Minnesota dairy farms made a significant comeback in 2010 after a very challenging 2009. With 557 dairies participating in Farm Business Management (FBM) programs, Minnesota dairy operators are in a unique position to benchmark their operations against a large subset of the state’s dairy operations. Participating farms complete a detailed annual financial analysis of their farm and each farm enterprise. Individual farm results are combined in the FINBIN database hosted by the Center for Farm Financial Management at the University of Minnesota (www.finbin.umn.edu) and made available to the public in summary form. FBM reports are also available at www.fbm.mnscu.edu.

The Minnesota dairy industry is characterized by a large number of relatively small herds and a growing number of larger herds. Most produce a large share, if not all, of their forage and much of their feed grain. These 557 dairy farms represent about 10 percent of the dairy farms in the state.

They span the size spectrum but would generally be considered small by our Western neighbors. The average herd size was 142 cows. While only 23 of the farms had herd sizes over 500 cows, those 23 farms represent about 30 percent of the 500+ cow herds in the state based on herd size estimates from the Minnesota Department of Agriculture.

Whole-farm financial performance

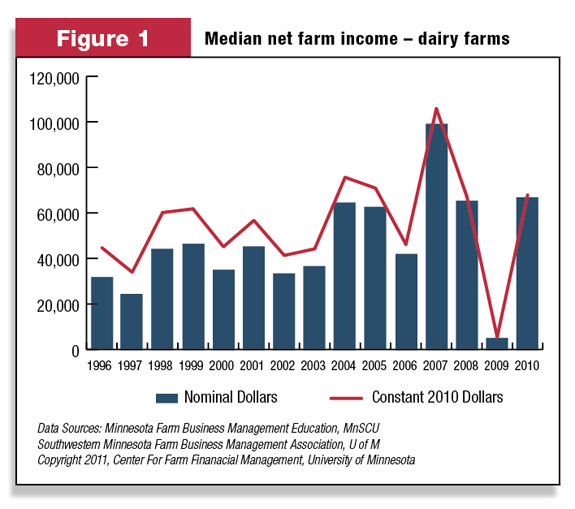

As was the case across the country, 2009 was a very challenging year for Minnesota dairy farms. With a median net farm income of $5,384 ( Figure 1 ), almost half of the dairy farms in FBM programs lost money in 2009, most lost net worth, and the average farm earned a negative return on assets (ROA).

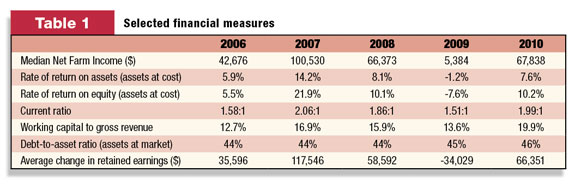

In 2010, the majority of these farms were back in the black. The median net farm income was $67,838 and the average dairy farm earned a 7.6 ( Table 1 ) percent ROA with assets valued at cost or book value. The average farm gained back all of the equity that was lost in 2009 and added a bit more.

Unlike 2009, when larger operations saw the largest losses, large herds were more profitable than smaller operations in 2010. Farms with more than 500 cows earned an average ROA of just over 10 percent. Smaller herds averaged in the 7 to 8 percent range, still high enough to cover interest costs on borrowed funds.

Liquidity is a chronic concern for dairy farms. At the end of 2010, FBM crop farms averaged 47 percent working capital to gross revenue. In contrast, the average dairy farm had 20 percent of a year’s gross income in working capital. That is a big improvement over 2009, when dairy working capital to gross averaged 14 percent, but it is still a risk management concern.

Granted, dairy producers have a monthly milk check that provides a liquid cash flow. But given the continued volatility of milk prices and feed expenses, working capital is one of the best risk management tools a dairy farmer can have in his toolkit.

Enterprise costs and return

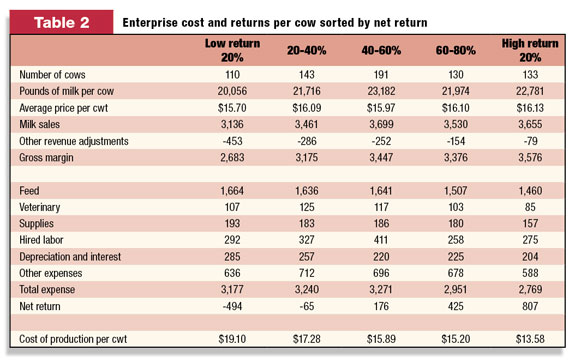

Looking at averages alone masks the variability of financial results across operations. What makes some herds more profitable than others? Table 2 shows the per-cow costs and returns when these dairy farms are sorted by net return per cow.

Note that high-return herds did not have the highest milk production per cow. This is a new phenomenon in the past couple of years. In fact, in every year from 1996 to 2008, net return and production per cow tracked together. This change may be related to the financial stress in the dairy industry that started in late 2008. Time will tell whether it will continue.

