You have all heard the expression “30,000-foot view.” Commentators often use this phrase when explaining something in a very broad sense. Recently, my wife and I decided to take our four daughters on their very first plane ride. The anticipation of the event was so thick in the days that led up to it that you could cut it with a knife.

They had all sorts of questions. Do we have to pack our own parachutes? Can we touch the clouds? Do they stop for potty breaks? How do the pilots know where they are going? If they get lost, can they stop for directions? There did not seem to be an end to their intrigue or their questions. However, nothing was more fun than getting them off the runway and into the sky.

Their perspective on things was quite interesting. Farm fields became patchwork quilts. Cities were filled with ants (cars). Lakes were puddles. And a trip halfway across the country made them feel like we just made the run to Grandpa and Grandma’s house.

While they were able to put everything together and see the big picture, the reality of that experience for them was that the world got a lot smaller. Their 30,000-foot view of the world minimized things that previously felt enormous.

For years we have been waiting for prices to return to “comfortable” levels – levels comparable to years gone by; levels that make creating profitability much more attainable; levels that were, very bluntly, much smaller in price.

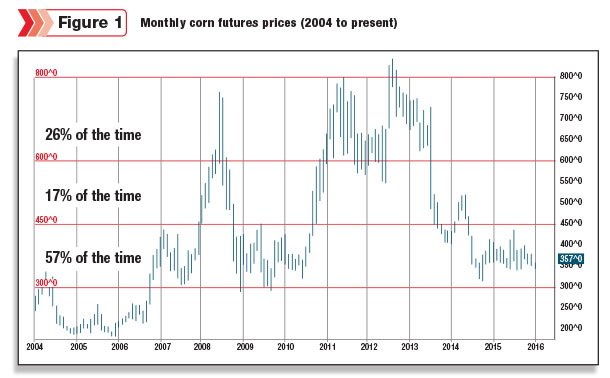

That desire is now being realized in a much lower market. What is appropriate now, is to define how much more opportunity we have to this end and begin to plan accordingly. To put this into perspective, let’s take a look at history. (Figures 1 and 2)

Since 2006, feed markets have been abiding by a new set of price parameters. Prior to that time, corn had a difficult time making its way to $3 per bushel. If such a move took place, maintenance of that price became an equally difficult feat. This had been true since 1995-1996.

In September 2006, what had been difficult again became easy for grain markets as a whole. Corn pulled away from the $2.50 static line and ran to $4.37 before running out of steam. The market returned to $3.085 before pulling itself together and bracing for the run to $7.65 per bushel.

That explosion wasn’t matched until the 2010-2011 run to $8 per bushel. However, before that could happen, prices moved back to $2.90/bu as the clamor of economic crisis and uneasy buyers allowed markets to fade.

While several different price moves have been staged in corn since the 2006 start to this 10-year parade, they have all started from prices near $3 per bushel. With cost of production through much of the Midwest hovering near $4 per bushel, the question that begs to be asked is, “How long can we stay here?”

Certainly it is not the market’s job to provide profitability to all that seek to participate in agricultural production. (Look no further than the 2009 dairy markets.) So to make the case that profitability must be present for grain producers in the 2016 calendar is a weak one.

However, over the period of several years, this argument does in fact hold water. Declining working capital, disinterested lenders and acts of mere survival will not allow for this to continue long term.

Let this serve as a wake-up call for anyone buying feed in the years to come. As markets naturally cycle, a low will be established and a move toward higher prices will begin. Based on current cycles, several indicators point toward lower prices yet in 2016. However, that low is not likely to be much lower than $3 per bushel. As witnessed in the last decade, $3 defines bottom-dollar value for corn and other products that use corn as a benchmark.

With current prices at $3.60, this offers some opportunity to buyers, but not much. With that in mind it is also important to discuss the risk we have as a new cycle begins. Since September 2006, 57 percent of the time corn price has been between levels of $3 and $4.50 per bushel.

