However, while up sharply from a year earlier, monthly alfalfa hay exports were still the lowest since September 2015.

Other issues, including the end of West Coast port worker slowdowns resolved in early 2015, likely also factored into the year-over-year export improvement.

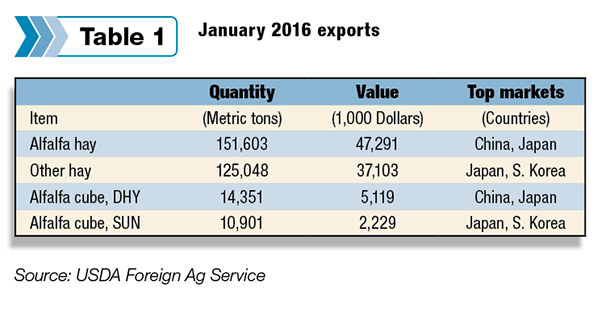

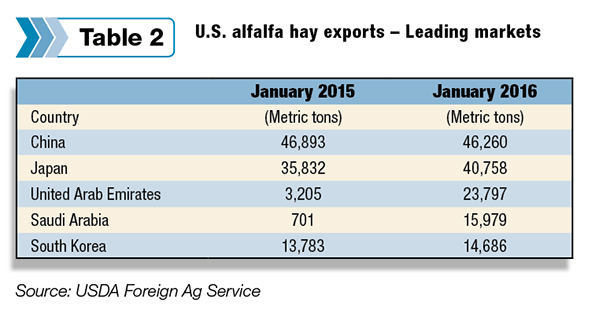

January 2016 alfalfa hay exports totaled 151,603 metric tons (MT), up 38 percent from 110,112 MT in January 2015 (Table 1). China was the top foreign alfalfa hay market for the month, importing 46,260 MT, followed by Japan, at 40,758 MT (Table 2).

The United Arab Emirates (UAE) and Saudi Arabia posted the largest year-to-year gains. UAE imported 23,797 MT in January 2016, up from 3,205 MT a year ago. Saudi Arabia imported 15,979 MT in January 2016, up from just 701 MT in January 2015.

With the jump in export volume, total value of alfalfa hay exports was also higher, despite lower hay prices. Total alfalfa hay exports were valued at $47.3 million in January 2016, compared to $38.5 million a year ago.

January 2016 U.S. exports of other hay, at 125,048 MT, were up from 111,999 MT in January 2015. Despite the higher volume, lower prices dampened total value. Other hay exports were estimated at $37.1 million in January 2016, compared to $37.8 million in January 2015. Leading markets were Japan and South Korea.

January 2016 exports of alfalfa cubes also posted gains compared to a year earlier.

Export outlook cloudier

Without detailing specific commodities, USDA’s latest quarterly Outlook for U.S. Agricultural Trade reduced projections for both values and volumes of U.S. feed and fodder exports in fiscal year 2016.

Hay and other feed exports face similar headwinds as other major agricultural commodities. A strong U.S. dollar relative to other currencies, including the Canadian dollar, hampers U.S. price competitiveness. A slower economy in China, a major foreign buyer of U.S. hay, could also limit exports.

Steady growth is expected for other Southeast Asian economies. Japan, South Korea and Taiwan are among leading U.S. alfalfa and “other” hay importers. FG