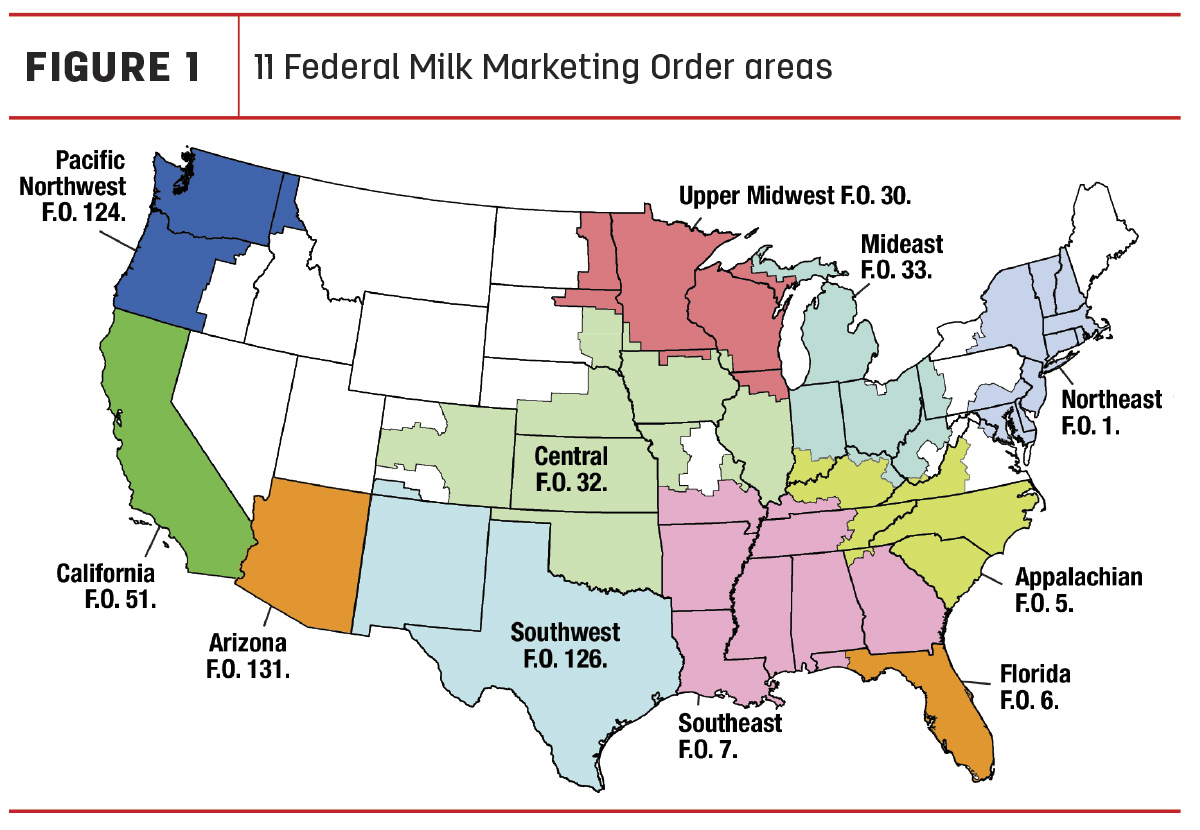

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported June 2023 prices and pooling data during the week of July 10-14. Uniform or blend prices continued to decline and Class IV milk pooling volume moved to a seven-month low.

Here’s Progressive Dairy’s monthly review of the numbers to provide some additional transparency to your milk check.

