A year ago, there was a series in Progressive Dairy on the “Three Camps,” a discussion describing the different financial situations farm businesses might find themselves in as a result of the pandemic and outlining the prudent paths forward for those businesses.

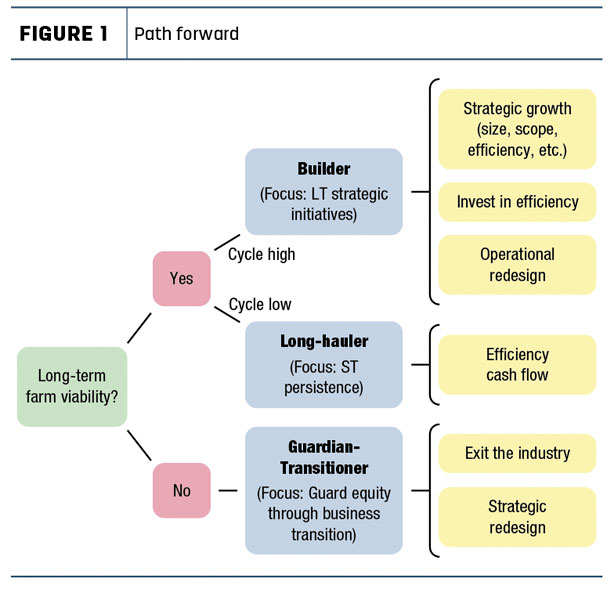

Figure 1 shows a modified version of the three camps.

The focus of this article is the beginning question: Does the operation have long-term viability?

If the answer to that question is yes, and the cycle of prices and profitability are currently favorable, then a farm business is in the “Builder” camp. Their path forward is continuing to build and invest in new strategic initiatives that build greater efficiency, economies of size and/or scope.

If long-term farm viability is a yes, but the current environment of profitability is challenged, then the business is in the “Long Haulers” camp. The challenge for this group is getting to the other side of the current financial pinch by focusing on cash flow and efficiency gains.

If the answer is no to long-term viability, then the challenge is how to guard business equity through transition to a more favorable situation, thus the “Guardian/Transitioner” camp. Keeping on is not an option, as it just means further erosion of equity. The options are many but not easy, including strategic change, different business model, partial exit or complete exit.

What is viability?

In all three cases, the first question is the same: Does the farm business have long-term viability? So what is long-term farm viability and how does one assess it?

The definition and measurement of “viability” is a debated topic in economic literature and research. There are many complicating socioeconomic factors, and viability can be economic, ecological, sociological or even moralistic. While the arguments in the literature might be interesting to an academic nerd like me, the goal of this article is understanding and assessing economic viability at the farm office and how it can be used to determine a path forward for farm businesses.

The three parts of viability

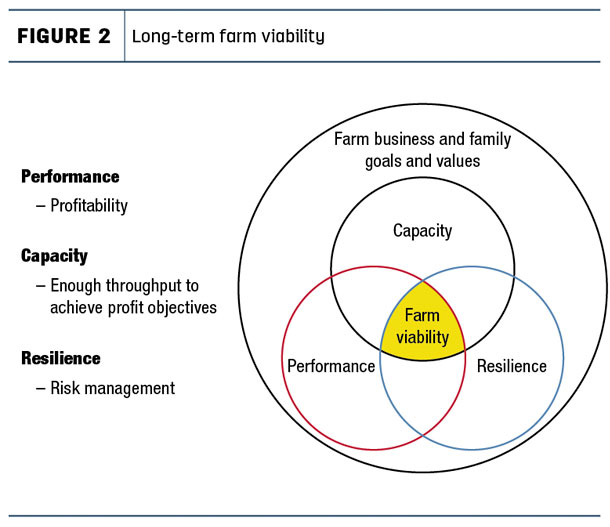

I believe long-term farm economic viability is the product of three parts – performance, capacity and resilience (Figure 2).

“Performance” is an efficiency measure, the ability of the farm business to create profit margins per unit of production. “Capacity” is whether there are enough production units (acres, cows, etc.) that, when multiplied over the profit margin, will cover debt service, asset maintenance and replacement, retained earnings and family living. “Resilience” is the ability of the business to take a punch and bounce back to normal operations.

“Performance” is an efficiency measure, the ability of the farm business to create profit margins per unit of production. “Capacity” is whether there are enough production units (acres, cows, etc.) that, when multiplied over the profit margin, will cover debt service, asset maintenance and replacement, retained earnings and family living. “Resilience” is the ability of the business to take a punch and bounce back to normal operations.

Surrounding these three parts is the type of farm business and family goals and values. A farm that has a commodity business model has a different goal for capacity compared to a value-added farm. A farm whose owners are close to retirement with no family heirs may have different goals and needs versus one managed by young beginning farmers.

1. Performance

“Performance” is a measure of management’s ability to achieve a successful profit margin through a combination of production, prices and costs of production. If a profit margin is continuously breakeven or less, then there can be 20,000 cows and the business will not be viable.

