Deb Reinhart and Dave Geiser, who made the decision to begin a consistent marketing program in November 2009 and agreed to share their experiences with Progressive Dairyman readers last year, recently provided an update on their journey to better control of their business through better marketing.

Q. It’s been 10 months since the last article in the fall of 2010. How has your marketing gone so far in 2011?

DEB: We’ve definitely matured in our knowledge. We’ve explored different tools. Our milk plant field rep (Land O’Lakes), our marketing consultant (Stewart-Peterson Inc.), Dave and I – we’ve all learned to work together well. I’m learning which tools I’m comfortable using to get the job done.

Q. With prices holding strong in 2011, what kinds of tools have you used?

DEB: In February we began using a min/max strategy* in anticipation that positive milk prices would not hold. The good news is that prices did hold. It was difficult, though, to see the minuses on the milk check from those contracts, especially when we were trying to get caught up from the last two years.

Our final February settled price was $17. In March we were able to sit down with our Land O’Lakes field rep and do more calculations on our cost of production. We used more min/max strategies for April, May and June milk to create a price window we were comfortable with. April settled at $16.82, May at $16.52 and June at $19.11.

I do not like margin calls, so the min/max and the forward contracts were really nice tools for us. Our adviser knew we didn’t have the cash flow for call options (expensive at the time) and the min/max was a nice way of creating a window.

The hardest part has been emotions – seeing the negatives on the milk check because we sold milk and the price went higher. We have to keep reminding ourselves that when we made the contracts, we knew what our price would be and were comfortable with that.

Q. Was regret one of your emotions?

DEB: Last fall, we thought the market was going to go to heck and $19 was a great price. If it had fallen to $16 and we hadn’t done anything, then it would be “woulda-coulda-shoulda.” So intellectually I know that; it’s just emotionally hard.

In June we still had a total settle price with about $3 profit. That’s not terrible.

Q. Do you ever wonder if you would be less emotional if you had never taken on marketing?

DEB: When I get emotional, Dave’s the one who always chimes in and reminds me, “We know we have a profit. We’ll get there.” That’s really what it’s all about – the comfort level. Those producers who didn’t do anything last year were taken to the cleaners, and this year they are making it up.

For us, it’s about managing our destiny and not being at the mercy of the markets. After going through 2009, David and I made some goals that we were going to have more control. Today we know what our input costs are, and we know what our income-over-feed is projected to be.

Q. Each month during this period of strong milk prices, you wrote in your diary that your contracts “lost money.” Do you look at it as a loss?

DEB: After June I was thinking, “I don’t know if I can stick with this.” I know I can’t take a short-term view, though. We’re in this for the long-term. Right now we’re in a time of high prices.

Last year, when we could reap the rewards of well-placed contracts, that was awesome. It saved us. As producers it’s those big swings that hurt us so much, because we have certain fixed costs.

For example, if it takes $50,000 per month to run our dairy, if we’re getting only $34,000 from milk, we’re really behind the eight-ball. Whereas, if we’re getting $55,000 versus $65,000, we’re still ahead.

Would it have been nice to bank that money? Yeah, it would be. But at least I didn’t get the $34,000.

Q. So are you better off now than when you first began?

DEB: We are always evaluating. Financially, this year will be interesting. No one thought the milk price would hold strong. So that’s a gift. We’re building in a profit, which was our goal.

We are using tools to protect our bottom line, because that’s where we are most at risk. Our adviser understands our goals, so he can help us use the tools better. Nine months ago we did not understand all the available tools or how they related to goals.

Now I can see that those min/maxes were right for us because we didn’t want to expend a lot of capital to buy protection. We just didn’t have the cash flow. Now that our cash flow is better, we can use tools that allow us to take advantage of the upside, too. So our goals and strategies are constantly changing.

Q. What do you say to a producer who says, “I don’t know why you expend so much effort. Financially you’ll probably come out the same.”

