Rolling into a new calendar year brings cooler temperatures and cooler prices for the hay market. Warmer temperatures across the north have prolonged the grazing season and delayed the warmup of hay sales. Take a closer look at prices and conditions in each region in the Progressive Forage Forage Market Insights column as of Dec. 10, 2023.

Moisture conditions increase

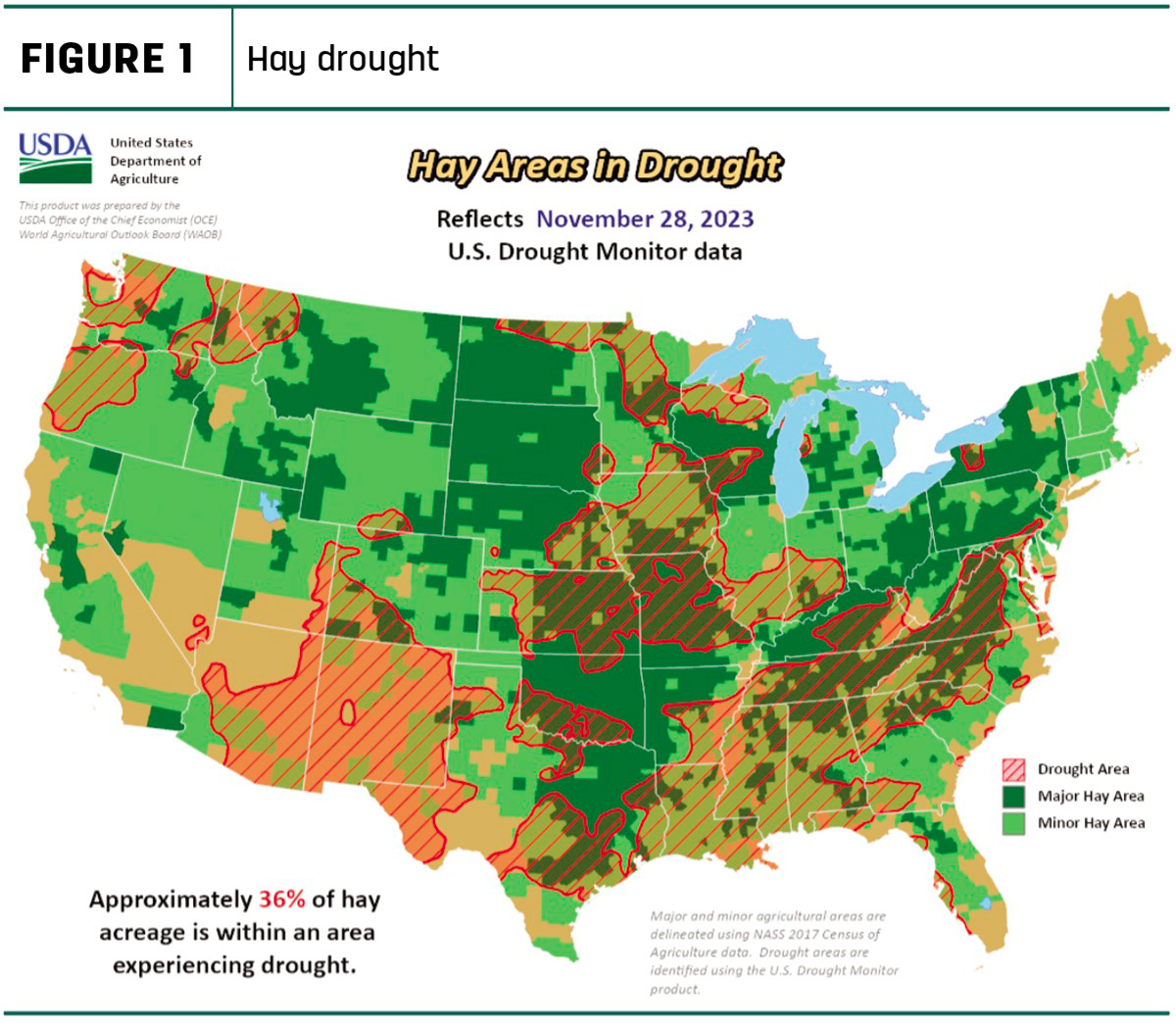

