It comes as no surprise that 2023 was a rough year for most dairy producers across the U.S. with low milk prices, high input costs and tight margins. Although some regions were hit harder than others, and some producers are in better financial positions due to reduced debt load and strategic use of profits in 2022, financial stress was emphasized by most dairy producers interviewed for our 2024 State of Dairy coverage.

Peter Vitaliano, vice president of economic policy and market research for National Milk Producers Federation, agrees.

“Dairy producers are not situated well financially going into 2024,” Vitaliano says. “Too many years of overproducing the market in 2015 through 2019, followed by pandemic-related disruptions, along with tight margins and low milk prices. Most recently, we’ve seen continued weakness of domestic demand, particularly in food service, inflation and weaker exports.”

However, as of mid-February, the futures markets are indicating a better year in 2024, with milk prices up at least $1 and feed costs down at least $3 over 2023.

“So far, that’s still not enough to totally make up for the past few tough years, but as the weeks go on, the futures have been getting progressively more optimistic,” Vitaliano adds.

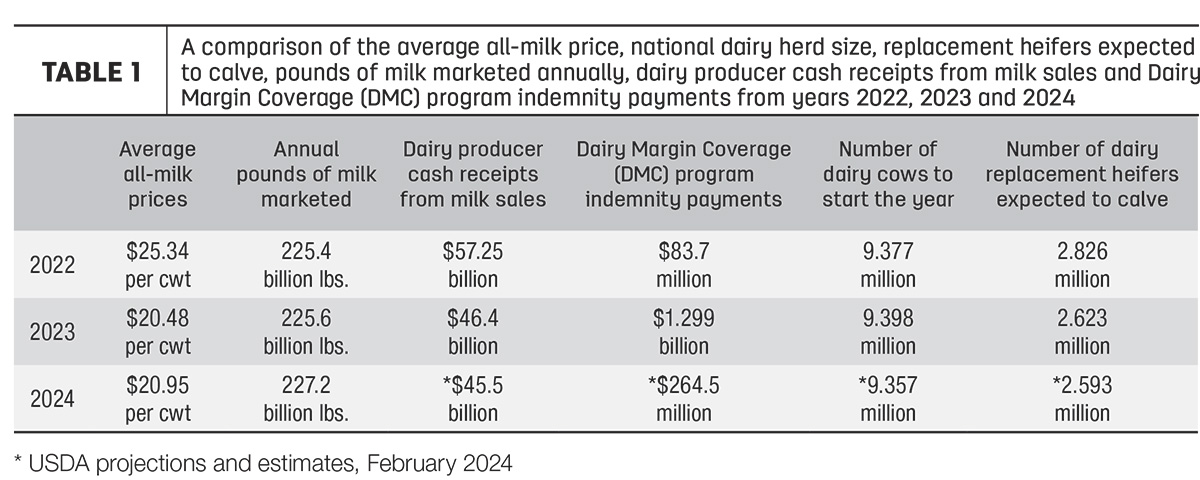

Table 1 highlights some noteworthy changes between 2022 and 2024 in all-milk price, annual pounds of milk marketed, dairy producer cash receipts from milk sales, DMC program indemnity payments, U.S. dairy cow numbers and the number of dairy replacements expected to calve.

Politically, the uncertainty of an election year makes it unclear what will be done this year in the nation’s capitol and what will be punted to 2025. The 2023 Farm Bill has been extended through 2024. While many sources say that most of the text in the new farm bill is complete, there is still work to do to bring it across the finish line. The Federal Milk Marketing Order (FMMO) Pricing Formula Hearing concluded on Jan. 30, 2024, breaking the record for the longest hearing in USDA history. The USDA will review the record and develop their “final decision,” which is expected to be in front of producers in 2025.

At the state level, regulatory concerns affecting dairy continue to primarily stay on the West Coast, although some issues are migrating east to Idaho, New York and other states. Most producers in primarily rural states say their state’s legislature is mostly “ag-friendly,” although there is always the need to provide education for legislators who are not familiar with the dairy industry. Read about some of the legislative challenges facing the West.

Labor cost, availability and regulations continue to be an ongoing challenge, as is transitioning the farm to the next generation. In most regions, producers and industry leaders mentioned the shortage of “next generation” owners and managers interested in stepping into those roles.

However, many factors in 2024 point to a brighter future.