If a supply-tightening bias or event moves into the market, this would be the market’s first target. Even last year, as excessive rainfall threatened yield potential in the Midwest, December corn futures rallied to $4.54 before retreating.

This framework of $3 to $4.50 sets the stage for what to expect under normal conditions. What happens if things get ultra-excited? As we break through $4.50/bu, we quickly pass through a transition zone from $4.50 to $6 per bushel and enter into the second-most popular range, that being from $6 to $8 per bushel.

There has been much rumor of drought in recent weeks. While probabilities remain low for such an event, if it should occur, prices would quickly return to this secondary range where we have spent 26 percent of our time since 2006. Coverage against such levels is paramount for buyers of corn, as milk prices adjust to the same changing environment.

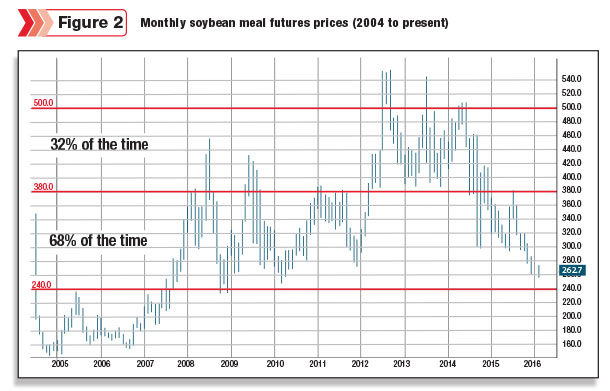

What has been true for corn has similarly been true for soybean meal. It took a little while longer than corn to breach old highs, but in 2007 it happened. After pushing through $240 per ton, soybean meal has not looked back. Prices would advance higher and then return to levels near $240 before staging another move higher.

Often, that move higher would fall flat near $380 per ton. Growing competition from South America would allow soybeans and soybean meal to flow into the U.S. to keep prices from breaching the psychological $400-per-ton figure. That was true until the 2012 drought, when an empty soybean pipeline took soybeans to $18 per bushel and soybean meal to $550 per ton.

Since that time, $500 per ton has served roughly as the peak in market values. Today, prices range from $260-$270 per ton throughout the calendar. We are nearing historical support with little cause to move beyond it. With more than two-thirds of our time since 2007 spent in the range between $240 and $380 per ton, opportunities are nearing.

So what should dairymen do to prepare for the balance of 2016 and the years to follow? At present, simple strategies are both available and logical.

Soybean meal calls can be purchased to protect current and future needs with a price ceiling of $280 for an average price of $8 per ton through the calendar end of 2016. That is cheap insurance against any potential weather or geopolitical event that may creep into our market between now and Thanksgiving.

Again, this can cover current protein use, but also any needs that you forecast for the 2017 calendar year. Scares, as witnessed in the chart, come quickly and give little chance to catch up.

If prices remain low as we enter the harvest season, booking product with local vendors offers an opportunity to both secure prices as well as product for the coming year. With corn hovering closer to mid-range, opportunities are similar, but not nearly as lucrative. Call options can be purchased to place a $4-per-bushel ceiling on prices through Thanksgiving for an average of 12 cents per bushel.

On coming silage purchases and 2017 needs, that coverage would be closer to a cost of 23 cents per bushel at the time of this writing. Again, if prices can in fact work lower into harvest, be ready to book needs forward and begin purchasing call options on 2018 usage.

We certainly have moved into lower feed price thresholds. This comes as great news. However, to expect that good news and good prices will stick around indefinitely would be an absent-minded position to take.

However, if you get caught up in the minutiae of the market, it is often easy to get lost in such a conversation. Take a step back, look at the big picture, respect market cycles and prepare accordingly! PD

For nearly 20 years, Mike North has educated and guided dairymen and farmers in their efforts to manage commodity price risk.

-

Mike North

- President

- Commodity Risk Management Group

- Email Mike North