Entering the final days of 2023, dairy producers have some assurances a major dairy risk management safety net will be in place for the new year. However, at Progressive Dairy’s deadline, the USDA had not yet announced a 2024 sign-up period for the Dairy Margin Coverage (DMC) program. (Read: Look for 2024 DMC program enrollment details early next year)

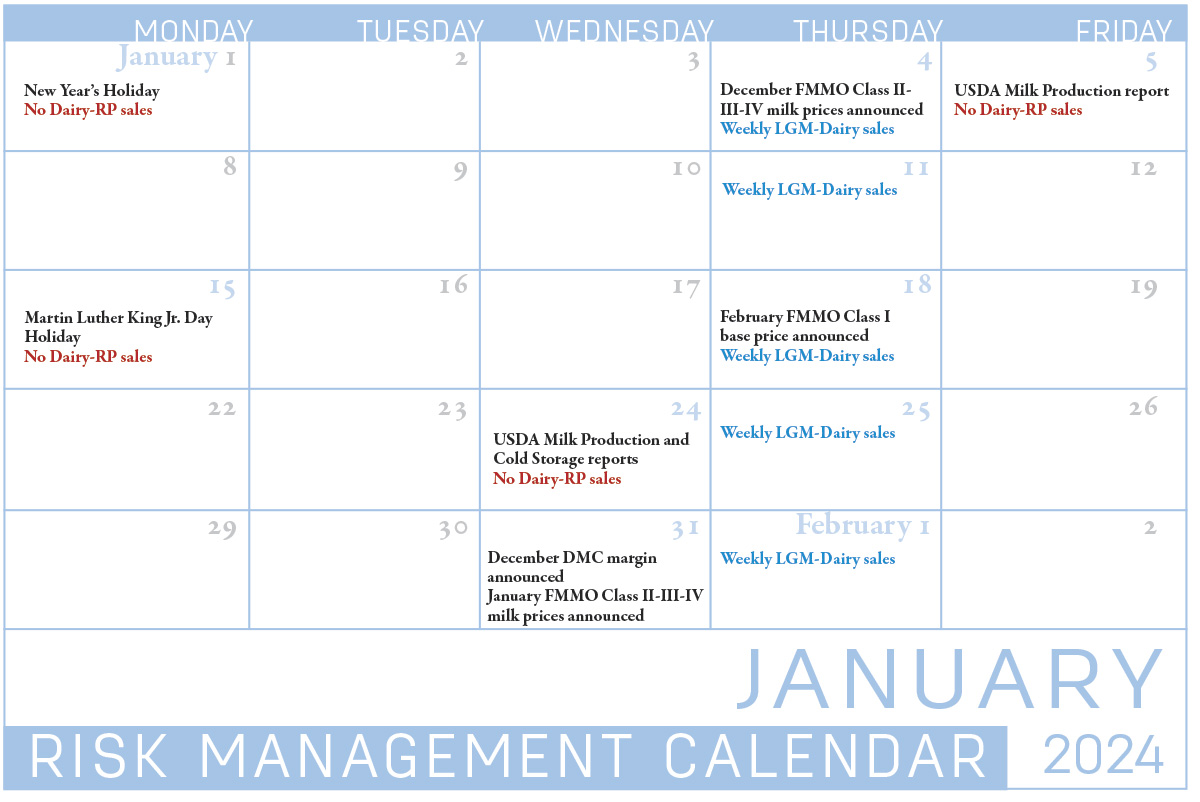

While waiting for that announcement, here’s a look ahead at important dates and reports affecting risk dairy management decisions, as well as other information impacting your milk check in January.

Upcoming workshops

The USDA’s Risk Management Agency (RMA) is hosting about a dozen in-person and virtual workshops this winter for producers to learn about new and expanded livestock risk management products, including Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy).

