The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), estimated the Aug. 1 feedlot inventory at 11.03 million head, over 2% below 11.289 million head in the same month last year.

As anticipated, feedlot net placements in July were 9% lower year over year at 1.553 million head. However, marketings in July tallied 1.727 million head, down about 5% year over year.

The year-over-year decline in marketings was largely expected with tighter cattle supplies.

For example, two of the three largest cattle-feeding states, Texas and Nebraska, were holding 9% and 37% fewer cattle on feed over 150 days as of Aug. 1 than a year ago – that is, these feedlots had fewer market-ready cattle available than at the same time last year.

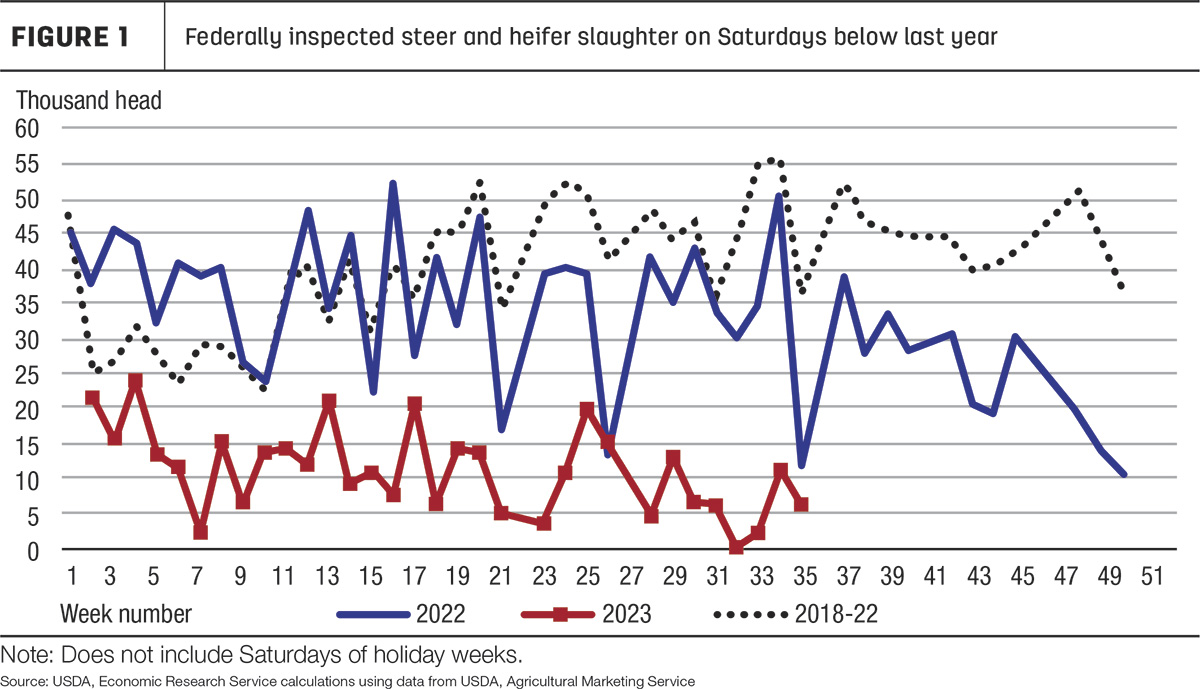

Recently, however, packers have further curbed the pace of fed cattle slaughter, principally by a reduction in processing on Saturdays, as shown in Figure 1.

Reflecting on the anticipated pace of cattle slaughter in 2023, the beef production outlook for 2023 is fractionally lower than last month at 26.9 billion pounds. There is a reduction in third-quarter beef production that reflects a slower-expected pace of fed cattle slaughter in September, which is partially offset by slightly higher average carcass weights and higher anticipated cow slaughter in September and the fourth quarter. For 2024, the beef production forecast remains unchanged from last month at 25.2 billion pounds.

