I bring up this illustration every year, but your perception of forage conditions and markets is probably a lot like the parable of the blind men and the elephant: it depends on where you are standing. Here’s a description of factors affecting hay markets as we approach the middle of July.

Dry conditions

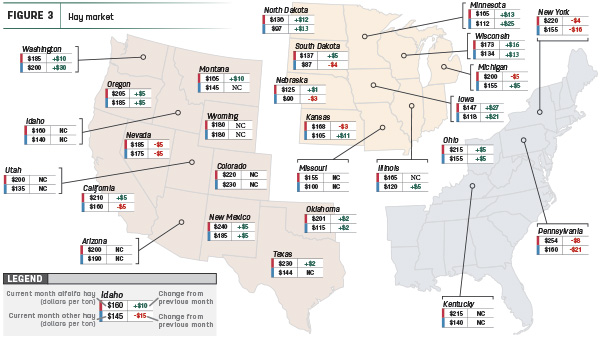

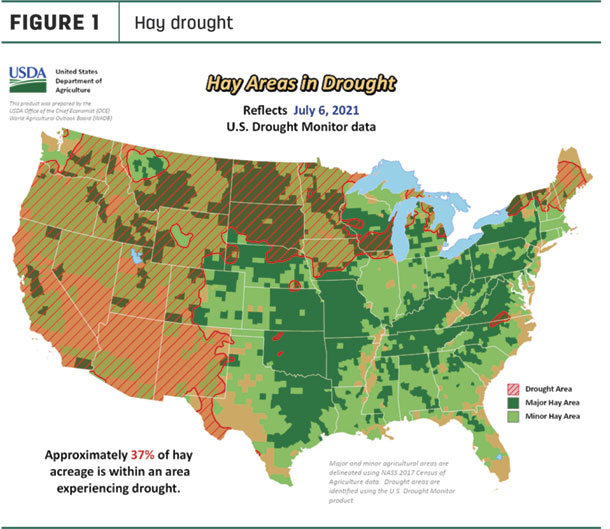

Moisture remains in short supply in major forage areas, based on U.S. Drought Monitor maps. As of July 6, about 37% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, up 2% from just two weeks earlier. The area of drought-impacted alfalfa acreage (Figure 2) grew another 3% since June 15, to 65%.

Despite higher drought percentages, there were substantial improvements in moisture conditions in some areas, especially southern Michigan, New England and the Mid-Atlantic states.

Prices moving higher

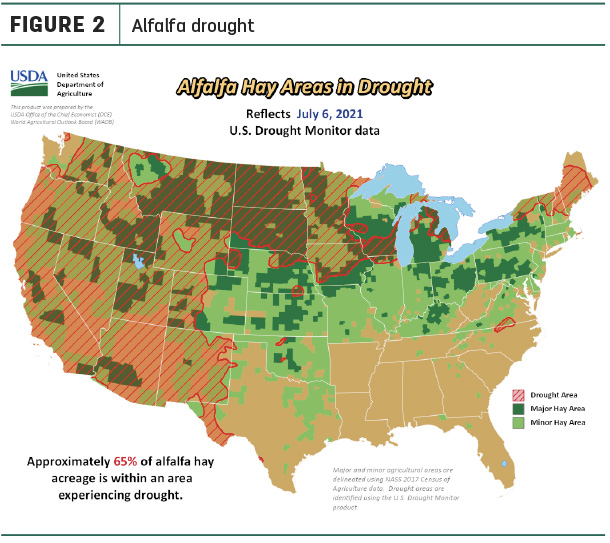

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new window.

Dairy hay

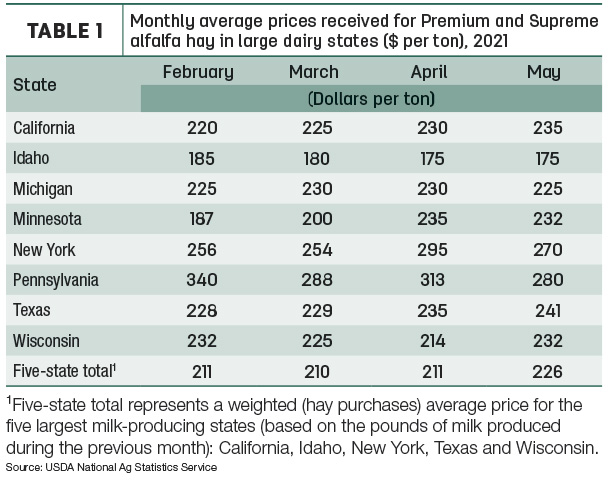

The average price for Premium and Supreme alfalfa hay in the top milk-producing states jumped $15 to $226 per ton in May (Table 1), the highest average recorded since the USDA began compiling dairy-quality hay prices in 2019. Averages were highest in New York and Pennsylvania. Combined with much higher corn and soybean meal prices, the U.S. average feed cost to produce milk in May was in record-high territory.