Uniform prices, PPDs

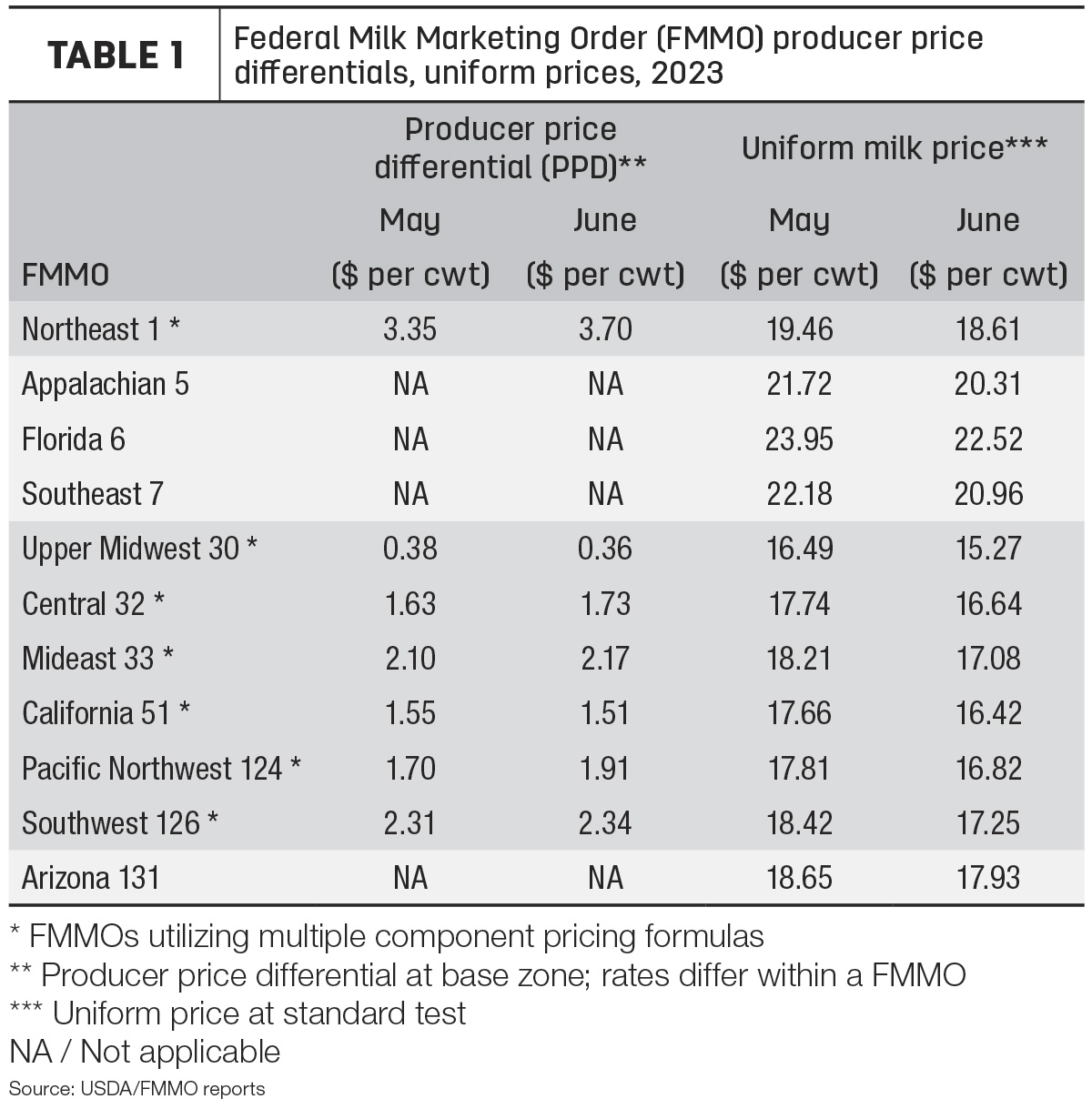

Compared with May, June 2023 statistically uniform milk prices were lower in all 11 FMMOs (Table 1). In most FMMOs, the decline was at least $1.10 per hundredweight (cwt). For Upper Midwest 30, Central 32 and California 51, the uniform prices are the lowest since February-April 2021.

The highest uniform price for the month was in Florida 6 at $22.52 per cwt, with the low in the Upper Midwest 30 at $15.27 per cwt.

Also, individual milk handlers apply premiums and market deductions to milk checks differently. For example, Progressive Dairy received copies of milk checks from the Upper Midwest FMMO 30 with a June 2023 pay price of less than $12 per cwt.

June baseline producer price differentials (PPDs) were mixed in a narrow range across all applicable FMMOs (Table 1), with a high of $3.70 per cwt in the Northeast 1 to a low of 36 cents in the Upper Midwest 30. PPDs have zone differentials, so actual amounts will vary within each FMMO.

Class prices for June

Compared to a month earlier, three of four FMMO milk class prices were down:

- Class I base price: $18.01 per cwt, down $1.56 from May and $7.86 less than June 2022 – it’s the lowest Class I base price since November 2021.

- Class I base with zone differentials: $23.41 per cwt in the Florida FMMO 6 to a low of $19.81 per cwt in the Upper Midwest FMMO 30

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($7.17 per cwt) and advanced Class IV skim milk pricing factor ($8.78 per cwt) is $1.61 per cwt, the widest spread since January 2023.

Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would have resulted in a Class I base price of $18.07 per cwt, 6 cents more than the actual price determined using the “average-of plus 74 cents” formula.

