Enrollment for the 2024 Dairy Margin Coverage (DMC) program begins Feb. 28 until April 29. While December 2023 DMC margins concluded a year of the lowest margins on record since the dairy safety net program began, 2024 is looking up with current futures indicating lower feed costs and improved milk prices. Yet, uncertainty is certain. Producers are encouraged to enroll in the voluntary safety net program. (Read: 2024 DMC program enrollment to begin Feb. 28)

Here's Progressive Dairy’s look ahead at important dates, reports and advice affecting risk management decisions, as well as other information impacting your milk check in March.

DMC program

The January 2024 DMC margin and indemnity payments will be announced Feb. 29, with the February 2024 DMC margin calculated March 28.

At $8.44 per hundredweight (cwt), the December DMC margin triggered Tier I indemnity payments at the $8.50 up to $9.50 margin coverages. There were no indemnity payments for Tier II producers at any level. (Read: December DMC margin is $8.44 per cwt)

December concluded a tumultuous year for the DMC program. As of Feb. 5, DMC indemnity payments distributed through the USDA’s Farm Service Agency (FSA) for milk marketings for 2023 (January-December) had reached about $1.29 billion. All DMC indemnity payments are subject to a 5.7% sequestration deduction.

Based on latest enrollment data as of Feb. 5, a total of 17,101 dairy operations were enrolled in the 2023 DMC program, representing about 75% of operations with established production history. Annual milk volume covered under the program totals 200.6 billion pounds, about 77% of production history established in 2023.

As of Feb. 26, January 2024 margin currently forecasts at $8.46, which would trigger Tier I indemnity payments for producers enrolled at the $8.50 per cwt and above coverage levels. While it’s still too early for certainty, projected DMC margins for 2024 are, on average, at least $4 per cwt higher than last year.

Dairy Revenue Protection (Dairy-RP)

Producers managing risk through Dairy-RP are eligible to cover revenue quarterly. In March, Dairy-RP coverage is available for the second quarter of 2024 (April-June) through the third quarter of 2025. Coverage for the second quarter of 2024 closes on March 15.

“When looking at how far out producers typically book coverage, it is clear that a majority is secured when a quarterly coverage period is nearing expiration. This trend seems to be primarily driven by the cheaper premiums since nearby coverage periods tend to have lower premiums,” says Alex Gambonini of HighGround Dairy. “However, when looking at the overall net benefit of Dairy-RP coverage based on how far out it was booked, there is an advantage to securing coverage further out. Despite the higher premiums, DRP coverage that was booked two to four quarters out has resulted in a significantly higher net benefit.”

The market changes daily and Dairy-RP endorsements must be purchased between the Chicago Mercantile Exchange (CME) market closing and the next CME opening. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when CME trading is closed due to holidays (see Calendar).

Also, Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets are released. This includes Milk Production, Cold Storage and Dairy Product reports.

Last year marked five years of Dairy-RP coverage availability. Gambonini states the risk management strategy resulted in a positive net benefit to producers where for every $1 spent on Dairy-RP, producers received $1.78 in return.

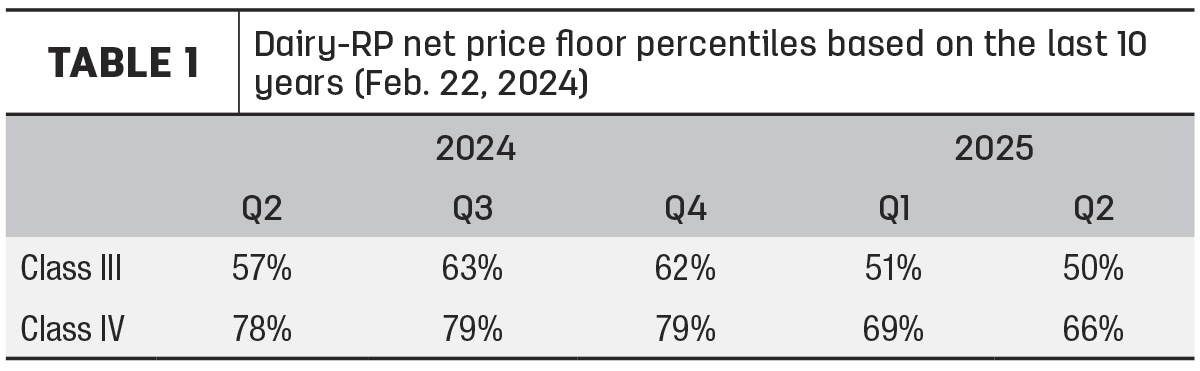

With prices on the rise in 2024, the net price floors at the 95% coverage level have been offered at price levels on the higher end of percentiles over the past 10 years as Gambonini notes in Table 1.

In 2023, Dairy-RP was a lifeline for producers, yet the program only covered 25% of all U.S. milk production. National Milk Producers Federation (NMPF) has stated part of the lack of coverage may be due to higher premium rates than what most dairy producers can afford for a dairy risk management program. The Federal Crop Insurance Corporation board of directors is meeting at the end of February to vote on a proposal for subsidy rates that vary with endorsement length.

Livestock Gross Margin for Dairy (LGM-Dairy)

LGM-Dairy is another subsidized margin insurance program administered by the USDA’s Risk Management Agency (RMA).

LGM-Dairy provides protection when feed costs rise or milk prices drop, and can be tailored to any size farm. This program uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of February includes months of April through February 2025.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Production and price outlooks

- The Farm Sector Income Forecast, released Feb. 7, projected 2024 DMC program payments at $264.5 million, down $900 million in 2023. (Read: Weekly Digest: Fewer dairy cows in drought areas)

- With the same number of milk marketing days in December and January, the total milk volume pooled through Federal Milk Marketing Orders in January was 12.9 billion pounds, about 260 million pounds more than in December. (Read: January 2024 brought more of the same for FMMO prices, pooling)

- The U.S. milk production forecast for 2024 was lowered in February due to lower expected output per cow. Yet, based on recent strengths, several dairy product price forecasts were raised for 2024. (Read: USDA milk production lower, offset by higher cow inventories)

- According to the USDA’s January Milk Production report, released Feb. 21, U.S. milk production fell below year-ago output for the seventh consecutive month. (Read: 2023 annual milk production down from 2022)

Check the Progressive Dairy website for updates affecting milk prices as they become available.