The 2022 growing season is winding down, and initial production numbers will be available soon. (Check the Progressive Forage website for the USDA’s first 2022 hay harvest area, yield and total production estimates, scheduled to be released on Oct. 12.)

In the meantime, the most striking factors driving hay markets are related to alfalfa exports, domestic prices for dairy-quality hay and an early start to the supplemental feeding season in drought areas. Despite strong prices, high input costs and escalating interest rates will continue to test margins.

Drought conditions worsen

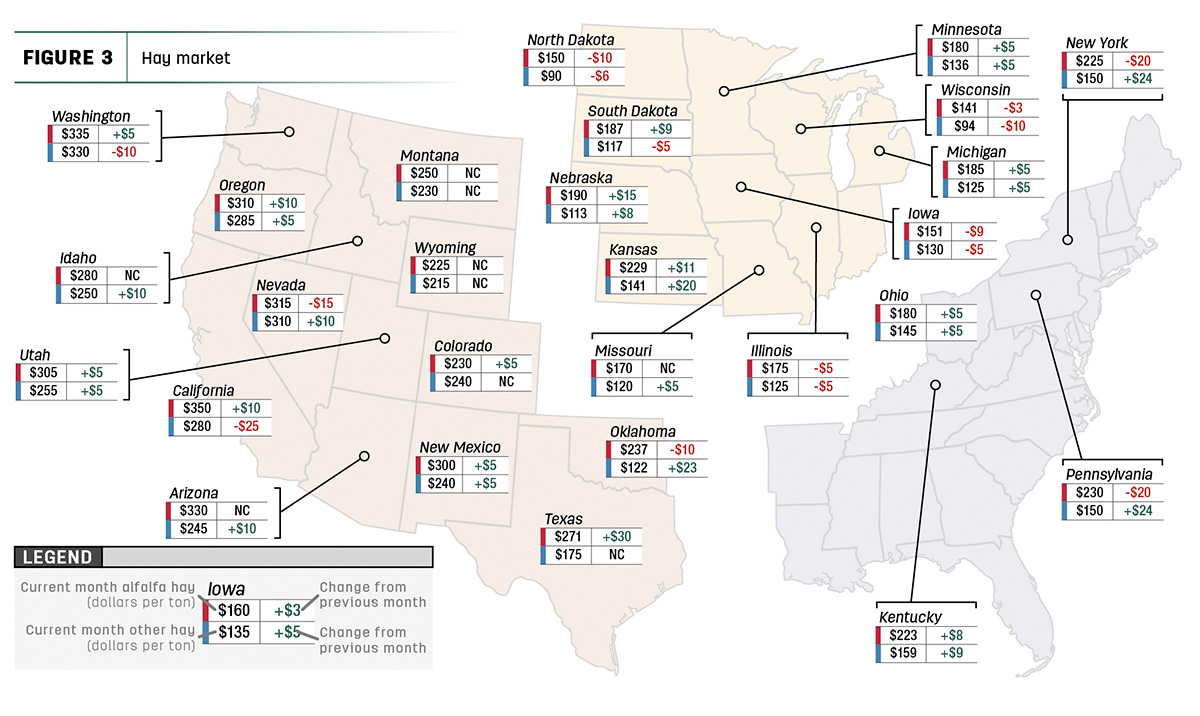

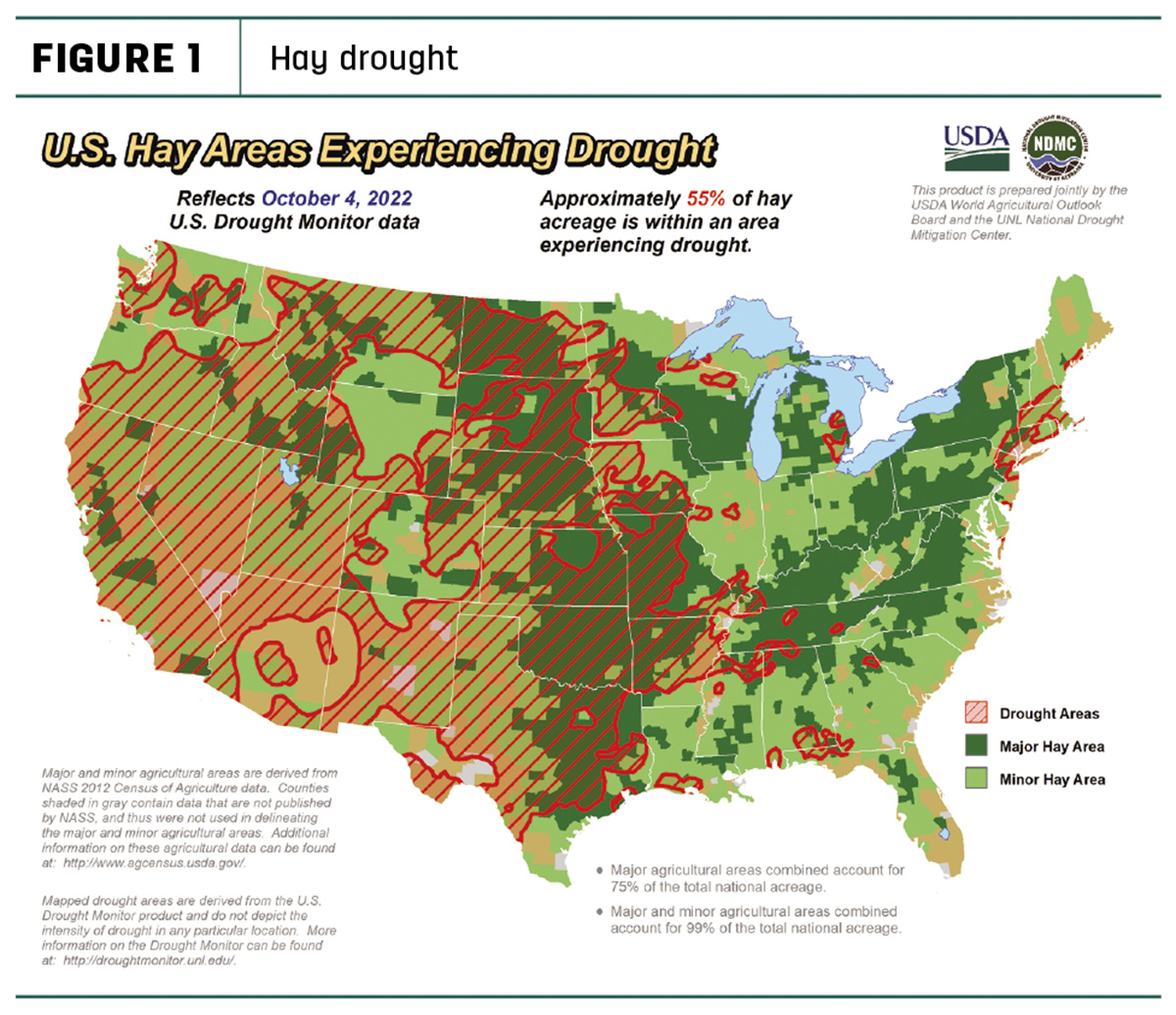

After a slight improvement in August, U.S. Drought Monitor maps indicate overall moisture conditions worsened over the past month. As of Oct. 4, about 55% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 16% more a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was up 14% to 59%. Drought-area expansion occurred in all or portions of Idaho, Iowa, Minnesota, Missouri, Montana, North Dakota and South Dakota.

Hay prices tracked

Western market conditions continue to be the predominant factor driving prices for alfalfa and other hay varieties. The spread between U.S. average alfalfa and other hay prices closed somewhat in August.