Cattle prices mostly unchanged from last month

In August, the weighted-average price for feeder steers weighing 750 to 800 pounds at the Oklahoma City National Stockyards was $248.73 per hundredweight (cwt). This was an increase of $4.51 from July and nearly $75 higher than August 2022. In the sale on Sept. 11, feeder steers set a new record at $251.94 per cwt. Accounting for recent price strength, the third-quarter price forecast for feeder steers is unchanged at $250 per cwt, but the fourth quarter is raised $4 to $259 per cwt. That price strength was carried into the first part of 2024, and the forecast of the annual prices is raised $1 to $254 per cwt.

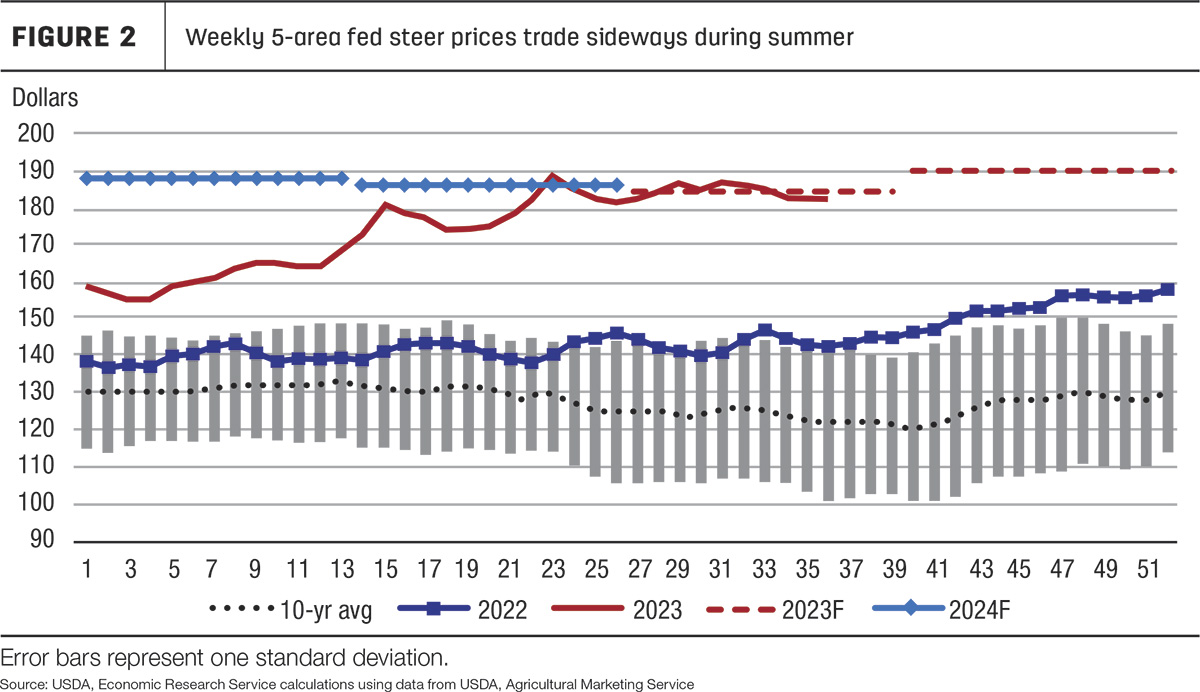

Over the last four weeks, wholesale boxed beef values have bounced back after retracting from this year’s highs set in June. However, fed cattle prices have not responded similarly (Figure 2). The August average price for fed steers in the 5-area marketing region was $184.85 per cwt, nearly flat since June but $41 higher year over year. This situation has allowed packer margins to improve during this time, and coupled with expected higher seasonal beef demand and tightening fed cattle supplies, prices are not expected to fall further. As a result, the fed steer price forecast is unchanged at $178.50 per cwt and unchanged for next year at $186 per cwt.

