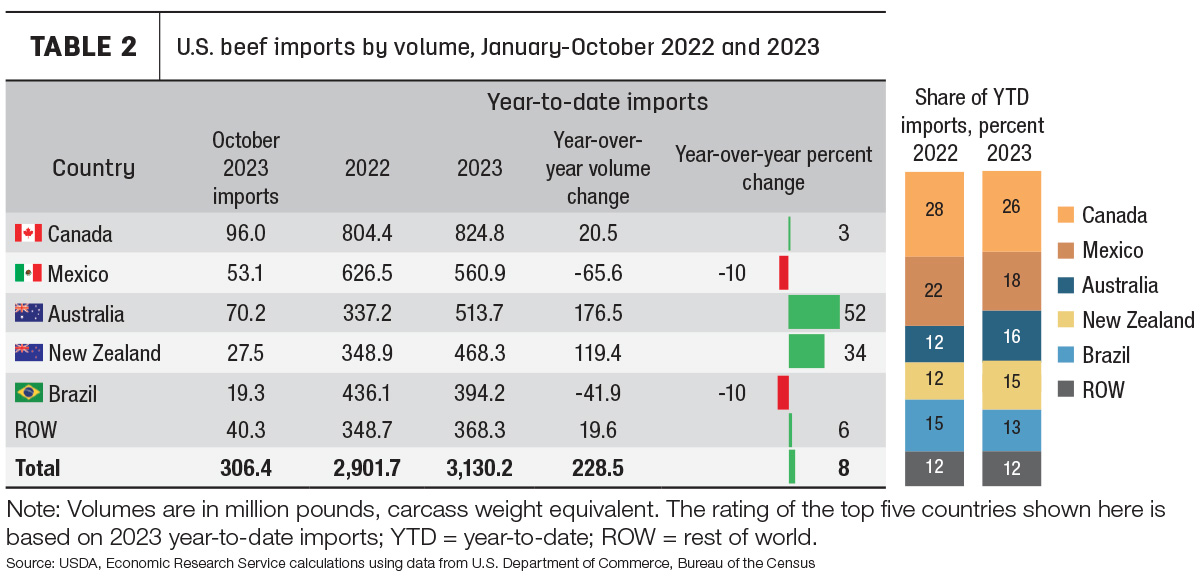

Monthly beef imports in October were 306 million pounds, a record for the month (Table 2). Imports from Canada were 96 million pounds, the second-highest shipments for the month behind 2004. Once again, imports from Australia were significantly higher year over year, up almost 78%.

Year-to-date imports from Australia have increased more than 50% from the same period last year. According to the Australian Bureau of Agricultural and Resource Economics and Sciences Agricultural Commodities Report from December 2023, increased beef production is expected as a result of herd destocking due to dry weather and lower feed availability, increasing exportable supplies in the July 2023 – June 2024 marketing year.

Based on recent data, the import forecast for fourth-quarter 2023 is raised 10 million pounds to 840 million, for an annual total of 3.663 billion. The forecast for 2024 is raised 10 million pounds as well, to 3.7 billion. If realized, this would be a 1% increase year over year.