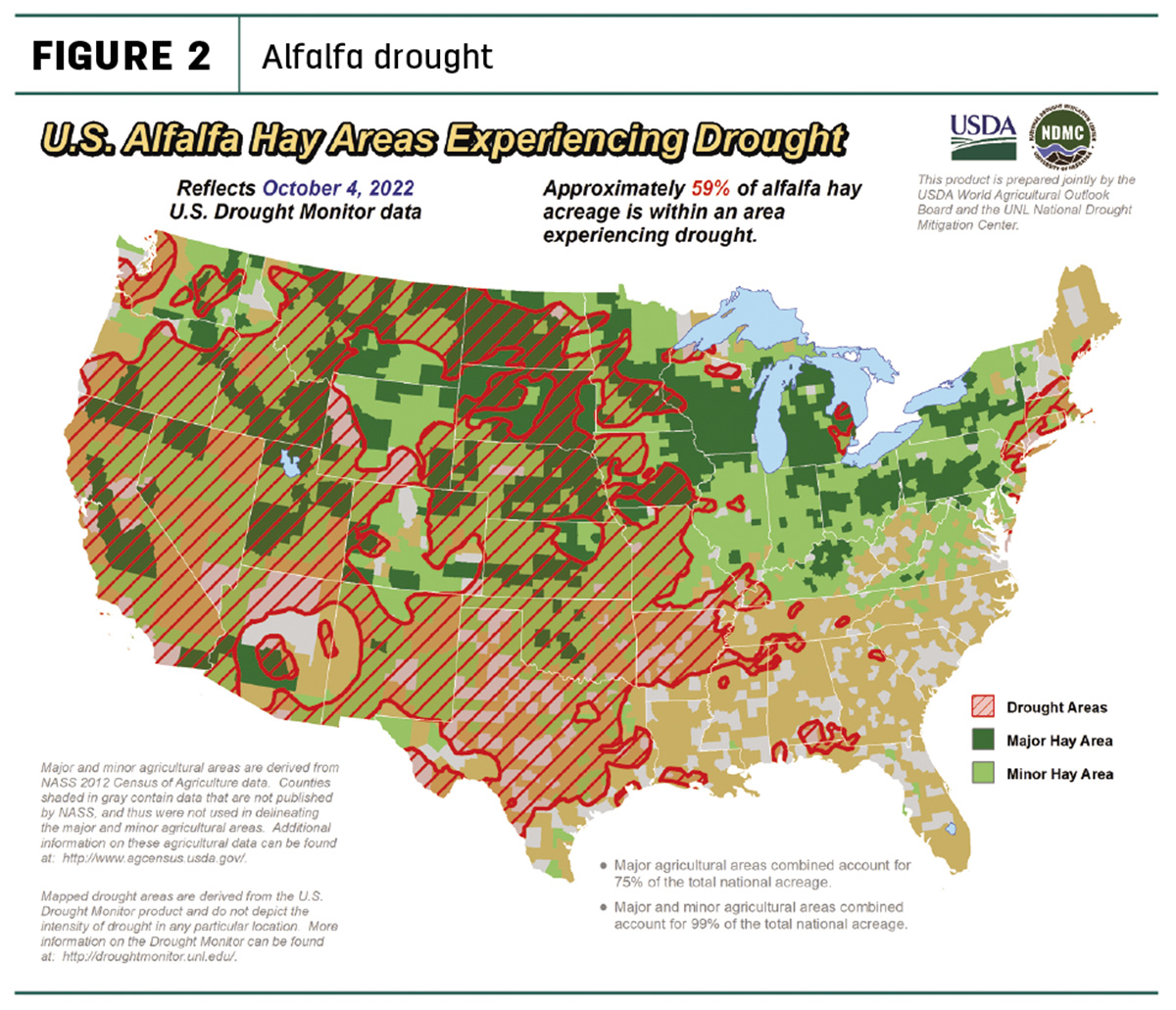

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Click here or on the map above to view it at full size in a new tab.