Alfalfa

The national average price for all alfalfa hay rose for a sixth consecutive month, up $7 per ton from April to $194 per ton, the highest average since May 2019.

Compared to a month earlier, average alfalfa hay prices increased in 14 of 27 major forage states, led by double-digit increases in Iowa, Wisconsin, Minnesota, North Dakota, Montana and Washington. May prices declined modestly in just five states, including Kansas, New York, Michigan, Nevada and Pennsylvania.

Even with an $8 decline, Pennsylvania alfalfa hay prices remained the highest in the country at $254 per ton. Nebraska turned in the nation’s low price in May at $125 per ton.

Other hay

In contrast to alfalfa hay, the U.S. average price for other hay dipped $3 in May to $140 per ton, the lowest since January 2021. However, May prices moved higher in 12 states, led by $25 and $30 increases in Minnesota and Washington, respectively. Price declines were reported in just six states, led by a $21 drop in Pennsylvania and $16 in New York. Colorado again had the top monthly average of $230 per ton; average prices were under $95 per ton in North Dakota, Minnesota and South Dakota.

Organic hay

The USDA’s latest National Organic Grain and Feedstuffs Report did not include any listings for organic hay prices.

Hay exports remain strong

May 2021 alfalfa hay exports totaled 253,804 metric tons (MT), up slightly from April and contributing to the highest three-month total since March-May 2020. Shipments were valued at about $339 per MT, down $6 from April.

At 131,373 MT, China purchased about 52% of the monthly total. May alfalfa hay exports to the second-leading market, Japan, were about equal to April, at 59,035 MT, representing about 23% of the total.

While still strong, May exports of other hay were down from April, at 136,738 MT. Exports of other hay were valued at about $348.50 per MT, down $1 from April. About 61% (83,515 MT) of the month’s sales went to Japan, down about 9,000 MT from April. Shipments to another major customer, South Korea, were steady with a month earlier, at 29,661 MT, representing about 22% of the total.

According to Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, ongoing political struggles between Australia and China mean China will continue to drive U.S. alfalfa sales. China placed a large import tariff on Australian oaten hay and wheat straw products, forcing those products to be diverted to South Korea and Japan. With China seeking replacement forages, there has been a large increase in requests for U.S. alfalfa hay and additional interest for timothy and hay cubes.

Counterbalancing those export factors, increased Australian oaten hay sales to South Korea and Japan are likely to reduce the need for U.S.-sourced grass and timothy to those markets. With timothy yields generally lower in the Pacific Northwest, prices are moving higher and may be less competitive with Australian oaten hay.

Regional markets

Here’s a snapshot of local markets:

- Southwest: In Texas, new crop prices were steady. Harvest, trading activity and demand slowed due to pasture improvements from recent rainfalls. Reports on sales volumes and prices were limited.

In Oklahoma, heavy rainfall slowed hay trade as cattle producers grew more optimistic about greener pastures and hay production increases. The moisture also slowed hay loading and movement.

In New Mexico, alfalfa hay prices were steady. Producers in the southern and southwestern areas finished with the third cutting; eastern growers finished second cutting.

In California, prices remained steady on moderate to good demand. Excessive heat continued to increase evaporative demand, dry out soils and vegetation, and strain water resources. Drought conditions worsened in the northwest.

- Northwest: In Montana, strong demand and light supplies pushed prices higher. Drought conditions coupled with swarms of grasshoppers, which were eating into yields; many producers reported yields down as much as 30% from last year. Additionally, many producers opted not to cut dry land hay because yields and quality were so low, leaving a huge hole in supply. Many cattle producers were already feeding hay for the season. Demand from horse hay buyers was also very good; prices on small quantities of stable hay were sharply higher.

In Idaho, all grades of alfalfa sold firm. Trade was active with good demand as drought conditions remained throughout the trade area. The state drought monitoring team noted that the Big Lost River is almost out of storage, and priority water use was limited.