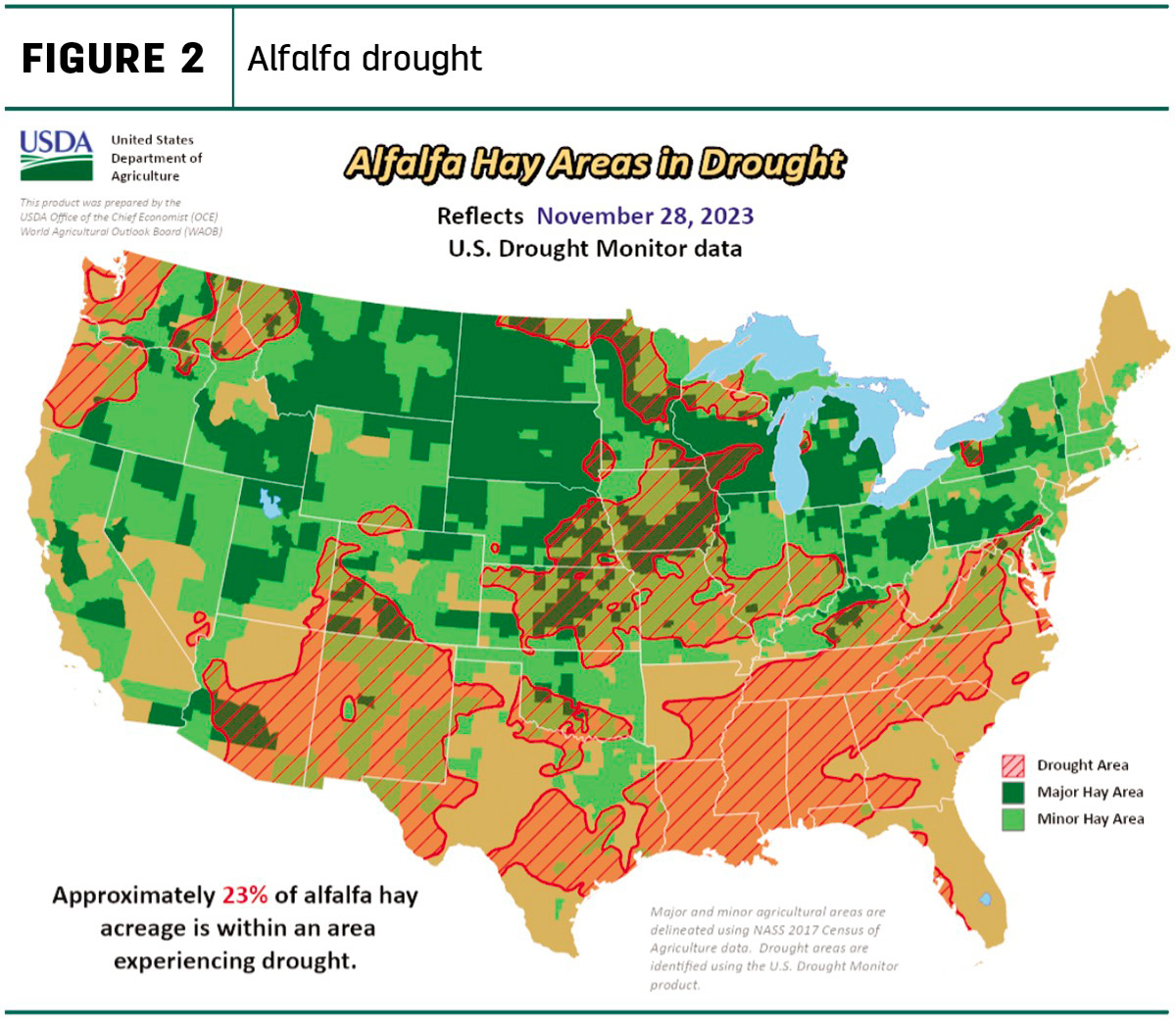

With reports of moisture in some parts of the country, overall U.S. drought monitor maps indicate drought areas that are in drought to be prevalent but decreasing. As of Nov. 28, approximately 36% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 37% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions decreased to 23% from 24% the month prior.

