One of my first jobs was as a swim instructor for young children who had never been in a pool before. A few of them jumped right in and instinctively made progress, but more often they were hesitant and a little fearful of the unknown. I had to build their confidence in themselves and their trust in me until they had enough courage to let go of the wall and get started. I never had anyone learn to swim without letting go of the wall. So often in life, it takes a leap of faith to make meaningful progress toward the result we desire.

For several decades now, my partners and I have been working with families on planning how to reduce the transfer costs on their estates, building a succession plan to transfer the management of their farm to the next generation and designing an ultimate exit plan that is fair to all parties. And just like when we were in the swimming pool, nothing happens until the current generation (that’s you) takes the leap of faith to let go of the wall and get started. We have found that building trust with an adviser who has expertise in both the technical aspects and family dynamics can help you find the confidence to take this on, even if you don’t understand the particular ins and outs of how to accomplish your goals.

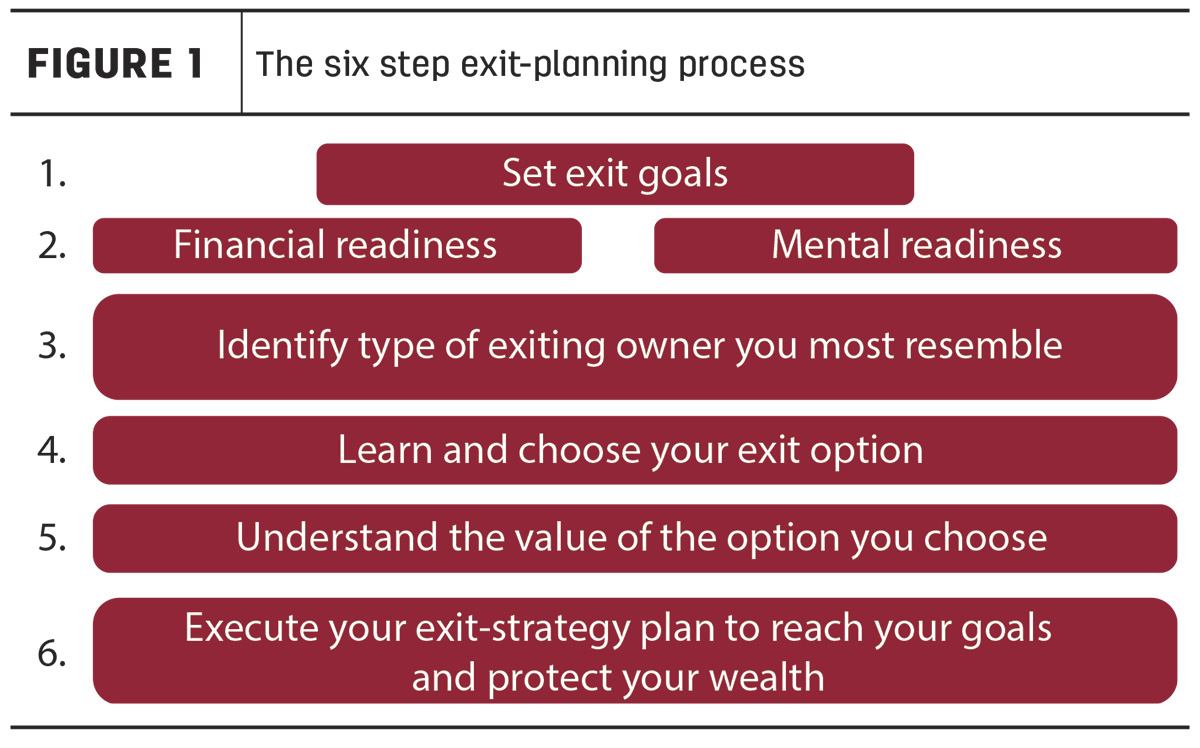

To help build that trust, as advisers we try to say what we will do and then do what we say. To help with that, we introduce families to our six-step process early on and then we frequently refer back to the picture in Figure 1 so they can see the progress they are making. Our clients have found that seeing the process in writing helps remove some of the mystery that surrounds succession and exit planning and helps them to think of this project in smaller, more manageable pieces. Let’s explore this a little further.

We have chosen to adopt this process created by The International Exit Planning Association (IEPA). They are also the governing body for the Certified Business Exit Consultant (CBEC) designation.

