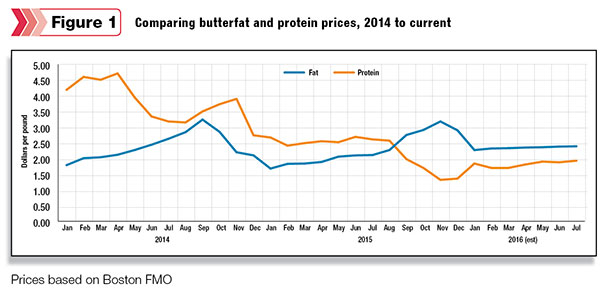

During the summer of 2015, the price of milk protein dropped below the price of butterfat for the first time in quite a while (Figure 1). In fact, the price of milk protein has lost more than half its value from where it was in early 2014, when U.S. protein exports were at an all-time high.

Butterfat, on the other hand, has suffered far less volatility and is actually higher in value today than it was at the beginning of 2014. Where has the money on your milk check gone? Just look at milk protein.

Pricing for dairy products is now based upon the value of the individual milk components – fat, protein and, to a lesser extent, lactose, vitamins and minerals. It’s essential for dairy farmers to understand that the price they now receive for their milk is based largely upon pounds of butterfat and pounds of protein produced.

Rather than measuring the total pounds of milk produced per cow, dairy farmers must now be focusing on the pounds of the milk components their cows produce. Component pricing is now the norm for most of the U.S. dairy industry.

Most of us have been taught to think in terms of pounds or gallons of milk per cow when evaluating the revenue produced by our cows. The metric of “dollars per hundredweight” has long been the standard for evaluating the value of milk produced per cow.

However, while this metric allows us to calculate cow profitability and income over feed costs, it does not show us the individual values of the components that contribute to the total value of the milk.

To start with, the dairy farmer must know the percentages of butterfat, protein and other solids being produced by the herd. Knowing those values allows us to calculate the associated pounds of fat, protein and other solids in a given amount of milk.

For example: We have a herd of cows with a 70-pound-per-day milk average; the butterfat percentage is 3.8 percent, and the protein is 3.1 percent. The average pounds of fat produced per cow are 2.66 (70 x 0.038 = 2.66).

Average pounds of protein are 2.17 (70 x 0.031 = 2.17). If the current price paid for butterfat is $2.50 per pound, the value of the butterfat produced per cow is $6.65 (2.66 pounds x $2.50 = $6.65).

If the price being paid for protein is $2 per pound, the value of the protein produced will be $4.34 (2.17 pounds x $2 = $4.34). Adding the two values of fat and protein together gives us $10.99 ($6.65 + $4.34 = $10.99) for the value of the milk’s butterfat and protein.

Note that the California pricing system prices milk according to fat and solids-not-fat, and a different pricing structure is used to establish the value of the milk.

This value of $10.99 is the value of the average milk per cow, not the value per hundredweight (cwt). A per-cwt value is calculated by dividing $10.99 by (70 pounds per day / 100 cwt).

This results in a value of $15.70 per cwt for the milk produced. Remember, this price does not reflect the value of the other solids fraction nor any Federal Milk Marketing Order price differential or bonuses, which would be added to the $10.99 to arrive at the gross milk value.

While this process may seem cumbersome, it enables us to see and evaluate the individual components produced both for the total herd and for individual cows when cows are tested. Computer spreadsheets can be easily set up to calculate these values and allow us to evaluate infinite combinations of pricing and production scenarios.

Other metrics can be calculated, such as the total amount of protein and fat produced per cow per day. In the case of the earlier example, the herd is producing 4.83 pounds of protein and fat per cow per day.

The producer may have set as a goal a minimum of 5 pounds. In this case, the herd must produce more pounds of components to meet the goal. This can be done in a combination of increasing the component percentages or the total volume of milk.

Once producers become familiar with the math and the calculations, they can easily determine how much more revenue can be gained by increasing the components 1 or 2 percentage points.

For instance, an increase of 1 percentage point for both the fat and the protein (e.g., 3.8 to 3.9 and 3.1 to 3.2) would result in an increase in total milk revenue of $11.30 per cow – an increase of $0.31 per cow. The value per cwt of milk rises to $16.15 as a result of the increase in component percentages – an increase of $0.45 per cwt in this case.

Manipulating protein

The current challenge for dairy producers is determining if they can achieve a net increase in milk revenue after manipulating dairy cow diets to increase components, especially protein. It’s well understood that butterfat production is closely tied to fiber digestion.

If milk cow rations contain adequate effective fiber, the rumen fermentation is being optimized, and there are no significant health challenges for the cow such as mycotoxins in the feed; the butterfat levels for Holsteins can be greater than 4 percent and greater than 5 percent for Jerseys.

Generally, only minor adjustments need to be made to diets to improve butterfat production.

Manipulating milk protein is a different matter. Milk protein synthesis is a complex process which includes genetics, animal age, stage of lactation and the environment as well as nutritional management. The fact that manipulating milk protein is so much more complicated than manipulating milkfat is probably the single biggest factor as to why dairy farmers are often slow to tackle changing milk protein.

In recent years, there has been a lot of progress made on improving milk protein production through the more complete balancing of metabolizable amino acids, as well as the improvement of total rumen function with an emphasis on improved fiber digestibility.

The introduction of rumen-protected methionine and rumen-protected lysine products to improve the balance of metabolizable amino acids have been met with good success in increasing milk protein production.

Feed additives ROI

At the beginning of 2016, milk protein has lost half its value compared to what it was in 2014. Returning to the example above, the total value of milk dropped more than $4 per cow from what it would have been in 2014.

This doesn’t mean dairy farmers should currently ignore the amount of milk protein they produce. Understand that 3.1 percent protein is still better than 3 percent protein. Milk protein still has value, just not as much as it did in the past.

For the remainder of 2016, milk protein prices are predicted to climb minimally and slightly surpass the price of butterfat. Therefore, there will be continued value in maintaining milk protein levels in your herds.

Due to the complexity involved with increasing milk protein and maintaining that increase, dairy producers should be working with computer nutrition models that can accurately predict the outcome of any and all changes in diets. There has always been an additional cost associated with adding rumen-enhancing supplements or rumen-protected amino acids to dairy diets.

However, when the value of milk protein was higher, there was more cushion to spend some extra money to increase the milk protein. The key now is to not overspend on the ration changes necessary to gain that extra point of protein.

Apart from capturing some of the added value at the retail level, the primary means for commercial dairy farmers to improve the value of the milk they produce is to ship more milk solids – fat and protein. For the foreseeable future, though, dairy farmers should cautiously approach any additional spending to increase milk protein.

They must examine the return on investment of adding to the cost of diets and be confident there is justification in spending more money to increase components and that there will be a payback in the higher value of the milk being shipped. PD

-

John Hibma

- Nutritionist

- Central Connecticut Cooperative

- Farms Association

- Email John Hibma