Dairy margins were weaker over the second half of August as increasing feed costs offset mixed milk prices, according to Commodity & Ingredient Hedging LLC (CIH). Margins improved over the first half of September on stronger milk prices, while feed input costs were largely steady.

Although the U.S. dairy herd appears to be stabilizing and showing modest growth, tight margins and labor conditions, high input costs, limited processing capacity and increased regulations will deter significant expansion, CIH added. Strength in dairy product exports is helping to support milk prices, as U.S. prices remain competitive on the world market despite strength in the U.S. dollar.

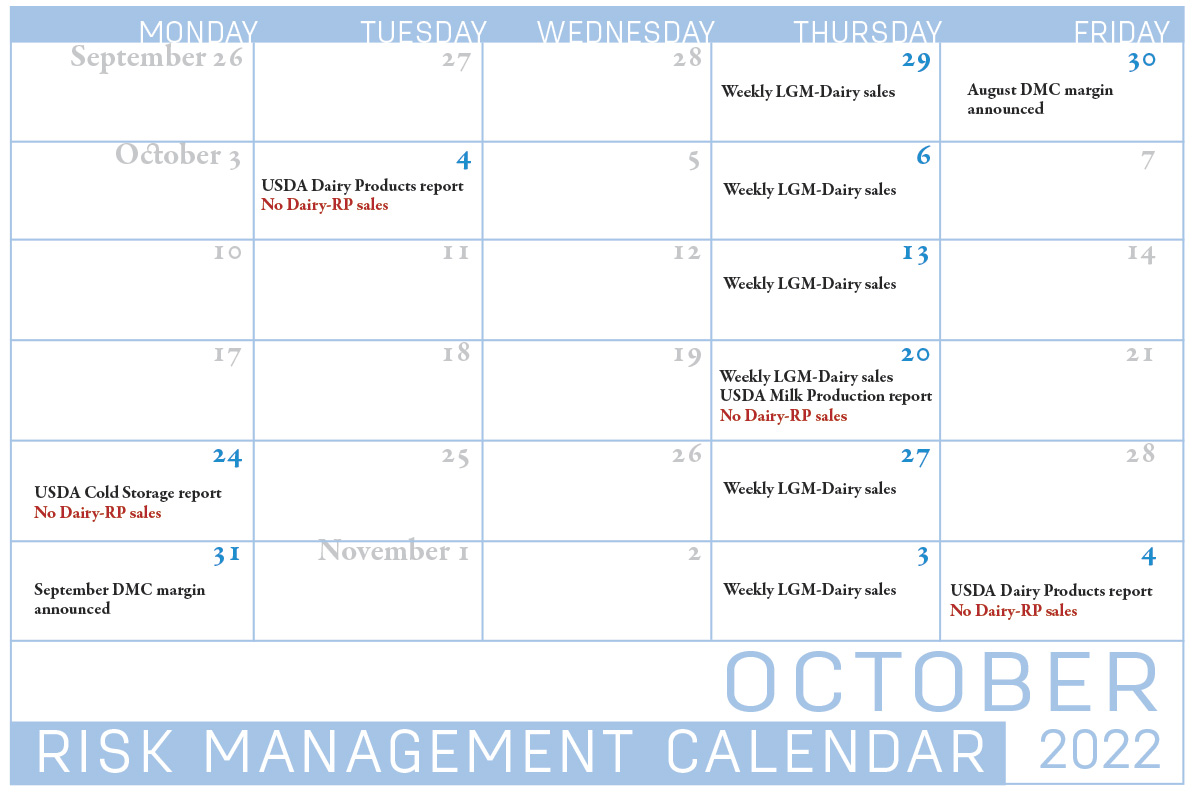

Here's a summary of tools and information to manage risks in the month ahead.

Dairy Revenue Protection

Dairy producers managing risk through the Dairy Revenue Protection (Dairy-RP) program are currently eligible to cover revenue through four quarters of 2023. The sales period for first-quarter 2023 coverage closes on Dec. 15.