If this topic interests you, chances are you are thinking about how you (or perhaps your parent) can slow down or step out of your operation while still maintaining some control, financial security, family legacy and income. You may also be concerned about if your family member is capable of running the business, how you will handle them making different decisions than you and, in some cases, if your ego can handle them growing bigger and better than you.

Step one involves setting exit goals and is where we put these issues on the table in a safe environment and begin to determine what is most important to you regarding your financial security, your family and the enterprise and employees that have helped you build it.

Our next step measures your financial and mental readiness to make a transition. Knowing where you stand today relative to your succession goals, even if the transition is expected to be many years in the future, may help you make better decisions as you operate day in and day out, knowing what your long-term destination is.

In step three, we help you identify the type of exiting or transitioning owner you have the most in common with. The IEPA identifies four categories of business owners: “stay and grow,” “well-off but choose to work,” “rich and ready to go” and “get me out at highest price” (Figure 2).

We walk you through a series of statements for you to either agree, somewhat agree or disagree with to help you discover which quadrant you are in. Some examples are:

- The value of my privately held business is less than 50% of my total net worth.

- I have a specific written plan in place for how I would invest the cash I would receive if I were to exit my business today.

- I have prepared myself by understanding the legal and tax implications of a business transition, and I’m confident that I’m ready for those aspects of the business transfer.

If you have other stakeholders in your operation, whether it is a partner, spouse or other family member, we will do this for them, also. Often, we find that the stakeholders are not in alignment. When that is the case, finding a way to reach a consensus is critical to being able to move forward successfully.

Each of these categories or quadrants has a different set of exit paths that are appropriate. As you reflect upon your work from steps one and two, knowing which type of owner you are most like will help you choose the strategy that is your best fit.

Step four is where you do a deeper dive into the strategy that seems to make the most sense for you. Whether you think you will be gifting to family members, selling to family members, selling to your management team or an unrelated third party, or contemplating one of the other succession/exit paths, it is important to understand the details and cost/benefit analysis before you move forward. Following the process this way versus letting a promoter of a particular transaction drive things forward may save you the time, money and heartache that pursuing the wrong path may cost. No matter how pretty the shoe, if it doesn’t fit it’s not going to work out. This is no different.

This leads us to step five, which is understanding the value of the path you are interested in. A synergistic sale to a motivated third party that believes your cattle ranch or dairy when added to theirs will be equal to more than the sum of the parts will likely bring you the highest price. You may want to use the lowest defensible valuation if you are considering gifting your dairy to your children. If you like the tax benefits of an Employee Stock Ownership Plan, that requires using a fair market valuation. Each path brings its own valuation, which means it isn’t so easy to answer the question of “What is my business worth?” At this point in the process, you have set your goals, measured your financial and emotional readiness, which also means that you have an understanding of how much you need to receive from your business going forward and you know what transfer strategy is likely to fit you best. To further test that fit, this is where we estimate the value your choice of exit path may bring and see if that meets the needs of your personal financial plan.

The last step is to build your team of advisers who are well-versed in the path you have chosen. That may be a group that will help you make progress toward your goal over a period of years, or it may include knowledgeable professionals in a particular type of transaction, if you are ready to go now.

It is important to note that as you think about all you have accomplished and where you want to go, time is your friend, but it is not a good reason to put off this planning. It has been said that everyone should have two exit plans. One for where they control each of the circumstances, including their health, timing, business cycles, needs of the next generation, etc. and another plan for when the circumstances are the boss.

Whether you have a dairy, cattle ranch or some other type of business, chances are that it is your most valuable asset. Planning for its longevity and success is best done in parallel with planning for your longevity and success. We always include personal financial planning as part of any succession or exit plans we get involved in. Coordinating your business plan with your personal financial plan is important to helping you achieve success for yourself, your spouse, your family and, if appropriate, your employees. You’ve worked hard to get here, and the people who admire you believe you have this all figured out. Take that leap of faith and get started today.

This article is Part 1 in a multipart series. Read Part 2 here.

Mark Sherin is a registered representative of and offers securities and investment advisory services through Lincoln Financial Advisors Corp. (member SIPC). Lincoln Financial Advisors and its representatives do not offer tax or legal advice. Progressive Dairy is not affiliated with Lincoln Financial Advisors Corp. This article is provided for information purposes only. Readers should consult their own professional advisers for specific advice tailored to their needs. Information contained in this article may be subject to change without notice.