Dairy hay

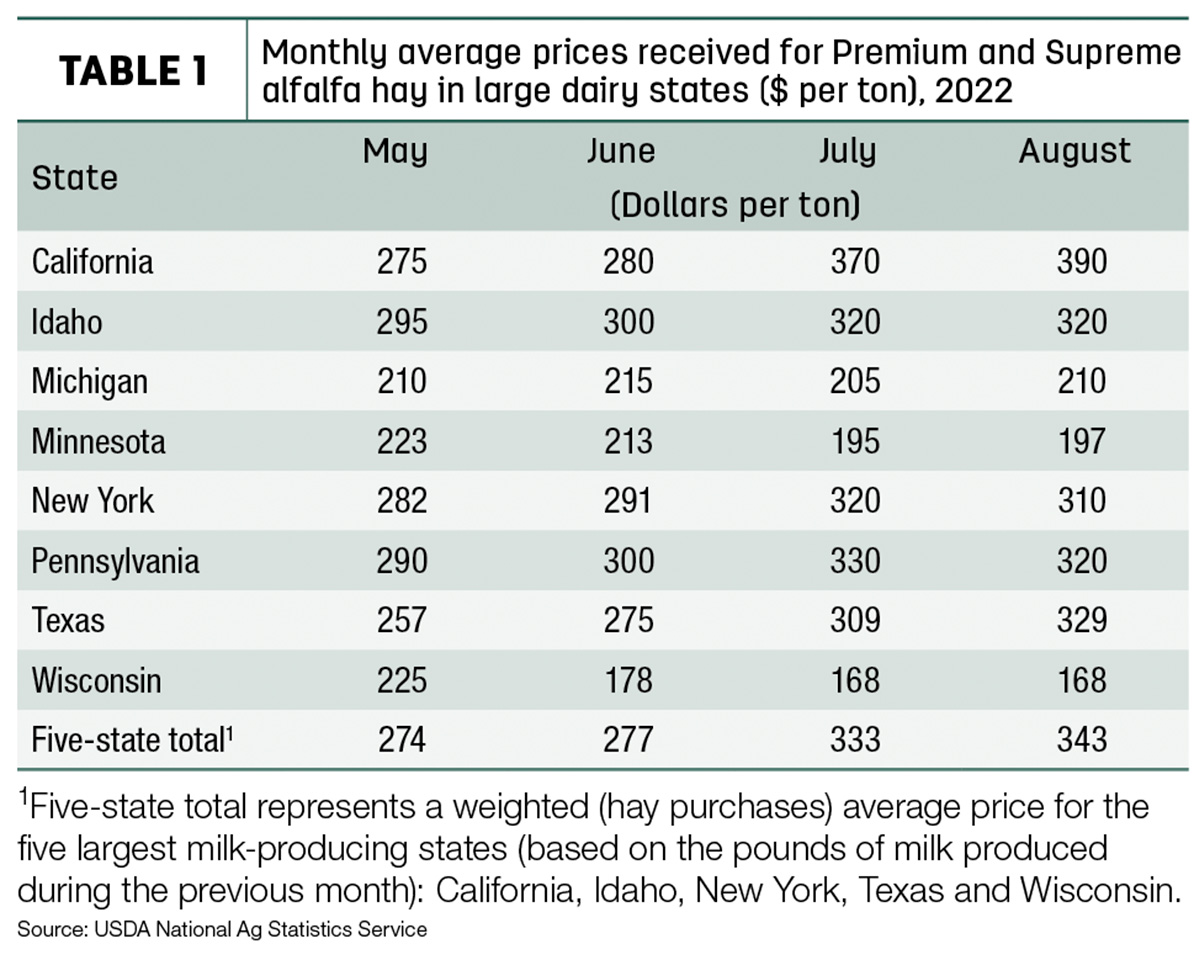

Higher prices in California and Texas pushed the average price for Premium and Supreme alfalfa hay in the top milk-producing states up another $10 from July to $343 per ton (Table 1), a record high and $105 more than a year ago.