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports are released that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s Risk Management Agency.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the insurance period for the Jan. 29 sales closing date contains the months of February through December. Coverage begins the second month of the insurance period, so the coverage period for this example is March through December.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report.

DMC margin shrinking

The August Dairy Margin Coverage (DMC) program margin will be announced on Sept. 30. There has been no announcement from the USDA on the enrollment period for the 2023 DMC program.

Milk prices declined and feed costs continued to rise in July, cutting into monthly dairy producer milk income over feed cost margins calculated under the DMC. The July DMC margin was $9.92 per hundredweight (cwt), down $2 from June but still above the top Tier I insurable level of $9.50 per cwt for an eighth consecutive month. However, indications are indemnity payments could be triggered this fall.

Read: DMC margin continued to shrink in July.

August uniform prices announced

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported August 2022 uniform milk prices, producer price differentials (PPDs) and milk pooling data, Sept. 11-14.

After setting record highs in most FMMOs in June, August 2022 uniform milk prices followed the downward trend started in July. Seven FMMOs saw uniform prices decline more than $1 per cwt from the month before, led by Class III milk-heavy Upper Midwest 30 and California 51.

August’s wide spread between Class III-IV milk prices continued to drive Class IV depooling. At about 835 million pounds in August, Class IV pooling across all FMMOs represented just 6.6% of the total milk pooled, the smallest volume and percentage since at least 2017. It was the sixth month so far in 2022 that Class IV pooling was below 10% of total milk pooled.

Read: August FMMO uniform prices dip, Class IV pooling plummets.

USDA milk production report

The USDA’s preliminary August milk production estimate was released on Sept. 19. Reversing last summer’s downward trend, August 2022 U.S. milk production increased as cow numbers moved higher and overcame hot weather to boost output per cow.

Preliminary August 2022 U.S. cow numbers were estimated at 9.427 million head, up 8,000 from July and pulling within 11,000 of August 2021. Among the 24 major dairy states, August 2022 cow numbers were estimated at 8.928 million, also up 8,000 from July and 11,000 less than August 2021.

Despite widespread reports of high heat and humidity this summer, growth in milk production per cow improved, with monthly production in the U.S. and major dairy states up about 35 pounds from year-ago August levels.

Read: August milk production up as cow numbers grow.

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Sept. 12, revised 2022-23 U.S. milk production estimates lower from last month, yielding slightly higher milk price projections.

Affecting production and milk marketings, estimated milk cow numbers were reduced, with slower growth in 2022 expected to carry into 2023. Output per cow was forecast to increase at a slightly more rapid pace in 2022, but the forecast for 2023 was unchanged.

Compared to a month ago, the projected 2022 annual average Class III price was raised a nickel to $21.65 per cwt. The projected Class IV price was raised 50 cents to $24.45 per cwt. The 2022 all-milk price forecast was raised 25 cents from last month to $25.45 per cwt.

For 2023, the projected Class III price was $19.70 per cwt, while the Class IV price forecast $20.85 per cwt. The projected 2023 all-milk price was $22.70 per cwt.

Read: USDA cuts 2022-23 milk production forecasts, with slight improvement in price outlooks.

CME futures

At the close of CME trading on Sept. 23, Class III prices for the fourth quarter of 2022 averaged $20.68 per cwt, for an annual average of $20.75 per cwt. Fourth-quarter 2022 Class IV futures prices averaged $23.45 per cwt, yielding an annual average of $24.27 per cwt.

Based on futures prices as of Sept. 23, Class III prices would average $20.39 per cwt in 2023, with Class IV prices averaging $21.24 per cwt.

Other resources

- Zach Myers, risk education manager with the Pennsylvania Center for Dairy Excellence (CDE), hosts a “Protecting Your Profits” webinar, Sept. 28, 12-1 p.m. (Eastern time). Myers highlights the latest Class III and IV futures milk price forecasts and share updates on DMC margins and the Dairy-RP program.

Each webinar is available via podcast or phone and is archived for viewing later. To participate, click here or phone: (646) 558-8656. When prompted, enter meeting ID 848 3416 1708 and passcode 474057.