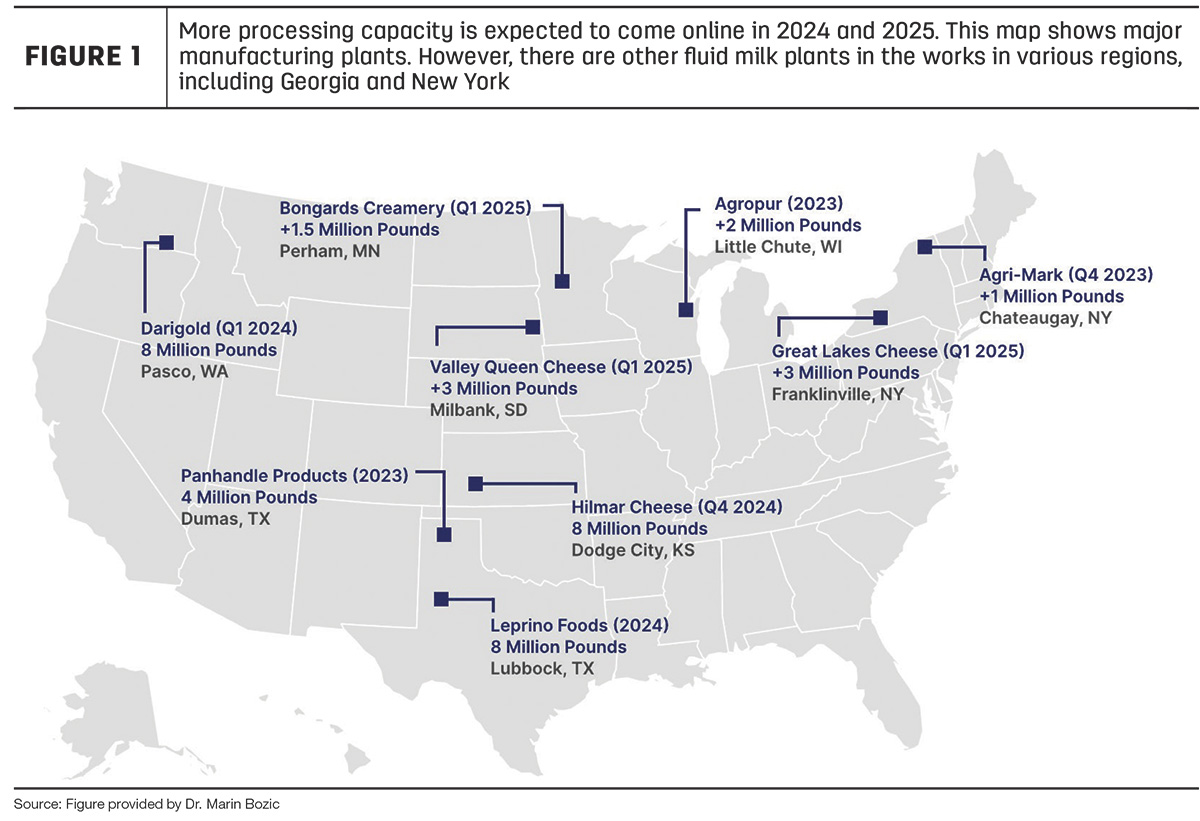

Increased processing capacity expected to come online in 2024 and 2025 is providing optimism as many processors loosen their base excess programs to allow for increased milk production. Dr. Marin Bozic and his team provided the map in Figure 1 that illustrates where many of these new processing facilities are located and the capacity of each. Note that this map includes major manufacturing facilities and does not show all fluid milk plants currently in the works or those that recently came online that may be mentioned throughout the State of Dairy articles.

Diversification is a theme woven throughout every region, as the additional revenue streams provide some relief for tight financial margins. On-farm processing, agritourism, other direct-to-consumer opportunities, replacement heifer sales, genetics, beef-on-dairy, crop production and income from green energy are examples of how dairy operations are diversifying in 2024.

High beef prices and declining feed costs were also noted as bright spots.

Many of the dairy producers interviewed commented on the changing consumer perception of dairy products and milkfat in general, saying it brings them hope that the dairy industry’s efforts to bridge the rural-urban divide are working.

“Consumers are starting to see the nutritional value of whole milk. Despite the pressure from fake foods, milk continues to be nature’s perfect beverage,” says Washington dairy producer Jason Vander Kooy.

Despite transition planning challenges, many producers are encouraged by the interest from dairy youth and young people who did not grow up on farms but who are excited to actively participate in the dairy industry.

Read more about the challenges and opportunities facing the dairy industry in 2024 in the West, Great Plains/central region, Midwest, Northeast and Southeast.