The Greek philosopher Epictetus once said, “First say to yourself what you would be, and then do what you have to do.”

You’ve been building your farm for years, and you’ve somehow acquired a land base, buildings, equipment and other assets. Most significantly, you’ve also built up people that have helped you realize your success. Your family, your employees, your customers and your community may look at you with a certain admiration and confidence that you have done what it takes to secure the future. That’s part of the legacy they think you’ve created.

However, we know that, if you are like most of your peers, securing the future of your business is something you have put off, probably because you aren’t sure how best to tackle it. Succession planning is about securing that future – for your family, your enterprise, your employees, your customers and your community.

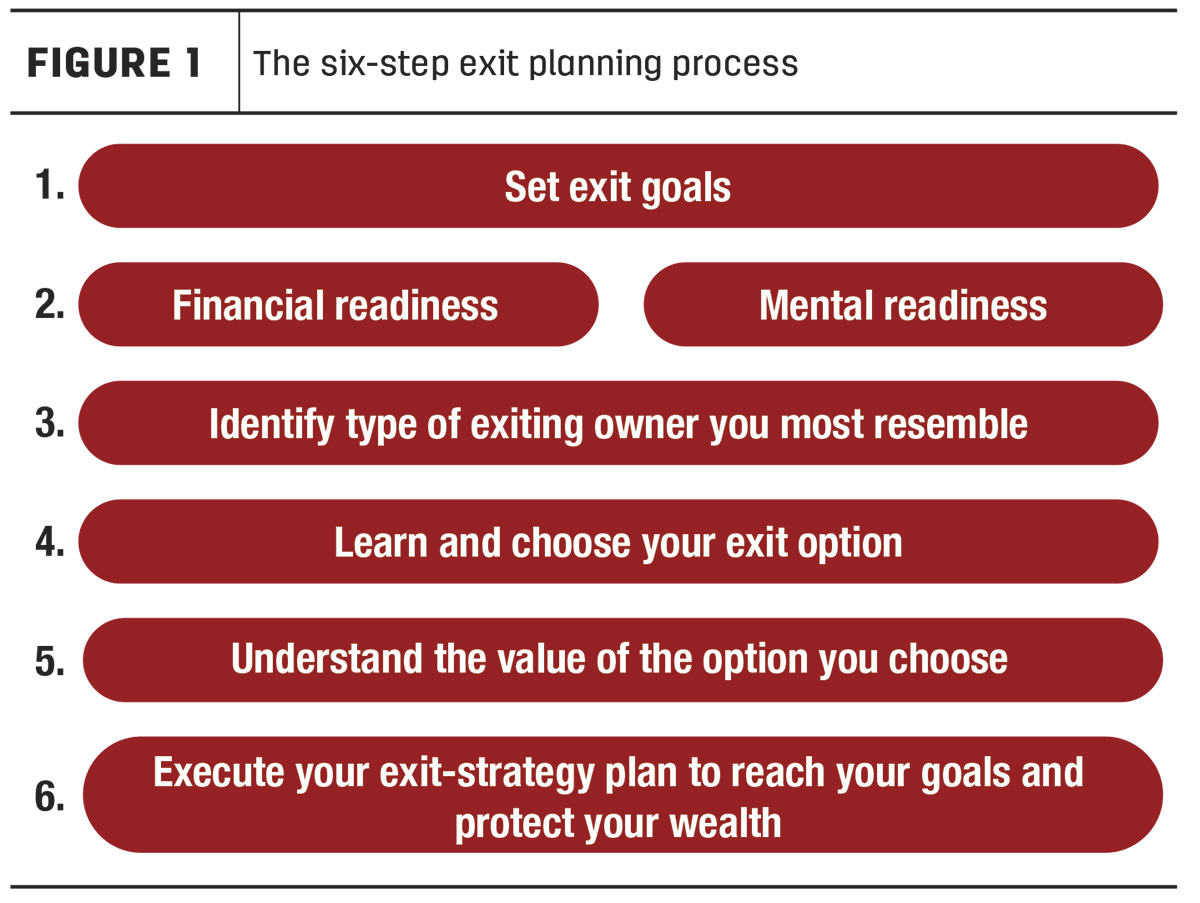

In a previous article, we introduced you to our six-step succession-planning process (Figure 1).

In this article, we want to go deeper into the first two steps to help you see that you too can make progress at this. We will do the same for steps 3 through 6 in future articles, so stay tuned!

Step one is all about setting your exit goals. You may have reflexive answers such as, “Give it to my kids,” or “Sell it for the most money,” but we want to challenge you to think beyond that. There are four prompts we use to assist our clients in this regard.

1. What do you want to achieve with your exit?

This may be about what’s in it for you, what’s in it for others or some combination. For example, your primary concern may be to retire knowing you are financially independent. Or, perhaps you are focused on leaving your farm to your family with confidence that your successor has the skills and ability to run the business as well, if not better than yourself. It’s not uncommon for us to hear that a farmer’s primary goal is to make sure their people are taken care of through any change in management, ownership or both.

2. When do you want to retire or move on to your next great adventure?

The second prompt is about timing. If you say “Never!” then we need to develop a solid contingency plan for when circumstance beyond your control chooses for you.