Beef exports face continuing challenges; export forecast lowered

U.S. beef exports continue to face a multitude of economic headwinds and have fallen significantly from last year’s record levels. On top of fewer exportable supplies due to lower domestic production, U.S. beef is more expensive on the global market due to the combination of higher domestic beef prices and rising exchange rates to some of the top markets. Exporters are also facing weaker demand in parts of Asia due to economic slowdowns and increased competition from Australia. All of these challenges combined to push July monthly exports down to 240 million pounds, nearly 22% lower year over year and 15% below the five-year average. Year-to-date exports are down 13% year over year but only 1% lower than the five-year average.

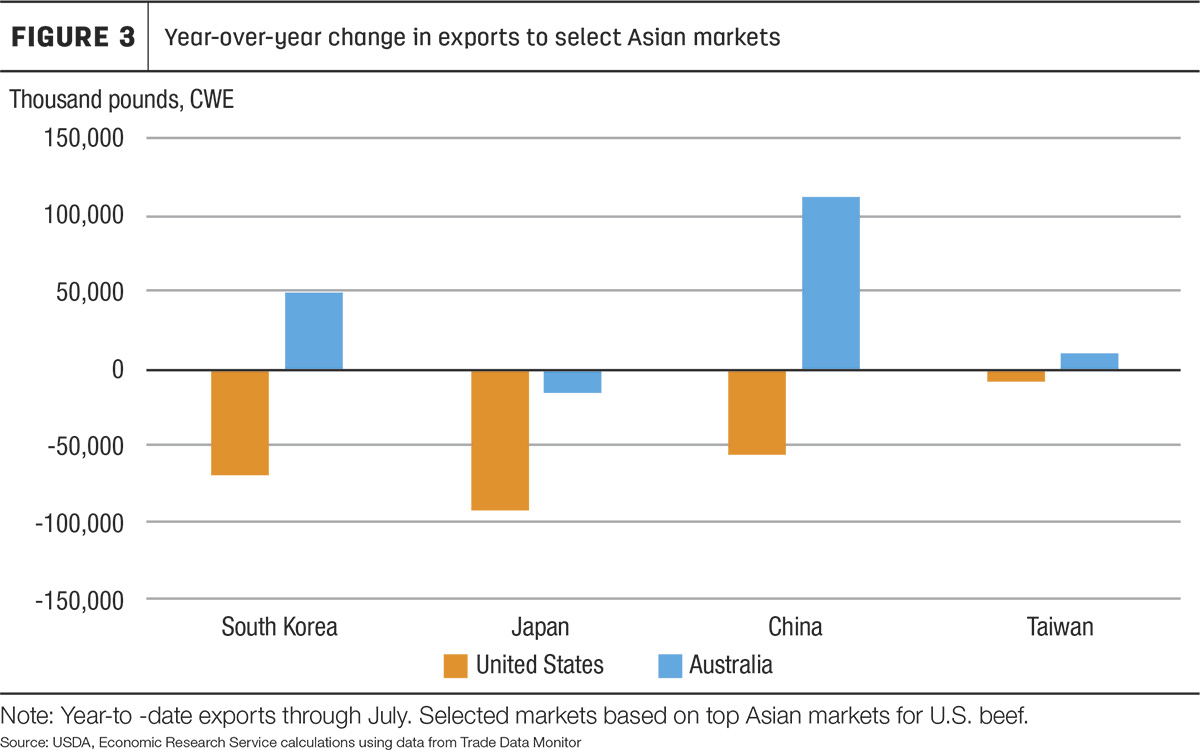

South Korea remains the top destination for U.S. beef so far this year, though exports to the country have fallen since March, decreasing to less than 47 million pounds in June, 26% lower year over year. Exports to Japan have been consistently low since March and fell 37% below a year ago in July. Exports to China in July dropped more than 10 million pounds from June and more than 35% lower year over year. Exchange rates to these top three beef markets have been mostly climbing throughout the year, making U.S. beef more expensive. In addition, beef exports from Australia to China and South Korea have increased more than 40% and 20%, respectively, and the unit value of beef exports from Australia is lower year over year. Figure 3 shows U.S. and Australian beef exports through July to the top four Asian markets for U.S. beef. U.S. exports to all four countries have declined, while Australian exports to most of these markets have increased compared to the same period last year.

