While the promise of cooler weather and fall are quickly approaching, moisture conditions continue to determine the availability of winter feed. As the hope for heavy rains during the growing season declines, producers are preparing to make the most of what they have and brace for impact this winter. Take a closer look at prices and conditions in each region in the Progressive Forage Forage Market Insights column as of Sept. 5, 2023.

Moisture conditions decrease

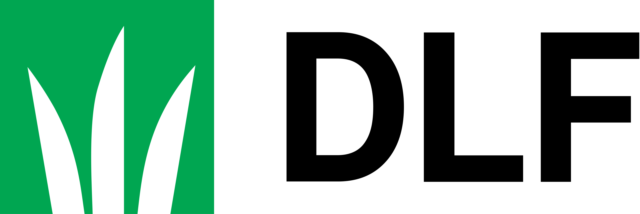

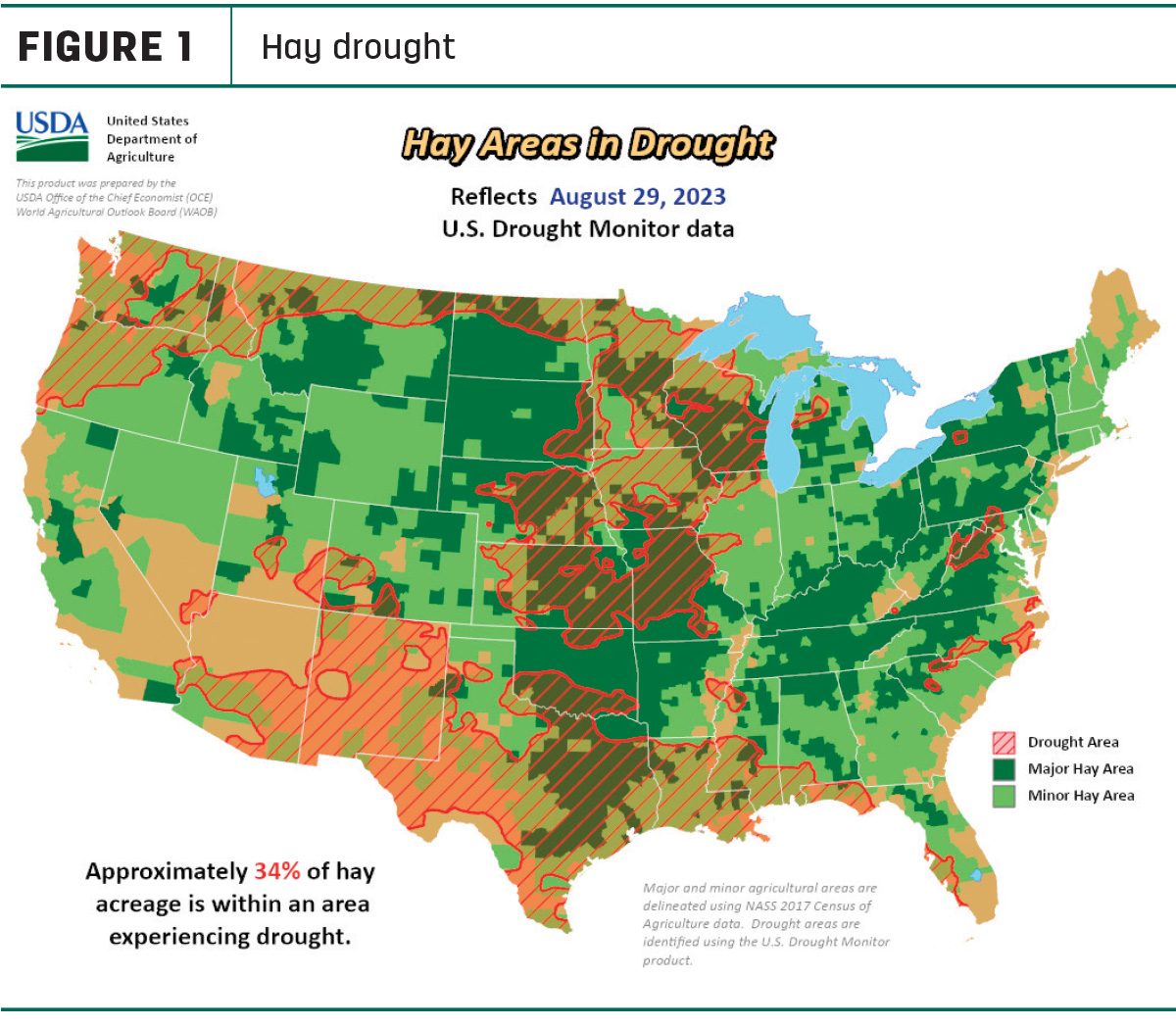

With reports of heavy rainfall in some parts of the country, overall U.S. Drought Monitor maps indicate drought areas that are in drought to be prevalent still. As of Aug. 29, approximately 34% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 30% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions increased slightly to 33% from 31% the month prior.

