Federal Milk Marketing Order (FMMO) uniform milk prices slipped lower in January, a combination of lower Class I and Class III milk class prices and continued depooling of Class IV milk. Administrators of the 11 FMMOs reported January 2024 prices and pooling data, Feb. 11-14. Here’s Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

Uniform prices, PPDs

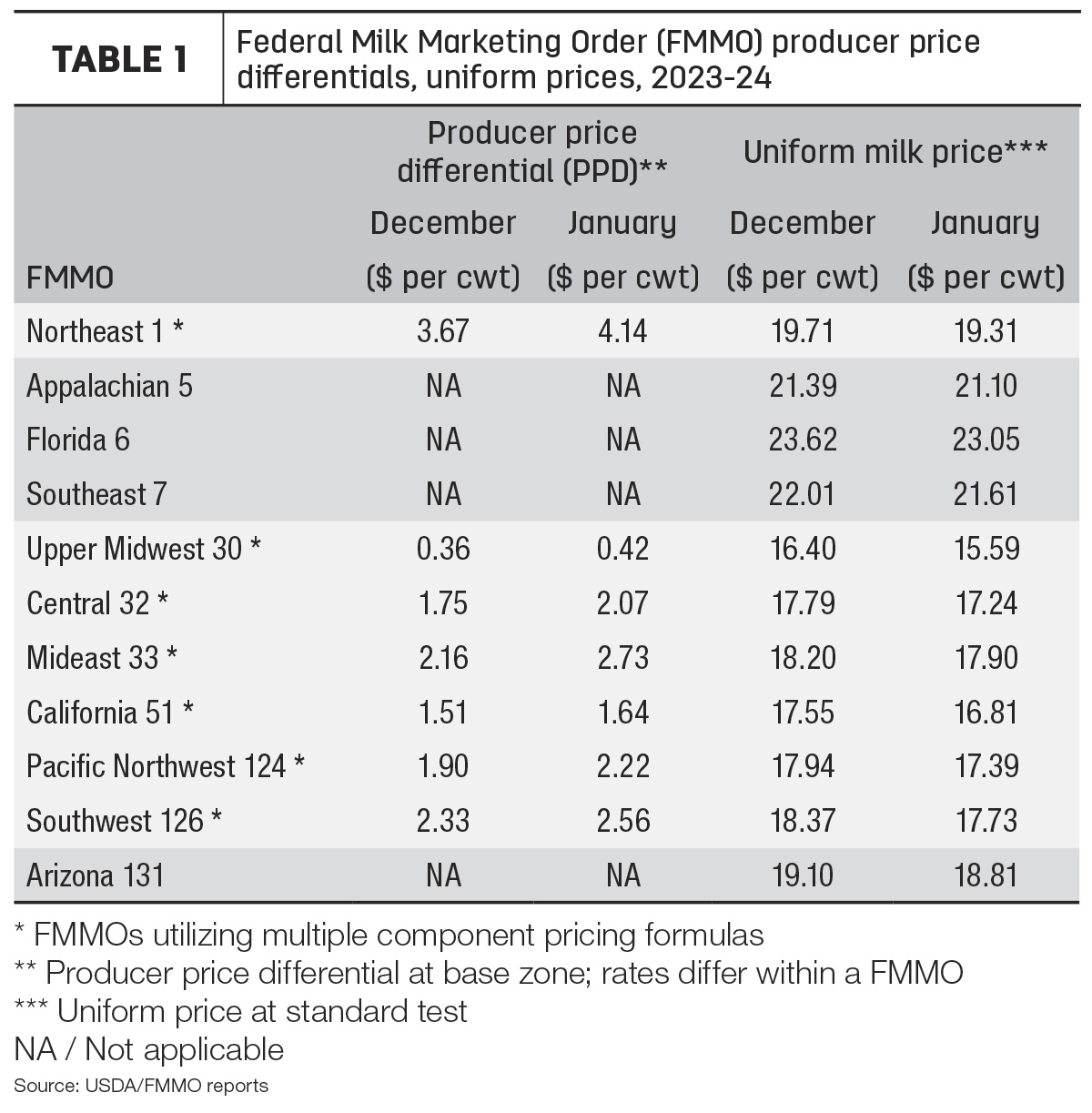

Compared with December, January 2024 statistically uniform milk prices were down in all 11 FMMOs (Table 1). Largest declines were in highest Class III and lowest Class I utilization areas. The highest uniform price for the month was in Florida at $23.05 per hundredweight (cwt), with the low in the Upper Midwest at $15.59 per cwt, a seven-month low.

January baseline producer price differentials (PPDs) were up slightly across all applicable FMMOs (Table 1), with a high of $4.14 per cwt in the Northeast to a low of 42 cents in the Upper Midwest. PPDs have zone differentials, so actual amounts will vary within each FMMO. Milk handlers may apply PPDs and other “market adjustment factors” differently on your milk check.

Class prices for January

- Class I base price: The January 2024 advanced Class I base price was $18.48 per cwt, $1.28 less than December 2023 and $3.93 less than January a year earlier.