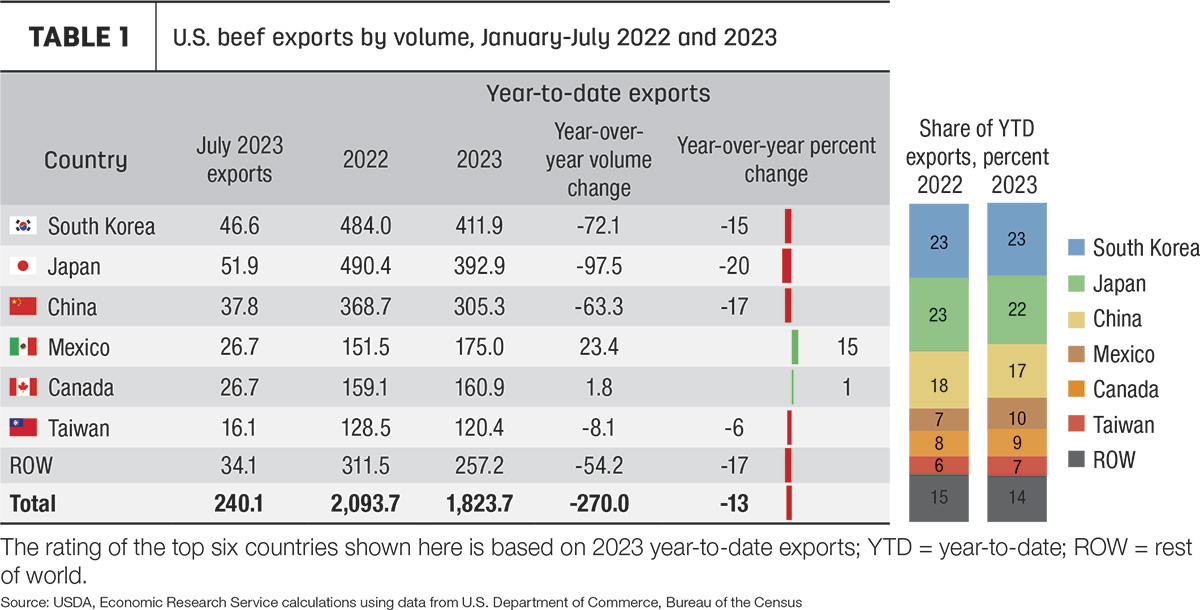

As shown in Table 1, among the top six markets, year-to-date exports are down to every country except those in North America. Exports to Mexico are up 15%. The exchange rate between the U.S. and Mexico has declined throughout the year, more than offsetting increases in unit values and making U.S. beef more affordable compared to last year. Exports to Canada are up just over 1% from last year. Although not depicted in Table 1, year-to-date exports to Hong Kong are up nearly 23% year over year; this year has been the first year-over-year increase since 2018.

Based on the current pace of exports and expected lower demand from Asia, the third-quarter forecast is lowered 100 million pounds to 740 million, and the fourth-quarter forecast is lowered 60 million pounds to 730 million. The annual export forecast is 3.054 billion pounds, a year-over-year decrease of nearly 14%. With fewer exportable supplies and expected challenges to the price-competitiveness of U.S. beef on the global market in 2024, the annual forecast for 2024 is lowered 70 million pounds to 2.9 billion pounds. This would be a year-over-year decrease of 5% and the lowest level of annual exports since 2017.