Alfalfa

After a large increase in July, the U.S. average price for all alfalfa hay dipped $1 in August to $275 per ton. Prices increased in 14 of 27 major forage states, led by a $30 increase in Texas. Prices softened in eight states, with New York and Pennsylvania leading decliners. Year-over-year prices were up $100 or more in Arizona, California, Idaho, Oregon, Nevada, Utah and Washington.

Other hay

At $183 per ton, the August 2022 U.S. average price for other hay was up $19 per ton from July. Prices increased in 16 of 27 major hay-producing states, with largest month-to-month increases in New York and Pennsylvania, up $24 per ton. Average prices for other hay remained $80 or more higher than a year ago in California, Idaho, Nevada, Oregon, Utah and Washington.

Alfalfa exports jump

At 337,189 metric tons (MT), August alfalfa hay exports to foreign markets shattered all previous volume records. Monthly exports were up 70,000 MT from July and 135,000 MT from June.

Much of the record-setting sales jump can again be attributed to China. At 228,015 MT, Chinese purchases of alfalfa hay represented 68% of all alfalfa hay exports in August. Elsewhere, sales to Saudi Arabia rose to a 25-month high at 37,855 MT, but sales to Japan fell to the lowest volume since mid-2015 at 32,453 MT.

Demand for U.S. alfalfa also showed up in related categories. August exports of dehydrated alfalfa cubes were the highest in 15 months, while shipments of dehydrated alfalfa meal moved to a two-year high. Offsetting that somewhat, sales of sun-dried alfalfa cubes and meal were down slightly from recent months.

The value of alfalfa exports has come off highs seen earlier this spring. August exports to all markets were valued at about $339 per ton, down about $13 from July and down $60 from April’s peak.

Export volume data for other hay again told a different story. Foreign sales totaled 82,169 MT, the lowest monthly total since at least 2005. At 44,800 MT, August sales to Japan represented about 55% of the monthly total but the volume was the lowest since at least 2013.

Offsetting the lower volumes, exports of other hay have increased in value on a per-ton basis. August exports averaged about $409 per ton, up about $16 from July and the highest of the year.

Looking ahead, Christy Mastin, sales representative with Eckenberg Farms, Mattawa, Washington, expects September hay export numbers to follow a similar pattern as August, but October sales could start to slow.

The dollar remains strong against other currencies, making U.S. hay more expensive. Additionally, foreign buyer warehouses are also starting to fill because farmers are not able to pay for forages at the higher prices and instead are quitting the dairy business. Milk prices received in Japan, China and South Korea remain flat or are increasing slightly but not enough to cover the increased cost of feed.

“This is different than in years past when [a] smaller farmer quit and a neighbor purchased the cows,” Mastin said. “These cows are not being purchased by another farmer.

“There is concern from our export customers about the volume of alfalfa that is available, but the prices currently are too high for them to purchase normal or larger volumes,” she concluded.

Regional markets

Here’s a snapshot of regional markets to start October:

- Southwest: In Texas, hay prices ended September firm. Rains in the southern and eastern regions helped pasture conditions, slowing supplemental feeding. Trading activity in the west, Panhandle and central regions was still moderate to active. Substitute forages were in short supply, and many producers were trying to acquire winter supplies. Finding trucking remained a challenge. Fall armyworm infestations were being reported around the state.

In Oklahoma, hay supplies tightened and were moving in from out of state.

In New Mexico, supplies were tight for top-quality alfalfa hay. Most areas had completed sixth cuttings.

In California, retail hay demand was strong with tight supplies; export and dairy hay demand was moderate.

- Northwest: In Montana, hay sold generally steady. Hay from far eastern Montana was competing with hay out of North Dakota, pressuring prices lower.

In Idaho, all grades of export and domestic alfalfa sold steady to weak, as lower-quality and rained-on supplies weighed on the market.

In Colorado, trade activity was moderate on very good demand for horse hay. Feedlots were putting offers on hay but finding few sellers accepting them.

