Update highlights

- Replacement cow prices higher

- Market cow prices hit $107 per cwt

- Dairy product inventories mixed

- All-milk, mailbox price spread steady in April

- ICYMI (In case you missed it)

- Coming up

Replacement cow prices higher

Prices for U.S. replacement dairy cows moved higher in July, despite weakening milk prices and shrinking income margins, according to latest quarterly estimates in the USDA's Ag Prices report.

U.S. replacement dairy cow prices averaged $1,760 per head in July 2023, up $40 (2%) from April 2023 and up $50 (3%) from July 2022. Quarterly average prices were still about 17% below the last peak of $2,120 per head in October 2014.

Market cow prices hit $107 per cwt

There was a positive in the USDA Ag Prices report: U.S. average prices received for cull cows (beef and dairy, combined) in June averaged $107 per hundredweight (cwt), up $4 from May and the highest monthly average since August 2015.

Dairy product inventories mixed

Cheese inventories in cold storage were up slightly to end June, while supplies of butter were down. According to the USDA’s monthly Cold Storage report, released July 25:

- Total natural cheese stocks were estimated at about 1.51 billion pounds, up 1% from May 31, 2023, and up about 5 million pounds from a year earlier. Stocks of American cheese were estimated at about 853 million pounds, up 1% from the previous year but down 3.8 million pounds from the previous month.

- Butter stocks were estimated at 347.5 million pounds, down 6% from the previous month but 5% more than the previous year.

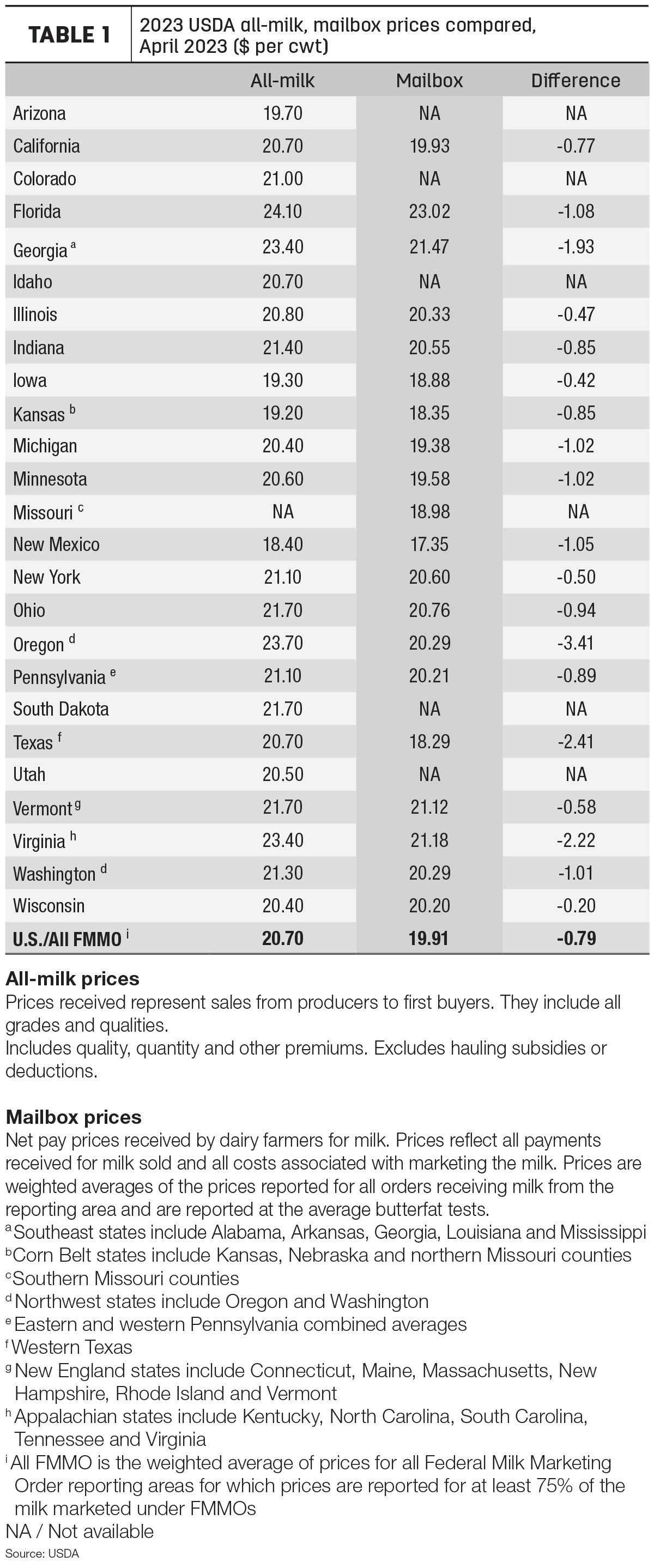

All-milk, mailbox price spread steady in April

April 2023 “mailbox” prices averaged about 79 cents per cwt less than announced average “all-milk” prices for the same month, based on a preliminary look at two USDA milk price announcements. The spread was 78 cents in March.

- During April, U.S. all-milk prices averaged $20.70 per cwt, down 40 cents from March 2023. All-milk prices are reported monthly by the USDA National Ag Statistics Service (NASS). The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

- The April 2023 mailbox prices for selected Federal Milk Marketing Orders (FMMOs) averaged $19.91 per cwt, down 41 cents per cwt from March. The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) and generally lag all-milk price announcements by a month or more.

As Progressive Dairy notes each month, there’s a disclaimer of sorts. Comparing the all-milk price and mailbox price isn’t exactly apples to apples. The price announcements reflect similar – but not exactly the same – geographic areas.

In Table 1, Progressive Dairy attempts to align the state-level all-milk prices and the FMMO marketing area prices as closely as possible. The April spread between individual states or regions varied widely, with a difference of -$3.41 per cwt in Oregon and -42 cents per cwt in Iowa.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the Dairy Margin Coverage (DMC) are based on the all-milk price, while Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are based on FMMO class and component prices.

ICYMI (In case you missed it)

- Fed raises interest rate another 0.25%. Meeting on July 25-26, the Federal Reserve Board raised interest rates by 0.25%, boosting the federal funds rate to 5.5%. The next meeting of the Federal Open Market Committee is scheduled for Sept. 19-20.

-

June 2023 DMC payments are large. Despite lower feed costs, declining milk prices drove dairy producer margins calculated under the DMC program to new lows. Here are the June 2023 DMC numbers (compared to May) at a glance:

- Total feed costs: $14.25 per cwt, down 22 cents

- Milk price: $17.90 per cwt, down $1.40

- Margin above feed cost: $3.65 per cwt, down $1.18

- Tier I indemnity payment at maximum $9.50 per cwt coverage: $5.85 per cwt

For more, read: June 2023 DMC margin falls below ‘catastrophic’ floor

Coming up

Check the Progressive Dairy website for other updates this week, including the announcement of July FMMO Class II-III-IV milk prices and DMC year-to-date indemnity payment totals. Third- and fourth-quarter milk futures prices are also showing some signs of recovery.