Dry conditions

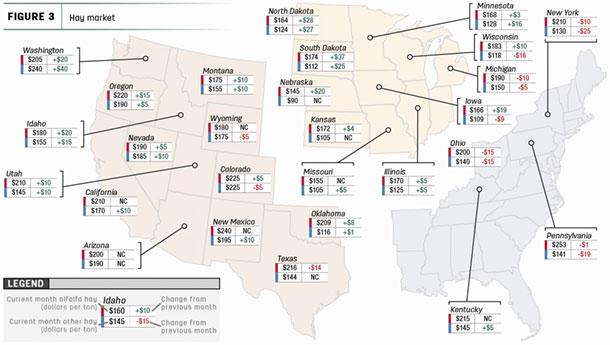

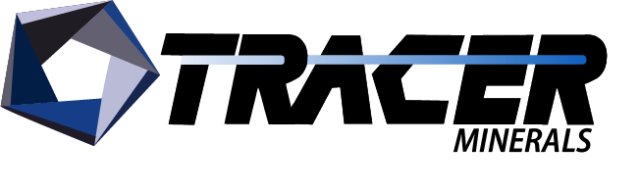

Moisture remains in short supply in major forage areas, based on U.S. Drought Monitor maps. As of Aug. 3, about 36% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, down 1% from early July. The area of drought-impacted alfalfa acreage (Figure 2) also improved just 1% since early July to 64%. Rainfall in parts of New England and Michigan accounted for the small improvement.

Prices moving higher

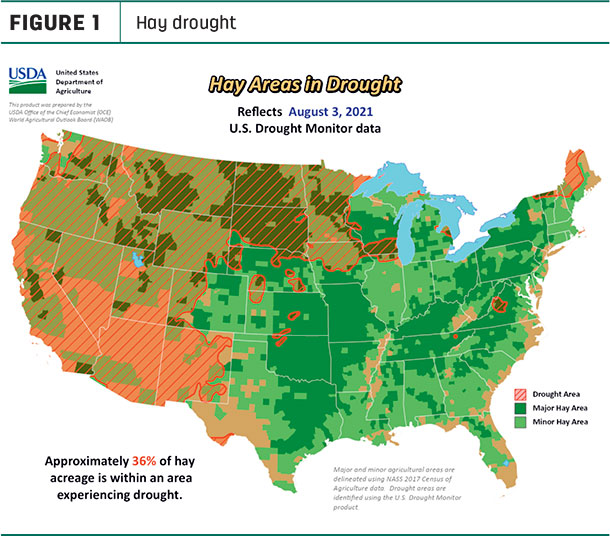

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

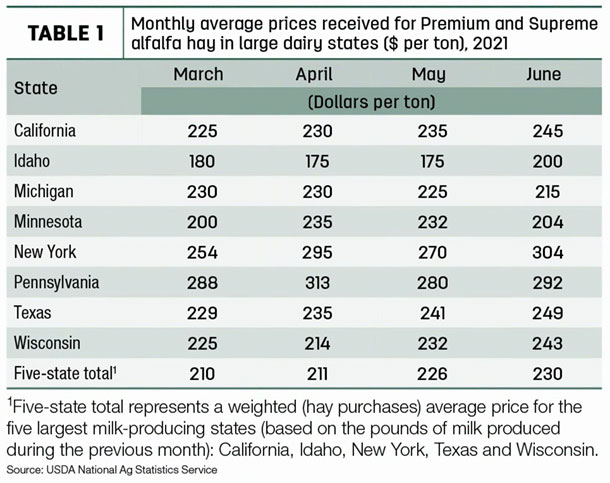

Dairy hay

The average price for Premium and Supreme alfalfa hay in the top milk-producing states rose $4 to $230 per ton in May (Table 1), the highest average recorded since the USDA began compiling dairy-quality hay prices in 2019. Average prices were again highest in New York and Pennsylvania; only Michigan and Minnesota saw price declines from May.

Alfalfa

The national average price for all alfalfa hay rose for a seventh consecutive month, up $6 per ton from May to $198 per ton, a 25-month high. Compared to May, average alfalfa hay prices increased in 16 of 27 major forage states, with largest increases primarily in the northern tier of states stretching from the Dakotas to Washington.

Other hay

The U.S. average price for other hay held steady in June at $140 per ton, even though prices moved higher in 15 states. Largest increases were in Washington, North Dakota and South Dakota. Price declines were reported in seven states, led by a $25 drop in New York and $19 in Pennsylvania.

Organic hay

The USDA’s latest National Organic Grain and Feedstuffs report listed organic hay prices for the final two weeks of July, (free on board [f.o.b.] farm gate). Premium large square bales of alfalfa hay averaged $250 per ton; Good large squares averaged $300 per ton.

Hay exports down slightly

June 2021 alfalfa hay exports totaled 233,008 metric tons (MT), down about 20,000 MT from May. January-June 2021 exports total almost 1.39 million MT, the third-highest total during the first half of a year on record.

Shipments to China were steady at 131,019 MT and represented about 56% of total alfalfa exports in June. However, lower volumes sold to the other leading markets: Japan, South Korea and Taiwan. Shipments were valued at about $348 per MT, up $9 from May.

June exports of other hay hit a four-month low at 114,617 MT. Despite that, exports of other hay total 758,071 MT through the first half of the year, the largest January-June volume since 2015.