DEB: When we did forward contracting five years ago, I tracked it both ways, with forward contracting and without, and the price basically came out the same. But five years ago we weren’t in this volatile market situation. We didn’t have access to as many flexible tools as we have now.

So I’d say, if it works for you to do nothing, that’s cool. It’s what you’re comfortable with. For me, it’s about being proactive and in control of the price we get.

Q. How do you compare the effort you’ve put into marketing with other changes you’ve made on your dairy?

DEB: Dairy is fraught with learning curves. Right now it’s not milk so much as feed procuring … We’re learning how to play the game with new rules there. You know, it used to be all about production, production, production.

We have so much more available to us now – more analytical skills, better goal-setting, more people walking in concert with us. It’s one of the hardest things I ever did, because the results of your decisions are so visible right on the milk check where, if you harvest bad feed or pick a bad pair in breeding, it’s not so immediately visible on the milk check.

But marketing is just one more area where we can improve. PD

Angie Molkentin is a writer from Oconomowoc, Wisconsin. She has access from Stewart-Peterson to observe Gold Star Farms’ interactions with its Market360 program.

Adviser’s turn

There is a certain segment of our client base that has been through the ups and downs of a milk price cycle, and they have the hindsight and experience to see how consistent marketing impacted their operation.

Then there is the segment of clients like Deb and Dave. They go forward on faith, sticking to their long-term goals while all along fighting emotions and uncertainty. It’s understandable.

Deb and Dave began marketing at the bottom of the cycle and have clawed their way up, making incremental sales, always a bit behind the market price in exchange for the bottom-line protection that was part of their overall risk management goal.

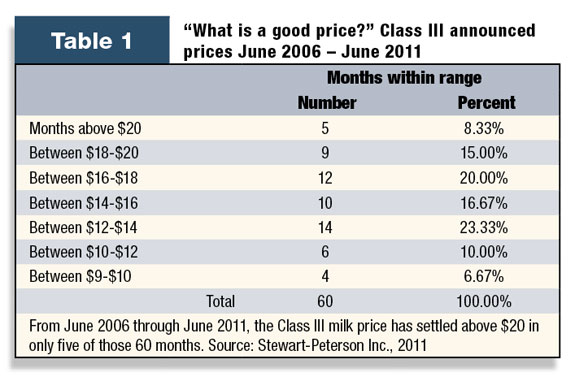

All bull markets do come to an end – a typical bull market lasts 11 to 22 months. Knowing Deb and Dave’s goals, as we progress in this cycle, it has been more important to protect against downside risk in 2011.

Deb and Dave have a few things going for them in their marketing: They are willing to try new strategies and tools, willing to learn and, most importantly, they have stuck with it, despite almost losing faith in June.

Consistent marketers work toward gradually building the best weighted average price over time within acceptable risk parameters. Deb and Dave’s approximate average price before premiums is $17.06 for the first seven months of 2011.

Producers who do not stay consistent throughout the entire price cycle almost never succeed in meeting their goals for cash flow, risk management or overall average price. They enter in and out of positions at exactly the wrong time and, in an effort to make up lost ground, they often take on unnecessary and costly risks.

Consistency is the one factor that separates successful marketers from unsuccessful. So far, according to the goals they have set, Deb and Dave can be counted among the successful.

— Matt Mattke, Stewart-Peterson Inc.

You can still join a team of Progressive Dairyman readers who want to learn how to make marketing decisions. To join, e-mail Mark Ludtke at mludtke@stewart-peterson.com or call him at (800) 334-9779 .

Benefits of participating:

• Learn the language, concepts and typical positions in commodity trading.

• Learn how to move in and out of positions.

• Experience the impact of decisions made.

• Develop the discipline to execute decisions.

• Share experiences and ask questions of those in your peer group.

PHOTO:

TOP RIGHT: Deb Reinhart and Dave Geiser

Gold Star Farms Chilton, Wisconsin

Milking: 270 cows Feed: Purchase feed from neighboring farms

Marketing Consistently Since: November 2009