Two virtual “Livestock Roadshow” events are scheduled online, Jan. 8 and Jan. 17, 2024. Nine in-person sessions are scheduled between Jan. 10-early March throughout the U.S.

Session topics include the following USDA RMA programs: Annual Forage; Dairy Revenue Protection; Livestock Gross Margin; Livestock Risk Protection; Pasture, Rangeland and Forage; and Weaned Calf Risk Protection.

Find links for the virtual sessions, dates and locations for in-person programs and other information on the Livestock Roadshow webpage.

DMC program

The November 2023 DMC margin and potential indemnity payments will be announced on Dec. 29. As of the close of trading on Dec. 21, milk, corn and soybean meal futures prices forecast a margin of about $9.45 per hundredweight (cwt), up a penny from October’s margin and triggering a very small indemnity payment to producers with Tier I/$9.50 per cwt coverage.

Looking ahead, the December 2023 margin will be calculated on Jan. 31, 2024. It is currently forecast at $8.90 per cwt, which would trigger Tier I indemnity payments to producers covered at $9 and $9.50 per cwt levels.

Through Dec. 4, DMC indemnity payments for the first 10 months of 2023 milk marketings had hit $1.27 billion, a new annual record high, and averaged $74,453 per dairy operation. About 17,059 dairy operations were enrolled in the 2023 DMC program, representing about 74.5% of operations with established production history. All 2023 DMC indemnity payments are subject to a 5.7% sequestration deduction.

Check the Progressive Dairy website or your Farm Service Agency office for the November DMC margin and 2024 enrollment details as they become available.

Dairy-RP

Producers managing risk through Dairy-RP are eligible to cover revenue on a quarterly basis. Coverage for the first quarter of 2024 closed on Dec. 15. In January, Dairy-RP coverage is available for the second quarter of 2024 (January-March) through the second quarter of 2025.

The market changes daily and Dairy-RP endorsements must be purchased between the Chicago Mercantile Exchange (CME) market closing and the next CME opening. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when CME trading is closed due to holidays. In January, that includes the New Years Day and Martin Luther King Day Jr. holidays (see Calendar). Also, Dairy-RP coverage cannot be purchased on days when major USDA dairy reports are released that could impact markets, including Milk Production, Cold Storage and Dairy Product reports.

Dairy-RP changes are under discussion. One of the limitations to participation in that program is the high cost of premiums for coverage on distant quarters. The premiums for near-term quarters are lower than the premiums for deferred quarters. However, risk management strategies using distant quarters are more effective in providing coverage that lasts for the entire duration of a typical slump in milk prices. A proposal to be considered in early 2024 would boost premium subsidies on deferred quarters (quarters three through five), providing more financial incentives for producers to seek longer-term revenue protection under Dairy-RP.

LGM-Dairy

LGM-Dairy is another subsidized margin insurance program administered by the USDA’s RMA.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of December contains the months of February-December 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Production and price outlooks

- U.S. milk production fell below year-ago output for a fifth consecutive month, according to the USDA’s November Milk Production report, released Dec. 18. Read: Cow numbers, milk production continue to decline in November USDA estimates

- The USDA’s monthly and weekly cull cow marketing reports continue to indicate a decline in the number of dairy cows marketed for beef. In part, that’s due to a smaller U.S. dairy herd. Monthly slaughter was below year-ago levels in September through November, with declines now stretching over a period of 14 consecutive weeks. That’s likely to continue to the end of 2024. Read: November report on dairy cows marketed for beef

- The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report reduced milk production forecasts for both 2023 and 2024 but also cut milk price projections for both years. Read: Reduced milk per cow, cow numbers lower USDA 2023-24 milk production estimates

- Federal Milk Marketing Order (FMMO) Class IV milk pooling trends continued into November, while weaker uniform prices were offset somewhat by higher butterfat and protein tests. Read: November prices aided by higher components as Class IV pooling stays low

Check the Progressive Dairy website for updates affecting milk prices as they become available.