A snapshot of hay prices

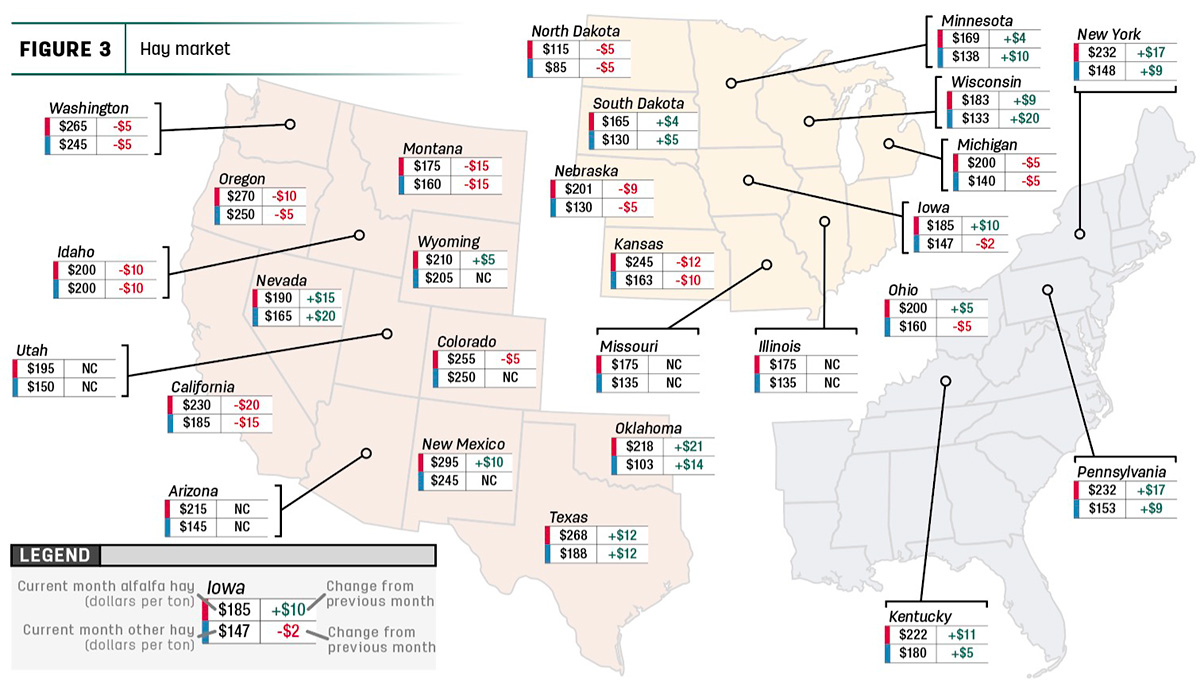

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

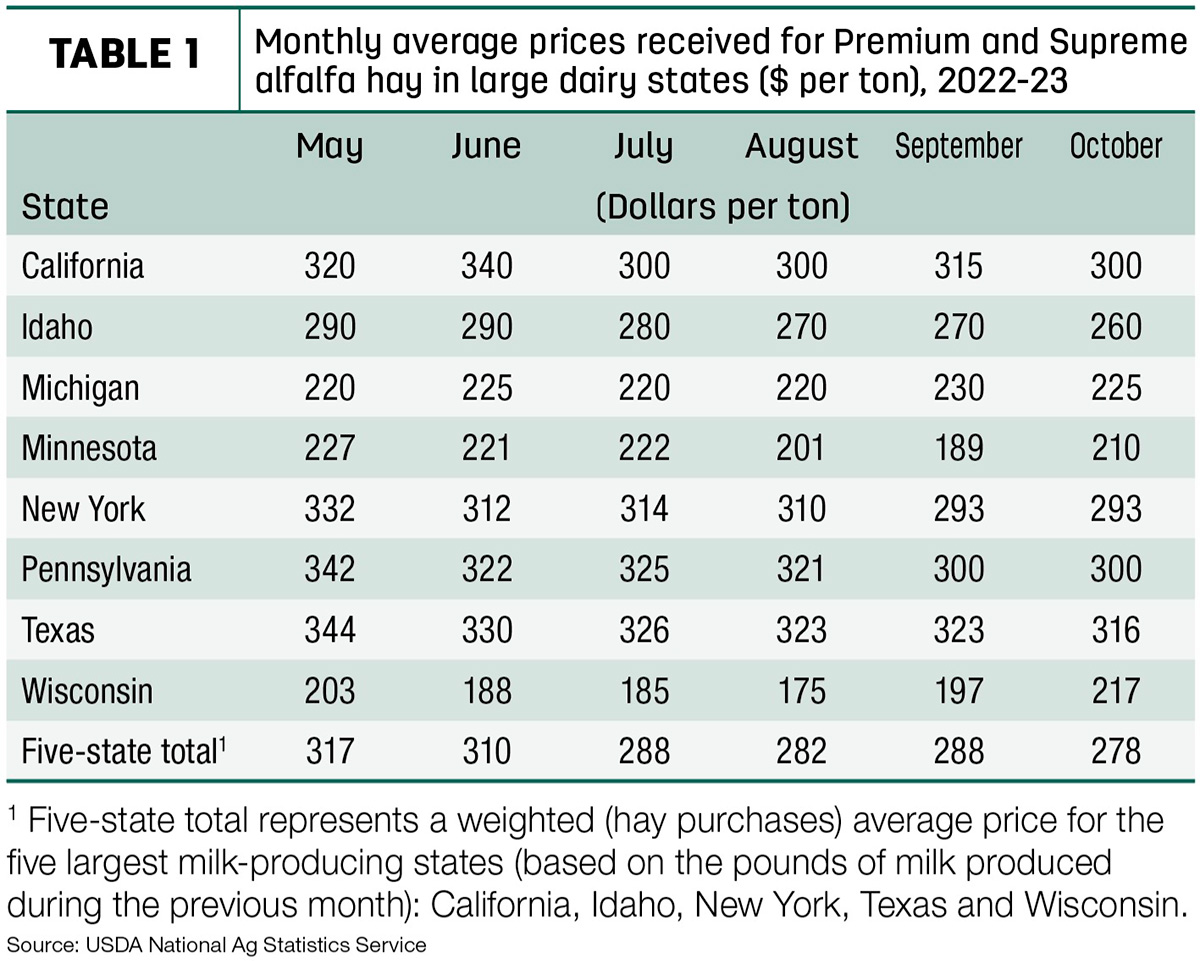

The top milk-producing states reported a price of $278 per ton of Premium and Supreme alfalfa hay in the month of October, a $6 increase from September of this year. The price is $70 lower than what was reported in October 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, alfalfa hay, grass hay, dehydrated alfalfa pellets and cornstalks all sold steady. Demand was moderate to light and unseasonably warm weather has been in favor of the livestock producers as the stock has been able to graze pastures and cornstalks longer than usual.

In Kansas, demand and trade remained low while prices were mostly steady. Grinders, pellet mills and feedyards still have several options for buying product to be processed, but not many are taking the offers. Good-quality grass hay is being sought out without many producers having much up for sale. Much of the state received snow over Thanksgiving weekend in addition to some rain, creating lots of mud but improving drought conditions.

