U.S. average milk production costs are the lowest since 2010, but so are milk prices. Commodity prices are impacting land values and credit conditions in the Southwest. Organic Valley cooperative reported an average milk pay price of $36.79 per hundredweight in 2015. This and other U.S. dairy economic news can be found here.

Monthly cost of production, milk prices back to 2010

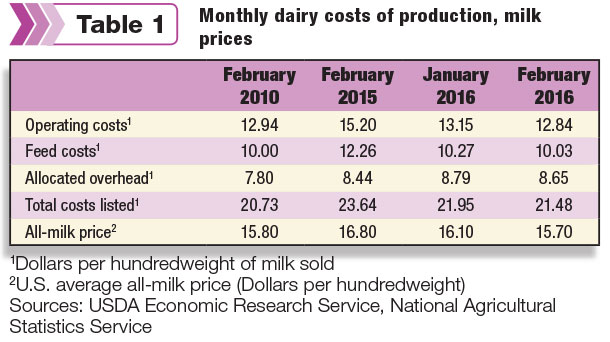

Love it or hate it, USDA’s monthly milk cost of production report was released for February. The good news: Total production costs, driven primarily by lower feed costs, were at levels not seen since 2010. The bad news: so were milk prices.

February 2016 total operating costs averaged $12.84 per hundredweight of milk sold, with feed (purchased, homegrown and grazed) making up about $10.03 per hundredweight (Table 1).

Compared to a month earlier, February 2016 feed and operating costs were down 24 cents and 31 cents, respectively, and were the lowest since May-June 2010.

Based on USDA estimates, feed represented about 47 percent of total costs in February 2016.

In addition to feed, operating costs include expenses related to such things as veterinary and medicine, bedding, marketing, custom services, fuels, electricity and interest.

When adding costs related to allocated overhead, total costs averaged $21.48 per hundredweight in February 2016, down about 47 cents from January and the lowest since July 2010.

Allocated overhead costs include expenses related to labor (both paid and opportunity costs for unpaid), capital recovery on machinery and equipment, opportunity costs of land (rental rate), taxes and insurance.

U.S. milk prices averaged $15.70 per hundredweight in February, down 40 cents from January, and 10 cents less than February 2010.

California May Class 1 milk prices lower

California's May 2016 Class 1 minimum milk prices fell to their lowest level since April 2010, according to the California Department of Food & Agriculture (CDFA).

The May 2016 Class 1 price for the North is $14.84 per hundredweight, with the South at $15.11 per hundredweight. Both are down 42 cents from April 2016 and about $2.22 less than May 2015.

Through the first five months of 2016, the Class 1 milk price averaged $15.67 per hundredweight in the North and $15.94 per hundredweight in the South, down about $1.78 from the same period a year earlier.

USDA will announce the May 2016 federal order Class I base price on April 20.

Organic Valley paid $36.79 per hundredweight in 2015

Organic Valley, the largest cooperative of organic farmers in the United States, reported an average milk pay price of $36.79 per hundredweight in 2015. The average is nearly $20 higher than the USDA-reported all-milk price average of $17.08 per hundredweight.

Organic Valley dairy farmers earned the highest organic premium over conventional dairy prices since the 2009 recession, cooperative leaders told more than 450 farmer-owners attending the organization’s 27th annual meeting on April 7 in LaCrosse, Wis.

Read more about Organic Valley’s annual meeting.

USDA raises 2016 milk output forecast, but price expectations mostly steady

USDA’s April World Ag Supply & Demand Estimates (WASDE) report raised 2016 U.S. milk production and marketing estimates slightly, but left projected milk prices mostly unchanged.

Milk production was projected at 211.8 billion pounds for 2016, up about 200 million pounds from last month’s forecast. If realized, the 2016 total would be up about 1.5 percent from 2015.

The higher milk production forecast is the result of a slower reduction in the cow inventory, combined with growth in milk output per cow.

The projected Class III price midpoint was unchanged, forecast in a range of $13.65-$14.15 per hundredweight. The Class IV price was lowered in a range of $12.90-$13.50 per hundredweight.

The 2016 all-milk price forecast is in a range of $15.00-$15.50 per hundredweight.

On the feed side of the equation, corn prices were projected slightly lower, with soybean and soybean meal prices unchanged.

Beef prices were projected lower.

Read the full Progressive Dairyman article.

Commodity prices impacting land values, credit conditions in Dallas Fed

Land values in the Federal Reserve Bank of Dallas region are feeling the pressure of lower commodity prices, although dryland values rose slightly in the first quarter of 2016. The district covers all or portions of Texas, New Mexico and Louisiana.

Based on a quarterly survey of agricultural lenders, dryland values across the region rose 1.4 percent during the quarter and were 5.1 percent higher than a year ago.

Irrigated land values declined 5.4 percent during the quarter, and ranchland values were mostly unchanged. However, values of irrigated land and ranchland remained above year-ago levels.

In contrast to land values, average cash rents for dryland dipped, but rental rates for irrigated land rose.

With the exception of operational loans, demand for other loan types declined. Loan repayment rates declined, while loan renewals and extensions picked up.

Variable interest rates rose for all loan types (feeder cattle, farm operating and intermediate and farm real estate) rose slightly during the quarter. Some bankers indicated they are tightening credit standards.

Read the Quarterly Survey of Agricultural Credit Conditions in the Eleventh Federal Research District

CoBank sees slower dairy recovery

We heard from Rabobank and New Zealand’s ASB. CoBank’s latest assessment of the dairy situation indicates milk prices will continue to test multi-year lows before recovering in 2017.

Relative to global prices, the domestic market continues to provide some strength. However, those spot butter and cheese prices are also attracting imports from Europe and Oceania.

CoBank remains skeptical the global milk powder market can recover in the short term.

“The memory of record high milk prices in 2013-14 still lingers in dairy producers’ minds,” according to the report. “Many are optimistic that a recovery is just around the corner. Perhaps it is. But the much-anticipated recovery in dairy product markets will remain elusive until end users can see that global milk and dairy product supplies are tightening.”

Read Global dairy recovery timeline hinges on European Union. PD

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke