In the past decade, we've watched laboratory-grown protein sources increase in prevalence, with marketing that positions them as an alternative to animal protein using ethical, environmental or health concerns. These alternatives include cell culture-based animal products, including “cultured meat” or “animal-free” meat or dairy products. They are presented as a way to produce large amounts of muscle or other animal products from few or no animals, with the goal of reducing meat and dairy product consumption. Should those who are investing in raising livestock for human consumption, many born from generations of farmers and ranchers, be concerned for the future of the industry?

To answer this question, we have to look at how these alternative protein sources are produced and what it would take for these technologies to scale to a level approximating the efficiency and productivity of traditional livestock raising. Here we will review recent technical and economic reports showing that culture-based animal products are a long way off from outcompeting animal agriculture – and may never be possible at all for some products.

The foundation of cultured meat happens in massive bioreactors, also called cultivators, where a small number of initial animal cells are exponentially grown into thousands of liters of a liquid cell slurry. These initial animal cells are originally biopsied from specific tissues of live animals to capture stem cells that will differentiate into cell types, like muscle cells for meat or adipose cells for fat.

Those differentiated stem cells that are found to be suitable for industrial proliferation are stocked as specific cell lines that cultured meat manufacturers multiply in an animal-like growth medium. After 42 days of scaling up growth in larger and larger bioreactors, 1.5 milliliters of starter cells are multiplied into approximately 3,080 kilograms of meat cells, the equivalent of about four live steers. So the science is there, but there are practical limitations when trying to scale this process to be accessible to consumers.

Techno-economic analyses show that one cultured meat facility could generate 22 million pounds of cultured meat per year, representing 0.02% of the 100 billion pounds of meat produced in the U.S. every year. While cultured meat products may be efficient from a “calories-in, calories-out" perspective, each of these facilities requires massive investment into bioreactors and infrastructure. The cost of a facility, projected at $450 million, is comparable to the price of a slaughterhouse. Each facility would need 130 production lines with 600 bioreactors continuously running. It should be noted that the total bioreactor volume for a single facility comes out to 2.1 million liters – a third of the total biopharmaceutical industry capacity available today. Notwithstanding the looming infrastructure project of a single facility, to meet the world’s demand of meat supply would require 4,000 of these facilities at an about $1.8 trillion investment. Those who claim that livestock meat will be replaced with a cultured alternative in the next 10 years are relying on more than one facility being built every day until then.

Beyond infrastructure, cultured meat is currently very expensive to grow. Culture medium, simulating animal conditions, requires the use of hormones and growth factors that cost tens of thousands of dollars per liter. Antibiotics are often used to control contamination. Even if manufacturers can slash today’s input prices by over a thousandfold, the cost of cell-based ground meat will be $17 per pound. Compared to animal meat prices at $4 per pound, the livestock industry has little to fear from this future.

While cultured meat is ultimately based on cells taken from animals, cultured milk is claiming the title of animal-free. Scientists aim to create a cultured milk that is chemically comparable to animal milk by genetically modifying fungi to produce a single bovine milk protein, then combining these lab-cultured proteins with plant fats, sugars and nutrients. A single 40,000-liter fermentation run of these genetically modified fungi can produce up to 4,000 kilograms of whey protein. Assuming a cow produces 80 pounds of milk per day containing 90 grams of whey protein (7%-9% of the total protein), it would take approximately 44,000 cows to produce an equivalent amount of whey. However, this comparison only considers one type of protein, which is a small proportion of the many nutritious molecules naturally occurring in dairy milk, and it remains to be seen how eager consumers are to spend $20 on a pint of GMO ice cream.