A snapshot of hay prices

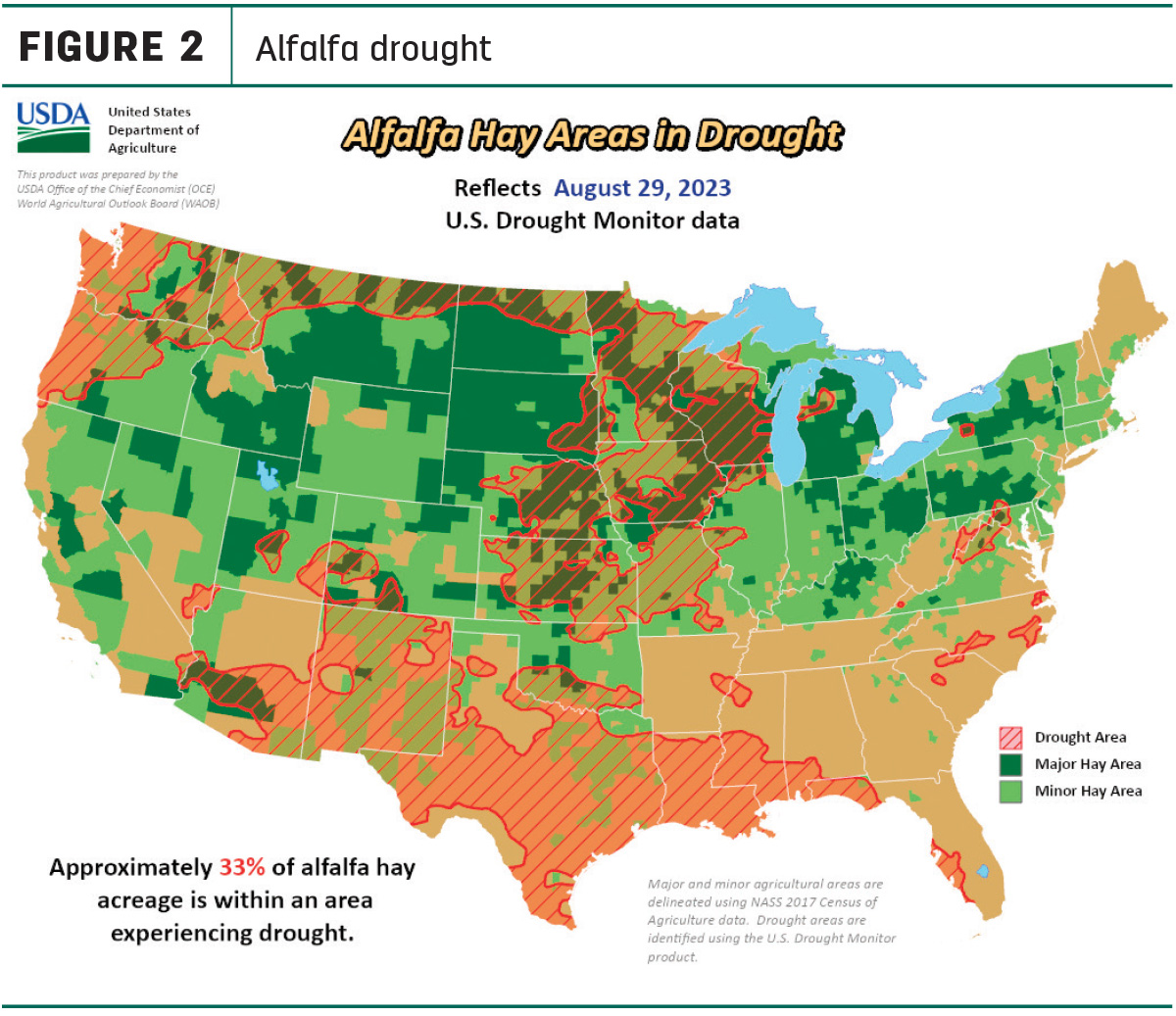

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

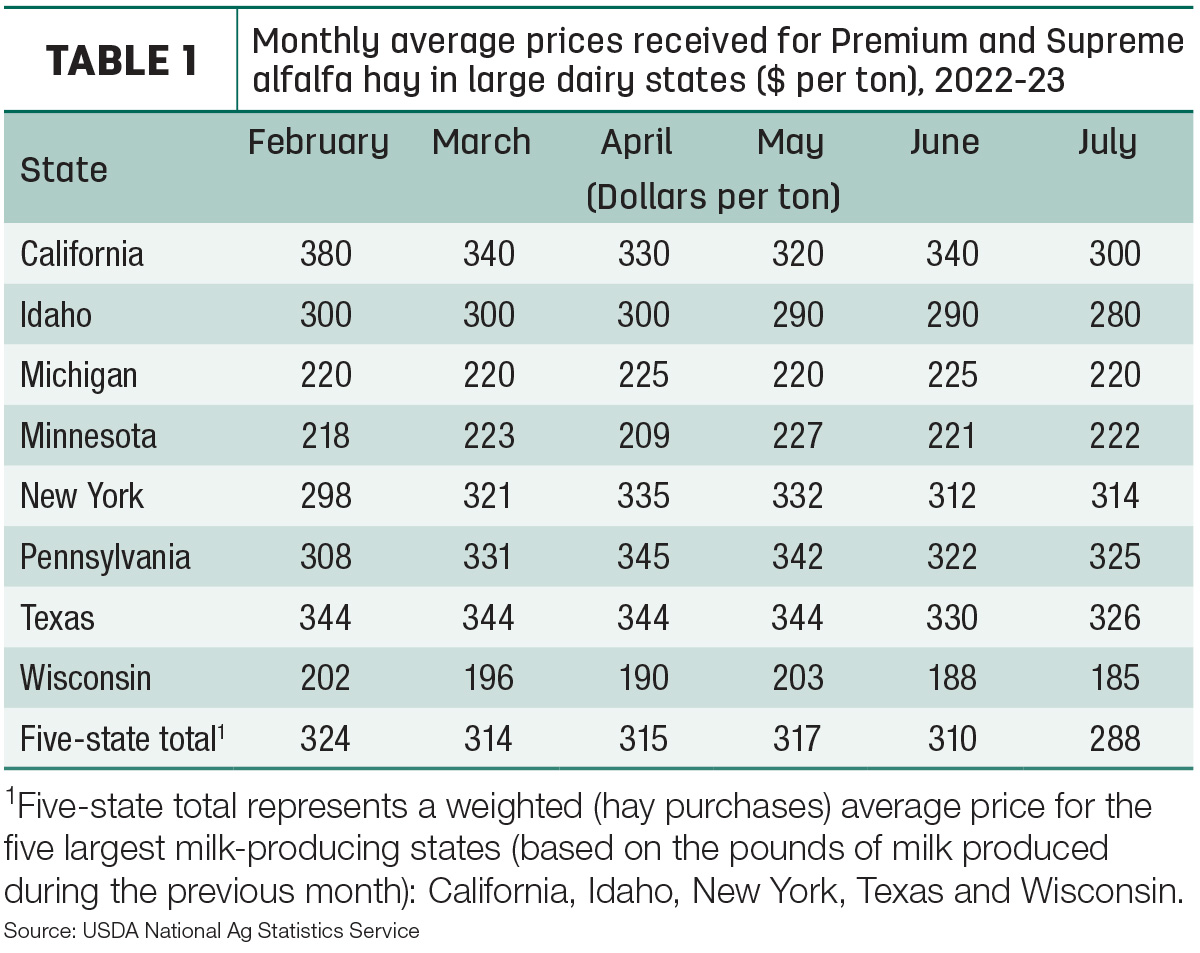

Dairy hay

The top milk-producing states reported a price of $288 per ton of Premium and Supreme alfalfa hay in the month of July, a $22 decrease from June of this year. The price is $45 lower than what was reported in July 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, reports of steady hay sales are coming in across the board. Demand was light in most areas, and good demand was noted in the eastern part of the state. Hot and dry weather is still present, but silage chopping, baling of cane hay and high-moisture corn harvest are beginning.

In Kansas, prices remain steady, while demand and trade activity have slowed. While many producers are reported to be in their third cutting, hot and dry weather still dominates the majority of the days. Drought conditions are worsening as the dry weather persists.

In South Dakota, alfalfa hay sales are being reported as steady to weak. Producers are holding steady against current asking prices and moderate demand persists. Haying from Conservation Reserve Program (CRP) lands are putting pressure on the normal hay market, yet high-testing hay is still in high demand as a result. As corn silage harvest wraps up, very hot weather still continues.