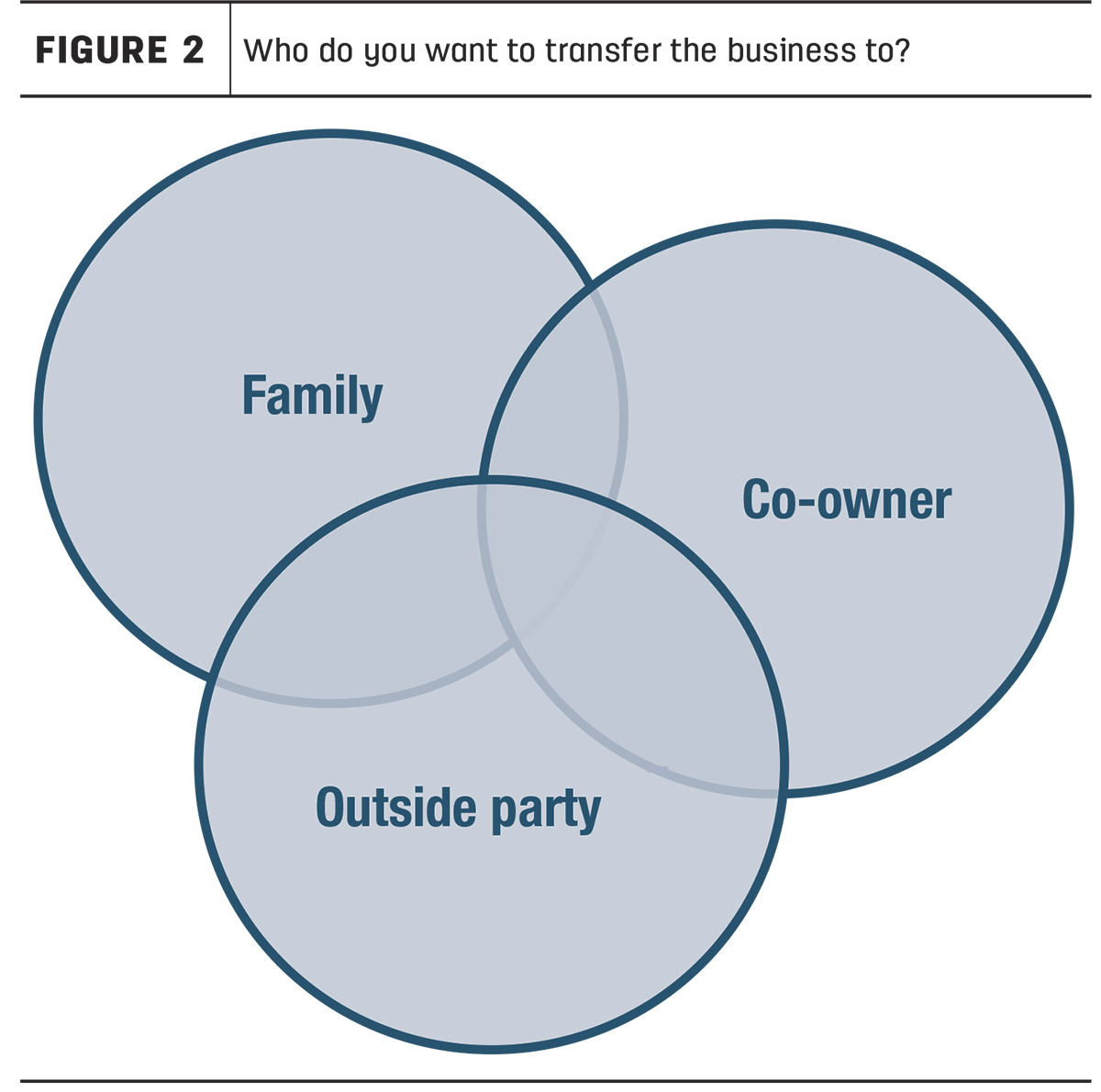

3. Who do you want to transfer the farm to?

Your response to this third prompt will help guide you to the appropriate internal or external transfer method (Figure 2).

Examples of internal transfers are transfers to family, business partners or managers. Whomever you are contemplating, one question to ask is if they are ready to take over. If they're not, what’s it going to take, and for how long? Do you want to wait that long? Another question is, how will they finance a buyout? These often are solvable issues, but they need to be addressed.

An external transfer is typically a sale to an outside third party. It could be a competitor or maybe a private equity group that is looking at purchasing several growers or dairies, eventually selling off the larger entity down the road. Either way, when we think about a transfer to an outside party, it then becomes about how salable your business is and what you can do to improve its transferability.

4. Can you afford the exit option that you most want?

Said another way, our fourth prompt asks, “Can you create and execute a plan that will generate enough income for you for life – separate and apart from the ongoing operation of your farm?” We define this as true financial independence – you no longer need to work and you have the freedom to start focusing on the next phase of your life.

We help our clients discover how much they will need to be financially independent through something called a “value gap analysis.” That is a good lead-in to step two in our process, determining your financial and mental readiness.