- Class I base with zone differentials: Adding zone differentials, January Class I prices averaged approximately $21.30 per cwt across all FMMOs, ranging from a high of $23.88 per cwt in the Florida FMMO to a low of $20.28 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($5.74 per cwt) and advanced Class IV skim milk pricing factor ($9.25 per cwt) narrowed slightly for January, to $3.51 per cwt. Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would also have resulted in a Class I base price of $19.46 per cwt, about 98 cents more than the actual price determined using the “average-of plus 74 cents” formula.

- At $20.04 per cwt, the January Class II milk price was up 16 cents from December but $1.57 less than January 2023.

- At $15.17 per cwt, the Class III milk price fell 87 cents from December and was $4.26 less than January 2023. It was the lowest since last July.

- At $19.39 per cwt, the Class IV milk price was up 16 cents from December but was 62 cents less than January 2023. Potentially affecting FMMO pooling, the January 2024 Class IV milk price was $4.22 more than the month’s Class III milk price.

Component values, tests

Contributing to the January milk class price calculations, the value of both butterfat and protein were down from the previous month.

The decline in the value of butterfat was small, just one-tenth of a cent to $2.9765 per pound, the second month under $3 per pound since July. The value of milk protein dropped about 32 cents from December to about $1.1265 per pound, a three-month low.

The value of nonfat solids rose slightly to about $1.03 per pound, while the value of other solids increased about 1.5 cents, to 24.2 cents per pound.

Affecting statistical uniform prices “at test,” January average butterfat tests in pooled milk were up in nearly all FMMOs providing preliminary data, with exceptions in the California and Pacific Northwest orders. Protein tests were mixed, in a range of +0.02% in the Mideast order to -0.04% in the California order.

Pooling totals

With the same number of milk marketing days in December and January, the total milk volume pooled through FMMOs in January was 12.9 billion pounds, about 260 million pounds more than December. The USDA releases January milk production estimates on Feb. 21.

January Class I pooling was up about 245.3 million pounds. At 3.7 billion pounds, it represented 28.6% of total milk pooled. Class II pooling was up about 174 million pounds to 1.25 billion pounds, representing about 9.7% of the total pooled.

Compared to a month earlier, January brought slightly less Class III milk to the pool, while pooling of higher-value Class IV milk also declined. At 7.08 billion pounds, Class III pooling represented about 54.8% of the total pool (Table 2). Class IV pooling decreased to 884.7 million pounds and represented 6.8% of the total milk pooled (Table 2).

Looking ahead

February uniform prices and pooling totals will be announced on March 11-14. Based on FMMO advanced prices and current futures prices, milk class prices are mixed.

- Class I base price: Already announced, the February 2024 advanced Class I base price is $17.99 per cwt, 49 cents less than January 2024 and $2.79 less than February a year ago.

- Class I base with zone differentials: Adding zone differentials, February Class I prices will average approximately $20.81 per cwt across all FMMOs, ranging from a high of $23.39 per cwt in the Florida FMMO to a low of $19.79 per cwt in the Upper Midwest FMMO.

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($4.73 per cwt) and advanced Class IV skim milk pricing factor ($9.29 per cwt) widened for February to $4.56 per cwt, the largest gap since August 2023. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $19.48 per cwt, about $1.49 more than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: February Class II, III and IV milk prices will be announced on Feb. 28. As of the close of trading on Feb. 14, the February Chicago Mercantile Exchange (CME) Class III milk futures price closed at $16.16 per cwt, up 99 cents from January. The February Class IV milk futures price closed at $19.90 per cwt, up 51 cents.

- Class III-IV milk price spread: If those futures prices hold, the February Class III-IV spread will shrink about 48 cents to $3.74, maintaining incentives for Class IV depooling.

Looking longer term, 2024 Class III futures prices at the close of trading on Feb. 14 averaged $17.68 per cwt; the Class IV futures averaged $20.59 per cwt. That would yield an average Class III-IV price spread of $2.91 per cwt, up from $2.10 per cwt in 2023 and maintaining Class IV depooling throughout the year.

Other information

- American Farm Bureau Federation dairy economist Daniel Munch analyzes cumulative FMMO pool losses due to the Class I mover change. Read: Federal order pool losses continue from 2018 Farm Bill formula change

- Released Feb. 8, the USDA’s monthly World Ag Supply and Demand Estimates (WASDE) identified milk and feed factors potentially impacting dairy producer income in the year ahead. The 2024 milk production forecast was lowered from a month earlier, and recent strength improved the outlook for cheese, butter, nonfat dry milk and whey prices boosting the milk price forecast somewhat. Read: USDA milk production lower, offset by higher cow inventories

- Tapping the brakes on milk production growth, the USDA’s semiannual estimate of cattle inventories indicates the number of dairy cows to start 2024 were the lowest in four years. With lower cow numbers and increased crossbreeding to beef sires, the number of dairy replacement heifers to start the year was the lowest in nearly two decades. Read: 2024 starts with fewer dairy cows, replacement heifers

- Check the Progressive Dairy website for the January Milk Production report on Feb. 21, and the January Dairy Margin Coverage (DMC) program margin on Feb. 29. Also, watch for 2024 DMC program enrollment information when it becomes available.