In Missouri, fall is in the air as cooler temperatures are allowing grain harvest to start. Some warm weather reprieve to enable pasture growth is a welcome addition. Prices remain steady for alfalfa as fall haying is still ongoing. Overall supply is reported as light while demand is moderate.

- East: In Alabama, trade is moderate with good supply and moderate demand. Steady prices all around were reported.

In Pennsylvania, alfalfa and grass mixes sold strong, while orchardgrass sold steady. Prairie/meadow grass sold light in comparison to alternatives. Wheat straw sales all reported as steady, while overall trade for all mixes was moderate demand on moderate to heavy supply.

- Southwest: In California, trade and activity were moderate. Demand for retail hay was good. Demand for tested dairy hay was good. Export demand for hay was moderate. Producers are preparing for rice and corn harvests. Worm damage was reported in a large portion of alfalfa crops.

In New Mexico, alfalfa hay sold steadily. Demand is good, while trade remains active. Alfalfa hay is over 90% finished with third cutting at least in most parts of the state, while many producers are finishing fourth or even fifth cutting. Some scattered showers are reported in some areas of the state, while other areas remain in desperate need of rainfall. Monsoon rains were subpar at best, and the drought conditions worsen as the monsoon season wraps up and much of the state’s chances at significant rainfall are decreasing.

In Oklahoma, not much movement of hay is being reported, while hay is slow to steady. The state needs some rain as drought conditions worsen.

In Texas, hay prices are mostly steady across the majority of regions. With the exception of the south, prices were still very good with firm buyer demand. Trade activity was good with steady demand. Seventy-two percent of rangelands are in poor to very poor conditions due to drought.

- Northwest: In the Columbia Basin, export and domestic hay remains steady. Interest from exporters is increasing as overseas contracts are gaining. More producers are opting to produce stable or retail hay rather than export hay while trade overall is slow. Demand seems to be picking up slightly.

In Montana, all hay prices were generally steady. Light demand is reported for local hay and moderate for hay to ship out of state. The northern half of the state has seen an uptick in Canadian buyers recently who are interested in higher-quality hay. Market activity continues to improve as more action is being seen each week.

In Idaho, not many sales have been reported to determine accurate trends. Most of the trade area has received some moisture recently, and drought conditions are improving. Demand is reported as light to moderate.

In Colorado, both trade activity and demand have softened, and hay trades are slow as third cutting is still in progress across the state. Areas that have received a lot of rain are struggling to put up quality hay that has not been rained on at some point.

In Wyoming, demand was light to moderate with all reported hay sales being steady. Many producers in the east are in their third cutting, while producers in the central and west remain on the second.

Other things we are seeing

- Land value increases: Average U.S. agricultural land values and cropland rental rates increased in 2023. U.S. farm real estate value, a measurement of the value of all land and buildings on farms, averaged $4,080 per acre for 2023, up $280 per acre from 2022. Cropland value averaged $5,460 per acre, an increase of $410 per acre from the previous year. Pasture value averaged $1,760 per acre, an increase of $110 per acre from 2022. More info can be found on page 14 of the Oct. 1 issue of Progressive Forage.

- Dairy: U.S. dairy exports ended the first half of 2023 weaker, and the USDA’s latest quarterly forecast indicates that trend could continue into next year. Compared to a year earlier, January-June 2023 U.S. dairy export volume fell 5% and value declined 10%, according to the U.S. Dairy Export Council’s U.S. Dairy Exporter Blog. May 2023 “mailbox” prices averaged about 77 cents per hundredweight (cwt) less than announced average “all-milk” prices for the same month, based on a preliminary look at two USDA milk price announcements. May U.S. all-milk prices averaged $19.30 per cwt, down $1.40 from April 2023. The May 2023 mailbox prices for selected Federal Milk Marketing Orders (FMMOs) averaged $18.53 per cwt, down $1.38 per cwt from April.

- Cattle: According to the USDA’s latest Cattle on Feed report, cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of at least 1,000 head totaled 11 million head on Aug. 1, 2023, 2% below year-ago levels. Perhaps the report’s biggest surprise to many industry experts was feedlot placements during the month of July, which totaled 1.62 million head, a full 8% below 2022. While placements were largely expected to be down from a year ago, most industry experts predicted the decrease to be close to 5%.

- Fuel: Fuel prices remain steady across the board, according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.60 per gallon. The average U.S. retail diesel price was around $3.88 per gallon.

- Trucking: Spot flatbed prices ticked down over the month of August, with a change in average price of 1%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.60, South-central – $2.47, Midwest – $2.64, South – $2.60, Northeast – $2.44 and West – $2.26.