June shipments to Japan were the lowest of the year and down almost 20,800 MT from May. China purchased 8,413 MT of other hay in June, the most for any month over the past two years. Although prices varied widely, exports of other hay averaged about $350.60 per MT, up $2 from May.

According to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, in-person visits by potential export customers are up but still lag normal. Shipment schedules remain the most difficult issue, with vessel delays and reduced vessel space pushing delivery back several weeks or more. Schedules are seldom as published. The cost for trucking is also increasing, and truck and container availability to move hay is tight.

“We do hope the shipments will become more reliable but have no idea if or when this would happen,” Mastin said. “We are making decisions hour by hour to react to the changes from the shipping lines.”

As the export numbers indicate, there continues to be heavy interest from China for both alfalfa and lower-grade timothy. Buyers from Japan and South Korea were confirming more purchases after balking at high prices earlier in the season.

Regional markets

Here’s a snapshot of local markets during the first week of August:

- Southwest: In Texas, trading activity and demand had slowed due to pasture improvements from recent rainfalls. Grinding quality or off-grade hay cheapened due to excess supply. Premium to Supreme hay was getting harder to come by.

In Oklahoma, hay trade slowed in most areas. With continued moisture and cooler temperatures there has been an ample supply of hay, making it a buyer’s market. Many producers expected a fifth cutting of alfalfa this year, although yields are down, and quality is lower. With low milk prices, dairies are switching to cheaper alternatives for the rations.

In New Mexico, alfalfa hay prices were steady. Producers in the southern and southwestern areas were working on fourth cuttings; eastern growers were on third cuttings. Price discounting was reported on rain-damaged hay.

In California, prices remained steady on moderate-to-good demand. Cooler temperatures aided crop growth.

- Northwest: In Montana, most producers were sold out of first cutting as second cutting entered the market, and there were reports of long waiting lists of people looking for hay. Many ranchers were already supplementing hay as pasture and range conditions continued to deteriorate, with some selling cows instead of paying for hay at these levels. Demand from horse hay buyers was also very good.

In Idaho, many hay producers were holding out for a higher market. End users were supplementing feed with more straw to lower expensive and scarce hay supplies. Demand remained very good as the threat of irrigation water being turned off remained in the background.

In Colorado, trade activity and demand were good on horse hay, moderate on good demand for feedlot and dairy hay.

In Washington, third-cutting alfalfa finished up with little rain damage, according to Mastin. Domestic demand remains strong. Export customers are now accepting the higher-priced alfalfa. Color and quality seem to be good as there has been limited rain and just recently a week of smoky weather. Dryland timothy production is about one-third of normal volume due to the drought, driving prices higher.

In the Columbia Basin, all grades of domestic and export alfalfa sold steady to firm. Trade remains active with very good demand as high temperatures returned.

In Wyoming, virtually all hay products (bales, cubes and pellets) sold higher. Several contacts had all their third cutting of hay sold even though it wasn’t yet baled. Many contacts have decided to go for tonnage instead of quality on their third cutting of alfalfa. Some irrigation districts were thinking of turning off the water earlier than normal this fall.

-

East: In Pennsylvania, buyer attendance at hay auctions was mixed, but prices were mostly stronger.

- Midwest: In Missouri, higher temperatures were forecast but given that grass was still green to start August had most farmers happy. Hay piles were full and there was plenty of hay for sale, reducing demand.

In Nebraska, demand was very good for all bales of forage, and some growers were planning to raise prices due to strong out-of-state interest. Conditions remain dry and forage is in short supply, and many contacts are planning on baling cornstalks and anything else they can wrap up to sell down the road. There were unconfirmed rumors of extremely high prices for large rounds of alfalfa hay in the central part of the state.

In Kansas, hay producers said market activity was “quiet” with steady prices. Demand remains good with lots of out-of-state interest.

In South Dakota, demand remained strong for all classes and types of hay as the drought raged on. Third cutting of alfalfa was taking place. The quality of alfalfa has been very high, but the tonnage was greatly reduced. Cattle producers were selling yearlings off grass earlier than normal and were trying to stretch their grass enough to keep from having to further sell down their cow herds.

In Iowa, the market was called steady to slightly stronger.

Other things we’re seeing

- Dairy: Although U.S. dairy cow numbers remain at a 27-year high, the USDA’s June 2021 Milk Production report was the first signal the size of the nation’s herd may have peaked. June 2021 U.S cow numbers were down 1,000 head from May. Even with June 2021’s small decline, U.S. cow numbers remain the highest since the fourth quarter of 1994 and up 153,000 head from a year ago.

Meanwhile, with higher alfalfa hay prices contributing to higher feed costs, U.S. dairy farmer income margins remain tight. The June 2021 Dairy Margin Coverage (DMC) milk income over feed cost margin was just $6.24 per hundredweight (cwt) – 65 cents less than May, the second lowest of the year and the fifth straight month in which the margin was below $7 per cwt.

- Fuel: In its early August report, the U.S. Energy Information Administration noted U.S. retail gasoline prices were 98 cents per gallon higher than a year earlier. U.S. average diesel prices were 94 cents higher than a year ago. The average regular retail gasoline price in the Rocky Mountain region was up $1.27 per gallon from a year earlier, in part due to refinery closures in the West Coast and Rocky Mountain regions in the past year, which may be contributing to low refinery output of gasoline and the resulting low inventories.