How prepared are you to transition the management and/or ownership of this enterprise that you have given so much of your blood, sweat and tears to? Many business owners don’t even want to think about this, they don’t know how much money they would need to take out of the business to be financially independent and they have no idea what to do with themselves that would bring self-satisfaction if they were no longer an owner. Our experience is that this is even more so in agriculture because the land and the lifestyle deepen the emotional connection in a way that’s different from other enterprises. But we are all going to leave sometime. Far better to influence that through a well-thought-out plan than to leave it to fate.

Consider the following exercises, completed either on your own or with a financial professional who has skills in this area.

- Project and plan your income needs. You may find out after modeling your retirement income needs that you have way more than enough or that you are coming up short. Don’t forget to consider factors such as inflation, health and long-term care costs, social security income, taxes, and your and your spouse’s joint life expectancy may impact your numbers.

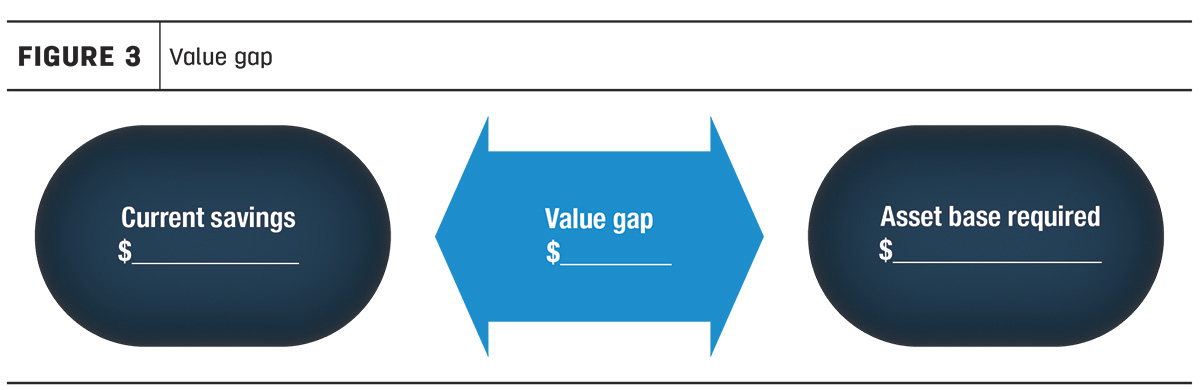

- Determine your value gap. Think of this simply as the current assets (and savings) on your balance sheet, separate from your farm versus what is required in the future to meet your after-tax retirement income needs (Figure 3).

- Determine the after-tax amount needed from your farm. Knowing how much you will need from the enterprise you have built to close the gap between your personal savings and the financial independence needed to secure your future is empowering. Once you know the number, it makes it much easier to evaluate transition options and build a plan that is customized for you and any other stakeholders.

Let’s look at a hypothetical example. If your current level of spending is $100,000 per year after taxes and you're at a 20% federal tax rate and 5% state tax rate, you would need to take an annual gross distribution of roughly $135,000. Based on a 3% withdrawal rate, you would need $4.5 million of assets to support your independence if you didn’t want to spend down any principal. If your current savings and retirement funds are worth $1 million, the difference of $3.5 million would need to come from the exiting of your business, after taxes. And this is before planning for any of the above contingencies.

When a farmer eventually sells their business, there is a change to their balance sheet. Today, your balance sheet may show that 90% of your assets are enterprise-related, with a more modest amount in cash, retirement accounts and other personal assets. You are used to living off your paycheck and maybe also the company checkbook for certain benefits.

Once you transition, whether it is to family or a third party, while you may still have land rents, there is no more company checkbook, and you will likely also be relying on a portfolio, which could include stocks, bonds and cash. This is a big transition for some, and learning more about how those assets work before the stakes are so high is a good idea.

When it comes to measuring your mental readiness, the real question is, “Are you ready to leave?” Many of our clients would initially respond to this with a resounding “No!” and may even add a few extra words for color and clarity.

Wherever you are today in your process, there is work to be done to help you prepare for the fruits of your labor, both the hard assets and the two-legged ones, to thrive throughout the next generation. Part of that preparation includes you thinking about what you will do next. People who go away from their businesses may get depressed. People who go to the next thing in their life may feel energized and excited. If you can write the next chapter of your life story in advance, even if it won’t begin until years from now, how will it read?

Maybe you are ready to run out the door today and never look back, or maybe you can’t imagine giving up the captain’s seat for another 10 years or more, or maybe you are somewhere in between. Wherever you are on that continuum, being in touch with it, along with knowing your financial readiness, can help you make ongoing impactful decisions for your family’s farm that will move you closer to achieving your goals.

Edward Rusnak is a registered representative of and offers securities and investment advisory services through Lincoln Financial Advisors Corp. (member SIPC). Lincoln Financial Advisors and its representatives do not offer tax or legal advice. Progressive Dairy, Progressive Cattle and Progressive Forage are not affiliated with Lincoln Financial Advisors Corp. This article is provided for information purposes only. Readers should consult their own professional advisers for specific advice tailored to their needs. Information contained in this article may be subject to change without notice.