The differences in gross margin are highly correlated to “other revenue adjustments.” This includes bull calf sales, other offspring sales and cull income, less the cost of replacements. Most of these producers raise their own replacements. Raised replacement costs are captured and charged back to the cow herd. It appears that replacement costs were one of the major differences in per-cow returns.

On the expense side, feed costs were lowest for the highest-return farms. In fact, every major expense category, with the exception of hired labor, tracked down as returns increased.

On the bottom line, there was a $1,300 per-cow difference between the high-return and the low-return herds. Forty percent of the difference was in milk sales, 29 percent in “other revenue adjustments” and 31 percent in farm expenses. But this is just the “per-cow” story. There are size differences too.

Herd size

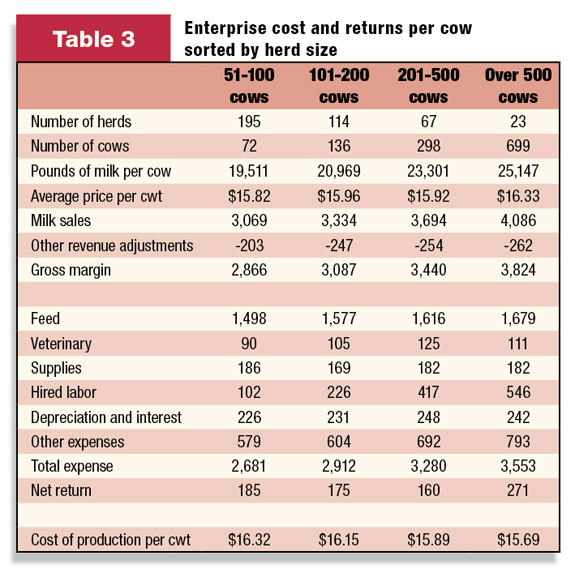

Table 3 shows the 2010 per-cow returns when these Minnesota herds are sorted by herd size. Per-cow returns generally improved with herd size. This is a relatively new phenomenon for our FBM group. Prior to 2005, the smaller herds were consistently more profitable than large herds on a per-cow basis.

Why has the profitability of larger Minnesota dairy operations improved relative to their smaller neighbors in recent years? A few possible answers occur to us. First, it is likely that many of the large herds have expanded over the past several years and are just now hitting their stride.

Second, many of the more efficient smaller operations may have expanded into the larger- herd size groups. We also notice that in several of the past “low price” years, smaller herds have benefited more than larger herds from MILC payments on a per-cow basis.

In 2010, larger herds had higher production per cow and received a higher milk price. In total, larger herds generated almost $1,000 more per cow than the smaller herds. But they also had higher costs. Their feed costs were only slightly higher, but the big equalizer was labor costs, more than $400 per cow higher than smaller herds. The bottom line is that the 500+ cow group netted only $86 more per cow than the smallest herds.

Comparing the 101-200 cow herds to the 500+ herds demonstrates the effect of volume. The smaller herd netted $175 per cow on an average of 136 cows, contributing $23,800 to farm profits. The 500+ cow herds netted $271 on an average of 699 cows, contributing $189,429 to the bottom line.

Volatility

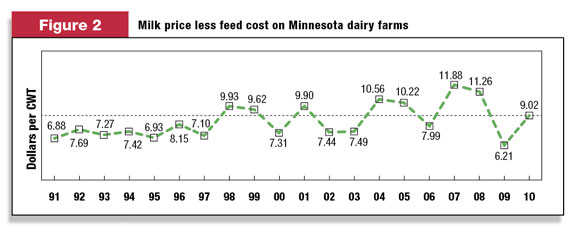

Volatility in the dairy industry has increased in recent years and one dramatic demonstration of that trend is a comparison of the milk price and the feed costs over the past 20 year. Figure 2 demonstrates that the trend began in the late ’90s and has continued to the current time.

The differential shown in this chart serves as another evaluation tool for future decision-making efforts. The volatility demonstrated here suggests the need for short-term and long-term planning is critical now more than ever before.

Summary

In years past, dairy farms were the most consistently profitable farm type in our FBM group. That has changed in the last few years with wide swings in milk price and feed costs. We expect well-managed dairy farms will continue to be profitable, but it is going to be important to be in the upper half in terms of profitability.

Producers will need to know their costs and how they stack up against the competition. Producers in these FBM programs have the advantage of being able to benchmark against their peers. We would encourage dairy producers who find their financial information system lacking to join an FBM program if one exists in your area. PD

Nordquist is associate director of the Center for Farm Financial Management at the University of Minnesota and Lecy is associate dean at Central Lakes College, a member of the Minnesota State Colleges and Universities System.

References omitted due to space but are available upon request to editor@progressivedairy.com .