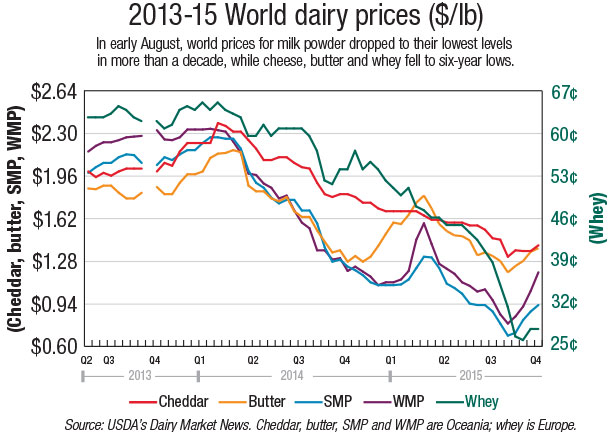

After falling steadily for 18 months, world dairy prices registered an impressive late-summer turnaround.

From early August to early October, Oceania whole milk powder prices jumped more than 50 percent, while skim milk powder prices improved 36 percent and butter tacked on 16 percent.

The gains were fueled by projections of lower milk production in New Zealand this season, as farmers grapple with severe price cuts and the threats of El Niño weather disruption. The Kiwis averaged 4 percent annual production growth for the last 15 years, and nearly all that increase was ticketed for the export market. But forecasters now expect production to fall 5 to 10 percent this year, potentially leaving overseas customers short.

“The main story in town is the fact that production is shaping up to be materially weaker this season,” said Nathan Penny, economist for New Zealand-based rural bank ASB.

The changing sentiment also meant that once prices started to climb, buyers who had been waiting on the sidelines re-opened their order books.

However, while the recent rally is encouraging, it’s coming off prices that were at multi-year lows, and most analysts don’t expect the market to rise much further in the short term. In fact, milk production continues to expand in the other major supply regions, large inventories now sit in the pipeline that have to be worked through, and global demand is still recovering from the closure of the Russia market and the pullback from China.

“While the world is for now awash with milk, the rebalancing of fundamentals for new milk is now near at hand,” according to the latest Rabobank Dairy Quarterly. Excess inventories will gradually erode as the first half of 2016 progresses, the bank says. That should set the stage for tighter markets and stronger prices in the second half of next year. PD

U.S. exports trailing in 2015

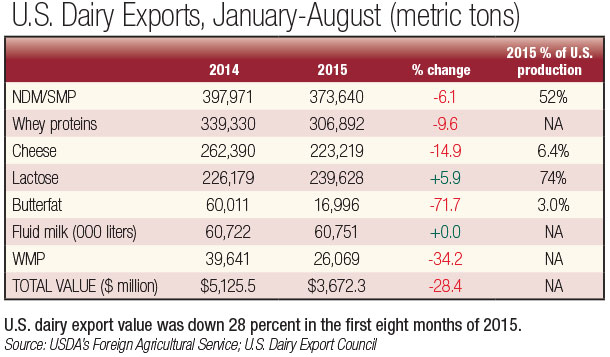

U.S. exports of cheese and whey products were at or near multi-year lows in August, pulling overall volumes down for the fourth straight month.

Suppliers shipped 139,281 tons of milk powders, cheese, butterfat, whey and lactose in August, down 13 percent from a year ago. Total overseas sales were valued at $390 million, down 33 percent from last year. For the first eight months of the year, U.S. exports were down 11 percent by volume and 28 percent by value compared with the record pace established in 2014.

Cheese exports fell for the fifth straight month, dropping to 22,658 tons. This figure is down 28 percent from last year and marks the lowest total in 31 months.

With very weak global whey markets, U.S. whey exports continued trending lower as well. Total whey export volume was just 32,843 tons, down 18 percent from last August and the second-lowest figure in the last five years (daily average basis).

Exports of nonfat dry milk/skim milk powder held up better in August. Suppliers moved 42,880 tons, slightly more than July but still down 6 percent from a year ago.

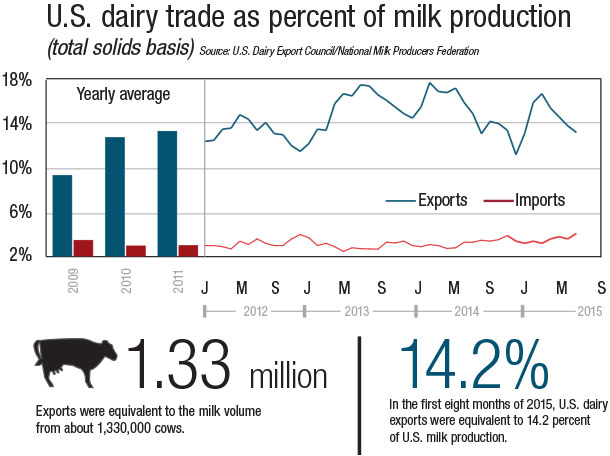

U.S. exports (on a total milk solids basis) were equivalent to 13.2 percent of U.S. milk solids production in August, bringing the year-to-date percentage to 14.2 percent. Imports were equivalent to 4.1 percent of production for the month, the highest figure since February 2009. PD

CDI recognized for investment in exports

Dairy Foods magazine selected California Dairies Inc. (CDI), based in Visalia, California, as its 10th annual “Tom Camerlo Exporter of the Year.” The honor is given to a company that demonstrates leadership in driving global dairy demand and advancing U.S. dairy exports, commits resources to export market development and makes exports a key part of its overall growth strategy.

CDI ships to nearly 50 countries and accounts for almost one-third of U.S. milk powder exports. Additionally, Dairy Foods recognized the co-op for recent investments of tens of millions of dollars in processes, equipment and training to develop product specifications that meet the exacting requirements of importers worldwide. For instance, CDI recently completed a new evaporator at its Visalia facility to produce heat-stable, low-spore milk powder.

The company also maintains dedicated capacity strictly for manufacturing export products, ensuring consistent supply for customers who require product year-round. Further, CDI earned high marks for its commitment to sustainability with a comprehensive greenhouse gas and water reduction strategy across its network of six plants.

The following update is provided by the U.S. Dairy Export Council (USDEC), a non-profit, independent membership organization that represents the global trade interests of U.S. dairy producers, proprietary processors and cooperatives, ingredient suppliers and export traders. Its mission is to enhance U.S. global competitiveness and assist the U.S. industry to increase its global dairy ingredient sales and exports of U.S. dairy products.

USDEC programs and activities are supported by the dairy checkoff program, with additional funding from the U.S. Department of Agriculture, Foreign Agricultural Service and from membership dues. For more information, go to their website.