In South Dakota, alfalfa hay sold steadily with moderate demand for alfalfa. Good-quality hay for starter calves is in high demand. Mild weather conditions means that cows could be turned out on cornstalks longer and winter pastures were grazed.

In Missouri, while most of the state did receive at least some light rainfall, drought conditions are still present in around 92% of the state. Warmer-than-normal weather conditions have been present, but frost in the morning is still present before thawing in early afternoon. The majority of cattle producers are now beginning to feed hay because of this.

- East: In Alabama, hay prices are reported to be holding steady while trade is moderate with good supply and moderate demand.

In Pennsylvania, alfalfa and alfalfa grass mixes sold weak on a light comparison. Orchardgrass and prairie and meadowgrass sold weak. Wheat straw sold weak while cornstalks were steady.

- Southwest: In California, trade activity and demand were moderate to good. Retail hay demand was sold good to $5 higher. Dairy hay demand was moderate while export demand remained light. Winter crops are planted and winter wheat planting is near completion.

In New Mexico, alfalfa hay sold steady with good demand and active trade. Seventy-three percent of the state is finished with fifth cutting, while the majority of the state is wrapping up harvest for the season.

In Oklahoma, hay trade is slow and steady at best in some areas. Oklahoma is seeing slightly more movement than in previous weeks but remains with minimal hay trading, causing a higher-than-usual inventory.

In Texas, hay prices are mostly steady across the region with freight remaining the main determining factor in price discrepancies across the state. Trade activity was limited due to the holidays, but cooler temperatures are settling in across the state and extreme drought conditions are still impacting most of the winter pastures across the state.

- Northwest: In the Columbia Basin, export and dairy hay were steady in a light test. Light to moderate demand is present with slow trade.

In Montana, hay sold fully steady. Reported hay sales were light this week. Sales between producers for cattle feeding seem to be leading most of the activity and are in direct competition with the large hay sellers. Larger hay producers are selling hay out of state. Demand for hay to ship to Canada has weakened over the course of the last few weeks as well.

In Idaho, organic and retail hay sold steady in a light test. Large supplies of export hay are hitting the market and slowing down trade. With a new hay press being operational, trade remains slow with light demand with large supplies of defective hay still in stock.

In Colorado, trade activity was light on moderate demand. The bulk of activity is still present in the horse hay markets with horse hay sales selling steady.

In Wyoming, all reported hay sales remain to be holding steady while demand was light to moderate. Large hay supplies will be carried over into the new year, but most will be grinding quality or destined for desperate cattle in the winter months.

Other things we are seeing

- Dairy: The October DMC milk income over feed cost margin rose to $9.44 per hundredweight (cwt), limiting indemnity payments of just 6 cents per cwt to dairy operations enrolled in DMC at Tier I insured levels of $9 and above. With revisions to the previous monthly report, 17,059 dairy operations are enrolled in the 2023 DMC program, representing about 74.5% of operations with established production history. January-October DMC payments averaged $74,453 per dairy operation enrolled in 2023, for a total of about $1.27 billion, based on latest enrollment data as of Dec. 4.

- Cattle: Prior expectations for the number of cattle on feed in the second half of 2023 were that generally tighter cattle supplies and potentially growing retention of heifers for breeding would lead to smaller levels than a year ago. However, the Cattle on Feed report, published on Oct. 20 by the USDA National Agricultural Statistics Service (NASS) estimated the Oct. 1 feedlot inventory at 11.58 million head, 0.6% above 11.509 million head in the same month last year. Feedlot net placements in September were 6% higher year over year at 2.149 million head, which was above industry analyst expectations. Marketings in September registered 1.663 million head, down more than 10% year over year.

- Fuel: Fuel prices are decreasing across the board, according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.61 per gallon, a 23-cent increase since last month. The average U.S. retail diesel price was around $4.51 per gallon, a five-cent decrease.

- Trucking: Spot flatbed prices ticked down over the month of November with a change in average price of 0.7%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.48, South-central – $2.30, Midwest – $2.65, Northeast – $2.43 and West – $2.23.