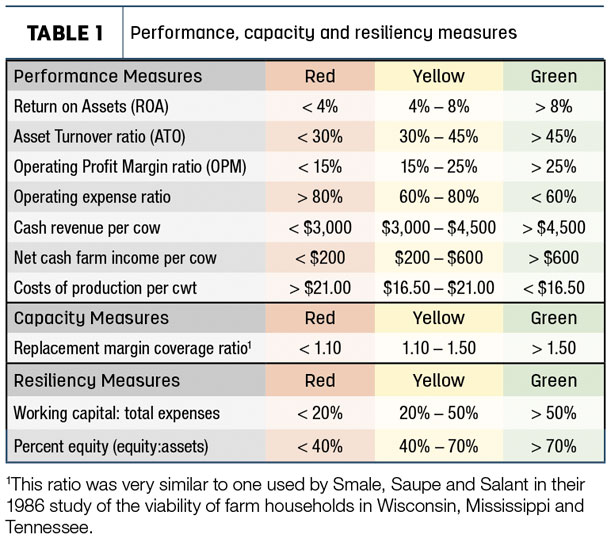

Performance measures include typical financial ratios such as return on assets, asset turnover ratio, operating profit margin ratio, operating expense ratio, costs of production and other cash-flow measures. Table 1 shows some common performance metrics along with a benchmark standard for evaluating the measure.

A description of and formulas for the measures can be found at the University of Minnesota Extension site that discusses the ratio scorecard (Ratios and measurements in farm finance).

Anything can happen in a given year, so these measures should be evaluated based on a three- to five-year average. Which way they are trending and comparison with a peer group are also important pieces of viability information.

2. Capacity

“Capacity” is measuring whether there are enough production units to achieve the absolute profits to meet the business goals. Assume a 50-cow dairy farm is making $1,000 profit per cow before debt service, capital asset replacement, retained earnings and family living. After paying debt service and asset replacement, there is $400 left, or $20,000 total for family living and retained earnings. Profit performance per production unit is good, but there may not be enough production units to achieve farm business and family goals.

One could add more cows. No doubt scaling up spreads fixed costs, but scaling up may add capital investment, management challenges, workers and maybe even owners who are drawing family living from the business. If profits fall to $500 per cow, then scaling up is not the answer. Long-term viability requires both capacity and performance.

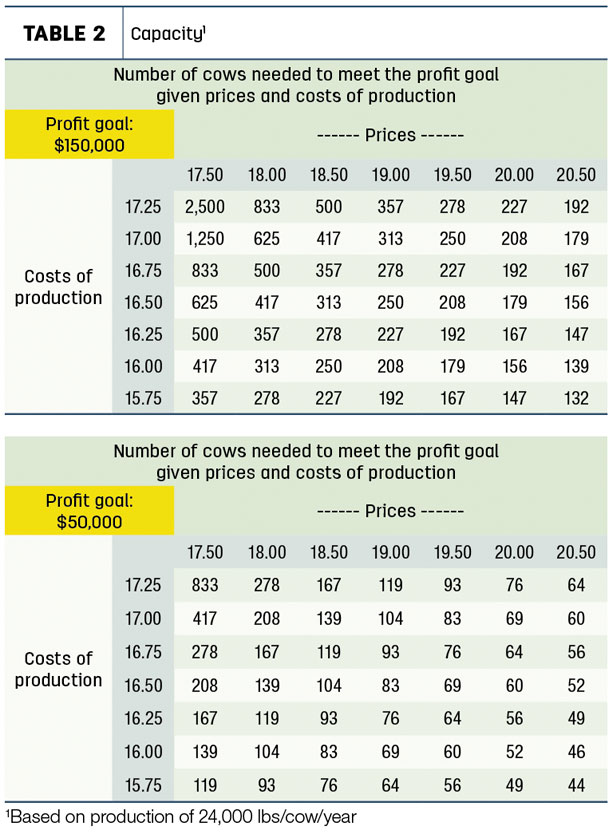

Table 2 shows spreadsheet results of the number of cows needed to achieve the stated profit goal given various levels of costs of production and prices.

For example, assume there are two families earning income from the farm, and the goal is $75,000 for each family ($150,000 total, top table in Table 2) and their planning milk price is $18. If costs of production are $17.25, then they would need 833 cows to achieve their profit goals. If their costs of production are $15.75, then they would need 278 cows to achieve the same profit goals. However, if their costs of production are $17.25 and they have 278 cows, then they will fall far short of their profit goals and long-term viability would be in question.

The literature on viability often uses an assessment based on enough cash flow to cover all cash needs. Table 1 gives an example of this kind of capacity measure (replacement margin coverage ratio). Another measure is comparison to some benchmark of income. For example, according to the USDA, median non-farm household income in 2019 was $68,703 (America’s Diverse Family Farms, 2020 edition).

3. Resilience

“Resilience” is what adds the “long-term” to long-term viability. Resilience is the ability of a business to take a punch and be able to bounce back to normal operations and profitability. The punches are risks that can occur due to decisions management has made or due to events completely outside of management’s control. (The COVID pandemic may come to mind.) The pandemic was, for sure, an unusual black swan event that likely will not happen again for a long time. That said, there is always something that comes up, including overproduction and thus low prices, death of a primary decision-maker, weather, hired labor making a mistake or getting injured, supply chain disruptions, disability and much more.

Financially, resilience is the ability of the business to cover financial hits. Table 1 shows some common metrics. Working capital (current assets minus current liabilities) is a short-term cushion that can soften a blow and enable the operation to continue uninterrupted. Percent equity is a longer-term measure of the accessibility the business may have to additional borrowing in the event of a risk to the operation.

Resilience is also the mitigation strategies a business has in place. This includes several kinds of insurance, written operating agreements, contractual relationships with suppliers and buyers, marketing programs, co-managers, standard operating procedures, strong human resource development programs, good relationships and networking, and continuous self-improvement.

Having mitigation procedures in place and having financial ability to soften the blow makes a business more resilient to any unpredictable challenges that could occur in the long term. Together with capacity and performance, it creates greater confidence in long-term viability.

We live in challenging times. Yet is there ever really a year when we can’t make the same statement? The path forward may sometimes look a bit foggy, but knowing the operation’s long-term viability with respect to performance, capacity and resilience may help clear the fog.