- Class II milk price: $18.83 per cwt, down 28 cents from May and $7.82 less than June 2022 – it’s the lowest since November 2021.

- Class III milk price: $14.91 per cwt, down $1.20 from May, $9.42 less than June 2022 and the lowest since May 2020

- Class IV milk price: $18.26 per cwt, up 16 cents from May but $7.57 less than June 2022

- Class III-IV milk price spread: The June 2023 Class IV milk price is $3.35 more than the month’s Class III milk price, the widest spread since last September and providing significant incentive for Class IV depooling.

Component values, tests

Contributing to the June milk class price calculations, the butterfat value held while the value of protein fell to the lowest level since February 2019.

At about $2.76 per pound, the value of butterfat was the highest since January. It’s still the sixth consecutive month the value of butterfat was below $3 per pound.

The value of milk protein fell 28.5 cents from May to about $1.51 per pound, a 52-month low.

The value of nonfat solids rose about 1.5 cents, to about 99 cents per pound, while the value of other solids dropped 6 cents, to just under 13 cents per pound, the lowest since September 2020.

Affecting statistical uniform prices “at test,” seasonal declines meant June average butterfat and protein tests in pooled milk were lower than May in FMMOs providing preliminary data.

With its high average butterfat (4.13%) and protein (3.31%) tests, producers in the Pacific Northwest 124 had the potential to see the at-test price at $19.06 per cwt, about $2.24 above the statistically uniform price. In California 51, the at-test average was $18.27 per cwt, $1.85 above the statistically uniform price. In Central 32, the at-test average was $18.15 per cwt, $1.51 above the statistically uniform price.

Impact on pooling

With one less day of production compared with May – combined with Class IV depooling – overall June FMMO milk pool volume was down about 830 million pounds in June at 12.64 billion pounds. The USDA releases June milk production estimates on July 20, determining the percent of U.S. milk production pooled through FMMOs.

June Class I pooling was down about 222 million pounds from May and at 3.13 billion pounds represented about 25% of total milk pooled. Class II pooling was down 13 million pounds to 1.2 billion pounds, representing about 9.5% of the total pooled.

Compared to a month earlier, June brought a little less Class III milk to the pool, while higher-value Class IV milk declined even more. At 7.33 billion pounds, Class III pooling represented about 58% of the total pool (Table 2), the highest percentage in several years. Class IV pooling across all FMMOs decreased another 392 million pounds from May and represented about 7.7% of the total milk pooled (Table 2). It was the lowest Class IV volume and percentage pooled since December 2022.

Looking ahead

July 2023 uniform prices and pooling totals will be announced around Aug. 11-14. The outlook for July prices is again lower:

- Class I base price: Already announced, it is $17.32 per cwt, down 69 cents from June and $8.55 less than July 2022. It is the lowest Class I base price since October 2021.

- Class I base with zone differentials: A high of $22.72 per cwt in the Florida FMMO 6 to a low of $19.12 per cwt in the Upper Midwest FMMO 30

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($5.33 per cwt) and advanced Class IV skim milk pricing factor ($8.94 per cwt) is $3.61 per cwt, the widest spread since October 2022.

Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $18.34 per cwt, about $1.02 more than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: July Class II, III and IV milk prices will be announced on Aug. 2. As of the close of trading on July 14, the July Chicago Mercantile Exchange (CME) Class III milk futures price closed at $13.82 per cwt, down more than $1 from June; the July Class IV milk futures price closed at $18.17 per cwt, down 9 cents from June.

- Class III-IV milk price spread: Based on those futures prices, Class IV milk handler depooling incentives jump even more in July, with the Class IV-III price spread hitting $4.35 per cwt, the widest since August-September 2022.

As always, markets change.

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released July 12, left the 2023 milk production estimate but reduced 2024 production expectations slightly. The outlook for prices continues to weaken for both years.

Read: USDA outlook sees little change in 2023-24 milk production but weakening prices

DMC summary

One life preserver in the turbulent milk marketing waters is the Dairy Margin Coverage (DMC) program. At $4.83 per cwt, the May DMC margin triggered Tier I indemnity payments at all coverage levels from $5 to $9.50 per cwt, with a top payment of $4.67 per cwt at the maximum $9.50 coverage level.

The May 2023 margin continued to be what looks like a lengthy stretch of extremely small margins and high indemnity payments into July-August. Based on the DMC decision tool as of July 14, forecast margins dip to about $4.34 per cwt for June (announced July 28) and just $3.85 per cwt for July (announced Aug. 31).