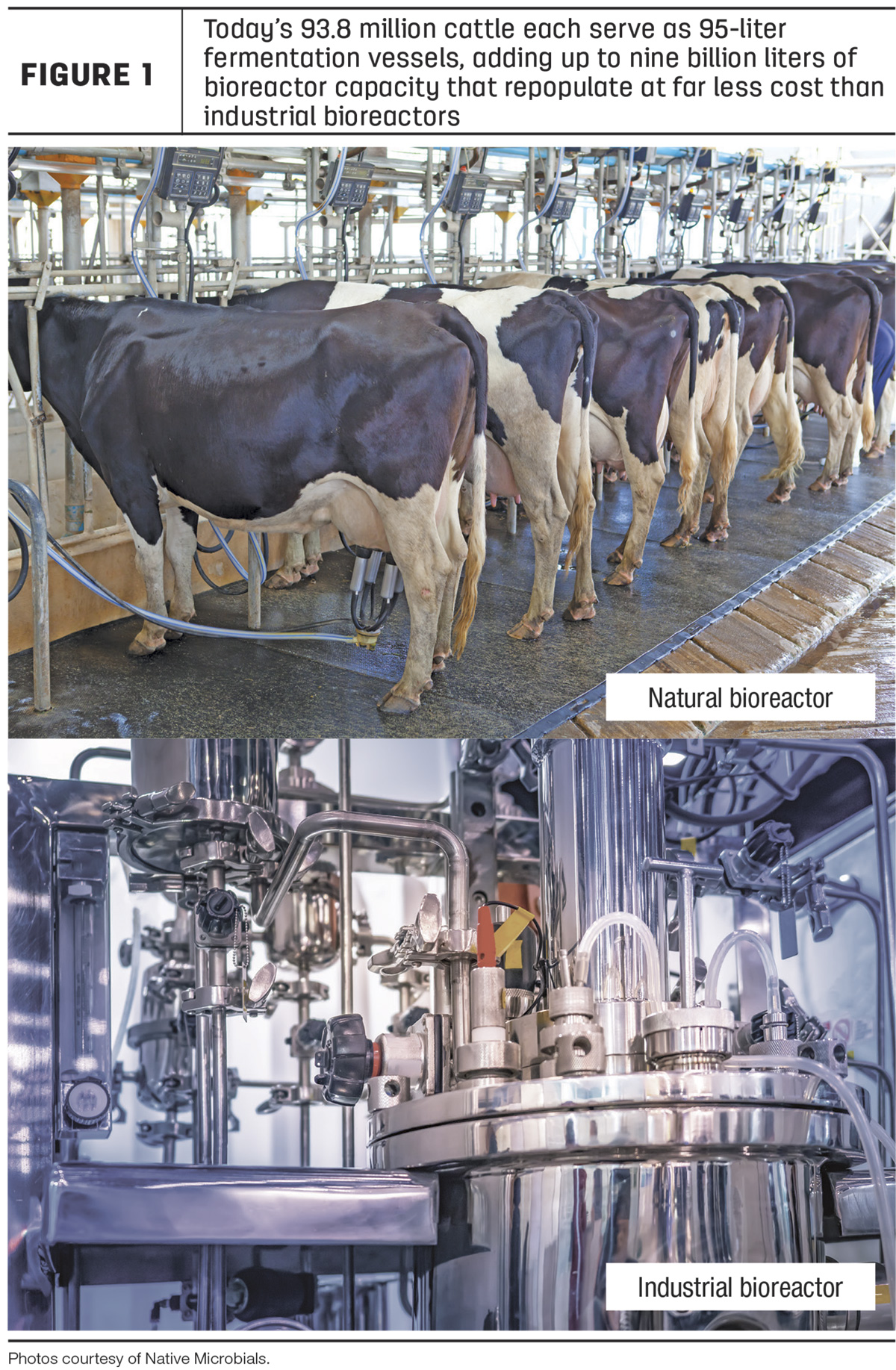

Even as bioreactor technology continues to advance, the long history of breeding ruminants has resulted in naturally efficient and self-replicating bioreactors that are integrated into human ecosystems. Today’s 93.8 million cattle each serve as 95-liter fermentation vessels, adding up to 9 billion liters of bioreactor capacity that repopulate at far less cost than industrial bioreactors. Moreover, livestock not upcycling plant byproducts that humans reject would add to landfills (e.g., almond hulls, citrus peels and bakery byproducts), which contribute 10 times more warming from greenhouse gas emissions than ruminants do. Furthermore, ruminant manure contains valuable fertilizing compounds that are used to boost plant production for both human and animal consumption.

Ruminant livestock already make nutrient-dense and desirable food far more efficiently than what’s grown in metal tanks. The best way to maintain a competitive edge is to invest in technologies that continue to improve animal welfare, increase animal productivity and efficiency, and reduce greenhouse gas emissions as demand for animal products scale with the world’s population.