Beef import forecasts raised on greater supplies from Oceania

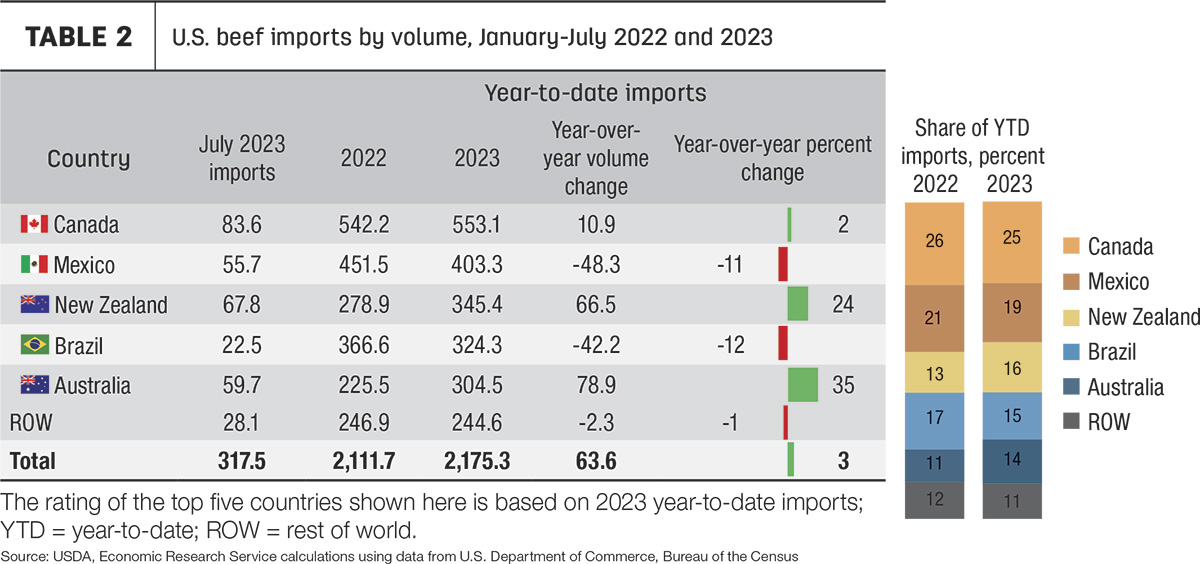

As mentioned above, Australia has been exporting significantly more beef this year, including to the United States. U.S. imports of Australian beef in July were nearly 60 million pounds, almost double the 31 million pounds from a year ago. Year-to-date imports from Australia are up 35% year over year (Table 2). Imports from New Zealand are also up significantly this year, with July coming in at 68 million pounds, also nearly doubling the amount from a year ago. The combined share of year-to-date imports from Oceania has increased year over year from 24% to 30%, offsetting declines in market share from Brazil and North America.

Year-to-date imports from Brazil and Mexico are down 12% and 11%, respectively. Imports from Brazil have decreased throughout most of the year, following a similar pattern from last year. The tariff rate quota under which beef from Brazil enters the U.S. was filled in early May, subsequently resulting in a higher tariff on beef imports from Brazil.

After four years of fresh beef imports outpacing frozen imports, frozen imports are higher than fresh this year. This is mostly due to the rise in imports from Australia and New Zealand compared to imports from North America, as frozen product is often more convenient for longer transportation. According to import inspection data from the USDA Food Safety and Inspection Service, imports of cuts and primals and subprimals through the first half of the year have decreased, while imports of boneless manufacturing trimmings have increased. The increase in boneless manufacturing trimmings has mostly been driven by Australia and New Zealand, while the decrease in imports of primals and subprimals has been mostly from Brazil. The decrease in cuts results mainly from lower imports from Mexico.

Due to higher expected supplies from Oceania, the import forecasts for the third and fourth quarters are raised 20 and 15 million pounds, respectively, for an annual 2023 forecast of 3.547 billion pounds. This would be a year-over-year increase in imports of nearly 5%. The import forecast for 2024 is raised 30 million pounds to 3.59 billion pounds on greater imports from Oceania.