With recent forecasts predicting lower milk prices and tighter dairy income margins ahead, is 2023 the year you explore dairy risk management options? Here’s a summary of tools available through the USDA and/or USDA’s Risk Management Agency (RMA).

Dairy Margin Coverage program

The 2023 Dairy Margin Coverage (DMC) program enrollment and coverage election period has been extended until Jan. 31, 2023.

After payments were triggered on August and September milk marketings, the October DMC margin moved above the indemnity trigger level.

The November DMC margin and potential indemnity payments will be released on Dec. 30, followed by the December 2022 margin and potential payments on Jan. 31, 2023. Based on DMC decision tool calculations as of Dec. 13, forecast margins were $10.21 per hundredweight (cwt) and $9.51 per cwt for November and December, respectively, above the top Tier I ($9.50 per cwt) indemnity trigger.

The outlook changes for 2023, however. As of Dec. 13, the DMC decision tool estimates margins below $8.50 per cwt for January-July and below $9.50 per cwt extending into August and September.

Dairy Revenue Protection

Dairy producers managing risk through the Dairy Revenue Protection (Dairy-RP) program are currently eligible to cover revenue from second-quarter 2023 through second-quarter 2024.

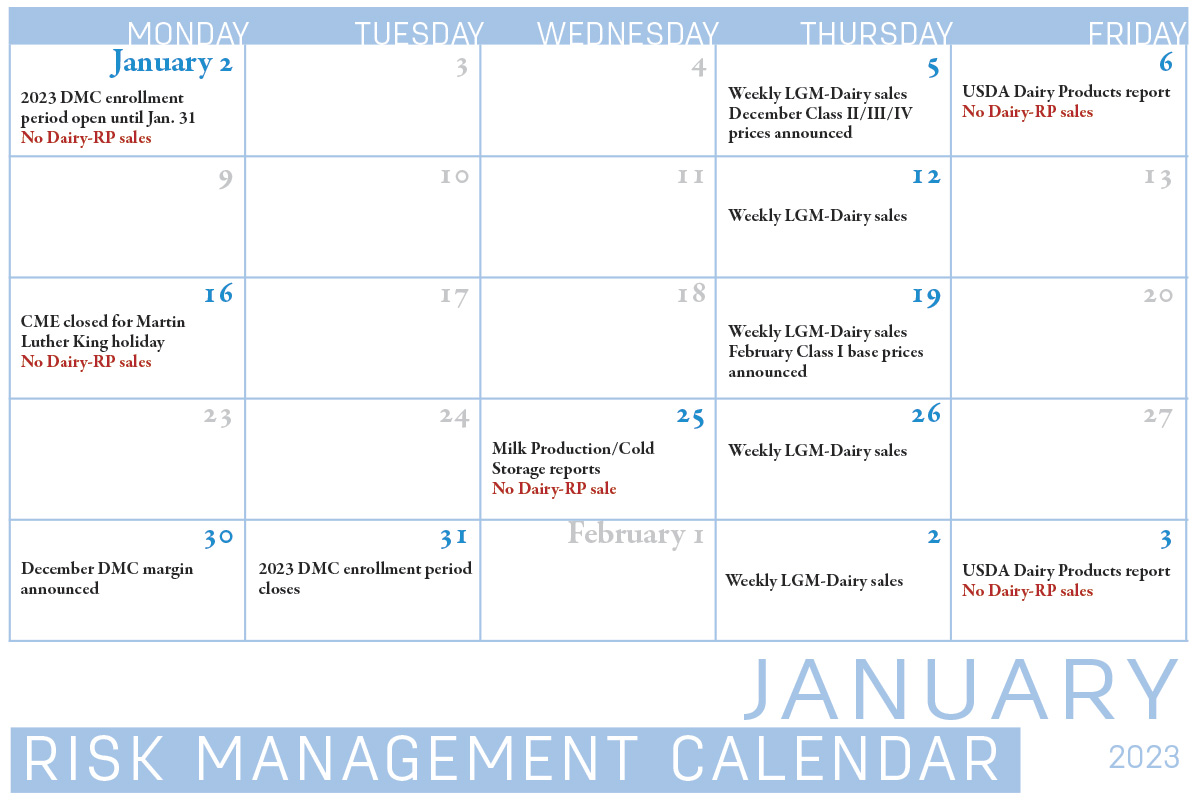

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily, and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the insurance period during the final week of January contains the months of February through December. Coverage begins the second month of the insurance period, so the coverage period for this example is March through December.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Other resources

With multiple risk management programs available to help dairy producers protect their bottom line when dairy margins fall, Pennsylvania’s Center for Dairy Excellence (CDE) created a new library of risk management resources. The library includes a new video series featuring conversations with Pennsylvania dairy farmers, case studies on specific risk management programs and more.

“Sometimes it helps to hear what other dairy farmers are doing when it comes to risk management. In our video conversations with these producers, they are not claiming to be experts, but instead, they’re giving unfiltered insight about what strategies work for them,” said Zach Myers, CDE risk education manager. “We wanted to capture this honest perspective and show that each approach to risk management can be a little different but customizable to individual operations.”

The video series features dairy producers who describe their overall risk management strategies, specific programs they use, tactics that work for them, challenges they have encountered and advice for other farmers who want to get started with risk management planning.

Along with the video series, the CDE also published three case studies about the DMC program for 2020-22 program years. The case studies give an overview of the indemnities triggered each year through the DMC program and in-depth calculations of the net benefit for farms enrolled in the program.

Visit Center for Dairy Excellence website to view these new risk management resources.

Protecting Your Profits webinar

Due to Christmas and New Year’s Day holidays, Myers will upload a prerecorded version of his “Protecting Your Profits” webinar on Dec. 22. He’ll highlight the latest Class III and IV futures milk price forecasts and share updates on DMC margins and the Dairy-RP program.

The regular live broadcast of the Protecting Your Profits webinar will return on Jan. 25, 2023. Each webinar is available via podcast or phone and is archived for viewing later. To participate, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.

USDA reports

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Dec. 9, left the 2022 U.S. milk production estimate unchanged from last month’s forecast but boosted the 2023 production forecast slightly, with both higher expected cow numbers and slightly more rapid growth in output per cow. The 2022 all-milk price forecast was raised 15 cents from last month to $25.65 per cwt. The projected 2023 all-milk price will be lower, but was raised 10 cents from last month’s estimate to $22.70 per cwt.

The USDA’s November Milk Production report, released Dec. 19, showed four-month trends of slow growth in cow numbers and a small increase in milk output per cow contributed to a 1.3% year-over-year milk production increase. Among the 24 major dairy states, November 2022 cow numbers were estimated at 8.936 million, up 48,000 from November 2021 and 1,000 more than October 2022. It’s also the highest number of cows in those states in 15 months.

Read Progressive Dairy summaries of the USDA’s Milk Production and WASDE reports.