In the Columbia Basin, all grades of hay sold steady to weak. Exporters were getting offers from producers outside the trade area. Dairies weren't chasing higher-testing supplies even if they could find it.

In Wyoming, more tons of hay were going to area ranchers. Several producers have not sold any hay until they were sure they have adequate supplies for their own livestock.

- Midwest: In Nebraska, livestock owners faced pressures as fall feeding season got underway and winter approaches. Most expenses have doubled or tripled in the last few months, adding pressure.

In Kansas, the hay market was a bit calmer than recent weeks. Producers were harvesting whatever they could find left to bale. Several hay fires were reported, adding to supply concerns.

In South Dakota, alfalfa hay sold steady with higher undertones. There was very good demand for limited supplies of high-testing alfalfa.

In Missouri, hay interest remained very high as conditions continued to decline. Many cattle producers were being forced to make tough culling decisions. Hay was by no means abundant, but it also wasn't so scarce it couldn't be found. Problematic, however, was that supplemental feeding had already started in early October and was compounded by higher costs for hay and trucking.

In Wisconsin, prices for dairy-quality hay were steady with limited supplies offered at quality-tested auctions.

- East: In Pennsylvania, alfalfa and alfalfa-grass blends sold unevenly steady on light tests; large bales of grass hay sold weaker, alfalfa sold steady, and alfalfa-grass and prairie-meadow grass mixes sold weaker. Buyer demand was moderate on a light to moderate supply, likely due to the rainy weather.

In Alabama, hay prices were fully steady, with moderate supply and demand.

Other things we’re seeing

- Dairy: The higher prices for dairy-quality alfalfa again contributed to sharply lower monthly dairy producer milk income margins calculated under the Dairy Margin Coverage (DMC) program. August feedstuff prices yielded an average DMC total feed cost of $16.22 per hundredweight (cwt) of milk sold, an all-time record high. The August 2022 announced U.S. average milk price fell $1.40 from July to $24.30 per cwt, the lowest since January.

While margins shrunk, cow numbers moved higher and, despite hot weather, milk output per cow increased. Texas led all states in year-over-year growth in August 2022, up 30,000 head from August 2021, followed by South Dakota, (+22,000), Iowa (+13,000) and Georgia (+11,000). Compared to a year earlier, cow number declines were again heaviest in New Mexico and Michigan, down 24,000 and 15,000 head, respectively.

- Cattle: Drought and high input costs continue to impact beef cattle marketing. With more cattle – including heifers and cows – headed to slaughter, August 2022 beef production was up 6% compared to the same month a year earlier. According to the American Farm Bureau Federation, August beef cow and heifer slaughter was up 6% and 9% respectively, and together represented nearly 51% of all cattle processed between January and August 2022. The growth in rate of cow and heifer slaughter will lead to a smaller calf crop and lower cattle supplies in the future.

- Fuel: After months of small incremental declines, gasoline prices reversed course. As of the first week of October, the U.S. regular gasoline retail price averaged $3.78 per gallon, up 7 cents on the week and about 59 cents more than a year earlier. The U.S. average on-highway diesel fuel price was $4.84 per gallon, down 5 cents from a week earlier but still $1.36 more than a year ago.

- Interest rates: The Federal Reserve approved a 0.75% increase in the primary credit rate to 3.25%, the highest since early 2008. In most cases, early reports from Federal Reserve district banks covering major agricultural areas indicated interest rates on fixed- and variable-rate loans starting the fourth quarter of 2022 were the highest since early 2019. The Fed also signaled more rate hikes to come when it meets in both November and December.

-

Trucking: Flatbed prices were slightly lower in early October, according to DAT Trendlines. The national average price was $2.89 per mile, down 2 cents from September and down 41 cents from July. Regionally, average prices per mile were: Southeast – $3.01, Midwest – $3.06, South – $2.96, Northeast – $2.84 and West – $2.58.