In Colorado, trade activity was moderate on good demand. Drought in the southwest areas continued and water shutoffs were expected, encouraging firm asking prices. Second cutting of alfalfa had begun. Stored feed supplies were rated 4% very short, 19% short, 54% adequate and 23% surplus.

In Oregon, the drought intensified and expanded, with conditions among the driest going back to 1895. Dryland agriculture was suffering, and fire risk escalated.

In Washington, abnormal dryness and moderate drought expanded to cover almost all the state, significantly impacting forage production. Third cutting of alfalfa had started. With high temperatures, quality and leaf retention were a concern. To date, limited wildfires and smoke from Canada and Oregon have helped maintain hay color.

In the Columbia Basin, hay trade was active with good demand for all classes. The market was firm for all grades of timothy and alfalfa; high-quality timothy remained sought after for export.

In Wyoming, mostly dry weather helped hay producers put up top-quality feed. Demand was good with several loads going out of state, some to feedlots in Colorado and ranches in Montana. Demand was good at the first video sale of the 2021 haying season.

The Northwest Farm Credit Services’ (FCS) quarterly hay market outlook forecast slightly profitable returns over the next 12 months, with producers in drought-impacted areas facing the strongest headwinds.

- East: In Pennsylvania, buyer demand remained moderate on light supplies offered for auction.

In Alabama, hay prices were steady, with trade moderate on light supply and moderate demand.

- Midwest: In Missouri, weather conditions remained calm, although standing water was evident. Pasture and water conditions seemed to be in pretty good shape around the state, although southcentral and southeast areas could use some rain. Hay harvest progress was behind; hay supplies were moderate, and demand was light to moderate, and prices were mostly steady.

In Nebraska, ground and delivered dehydrated pellets sold steady. New crop hay was lightly tested but sold steady too, with a higher undertone noted. Buyer inquiry was good, especially from out-of-state buyers. Quite a few loads reported in the western areas of the state were headed to ranchers in other states. On the most part, tonnage has been near normal with a few reports of up to 4 tons per acre yield on alfalfa in eastern Nebraska.

In Kansas, prices were steady for alfalfa and mostly steady for grass hay, while demand remained good.

In South Dakota, markets remained firm with very good demand for grass and alfalfa hay. New crop tonnage was reduced, and hay users were wanting to get their needs secured now while hay is available. Dryland hay in central and western South Dakota is very short, with many producers not able to cut anything. Second cutting of alfalfa was taking place in areas where rains allowed a regrowth.

In Iowa, quality varied on some second-cutting alfalfa. Overall, the market was steady with good interest in all classes.

In southern Michigan, precipitation has brought soil moisture in the top 3 feet up to near-normal levels, after having been in a significant deficit for most of the early growing season.

Other things we’re seeing

- Fuel: In its early July outlook report, the U.S. Energy Information Administration forecast uncertainty over crude oil production and if larger draws on inventories during the second half of 2021 will boost prices and market volatility.

During the first week of July, the U.S. average regular gasoline retail price increased more than 3 cents to $3.12 per gallon, 95 cents higher than the same time last year. The Rocky Mountain price increased nearly 8 cents to $3.43 per gallon; the Midwest price increased nearly 4 cents to $3.03 per gallon; the West Coast price increased more than 3 cents to $3.84 per gallon; the East Coast price increased 3 cents to $3.01 per gallon; and the Gulf Coast price increased 2 cents to $2.80 per gallon.

The U.S. average diesel fuel price increased more than 3 cents to $3.33 per gallon, 89 cents higher than a year ago. The Rocky Mountain price increased more than 8 cents to $3.52 per gallon; the West Coast price increased nearly 6 cents to $3.90 per gallon; the Gulf Coast price increased more than 3 cents to $3.08 per gallon; the Midwest price increased nearly 3 cents to $3.26 per gallon; and the East Coast price increased nearly 2 cents to $3.31 per gallon.

- Trucking: As of late June, U.S. average flatbed rates are still 81 cents per mile higher than the same week last year and 24 cents per mile higher than the same time in 2018. However, analysis from DAT Trendlines indicated that early July 2021 spot flatbed rates softened somewhat and there were signs drivers were coming back to the industry.

- Interest rates: An FCS Northwest summary of the June Federal Reserve’s Federal Open Market Committee (FOMC) meeting indicates several members moved up their projected timeframe for beginning to increase interest rates. A majority of the participants forecast a rate increase in 2023 with seven out of 18 members projecting a rate hike in 2022. A difference of opinion over how temporary the recent runup in inflation will be is largely responsible for the shift in policy expectations.